💥How to Invest (and My Market Analysis) - September 2025 Update

There are more unemployed people than job openings, 70% believe the American dream is gone, Diamond prices have fallen to a new low — Plus stock picks, insider trades, interest rate predictions & more

👋 Good morning my friend! Thank you for joining 108,000+ readers who trust our newsletter to help you become richer and smarter with your money!

Today’s newsletter took 6 hours to research and write so I hope you enjoy it! And if you enjoy reading, please tap the ❤️LIKE button on this post so we can grow our audience on Substack 🙏 (and please consider becoming a paid subscriber to support this newsletter. Get 50% off now, with this link).

Did you know that your job can pay for the cost of this newsletter’s subscription? This newsletter is an educational resource and can likely be expensed through your job’s training budget/ professional development budget. To make the expensing process as easy as possible, we’ve created this email template that you can send to your manager.

📬This week we discuss:

Part I — Financial Insights:

1) Stock Market & Economic Analysis (and how it impacts YOU)

2) Most Important Finance Events This Week (and what it means for you)

3) Important Charts & Numbers (and why they matter)

🎯Premium Research & Analysis:

Part II — Stock Market Insights:

4) Stock Picks, Research, and Analysis (what every investor needs to know)

5) Billionaire, Politician and CEO Insider Trades

6) Trade of the Week (options trading)

7) Best Performing Stocks This Week (catalysts, earnings, and news)

8) Important Earnings & Stocks to Watch

Part III — Real Estate & Housing Insights:

9) Real Estate Market Analysis & Predictions

10) Interest Rate Predictions & Current Rates

Part IV — Economic & Marco Insights:

11) Market Sentiment & Economic Outlook

12) Technical Analysis (S&P 500, Tech Stocks, Bitcoin)

13) Important Economic EventsBut before we get into it, please help us and:

Hit the ❤️LIKE button on this post so we can grow our audience on Substack 🙏

Share this newsletter with your friends and family to help them get richer and smarter with money!

Become a paid subscriber and support our newsletter! (you can learn about all the benefits here) (Get 50% off your subscription with this link)

1. Stock Market & Economic Analysis (and how it impacts YOU):

Here’s everything important you need to know:

The stock market hit new highs this week. The S&P 500 closed at another record, its 21st this year, driven by hopes the Federal Reserve will start cutting interest rates soon.

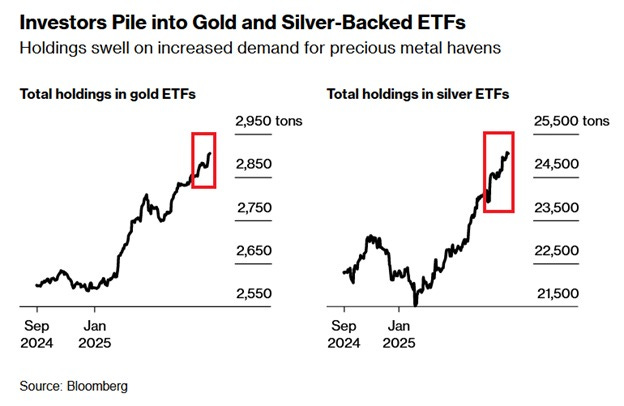

Gold also reached a record high as investors looked for safety in case the Fed loses independence (if that happens, Goldman Sachs thinks gold could hit $5,000). Silver hit a record too.

The U.S. dollar fell to a five-week low, showing investors are betting on lower rates.

Alphabet stock jumped 9% after a U.S. judge ruled Google could keep both its Chrome browser and its Apple search deal, avoiding major antitrust penalties.

💡Andrew’s Market Analysis:

It's all about confidence and fear. Stocks went up because investors feel optimistic about rate cuts. But gold went up because some people worry about economic instability. The weak dollar helps exporters but shows concerns about U.S. economic strength.

These moves all tie back to one thing: expectations about Federal Reserve policy.

When people think the Fed will cut rates, stocks usually rise (cheap money fuels growth).

The dollar weakens because lower rates make holding dollars less attractive.

Gold and silver rise because people want safety if the Fed loses credibility or if inflation comes back.

They’re all pieces of the same puzzle: markets are trying to price in what the future looks like under lower interest rates.

This week's market action shows us something crucial: successful investing isn't about predicting what happens next - it's about being prepared for whatever does happen.

Advice: Add exposure to gold or silver ETFs as a hedge (don’t go all in). Keep a core in S&P 500 or total market funds, but be mindful of over-reliance on Big Tech.

Psychological Trap (Recency Bias): We tend to think what happened recently will keep happening. Tech has been a winner for years, so we assume it will be forever. That's a dangerous assumption.

Instead of picking individual tech stocks, consider a tech-focused ETF like 'QQQ'. This buys you a piece of the 100 largest companies on the Nasdaq (which is heavy on tech). You get the upside of the whole sector without the company-specific risk of a single stock blowing up.

👉 For daily insights, follow me on Twitter/ X, Instagram Threads, or BlueSky, and turn on notifications!

2. Important Finance Events This Week (and what it means for you):

This week, we analyze:

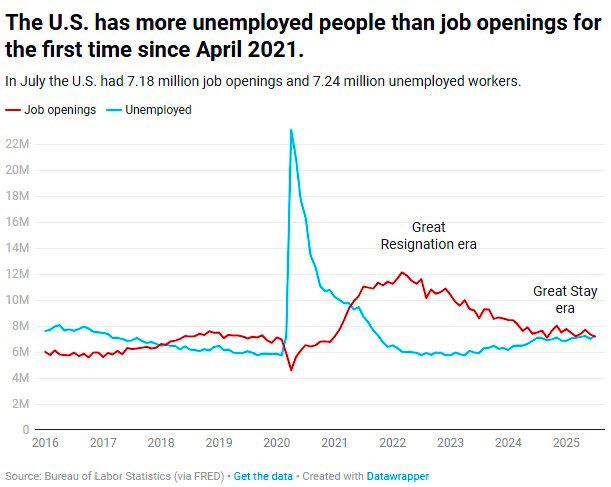

1) The US now has more unemployed people than job openings for the first time since April 2021. America is in a serious jobs slump.

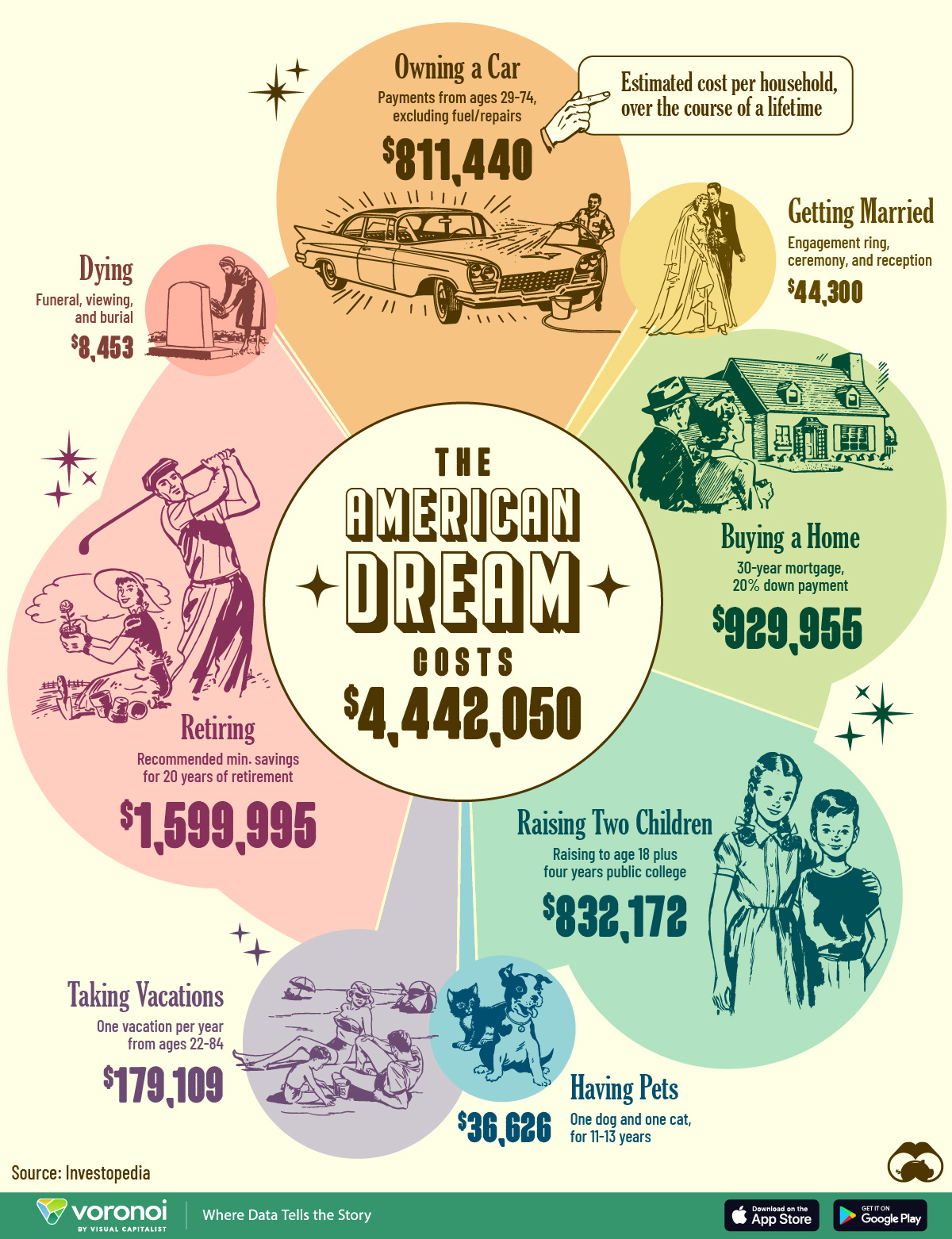

2) 70% believe the American dream—that if you work hard, you will get ahead—no longer holds true or never did, the highest level in 15 years.

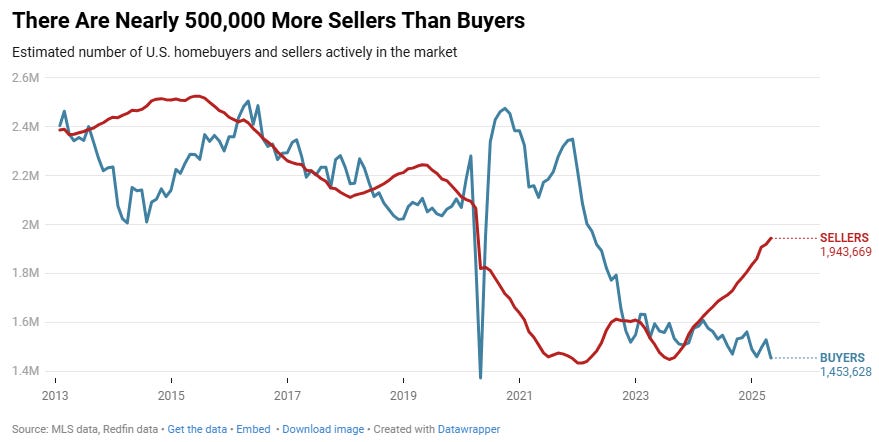

3) Housing data shows sellers now exceed buyers by over 500,000, marking the largest imbalance ever recorded in the market.

4) Gold reaches new all-time high, $3,600/oz.These four events aren't separate events - they're interconnected signals of a massive economic transformation. The job market is weakening, confidence is collapsing, housing is correcting, and money is fleeing to safety.

1️⃣ The US now has more unemployed people than job openings for the first time since April 2021. America is in a serious jobs slump.

CNN Business reported that for the first time in over four years, there are more unemployed Americans than available job openings - a turning point that signals serious trouble ahead. The Bureau of Labor Statistics showed 7.2 million unemployed workers against just 7.18 million job openings in July, confirming America is in a serious jobs slump.

💡Andrew’s Analysis:

This isn't just a statistic; it's a fundamental power shift. For the last few years, employees had all the leverage. They could quit, demand higher pay, and find a new job easily (the "Great Resignation"). That era is now over. This new data shows that companies are pulling back on hiring, and the safety net of abundant jobs is gone. The long-term implication is that job security will once again become a top priority for millions

We're entering what economists call a "employer's market" - and it could last for years. Companies will slash benefits, freeze wages, and demand more work from fewer people. (It's already happening - layoffs jumped 39% in August alone.)

Advice:

Your career is your biggest asset. Now is the time to protect it. Make yourself indispensable at work. Don't just meet expectations; exceed them.

Start networking NOW - 70% of jobs aren't posted publicly.

Strengthen your buffer: Build or refill a 6-month emergency fund (so a layoff doesn’t derail you).

2️⃣ 70% believe the American dream—that if you work hard, you will get ahead—no longer holds true or never did, the highest level in 15 years.

The Wall Street Journal reported that nearly 70% of Americans say the American dream—“work hard, get ahead”—no longer holds. Only 25% think they can raise their standard of living. (That’s the weakest reading in decades.)

💡Andrew’s Analysis:

We're splitting into two Americas: those who own appreciating assets and those who only earn wages. Guess which group builds wealth?

This creates what I call the "Great Wealth Divergence." People with assets (stocks, real estate, businesses) will get richer while people depending only on job income will fall further behind.

This isn't just about money (it's about the fundamental collapse of belief in the system that built America). When people lose faith that effort leads to reward, everything changes - politics, spending habits, life choices.

The new reality? Asset owners thrive, wage earners struggle. It's not about working harder anymore - it's about working smarter and thinking like an owner, not an employee.

3️⃣ Housing data shows sellers now exceed buyers by over 500,000, marking the largest imbalance ever recorded in the market.

Redfin reported that the U.S. housing market has ~490,000 more sellers than buyers (about 34% more sellers), the largest imbalance ever recorded since they started tracking in 2013.

💡Andrew’s Analysis:

Imagine you're at an auction where everyone wants to sell but nobody wants to buy. That's exactly what's happening in housing right now. For years, buyers had no leverage (sellers held all the cards). Now the entire game has flipped.

We're entering the first buyer's market in over a decade. Redfin predicts 1% national price drops, but overheated markets like Florida and Texas could see 10-20% declines. The mortgage lock-in effect is breaking as life forces people to move (divorce, job changes, financial stress).

This creates a massive wealth transfer opportunity from desperate sellers to prepared buyers.

Advice:

Get mortgage pre-approval NOW (even if you're not ready to buy). When the perfect deal appears, you can move faster than cash buyers.

Target desperate sellers - Listings sitting 60+ days, divorce sales, job relocations, estate sales

Demand major concessions - Sellers will pay closing costs, do repairs, include appliances

Lowball strategically - In buyer's markets, offers 10-15% below asking price often get accepted

4️⃣ Gold reaches new all-time high, $3,600/oz.

Reuters confirmed that gold shattered through $3,600 per ounce for the first time in history, driven by weak jobs data and Federal Reserve uncertainty. The precious metal has surged 37% this year, crushing traditional investments and sending a clear message about economic confidence.

💡Andrew’s Analysis:

Gold is the ultimate fear gauge. It doesn't pay dividends or have earnings reports. Its price goes up for one simple reason: fear. Investors are not just worried about a slowing economy; they are worried about the stability of the entire system. Surging government debt and political pressure on the Federal Reserve are eroding trust in traditional money. When people lose faith in paper currency and government promises, they have run to gold for 5,000 years. Gold's rally today is a powerful vote of no confidence in the current economic path.

Here's what most people don't understand: Gold hitting records while stocks also hit records is extremely rare. Normally, they move in opposite directions. This suggests smart money is hedging - they want stock gains but they're buying insurance too.

This isn't just about inflation (it's about loss of confidence in the entire monetary system). Central banks worldwide are dumping U.S. Treasury bonds and buying gold. Goldman Sachs predicts gold could hit $5,000 if the Fed loses its independence - and Trump's attacks on Jerome Powell suggest this isn't theoretical anymore.

Advice: Consider an allocation (think 5-10%) of your portfolio to gold. It acts like insurance. When your stocks are down, gold often goes up, smoothing out your returns.

The "Crisis Arbitrage" Method:

Increase gold during: Elections, wars, banking crises, currency collapses

Reduce during: Economic booms, rising rates, strong dollar periods

*️⃣ Other news this week:

Only 18% of US individuals earn more than $100,000, per FORTUNE.

President Trump says tariffs could replace federal income tax.

Robinhood $HOOD to join S&P 500.

Alcohol consumption in the US has fallen to record low, per Bloomberg.

👉 For daily insights, follow me on Twitter/ X, Instagram Threads, or BlueSky, and turn on notifications!

3. Important Charts and Numbers (and why they matter):

This week, we analyze:

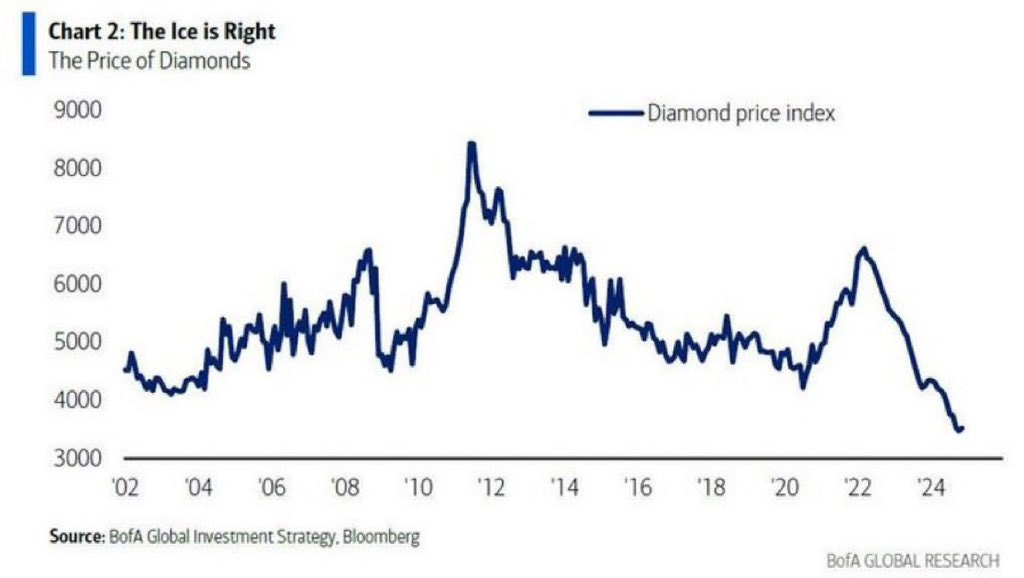

1) Diamond prices have fallen to their lowest level this century!

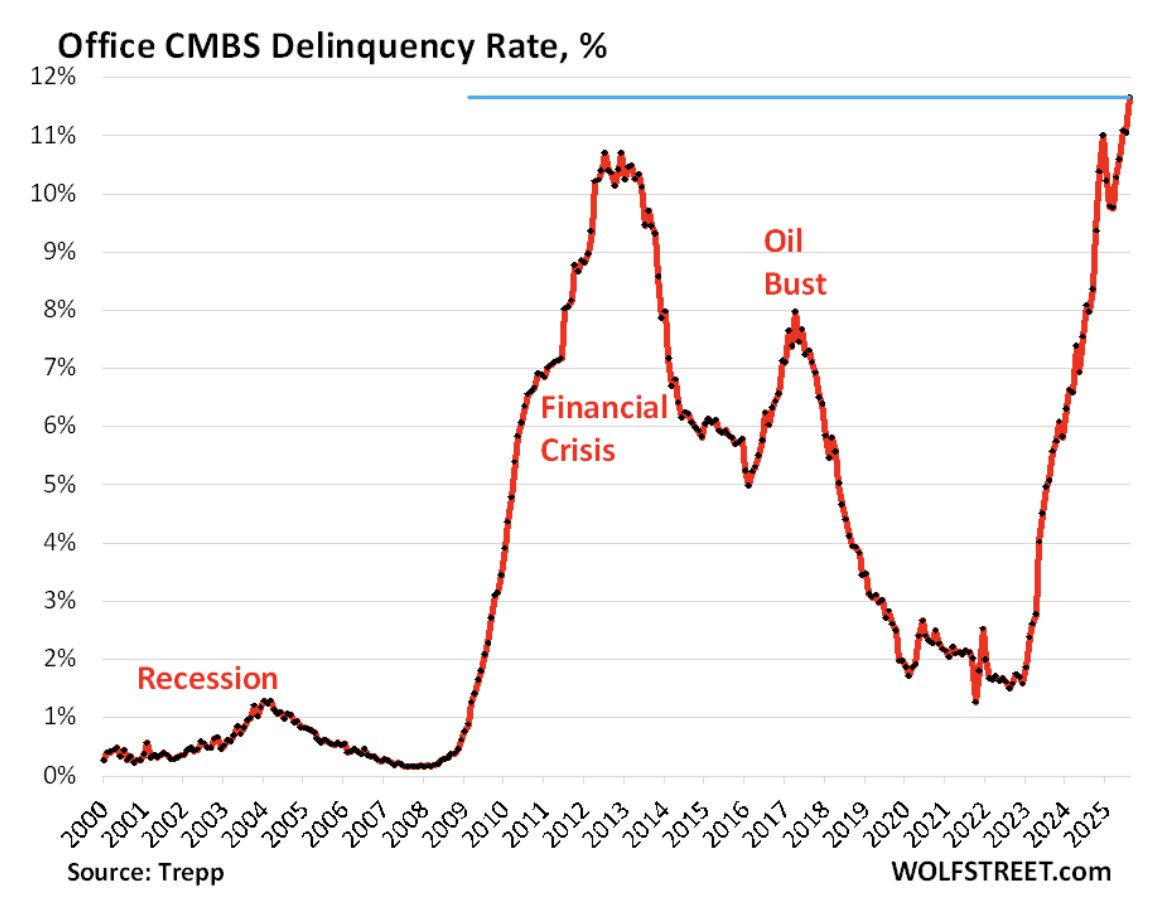

2) Office CMBS Delinquency Rate jumps to 11.7%, the highest level in history.

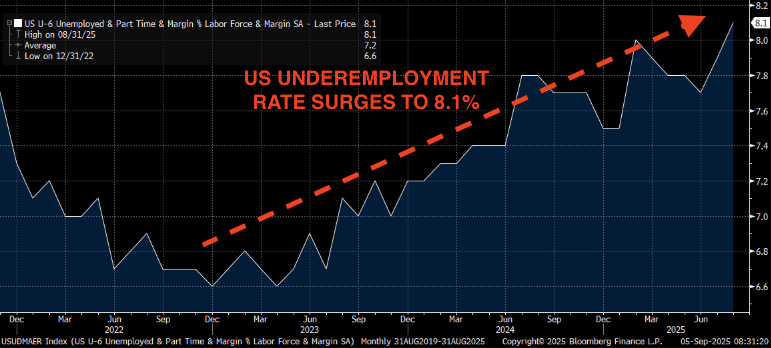

3) The underemployment rate in the US just jumped to 8.1%, marking the highest level since 2021.

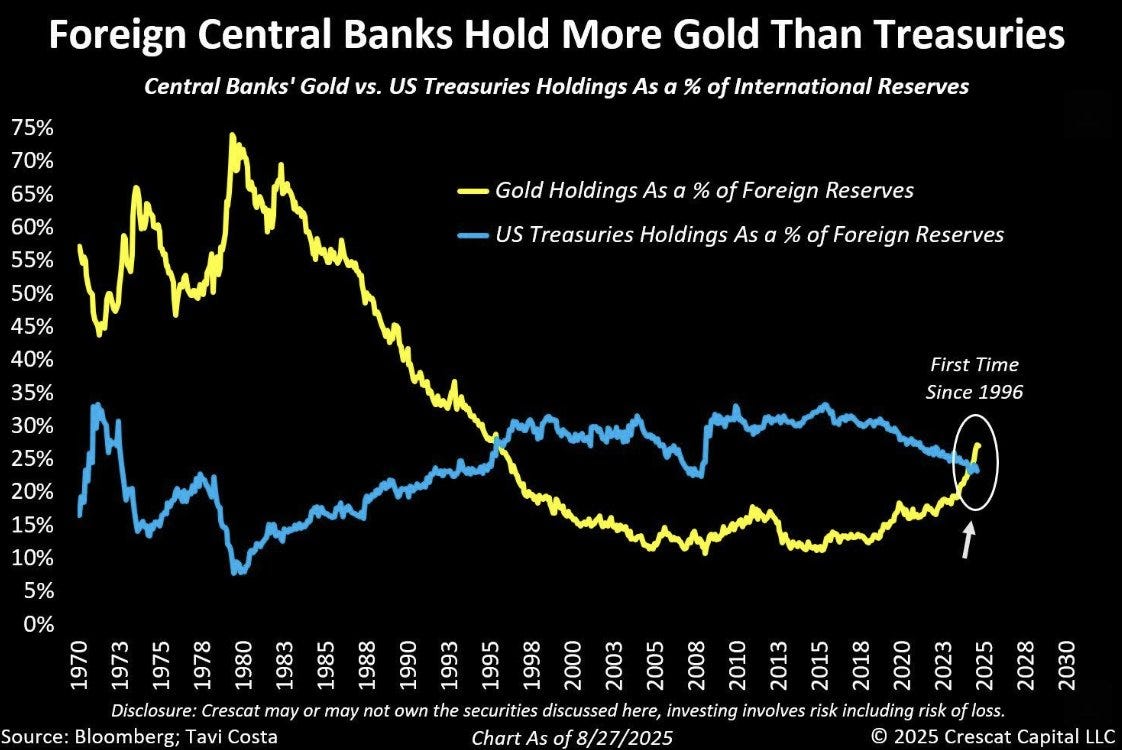

4) Foreign Central Banks now own more Gold than U.S. Treasuries for the first time in almost 30 years.These four charts tell one coherent story: We're in the early stages of a massive economic restructuring that will create winners and losers for decades.

Jobs are softening, office debt is breaking, consumers are cautious, and central banks are choosing gold.

1️⃣ Diamond prices have fallen to their lowest level this century!

💡Andrew’s Analysis:

The diamond market just experienced something that wasn't supposed to happen - prices collapsed to their lowest level in over 100 years. From the 2011 peak around 8,500 on the index, diamonds have cratered to under 3,500 today. That's a 60% destruction of value in what was supposed to be a "forever" asset.

This reminds me of the famous De Beers slogan "A Diamond is Forever" - one of the most successful marketing campaigns in history. For decades, they convinced people that diamonds were rare, valuable, and would always hold their worth. That story just shattered.

What's Really Happening:

The diamond crash reveals three massive economic shifts:

Lab-grown diamonds now cost 90% less than mined ones with identical quality

Younger generations don't buy the "diamonds equal love" marketing

Economic pressure makes luxury spending the first thing people cut

Advice

Avoid diamond jewelry as an investment (it was never a good one anyway)

Buy gold instead - while diamonds were marketing, gold has 5,000 years of monetary history

Never confuse a luxury purchase with an investment. Buy things like jewelry, watches, or designer bags because you love them and will enjoy using them, not because you think they will grow in value.

2️⃣ Office CMBS Delinquency Rate jumps to 11.7%, the highest level in history.

💡Andrew’s Analysis:

The office building market is experiencing something worse than the 2008 financial crisis. Commercial Mortgage-Backed Securities (CMBS) delinquencies just hit 11.7% - higher than the 10.7% peak during the banking meltdown.

This chart shows a parabolic spike that should terrify anyone who owns commercial real estate or works in a downtown office. Since December 2022, delinquencies have risen over 10 percentage points. That's not a trend - that's a collapse.

This means that more office landlords are failing to pay their mortgages than at any time in history, including the 2008 financial crisis. The problem is getting worse, faster than it did back then.

Think about this like the Titanic hitting the iceberg. The initial impact seemed manageable, but the structural damage was massive and irreversible. That's what's happening to office buildings right now.

Steve Jobs predicted this shift decades ago when he said, "The desktop metaphor was revolutionary, but the future is mobile." He didn't just mean phones - he meant work itself would become mobile.

What This Really Means:

This isn't just about remote work (though that's part of it). We're witnessing:

Permanent downsizing of office space needs

Bank failures as commercial real estate loans default

This is a massive red flag for regional banks, which are heavily exposed to these commercial real estate loans. The risk is that these bad loans could trigger a wave of bank failures.

Urban economic collapse as downtown areas empty out

Pension fund losses heavily invested in commercial real estate

3️⃣ The underemployment rate in the US just jumped to 8.1%, marking the highest level since 2021.

💡Andrew’s Analysis:

While everyone focuses on the official unemployment rate, the underemployment rate just hit 8.1% - the highest since 2021. This chart shows the real story of American workers that politicians don't want you to see.

Underemployment captures people working part-time who want full-time work, plus those who've given up looking entirely. This is the economic reality for millions of families that traditional unemployment statistics completely miss.

Ray Dalio calls this type of hidden economic weakness a "beautiful deleveraging" - where the surface looks calm while massive structural problems build underneath.

What the 8.1% Really Tells Us:

The rising underemployment rate reveals:

Gig economy exploitation - people calling Uber driving a "job"

Corporate cost-cutting - hiring part-time to avoid benefits

Skill mismatches - workers trained for jobs that no longer exist

Economic desperation - people taking anything they can get

The Big Picture Warning: When underemployment stays high, social unrest and political instability follow. History shows this pattern repeatedly. Position yourself accordingly.

Advice If You're Employed:

Skill up immediately in AI, healthcare, or trades that can't be automated

Build side income streams before you need them

Network aggressively - most jobs come through connections, not applications

Advice If You're Underemployed:

Stop waiting for the "perfect" job - take something stable and keep looking

Learn high-demand skills through free online courses (coding, digital marketing, healthcare)

Consider moving to areas with better job markets

4️⃣ Foreign Central Banks now own more Gold than U.S. Treasuries for the first time in almost 30 years.

💡Andrew’s Analysis:

This chart shows the most important monetary shift in 30 years. For the first time since 1996, foreign central banks now hold more gold than U.S. Treasury bonds as a percentage of their reserves.

Look at that crossing point - it's not gradual, it's decisive. The yellow line (gold) is rising while the blue line (Treasuries) is falling. This represents a fundamental loss of confidence in the U.S. dollar as the world's reserve currency.

This reminds me of when Britain lost its reserve currency status to the U.S. after World War II. It didn't happen overnight, but once the trend started, it accelerated rapidly.

Ray Dalio has been warning about this for years: "The biggest risk is that we're in a period where the world's reserve currency is being challenged."

What This Seismic Shift Means:

Central banks are the smartest money in the world. When they collectively dump Treasuries for gold, they're signaling:

Inflation concerns about unlimited money printing

Political instability in the U.S. (debt ceiling fights, Fed independence threats)

Preparation for a multipolar currency world where the dollar isn't dominant

Protection against sanctions (gold can't be frozen like digital assets)

Historical Perspective: Every reserve currency in history eventually lost its status - the British Pound, the Dutch Guilder, the Spanish Real. The dollar's 80-year run is actually longer than most.

Advice:

Buy gold and silver before the crowd realizes what's happening. If the world's central banks are buying gold as long-term insurance, it makes sense for you to consider it, too.

You don't need a vault. A simple way to add gold to your portfolio is through an ETF like the SPDR Gold Shares (ticker: GLD). A small 5-10% allocation can act as powerful protection against uncertainty.

Avoid long-term Treasury bonds - central bank selling will push yields higher

Consider international exposure - not everything should be dollar-denominated

Make sure you're not 100% invested in the U.S. stock market. Add a low-cost international stock market ETF to your portfolio. This gives you a stake in global growth and protects you if the U.S. market underperforms in the coming years.

Buy assets that benefit from dollar weakness - commodities, foreign stocks, real estate

Own tangible assets that hold value regardless of currency fluctuations

Pay off dollar-denominated debt while the dollar is still strong

👉For more charts, follow me on Instagram, Facebook, LinkedIn, and turn on notifications!

🔒 Premium Research & Analysis 🔒

4. Stock picks, research and analysis (what every investor needs to know):

Each week, I invest around $5,000 into my long-term investments. Here’s where my money is going this week.

This week, we analyze:

1) Rocket Lab (RKLB) — The Toll Road to the Final Frontier

2) Arm Holdings (ARM) — The Invisible Power Behind Everything

3) Snowflake (SNOW) — Monetizing the world’s data, then feeding AI

Own the picks-and-shovels of two unstoppable waves—space infrastructure and AI—and a pure play on data monetization:

Rocket Lab: Pure growth play on space infrastructure (high risk, high reward)

Arm Holdings: Steady technology royalties with massive scalability (medium risk, high reward)

Snowflake: Data infrastructure play on AI revolution (medium risk, medium-high reward)

These companies are building the invisible infrastructure of tomorrow:

Space connectivity for everything

Energy-efficient computing for AI

Data organization for intelligence