💥My Investing Insights & Market Analysis [August 26, 2025]

The AI bubble, Interest rate cuts coming in September, U.S. debt tops $37 trillion — Plus My Stock Picks, Insider Trading, Interest Rate Predictions, Technical Analysis and More!

👋 Good morning my friend and welcome back to your favorite newsletter! I hope you’ve had a wonderful weekend!

Thank you for joining 108,000+ members and subscribing to our newsletter, dedicated to helping you get richer and smarter with money!

If you enjoy reading our newsletter, please hit the LIKE button❤️ on this post so more people discover it on Substack 🙏

📬This week we discuss:

Part I — Financial Insights:

1) My Weekly Stock Market & Economic Analysis

2) Most Important Financial Events This Week (with my thoughts)

3) Important Charts & Numbers

🎯Premium Research & Analysis:

Part II — Stock Market Insights:

4) My Stock Picks, Research, and Analysis

5) Billionaires, Politicians and CEO Insider Trading

6) Trade of the Week (options trading)

7) Best Performing Stocks This Week (catalysts, earnings, and news)

8) Important Earnings & Stocks to Watch

Part III — Real Estate Insights:

9) My Real Estate Market Analysis & Predictions, This Week

10) My Interest Rate Predictions & Current Rates

Part IV — Macro & Economic Insights:

11) My Technical Analysis (S&P 500, Tech Stocks, Bitcoin)

12) Market Sentiment & Economic Outlook

13) Important Economic EventsBut before we get into it, please support us and:

Hit the LIKE button❤️ on this post so more people discover it on Substack 🙏

Share this newsletter with friends and family to help them get richer and smarter with money!

Become a paid subscriber and support us! (This newsletter takes many hours of research and writing!)

1. This Week’s Stock Market & Economic Analysis:

Everything important that happened this week:

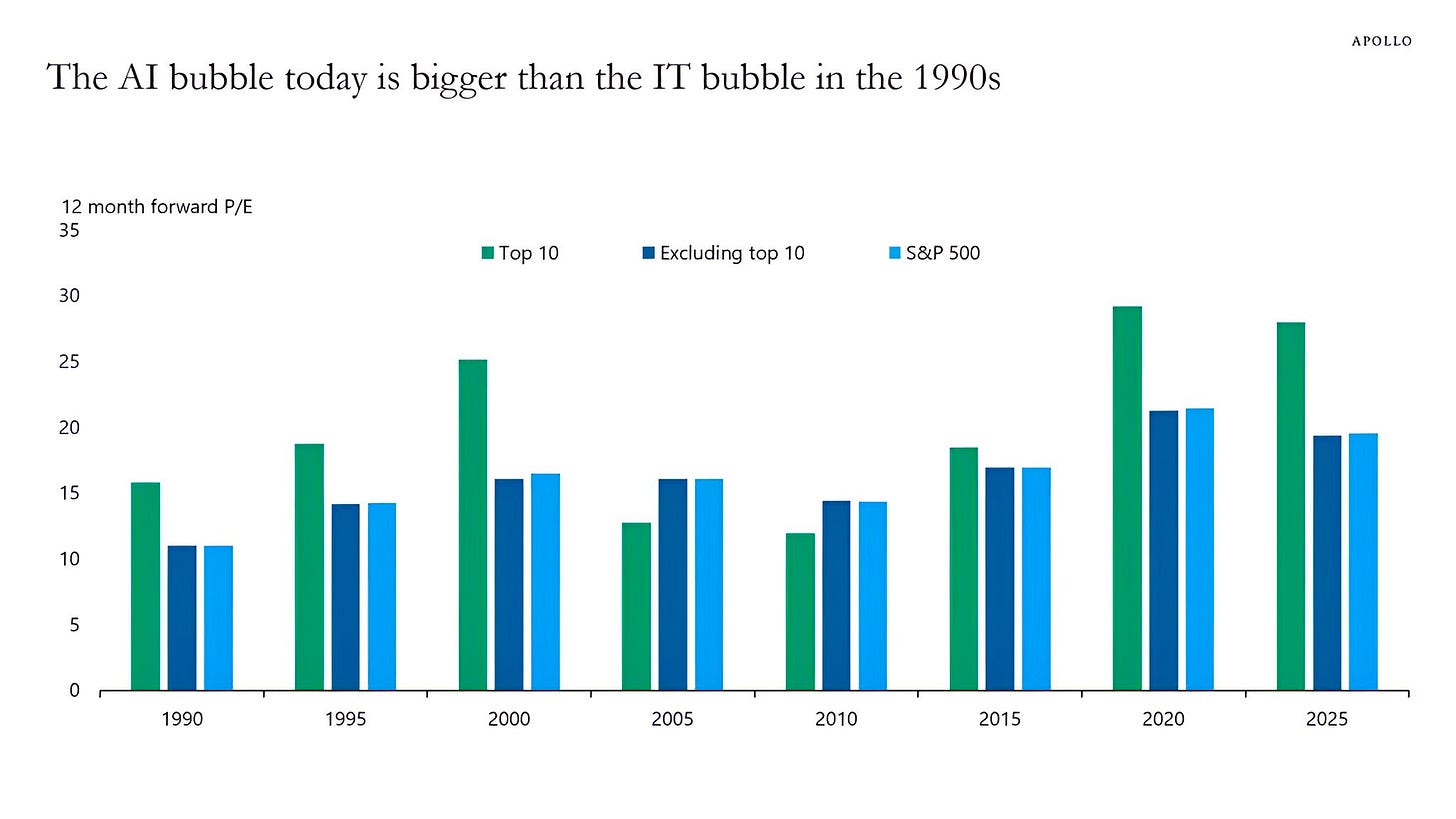

The S&P 500 fell for five straight days, weighed down by weak earnings, soft job data, low consumer confidence, and a tech selloff sparked by worries about high valuations and a possible AI bubble.

Concerns about the AI boom grew after an MIT report showed that 95% of companies using generative AI have little to show for their investments, despite spending billions.

On Friday, Fed Chair Jerome Powell signaled that rate cuts may come in September. Markets now see an 83% chance of a cut, and the Dow jumped to a record high.

Coffee prices surged, rising for six days in a row and logging their biggest weekly gain since 2021.

Tariff-driven inflation is hitting consumers: Pepsi announced price hikes on sodas, Sony said the PlayStation 5 will cost more, and Nikon raised U.S. prices on cameras.

💡Andrew’s Analysis:

The AI Reality Check

Remember the dot-com bubble? Everyone thought every company with ".com" in its name was pure gold. Warren Buffett famously avoided tech stocks during that frenzy, saying he didn't understand them. While others lost fortunes, Berkshire Hathaway stayed steady.

Today's AI situation mirrors that same pattern. MIT's bombshell report showing 95% of AI investments producing zero results isn't just a statistic – it's a massive red flag waving in your face. Think about it: if you spent $1,000 on something and had a 95% chance of getting nothing back, would you do it?

Here's what you need to do right now:

Audit your portfolio for companies that justify high valuations purely on "AI potential"

Look for companies actually making money from AI (like NVIDIA selling the shovels during the gold rush)

Consider taking profits from overvalued AI stocks before the bubble fully pops

Why Your Coffee Costs More Than Your Attention

Here's something most people miss: commodity prices often predict broader economic trends. Coffee prices surging isn't just about your morning latte – it's a canary in the coal mine for global inflation pressures.

Steve Jobs once said, "Innovation distinguishes between a leader and a follower." The same applies to investing: leaders spot trends before they become obvious. When Pepsi, Sony, and Nikon all raise prices in the same week, that's not coincidence – that's tariff-induced inflation hitting Main Street.

Three Scenarios:

Best-Case Scenario: The Goldilocks Economy

If the Fed cuts rates gently and inflation cools, you'll see a "soft landing" where stocks recover gradually. Companies with strong fundamentals will shine while AI hype stocks get left behind.

Advice: Focus on dividend aristocrats (companies that've raised dividends for 25+ years). These survivors know how to navigate any storm.

Worst-Case Scenario: The Double Whammy

If rate cuts can't fix underlying economic problems while inflation keeps rising, we get stagflation (slow growth + high prices). Think 1970s all over again.

Your defense strategy: Real assets become king – precious metals, real estate, commodities, and inflation-protected bonds (TIPS).

Most Likely Scenario: The Bumpy Ride

Markets will probably zigzag for months as investors debate AI valuations, rate cut timing, and inflation persistence. Volatility becomes the new normal.

Your opportunity: Dollar-cost averaging into quality stocks during the bumps. As Buffett says, "Time in the market beats timing the market."

Cognitive Biases That'll Cost You Money

Recency bias will make you think this week's patterns continue forever. Confirmation bias will make you seek news that supports your existing positions. FOMO will make you chase whatever's working today.

The antidote? Create rules before emotions kick in:

Set stop-losses at 15-20% for speculative positions

Write down why you bought each stock – if reasons change, so should your position

Personal Finance Advice

Review your emergency fund – aim for 6-12 months of expenses

List all subscriptions and monthly expenses – inflation's coming, so cut the fat now

Check your credit score – if rates drop, you might refinance or consolidate debt

Invest in yourself first – skills and knowledge can't be inflated away

Think global – don't just buy American stocks when the whole world's your marketplace

Stay curious, not convinced – the best investors change their minds when facts change

The Coffee Shop Test

Here's a simple way to gauge real economic health: Track everyday prices at places you visit regularly. If your local coffee shop, grocery store, and gas station all raise prices within months of each other, that's inflation's footprint in your daily life.

This isn't academic theory – it's your purchasing power shrinking in real time. The companies that can maintain margins during these periods (by passing costs to consumers) are often the best investments.

Final Thoughts: Playing Chess While Others Play Checkers

Most investors react to news. Smart investors position for what comes next. This week's market action isn't just random noise – it's three major themes converging: AI reality check, monetary policy shifts, and inflation pressures.

The question isn't whether these trends continue (they will), but how you'll position yourself to profit from them. Remember: every market crisis creates millionaires – they just don't panic with the crowd.

The market's giving you signals. The only question is: Are you listening?

👉 For daily insights, follow me on Twitter/ X, Instagram Threads, or BlueSky, and turn on notifications!

2. Most Important Financial Events This Week (with my thoughts):

This week, we analyze:

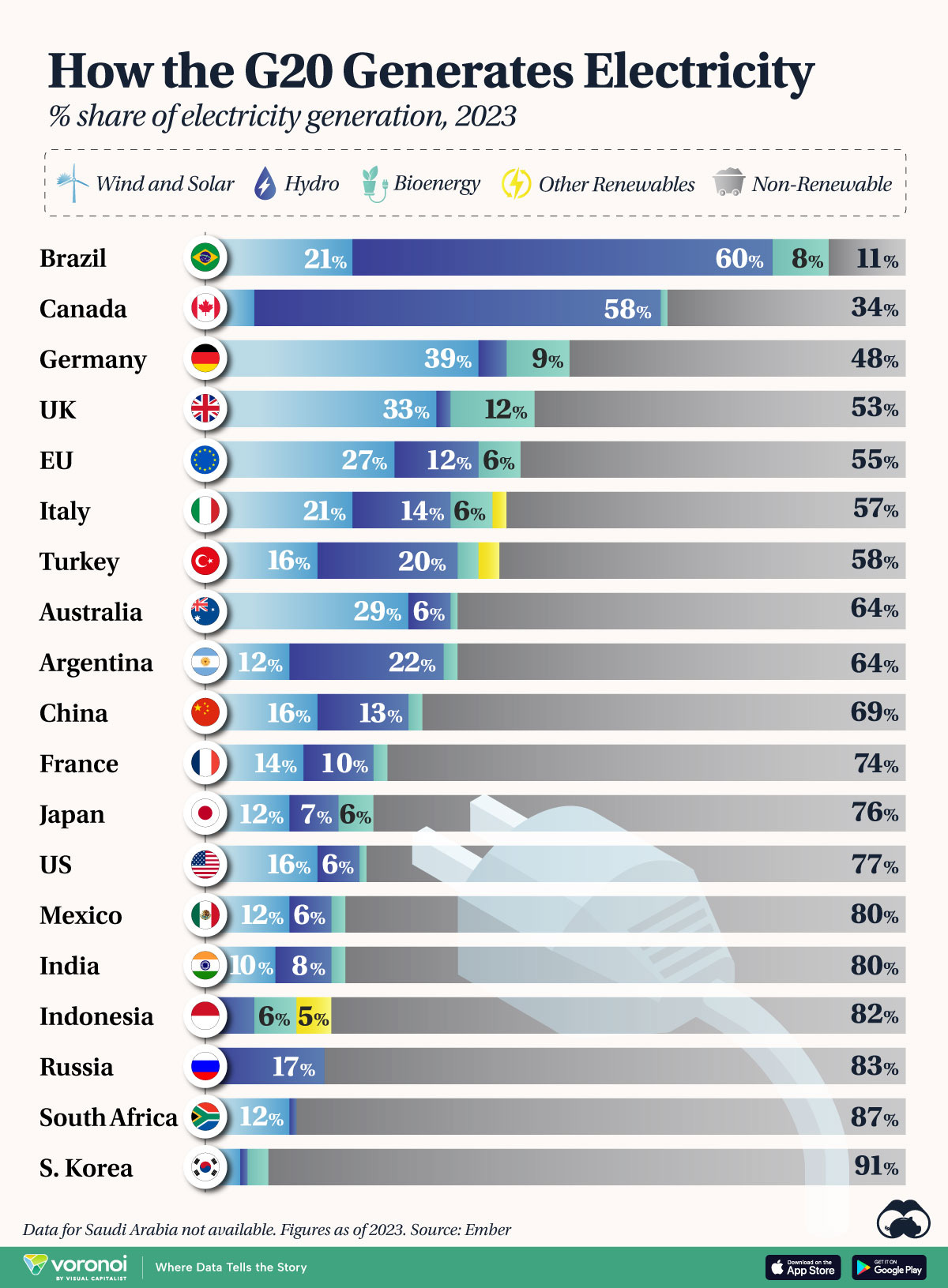

1) Electricity prices are climbing more than twice as fast as inflation

2) 95% of Companies See ‘Zero Return’ on $30 Billion Generative AI Spend, MIT Report Finds

3) U.S. Corn Harvest Hits Record 16.7 Billion Bushels — Farmers Call It ‘A Disaster in Disguise’

4) The warning signs the AI bubble is about to burst

5) US National Debt Now Surpasses $37 Trillion Milestone

6) Massachusetts collected $2 billion more in tax revenue than expected because of millionaires tax 1️⃣ Electricity Prices Outpacing Inflation

Electricity costs are rising at more than double the rate of inflation, hitting households hard during peak summer. Families in Florida are reporting $400–$500 monthly bills.

💡Andrew’s Analysis:

Here's what's driving the surge: Power-hungry AI data centers are gobbling up electricity like never before. The Energy Department says these data centers will use more power than all American homes combined next year. Meanwhile, we're exporting more natural gas overseas (which generates 40% of our electricity), creating competition that drives up domestic prices.

The harsh reality? One in six households already struggles to pay their power bills.

Why this matters long-term:

Energy is the foundation of modern life. When power prices rise faster than wages, it squeezes consumer spending and slows the economy.

Data centers driving the AI boom are major energy users. The more AI grows, the more pressure it puts on power grids — and on your wallet.

Natural gas exports add another cost driver. As the U.S. sells more LNG abroad, domestic utilities face higher input costs.

Investing takeaway: Utility companies may benefit in the short run from higher rates, but long-term winners will be firms building cleaner, cheaper energy (solar, wind, nuclear). If you’re investing, consider ETFs focused on renewable infrastructure.

Personal finance tip: Audit your own power usage. Energy efficiency (like insulation, LEDs, smart thermostats) often pays back in less than two years. Think of it as a guaranteed return — just like Warren Buffett sees “saving” as the same as earning.

2️⃣ MIT Report: 95% of Companies See Zero Return on AI Spend

After $30–40 billion poured into generative AI pilots, only 5% of companies report meaningful business gains. Most projects stalled due to poor integration, brittle workflows, and inflated expectations.

💡Andrew’s Analysis:

Why this matters long-term:

Every bubble starts with overinvestment. This is the dot-com playbook all over again: lots of failures, a few Amazons.

Companies that treat AI as a magic bullet will keep losing money. Firms that apply it narrowly (customer support, coding, documentation) will thrive.

Investing takeaway: Don’t blindly chase “AI stocks.” Instead, focus on firms already delivering profits from AI — like chipmakers and cloud providers. Or diversify with an AI ETF to spread your risk.

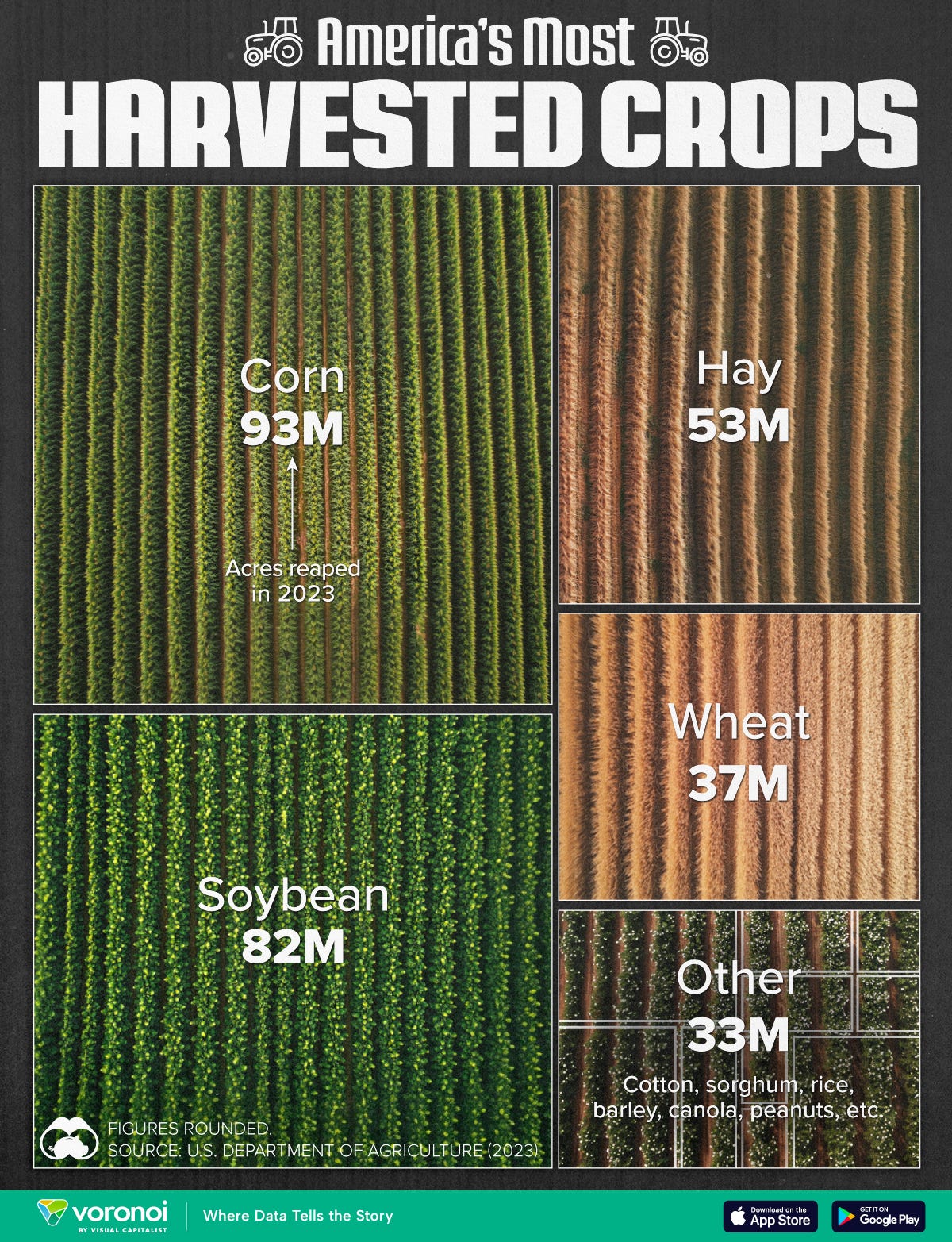

3️⃣ U.S. Corn Harvest Sets Record — Farmers Call It a Disaster

The U.S. will harvest a record 16.7 billion bushels of corn this year. Instead of celebration, farmers see disaster: oversupply is driving prices to five-year lows, with losses of $80–$100 per acre.

💡Andrew’s Analysis:

Why this matters beyond farming: Corn feeds our entire food system. It goes into animal feed (40%), ethanol fuel (37%), and exports (15%). When farmers lose money, they plant less next year, potentially creating shortages and price spikes later.

The trade war factor: Tariffs are creating uncertainty in export markets. While some countries are buying now before tariffs hit, others are finding alternative suppliers. Trade wars often hurt farmers first and hardest.

Why this matters long-term:

This is the paradox of abundance: too much supply can hurt producers while barely lowering prices for consumers.

Global trade tensions could make things worse. If tariffs cut exports, farmers face deeper losses, pushing rural America into more financial stress.

Personal finance tip: Don’t assume falling commodity prices mean cheaper groceries. Food inflation is more about supply chains, labor, and tariffs. Plan your budget with the expectation that food prices will stay high.

4️⃣ The Warning Signs of an AI Bubble

Tech stocks sold off this week after MIT’s report confirmed most AI projects aren’t paying off. Nvidia slipped 3.5%, Palantir fell 9%, and even Meta began restructuring its AI division. Sam Altman himself admitted investors are “overexcited.”

💡Andrew’s Analysis:

The warning signs are everywhere:

ChatGPT-5 underwhelmed users – many preferred the older version

Meta is downsizing its AI division despite Mark Zuckerberg spending hundreds of millions on AI talent

Morgan Stanley predicts $3 trillion in data center investment over three years, mostly funded by debt

Why this matters long-term:

Every bubble follows a pattern: excitement, overinvestment, and eventual shakeout. AI is no different.

The risk isn’t that AI dies — it’s that too much debt is being used to fund AI data centers. If the returns don’t match the hype, the fallout could ripple through tech stocks and credit markets.

Investing takeaway: Don’t get caught in the hype cycle. Build a “barbell” strategy: hold broad market ETFs for stability, but add small, careful positions in proven AI winners. (Think of this like venture capital — expect most to fail, but one or two to drive big returns.)

Personal finance tip: The bubble mindset hurts individuals too. When everyone around you is hyping an investment (crypto, meme stocks, AI), step back and ask: “If this crashes tomorrow, can I afford to lose it?” If not, size down.

5️⃣ U.S. National Debt Tops $37 Trillion

America’s debt has crossed $37 trillion, hitting this milestone years ahead of forecasts. The government is now paying more than $1 trillion a year in interest — more than it spends on defense.

💡Andrew’s Analysis:

America's debt just hit $37 trillion and grows by $1 trillion every 100 days. That's over $100,000 for every citizen, including newborn babies. We're paying $1.3 trillion annually just in interest – more than we spend on defense or Medicare.

The acceleration is alarming: The Congressional Budget Office predicted this debt level wouldn't hit until after 2030. COVID spending and recent legislation pushed us there five years early. We're borrowing money to pay the interest on money we already borrowed – a dangerous spiral.

Why this isn't just government accounting: When debt service consumes 25% of all tax revenue, there's less money for infrastructure, education, and social programs. Higher debt also means higher interest rates, which hurt everyone from homebuyers to small businesses.

The international angle: Foreign countries hold significant portions of our debt. If they lose confidence in America's ability to repay, they could dump treasuries and crash our currency.

Why this matters long-term:

High debt loads slow growth, weaken the dollar, and force future tax hikes.

Rising interest costs eat into the federal budget, crowding out spending on healthcare, education, and infrastructure.

No empire in history has thrived with runaway debt — Rome, Spain, Britain all serve as reminders.

Investing takeaway: High debt often leads to financial repression — policies that favor borrowers over savers. Expect future inflation and weaker currency. Gold, real assets, and inflation-protected bonds (TIPS) can help hedge.

6️⃣ Massachusetts Collects $2B Extra from Millionaires Tax

Massachusetts collected $2 billion more than expected this year, thanks to a surtax on millionaires. Most of the money will fund education and transportation.

💡Andrew’s Analysis:

The surprise factor: Economists predicted wealthy residents would flee to Florida or New Hampshire. Instead, millionaires largely stayed and paid up. This money can only go to education and transportation under the state constitution.

The national implications: Other states are watching closely. If taxing the wealthy works in Massachusetts without mass exodus, expect copycat legislation in California, New York, and other high-tax states.

The mobility myth: Contrary to popular belief, most wealthy people don't move just for taxes. They value quality schools, healthcare, infrastructure, and business networks – things taxes often fund.

Why this matters long-term:

States are experimenting with taxing the wealthy more aggressively. If successful, expect other states to follow.

This may reshape where people choose to live and work. (Remember how Florida and Texas gained population after New York and California hiked taxes?)

Investing takeaway: High state taxes often push wealthy residents and businesses to migrate. Real estate and local economies in low-tax states could benefit. Watch for trends in migration, since housing and job markets follow people.

Personal finance tip: Taxes are one of the few “guaranteed” expenses. Don’t just focus on income — plan around after-tax income. If you’re mobile, think about where you live (state taxes can make a bigger difference than federal rates for many high earners).

*️⃣ Other important news this week:

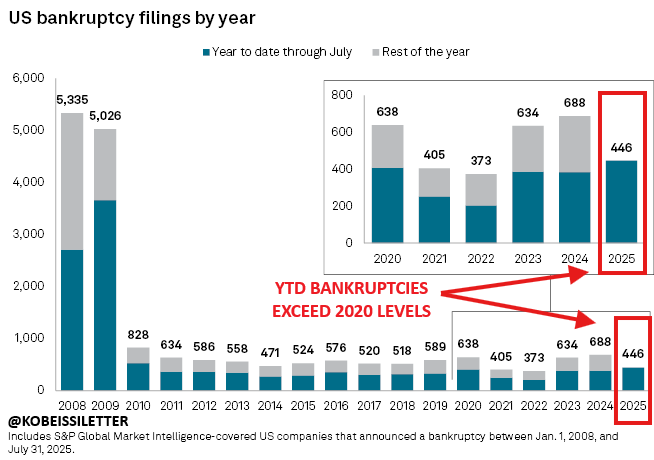

US bankruptcies are surging past 2020 pandemic levels, per Business Insider

CEOs are warning entry-level jobs are on the brink of extinction thanks to AI, per FORTUNE

Ethereum reaches new all-time high of $4,880

FDA warns public not to eat possibly radioactive shrimp sold at Walmart

👉 For daily insights, follow me on Twitter/ X, Instagram Threads, or BlueSky, and turn on notifications!

3. Important Charts and Numbers:

This week, we analyze:

1) There are now $40 BILLION worth of US data centers under construction, up +400% since 2022.

2) The US has now seen 446 LARGE bankruptcy filings in 2025, officially +12% ABOVE pandemic levels in 2020.

3) A homebuyer must now earn $114,627/year to afford the median-priced US home, per Redfin.

4) 39 of the Top 50 U.S. Metros have seen month-over-month housing price declines for the first time in history.1️⃣ There are now $40 BILLION worth of US data centers under construction, up +400% since 2022.

💡Andrew’s Analysis:

There’s now $40 billion worth of U.S. data centers under construction — a 400% jump since 2022. For the first time, spending on data centers will overtake office buildings. Meanwhile, office construction has collapsed, vacancy rates are at a record 20%, and prices are down more than 40% from pre-pandemic highs.

Why this matters: This is the clearest sign yet that the economy is shifting from the physical office age to the digital AI age. Think about it: in the 20th century, cities were built around office towers. In the 21st, they’re being rebuilt around servers.

Investing angle:

Look at AI infrastructure plays: data center REITs, chipmakers, energy utilities, and even companies converting empty offices into server farms.

Energy is the new bottleneck. By 2030, data centers could consume 10%+ of all U.S. power. That means renewable energy and nuclear may be the next “picks and shovels” play, just like chips are now.

In the late 1990s, Jeff Bezos built warehouses when everyone else thought the internet was about websites. The lesson? Follow infrastructure, not just hype. Today, infrastructure = data centers + energy.

2️⃣ The US has now seen 446 LARGE bankruptcy filings in 2025, officially +12% ABOVE pandemic levels in 2020.

💡Andrew’s Analysis:

So far in 2025, 446 large U.S. companies have filed for bankruptcy — already 12% above 2020 pandemic levels. July alone saw 71 bankruptcies, the worst month since July 2020.

Why this matters: This shows how damaging high interest rates and tariffs have been. Small-caps and consumer businesses are hit hardest, with iconic brands like Rite Aid, Joann’s, and Claire’s collapsing.

Investing angle:

Expect consolidation: strong companies will buy distressed ones cheap. Investors who spot acquirers early can ride that wave.

Personal finance tip: Rising bankruptcies mean rising layoffs. Build an emergency fund of 6 months minimum, avoid over-leverage, and protect yourself in case your employer is exposed.

3️⃣ A homebuyer must now earn $114,627/year to afford the median-priced US home, per Redfin.

💡Andrew’s Analysis:

It now takes an income of $114,627/year to afford the median U.S. home. That’s 42% higher than average household income. For most Americans, homeownership is now a luxury.

The math is brutal:

Median home price keeps rising

Interest rates remain elevated

Wages aren't keeping pace

Most Americans are being priced out of homeownership permanently

Why this matters: The American Dream is being redefined. With affordability this stretched, housing becomes less about living and more about wealth inequality. Renters fall behind, owners get richer.

Personal finance tips:

Follow the 28/36 Rule. This is your best defense against becoming "house poor." Your total housing cost should be no more than 28% of your pre-tax income, and your total debt payments should be no more than 36%. Do not break this rule.

Don't "Marry the House" if You Can't Afford the "Rate." People will tell you to just buy an expensive house now and refinance later when rates drop. This is a dangerous gamble. What if rates don't drop? What if you lose your job? Buy a home you can comfortably afford today, with today's income and today's interest rates. Period. If that's not possible, keep renting and saving aggressively. That is the winning move.

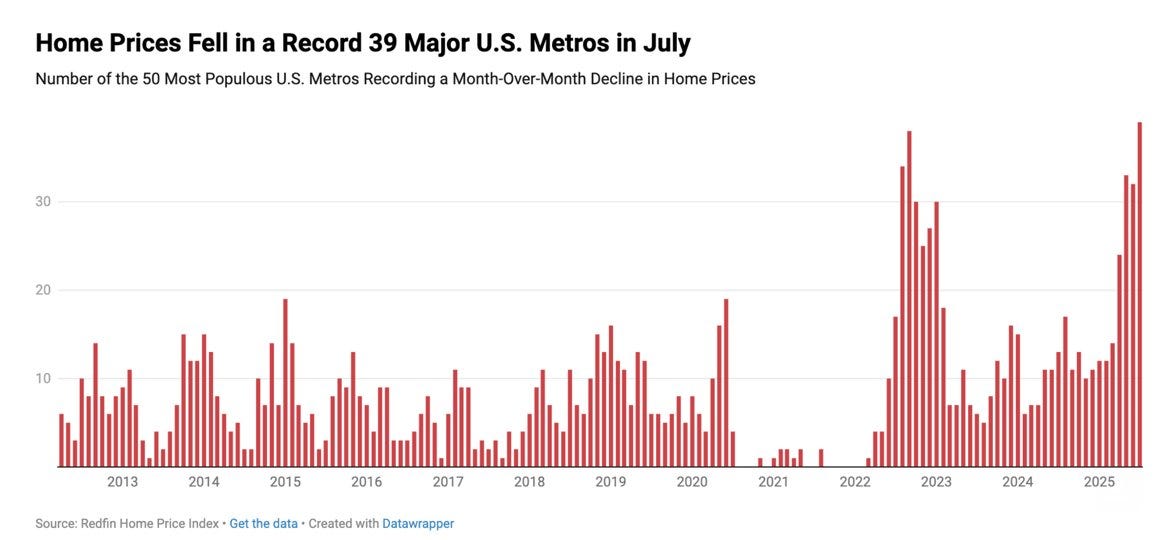

4️⃣ 39 of the Top 50 U.S. Metros have seen month-over-month housing price declines for the first time in history.

💡Andrew’s Analysis:

In July, 39 of the 50 largest U.S. metros saw home price declines — the most in history.

Why this matters: After years of non-stop appreciation, cracks are finally showing. Prices falling in so many metros at once signals the start of a possible housing reset.

Personal finance tip: If you’re a buyer, don’t panic. Falling prices can work in your favor. Patience pays. Just like in the stock market, sometimes the best strategy is to wait for the right entry point.

After the 2008 crash, those who bought foreclosures became millionaires a decade later. The takeaway? Housing downturns create once-in-a-generation chances for disciplined buyers.

👉For more charts, follow me on Instagram, Facebook, LinkedIn, and turn on notifications!

🔒 Premium Research & Analysis 🔒

4. What I’m Investing in (stock picks, research and analysis):

Each week, I invest around $5,000 into my long-term investments. Here’s where my money is going this week.

This week, we analyze:

1) MercadoLibre (MELI) — The Amazon of Latin America

2) Honeywell (HON) — The Quantum Supercomputing Play Nobody Sees ComingBoth picks—MercadoLibre and Honeywell—have one thing in common: They’re playing the long game.

MercadoLibre could triple if it executes the Amazon playbook successfully in a trillion-dollar market.

Honeywell could see a significant revaluation when Quantinuum goes public, plus you collect dividends while waiting.

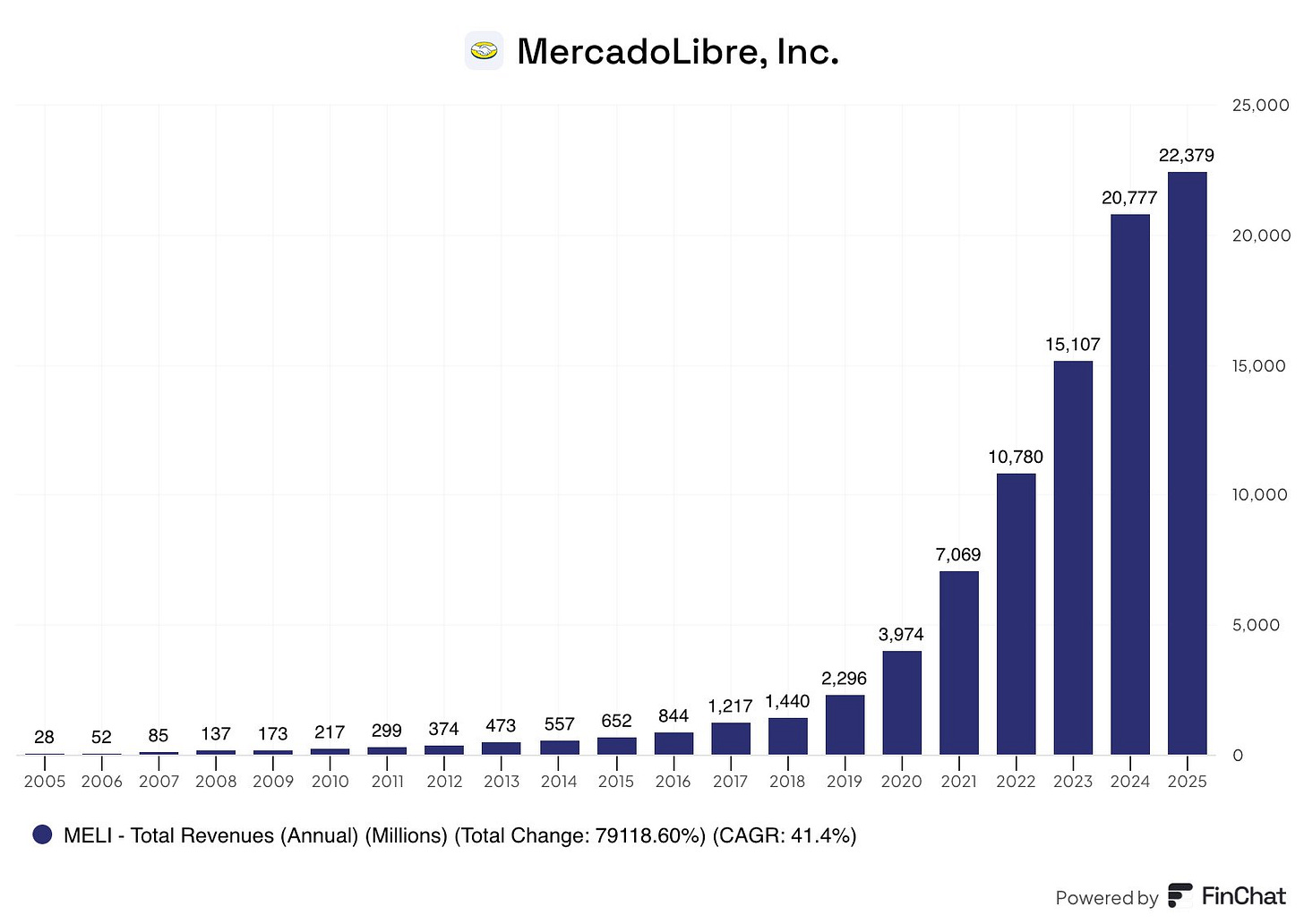

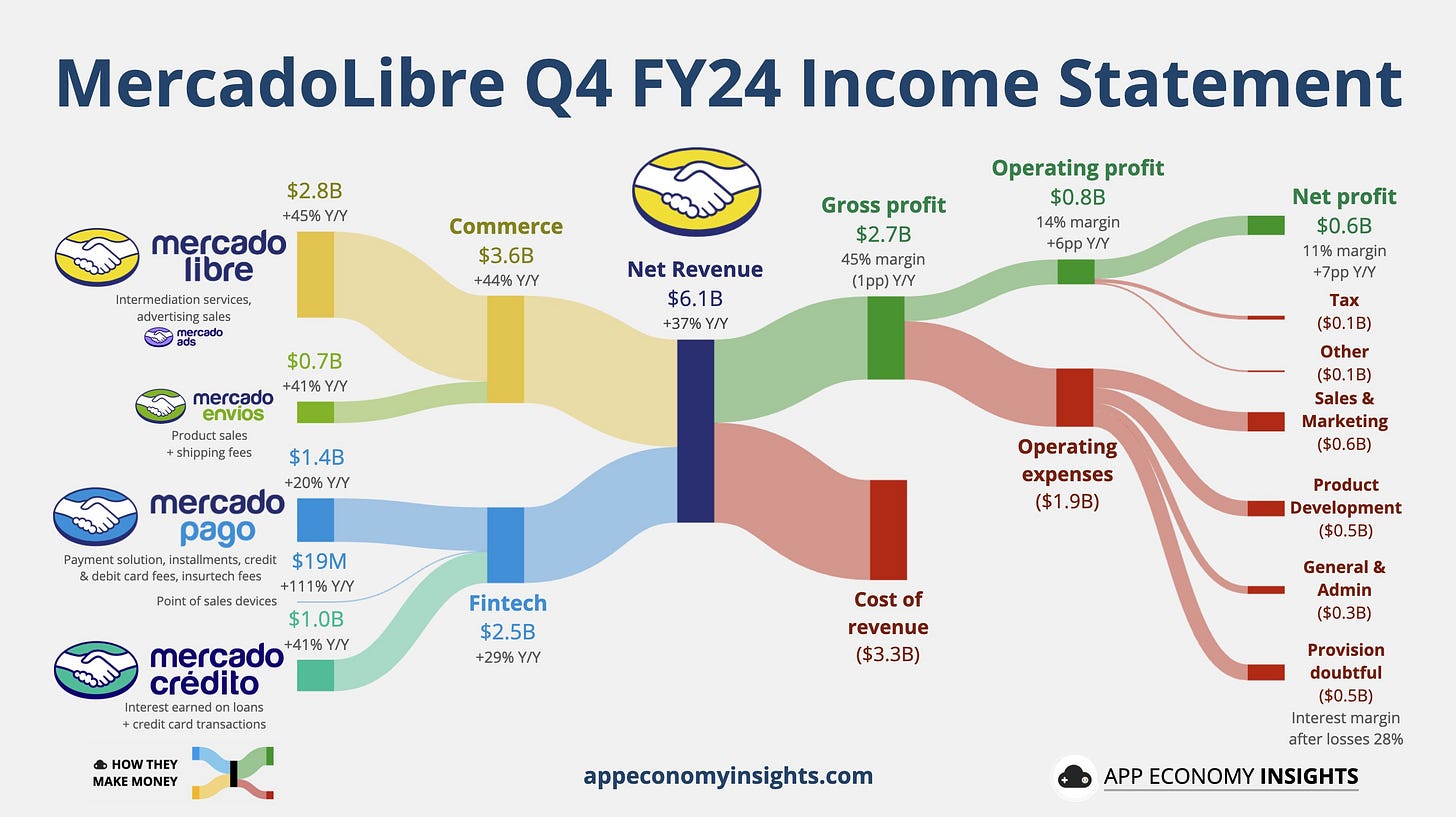

1️⃣ MercadoLibre (MELI) — The Amazon of Latin America

Here’s the big idea: You’re not just buying an e-commerce stock. You are buying the digital backbone of a continent whose middle class is just starting to boom. Think of MercadoLibre not as the "Amazon of Latin America," but as something much bigger: it's Amazon, PayPal, and UPS all rolled into one dominant company.

A 41% CAGR over 20 years:

What the Market Is Missing

Right now, Wall Street is stuck on the last quarterly report. They saw that earnings per share missed expectations and they panicked. They see a company spending money on "free shipping" in Brazil and think it's a sign of weakness.

This is a classic case of short-term thinking creating a long-term opportunity. They are completely missing the playbook that MercadoLibre is running. It's the exact same strategy Jeff Bezos used to build Amazon into a global empire.

The Real Story: The Bezos Playbook in a $1 Trillion Market

Remember what made Amazon unstoppable? Bezos was famous for ignoring short-term profits to gain long-term market dominance. He poured every dollar back into making the customer experience better—faster shipping, lower prices, more selection. He knew that by building the best service, he was building an unbreachable moat around his business.

That is precisely what MercadoLibre is doing right now.

They aren't "losing money" on shipping; they are buying customer loyalty for life. In a region where logistics are complex, becoming the most reliable and affordable delivery service is the ultimate competitive advantage.

They are building a three-part empire:

The Marketplace (Amazon): The dominant platform where everyone in Latin America shops online.

The Payment System (PayPal): Their "Mercado Pago" fintech arm is the leading digital wallet in a region where many people don't have bank accounts. It's becoming the standard for how people transact.

The Logistics Network (UPS): Their "Mercado Envios" division is building the delivery infrastructure that the continent desperately needs.

The market is valuing MercadoLibre as just one of these businesses, but we get all three. This ecosystem creates a powerful network effect: people shop on the marketplace, pay with Mercado Pago, and get it delivered by Mercado Envios. Each part of the business makes the other parts stronger.

And they are doing this in a market that is set to double in size to $1 trillion by 2027. We are in the very early innings of digital adoption in a region with over 650 million people.

The Investor's Playbook: How We Win

Our edge is simple: We will be patient when the market is being impatient.

We are buying the undisputed king of Latin American commerce and fintech at a discount because of short-term noise. While others are worried about this quarter's operating margin, we are focused on the company's march toward dominating a trillion-dollar market. This is a chance to buy a long-term compounder at a moment of temporary doubt. We get in now, and in 3-5 years, we will look back at this as the moment we bought a foundational piece of a continent's economy.

Big picture: Warren Buffett once said, “The best investment you can make is in a company with an enduring moat.” MELI is building that moat right now — sacrificing pennies today for dollars tomorrow.

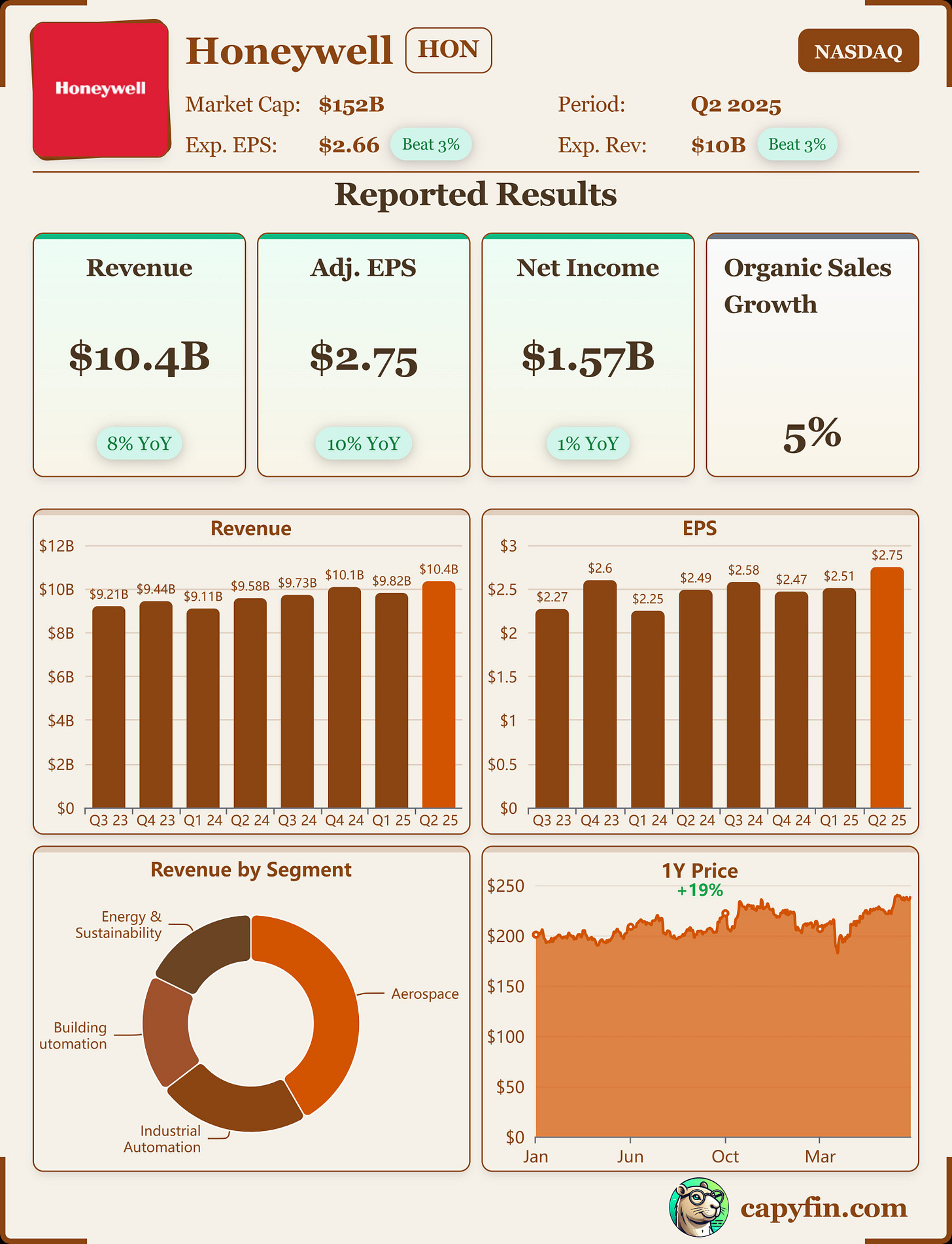

2️⃣ Honeywell (HON) — The Quantum Supercomputing Play Nobody Sees Coming

Honeywell is a diversified industrial leader in automation, aerospace, and defense. But the hidden gem is its 54% stake in Quantinuum, a top player in quantum computing. Most investors overlook this because quantum is still “early stage.” That’s a mistake.

Why it matters long-term:

Quantum computing could be the next platform shift after AI. Think of it like the internet in 1995 — the payoff isn’t immediate, but the upside is massive.

Quantinuum is on track for an IPO by 2026–2027, with potential valuations north of $10 billion. This could unlock hidden value on Honeywell’s balance sheet.

Meanwhile, Honeywell’s core businesses (automation, defense, aerospace) are already in multi-year upcycles. These provide steady growth and cash flow while we wait for the quantum catalyst.

Investment edge: Unlike pure-play quantum startups (which burn cash and have no revenue), Honeywell gives you upside exposure with downside protection. You get dividends, steady EPS growth (7%+ expected), and optionality if quantum breaks through.

How to profit:

Treat Honeywell as a “sleep-well-at-night” stock with a free call option on quantum computing.

The IPO of Quantinuum could act as a major re-rating catalyst for HON. Position ahead of that event.

In a diversified hedge fund portfolio, HON adds exposure to defense spending, automation, and quantum computing — all major secular themes.

Big picture: Investors often chase shiny startups, but real wealth comes from buying stability with optionality. Honeywell is a rare case where you get both. Think about how Apple bundled steady iPhone sales with optionality on future products. Honeywell’s playbook is similar.

👉For more insights, follow me on Twitter/ X, Instagram Threads, and turn on notifications.

5. Insider Trading from Billionaires, Politicians and CEO’s:

They're not gambling – they know something.

Legendary investor Peter Lynch famously said, "Insiders might sell their stock for any number of reasons, but they buy them for only one: they think the price is going up."

This week, we analyze:

1) Novo Nordisk $NVO

2) ICU Medical $ICUI

3) Check Point Software Technologies $CHKP1) Novo Nordisk NVO 0.00%↑

Novo Nordisk $NVO is having a moment with politicians. Congresswoman Marjorie Taylor Greene from Georgia bought between $15,000-$50,000 worth at $54.78 on August 18, 2025, filing just three days later on August 21. Fellow Republican Scott Franklin from Florida made a similar move earlier, purchasing between $15,000-$50,000 at $48.81 on August 3, 2025, filing on August 15.

Novo Nordisk is the Danish pharmaceutical giant behind Ozempic and Wegovy, the blockbuster weight-loss drugs that have Hollywood celebrities and everyday Americans lining up at pharmacies.

Politicians often have early access to healthcare policy discussions and Medicare coverage decisions. When two Republicans from different states buy the same pharma stock within weeks of each other, they're likely betting on favorable regulatory outcomes or expanded insurance coverage.

2) ICU Medical ICUI 0.00%↑

ICU Medical $ICUI made a big insider splash with CEO Vivek Jain purchasing a massive 21,929 shares for $2,474,375 at $112.84 on August 14, 2025, filing the same day. This represents an 11% increase in his ownership stake, sending a powerful signal about the company's prospects.

ICU Medical manufactures critical care medical devices and infusion systems that hospitals depend on for patient care. Jain's massive purchase suggests either major contract wins, new product launches, or acquisition discussions that haven't been made public yet. CEOs have access to forward-looking information that won't show up in quarterly reports for months.

3) Check Point Software Technologies CHKP 0.00%↑

Check Point Software Technologies $CHKP got the attention of Thomas Kean Jr, a New Jersey Congressman, who reported buying between $15,000 and $50,000 worth of shares on July 28, and made it public on August 21.

Check Point makes cybersecurity solutions that protect networks and data for businesses worldwide. The company's latest upgrades are focused on stopping new AI-driven cyber attacks, which is grabbing attention as attacks get more sophisticated.

When you see a politician buy into cybersecurity right before new tech rollouts or rising threats, that’s worth watching —especially as businesses and governments spend more to protect themselves.

6. Trade of the Week (options trading):

Each week, I swing trade around $1,000-$2,000 in stock options. I use AI to monitor options flow activity. Here’s where my money is going this week.

Bullish on CoStar Group CSGP 0.00%↑

Imagine a room where 20 people are betting a stock will go up, and only one person is betting it will go down. That’s exactly what happened with CoStar Group $CSGP, a company that is the king of real estate data. Think of it as the Bloomberg Terminal for commercial real estate; if you're a professional buying, selling, or leasing big buildings, you can't live without their information.

A big trader, or group of traders, just made a very loud bet that the stock will rise above $90 per share by September 19th. This wasn't just a small wager; they poured money into new positions, signaling fresh conviction. This is happening even as headlines scream about the "commercial real estate crisis."

This is a classic contrarian bet, and I am bullish on the signal it's sending. The person making this trade isn't betting on the real estate market itself; they are betting on the company that sells the maps during a storm. When an industry is in chaos, the need for reliable data and information becomes more critical than ever. CoStar provides that clarity. The big, long-term story is that data is the new oil, and CoStar has one of the deepest data moats in any industry. They are also making aggressive moves to enter residential real estate, which could be a huge new growth engine.

This trade is a powerful reminder to look past the scary headlines and find the "picks and shovels" businesses that profit from the turmoil itself.

Bullish on Commercial Metals Company CMC 0.00%↑

Someone with a lot of conviction just made a big bet on a "boring" but essential business: Commercial Metals Company $CMC. This company is a metal recycler; they take scrap metal—think old cars, washing machines, and demolished buildings—and melt it down in efficient "mini-mills" to create new steel products, like the rebar that strengthens concrete in new construction.

The specific bet was a single block of 1,400 call options, signaling that one powerful player is betting the stock will climb past $62.50 per share by September 19th. With a call-to-put ratio of about 10-to-1, the bullish sentiment is overwhelming.

I am very bullish on the logic behind this trade. This isn't a bet on a flashy tech trend; it's a grounded, powerful bet on the physical rebuilding of America. Congress has allocated trillions for infrastructure—rebuilding roads, bridges, airports, and the power grid. All of that work requires immense amounts of steel, and CMC is perfectly positioned to supply it. Furthermore, their recycling model is greener and more efficient than traditional steelmaking, which is a huge advantage in today's world.

While everyone is looking for the next AI stock, there are fortunes being made in the tangible world. This trade is a perfect example of investing in an undeniable, government-funded mega-trend.

You can apply this by looking for other "boring" companies that are essential to the infrastructure boom. Think about the companies that make the asphalt for roads, the gravel for concrete, or the heavy machinery that does the work. These are often the overlooked businesses that can build tremendous wealth over the long run.

7. Best Performing Stocks This Week (catalysts, earnings, and news):

Hedge Fund’s Biggest Bets. Here are the stocks making millionaires:

1) GoodRx Holdings $GDRX up +36% on August 18

GoodRx Holdings $GDRX exploded higher after announcing a game-changing partnership with Novo Nordisk to offer the blockbuster weight-loss drugs Ozempic and Wegovy for $499 per month to self-paying patients. This is like getting exclusive distribution rights to the iPhone when everyone else is selling flip phones. GoodRx operates a digital platform that helps Americans find discounted prescription medications, and this Ozempic deal transforms them from a coupon app into a gateway for the hottest drugs in America. The timing couldn't be better - Novo Nordisk just won FDA approval for Wegovy to treat serious liver disease, expanding the drug's market even further. Warren Buffett always says "buy when there's blood in the streets," but sometimes you buy when there's gold in the streets too.

This partnership validates GoodRx's strategy of becoming the middleman between pharma companies and cash-paying patients. Consider this a direct play on America's obesity epidemic and the growing trend of people paying cash for healthcare to avoid insurance hassles.

2) Paramount Skydance $PARA up +15% on August 21

Paramount Skydance $PARA continued its hot streak with month-to-date gains exceeding 25% after surprising investors with better-than-expected Q2 earnings. The real shocker was their streaming division turning an unexpected profit - this is like watching a startup suddenly become profitable after years of losses. Paramount operates CBS, MTV, Nickelodeon, and the Paramount+ streaming service, putting them in direct competition with Netflix and Disney+. The Warren Buffett lesson here: "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price." Paramount's content library includes decades of hit shows and movies, giving them valuable intellectual property that keeps generating revenue.

Streaming wars are creating winners and losers quickly. Paramount's profitable streaming business suggests they've figured out the formula for making money in digital entertainment, which could drive further gains.

3) Xpeng $XPEV up +14% on August 21

Xpeng $XPEV surged after CEO Xiaopeng He bought 3.1 million shares through his investment vehicle, signaling strong confidence in the Chinese EV maker's prospects. The insider buying followed better-than-expected Q2 revenue and a narrower loss, suggesting the company is moving toward profitability. Xpeng manufactures smart electric vehicles with advanced autonomous driving features, positioning itself as China's answer to Tesla. China is aggressively pushing EV adoption while European and American markets are showing slower growth.

Chinese EV stocks are volatile but offer exposure to the world's largest auto market. CEO stock purchases often precede positive news flow, so this could be early positioning before major announcements.

4) TeraWulf $WULF up +13% on August 18

TeraWulf $WULF rocketed higher after Google expanded its partnership and committed up to $3.2 billion total to fund the expansion of TeraWulf's Lake Mariner facility in New York. This is like getting Google as both your biggest customer and your bank - an incredibly rare and valuable relationship. TeraWulf operates Bitcoin mining and AI computing infrastructure, positioning them at the intersection of two massive trends: cryptocurrency and artificial intelligence. The Google partnership validates TeraWulf's strategy of diversifying beyond just Bitcoin mining into high-performance computing for AI workloads. Peter Lynch always said "invest in what you know," and right now everyone knows AI needs enormous computing power.

TeraWulf offers leveraged exposure to both Bitcoin prices and AI infrastructure demand. The Google backing reduces execution risk significantly.

5) Duolingo $DUOL up +12% on August 18

Duolingo $DUOL gained momentum after KeyBanc upgraded the stock to overweight, citing new product launches and viral marketing campaigns as key catalysts. Citigroup also initiated coverage with a buy rating. Duolingo has mastered something most companies struggle with: making boring activities addictive. Their language learning app uses gamification to keep users engaged, creating daily habits that translate into recurring revenue. The company continues expanding beyond core language learning into math, music, and other subjects. The TikTok generation doesn't want traditional education - they want bite-sized, entertaining content that feels like playing games rather than studying.

Duolingo represents the future of education technology, where engagement metrics matter more than traditional learning outcomes. Multiple analyst upgrades suggest institutional recognition of their competitive advantages in the EdTech space.

6) Zoom Communications $ZM up +10% on August 22

Zoom Communications $ZM popped after crushing Q2 expectations with adjusted earnings of $1.53 per share versus $1.37 expected, on revenue of $1.22 billion beating the $1.2 billion consensus. Zoom proved that reports of its death were greatly exaggerated - while everyone assumed the return to office would kill video conferencing, Zoom adapted by expanding into phone systems, webinars, and collaboration tools. The company has successfully evolved from a pandemic beneficiary into essential business infrastructure. Warren Buffett's partner Charlie Munger used to say "show me the incentive and I'll show you the outcome" - companies had every incentive to keep using Zoom because switching communication platforms is expensive and disruptive.

Zoom's beat suggests the hybrid work model is permanent, not temporary. This creates ongoing demand for their expanding suite of communication tools, making them a steady grower rather than a pandemic stock.

👉For more insights, follow me on Twitter/ X or Instagram Threads, and turn on notifications.

8. Important Earnings & Stocks to Watch:

Here’s what you need to know for the most important earnings this week:

Nvidia - The AI chip king faces its biggest test yet as investors scrutinize whether AI demand is real or just hype. Recent concerns about AI companies seeing zero returns on their investments have created doubt about whether data centers will keep buying Nvidia's expensive chips. Think of Nvidia like a gold rush shovel seller - they profit whether AI succeeds or fails, but only if people keep digging. Watch for guidance on future quarters more than current results, since that tells you if the AI boom has legs.

Advice: If they beat and raise guidance, the AI story continues; if they disappoint, expect a sector-wide selloff that could create buying opportunities in oversold AI names.

Alibaba - China's e-commerce giant reports amid ongoing tensions between the U.S. and China, plus concerns about China's slowing economy. The recent stimulus measures from Beijing and improved consumer spending data could provide a tailwind, but tariff threats remain a headwind. Warren Buffett once said "be greedy when others are fearful" - and right now, everyone's fearful of Chinese stocks.

Key catalyst to watch: Any mention of international expansion or cloud computing growth, which could help diversify away from the domestic Chinese market.

Advie: Consider this a contrarian play - if results surprise positively, the upside could be massive given how beaten down the stock has been.

Dell Technologies - This PC and server maker sits at the intersection of AI infrastructure demand and traditional computer sales decline. Recent partnerships with AI companies and increased data center demand provide a bullish backdrop, but consumer PC sales remain weak. Dell is like the arms dealer in a war - they sell to everyone who needs computing power. Focus on their server and data center revenue, which should benefit from AI buildout.

Advice: If they report strong enterprise and server sales, it validates the AI infrastructure theme without the frothy valuations of pure-play AI stocks.

CrowdStrike - The cybersecurity leader faces scrutiny after their massive global IT outage earlier this year that crashed millions of computers worldwide. This earnings report will show whether customers forgave them or jumped ship to competitors like Palo Alto Networks. Steve Jobs famously turned Apple's antenna-gate scandal into a comeback story - CrowdStrike needs to do the same. Watch for customer retention metrics and new client wins to see if their reputation has recovered.

Advice: If they report strong customer growth despite the outage, it proves their technology is indispensable, making this a potential comeback story.

Snowflake - This cloud data platform company has struggled with slowing growth as enterprises tighten IT spending budgets. Recent AI partnerships and new product launches around data analytics could provide growth catalysts, but they're fighting headwinds from cautious corporate spending. Think of Snowflake as the plumbing for the AI revolution - essential but unglamorous.

Key metric: Net revenue retention rate, which shows if existing customers are spending more or less.

Advice: A beat here could signal that the cloud spending slowdown is ending, potentially lifting the entire software sector.

Marvell Technology - This chip company benefits from AI data center buildout but faces headwinds from broader semiconductor cyclicality. Recent wins in AI infrastructure and 5G networks provide growth drivers, but memory chip weakness could hurt overall results. Watch for comments about AI chip demand and automotive semiconductor recovery. The company is leveraging the same AI wave as Nvidia but at cheaper valuations.

Advice: Consider this a lower-risk way to play AI infrastructure than betting on the highest-flying names.

MongoDB - The database software company faces increasing competition from larger players like Microsoft and Amazon who offer similar services. Recent product updates and AI integration features could help differentiate them, but customer acquisition costs are rising.

Key focus: New customer additions and expansion within existing accounts. Like David fighting Goliath, MongoDB needs to prove they can compete against tech giants.

Advice: Strong results here could signal that specialized software companies can still thrive against big tech, making it a potential sector leadership indicator.

Okta - This identity management company has been recovering from security breaches that hurt customer confidence in 2023. Recent new product launches and improved security measures suggest they're moving past those issues, but enterprises remain cautious about security vendors. Watch for new customer wins and retention rates to gauge trust recovery.

Advice: A strong report could mark the turnaround moment where security concerns become competitive advantages due to lessons learned.

Iris Energy - This Bitcoin mining and AI data center company benefits from both cryptocurrency prices and AI infrastructure demand. Recent partnerships with tech companies for AI computing provide revenue diversification beyond just Bitcoin mining. Watch for updates on their AI computing business and power costs, which drive profitability. Think of them as picks-and-shovels for both the crypto and AI gold rushes.

Advice: This offers leveraged exposure to both Bitcoin prices and AI infrastructure demand, but comes with higher volatility risk.

👉For more insights, follow me on Twitter/ X or Instagram Threads or BlueSky, and turn on notifications.

9. My Real Estate Market Analysis & Predictions, this Week:

Fed Chair Jerome Powell’s Jackson Hole speech set the stage: the economy is slowing, inflation is sticky, and the Fed is now signaling a September rate cut. That matters because when borrowing costs fall, housing feels it first. But here’s the twist — even with mortgage rates dipping to around 10-month lows, the housing market is still stuck.

Why? Most homeowners are locked into ultra-low mortgages — 81% have rates under 6%, and more than half are under 4%. That “lock-in effect” is like golden handcuffs, keeping people from selling. Until rates drop meaningfully, listings will trickle in slowly, and homes will sit longer on the market.

At the same time, new-home construction is quietly becoming the release valve. Builders are cutting prices, offering incentives, and making move-in-ready homes more attractive. In fact, in many metros — especially in the South and growing mid-sized markets like Fayetteville, Boise, and Nashville — new builds are now cheaper than resales. That flips the old playbook: for the first time in decades, the “brand-new house” may cost you less than buying an older home down the street.

But here’s the problem — even with rising incomes, higher mortgage rates have erased nearly $30,000 in buying power for the average household since 2019. That means affordability is still stretched thin. Sales are sluggish, days on market are up, and inventory is climbing because homes aren’t moving. It feels a lot like a staring contest between buyers and sellers.

Why This Matters Long Term

Think back to the late 1970s. Mortgage rates were sky-high, buyers froze, and the market slowed until the Fed finally eased. When rates fell, housing roared back. We’re in a similar setup now. This stalemate won’t last forever. Once rates move meaningfully lower — paired with the Fed’s shift back to balancing inflation with jobs — pent-up demand could unleash a wave of activity.

What To Do

If you’re a buyer: Don’t assume you’re priced out. New homes may be cheaper than resales in some markets, and builders are offering rate buydowns and closing cost help. That can save you tens of thousands over the life of the loan.

If you’re a seller: Be realistic. Homes are sitting longer, and buyers are picky. Price competitively, offer concessions, or consider waiting until rates drop further if you’re not in a rush.

If you’re an investor: Focus on markets with strong new construction activity and population growth. Southern metros and mid-sized college towns are pulling in builders and buyers alike. Long term, these are the places where jobs, affordability, and housing demand intersect.

If you’re a homeowner sitting on a 3% mortgage: You’re not alone. Instead of feeling stuck, think about unlocking equity through HELOCs or renting your home if you want flexibility without giving up your rate.

Final Thoughts

The housing market feels frozen, but beneath the surface it’s shifting. Rate cuts are coming, builders are adjusting, and affordability will slowly improve. When the Fed finally eases, expect the market to heat up fast. The winners will be the ones who prepared during the slowdown — buyers who shopped incentives, sellers who priced smart, and investors who targeted growth markets before everyone else piled back in.

Don’t just wait for the market to change. Position yourself now so when the thaw comes, you’re ahead of the crowd.

Important Charts:

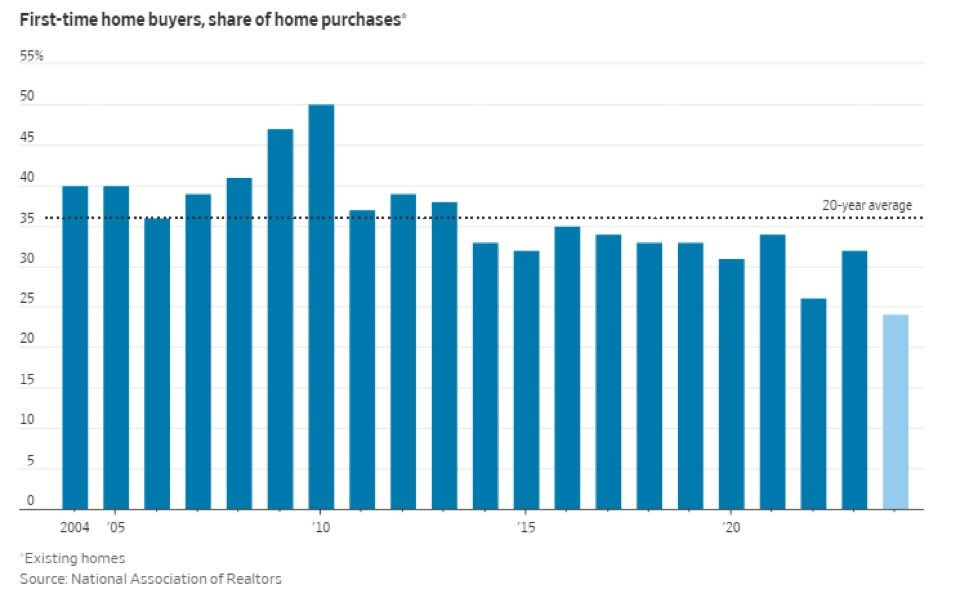

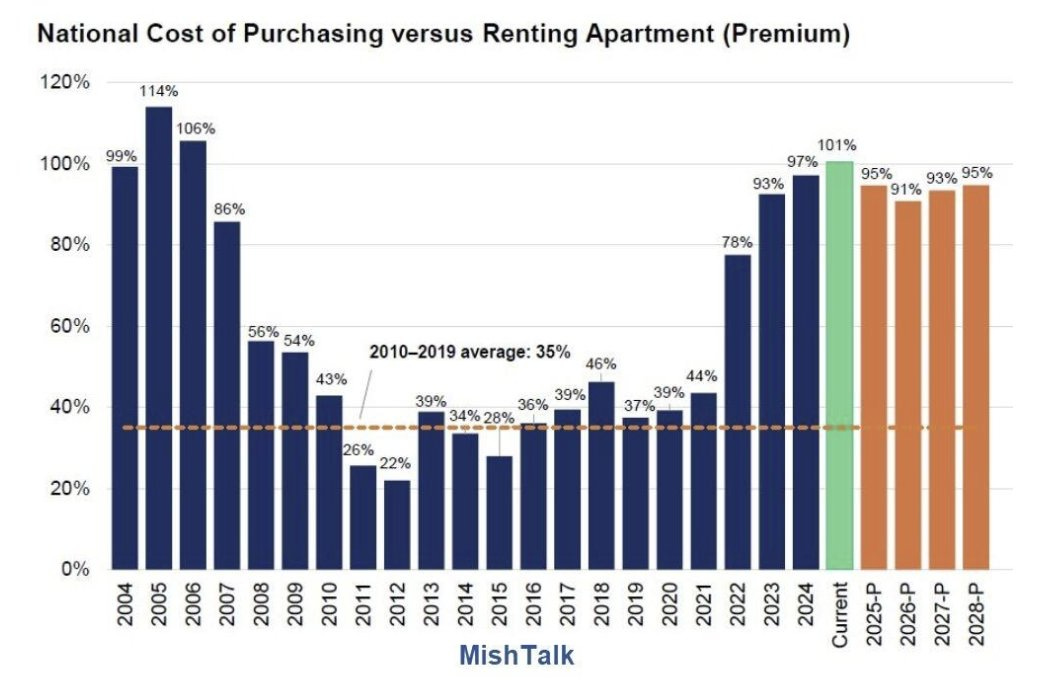

First-time home buyers have fallen to a record low:

For the first time since 2006, it's now twice as expensive to buy an entry-level home as it is to rent:

👉For more insights, follow me on Twitter/ X or Instagram Threads or BlueSky, and turn on notifications.

10. My Interest Rate Predictions:

Rates will remain unchanged.

Yields on bonds, which drive mortgage rates, are moving sideways. Unless something unexpected happens — like a shock in Powell’s speeches or a big surprise in the jobs report — rates won’t move much in the short term.

Movement could come in September. The market is betting heavily on the Fed cutting rates by a quarter point. Powell’s dilemma is simple but painful: inflation is still too high, but the job market is slowing. History shows the Fed tends to protect jobs, especially in an election season, so cuts look more likely than hikes.

But here’s the catch: a Fed cut doesn’t guarantee lower mortgage rates. Mortgage rates track the 10-year Treasury yield, not the Fed’s overnight rate. Last fall, the Fed cut half a percent and mortgage rates actually went up, because bond investors worried about inflation. If inflation keeps running hot or tariffs push prices higher, rates could stay sticky no matter what Powell does.

For now, I think we’ll see mortgage rates hang in the mid-to-high 6% range through September, with some softening possible if the job market keeps cooling. That’s not great for affordability, but it’s better than the 7%+ highs we saw not long ago.

Why This Matters Long Term

This is bigger than just waiting for one cut. The real story is about direction. If September is the first cut in a new cycle, it signals a shift from “higher for longer” to “easier for longer.” Over time, that could rebuild confidence in housing, slowly restore affordability, and unlock some of the pent-up demand from buyers and sellers stuck on the sidelines.

But don’t expect magic overnight. It will likely take multiple cuts over months before mortgage rates fall enough to truly change behavior. Until then, we stay in a gridlocked market: buyers waiting for relief, sellers clinging to low-rate mortgages, and builders offering incentives to keep sales moving.

What To Do

If you’re a buyer: Don’t just wait for rates to drop. Look at new construction. Builders are cutting prices and offering rate buydowns that can get you a lower payment today. Locking in a slightly lower rate now, with the option to refinance later if cuts materialize, may beat waiting.

If you’re a seller: Price realistically. Homes are sitting longer, and buyers are cautious. You can sweeten the deal by offering to cover part of the buyer’s closing costs or even help buy down their rate.

If you’re an investor: Think like Warren Buffett during a slowdown — prepare before the floodgates open. Focus on markets with population growth and new construction activity (the South, mid-sized college towns, and affordable metros like Fayetteville or Boise). When rates fall further, those markets will lead the rebound.

If you’re refinancing: Stay patient. If you’re holding a rate above 7%, watch closely. Even one Fed cut could open a window to lock in savings — but don’t assume a cut automatically lowers mortgage rates. Track the 10-year Treasury, not just the Fed headlines.

Final Thoughts

The Fed is setting the stage for a cut, but mortgage rates may not follow as fast as people hope. For the housing market, this means more of the same in the short run: flat sales, cautious buyers, and stubborn affordability challenges. The longer-term story is brighter — once cuts stack up and confidence returns, housing demand will roar back.

Don’t just sit on the sidelines waiting. Use this “pause” to position yourself — whether that’s negotiating with builders, scouting undervalued markets, or prepping for a refinance. When the shift comes, the people who prepared early will be the ones who win.

Current Rates:

11. My Technical Analysis (S&P 500, Tech Stocks, Bitcoin):

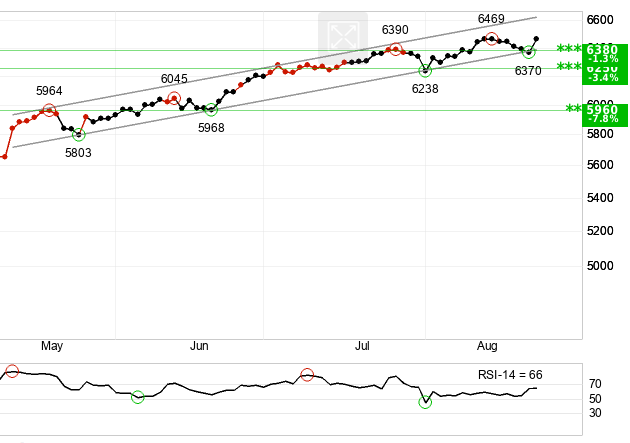

1) S&P 500 SPY 0.00%↑ (Short-term): Positive

The S&P 500 just broke above resistance at 6,380 and is now moving in a rising channel. That’s a strong technical sign — it means buyers keep stepping in at higher prices. Think of it like climbing a staircase: each step higher makes it harder for sellers to push it back down. Now, that 6,380 level becomes new support (like a safety net).

The timing matters. Powell’s Jackson Hole comments hinted at a possible September rate cut, and stocks love lower rates. Earnings season also surprised to the upside, especially for big tech and industrials. Together, that gives the S&P fuel for another leg up.

In the short term, momentum is with the bulls. If you’re trading, you can lean into strength with index ETFs or call options. Just watch for pullbacks to 6,380 — if the index holds above that, it’s a chance to add. If it falls back through, that’s a warning sign. Long-term investors should stay the course — rate cuts plus steady earnings usually mean higher stock prices ahead.

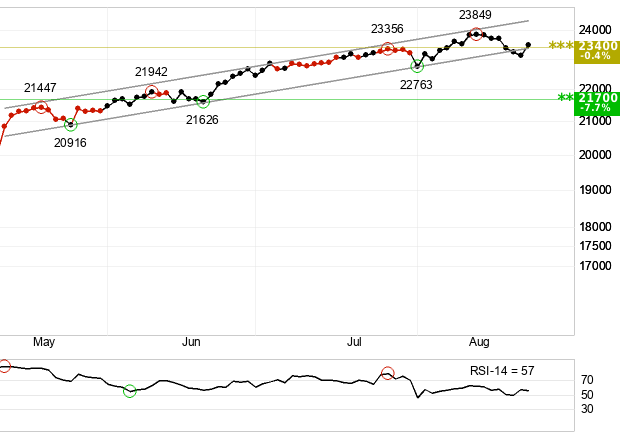

2) Tech Stocks QQQ 0.00%↑ (Short-term): Positive

The Nasdaq-100 follows a similar story. It’s riding a rising trend and recently pushed above resistance at 23,400, encouraging bulls to believe in more gains ahead. The volume supports this move, indicating strong buying interest. Still, the RSI is also heading lower, warning that the rally may be stretched. This pattern often signals the market is ready for a breather before deciding its next move. The overall technical setup remains positive over the short and longer terms.

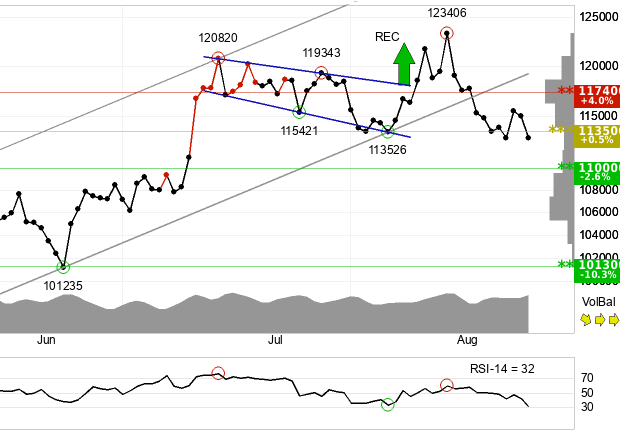

3) Bitcoin $BTC (Short-term): Neutral

Bitcoin $BTC is showing solid strength in its short-term uptrend. It recently hit resistance near 122,400 and pulled back slightly, but the price stays above strong support levels around 113,500. The RSI confirms a positive momentum, which suggests buyers still control the market. Bitcoin is in a healthy rally phase but has key levels to break to confirm the next leg higher.

12. Economic Outlook and Market Sentiment:

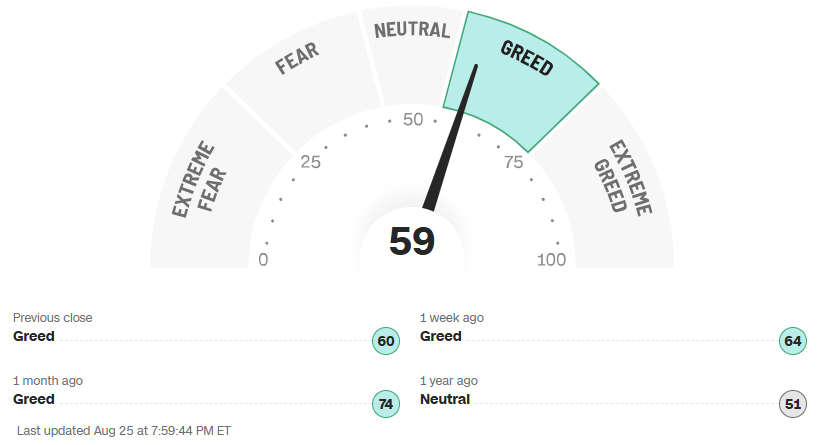

1) Fear & Greed Index = Moderate Greed

Think of the Fear & Greed Index like a thermometer for Wall Street's emotions. At 59, the market is feeling optimistic but not euphoric. This is actually healthy territory.

Here's what's fascinating: The index was at 74 just a month ago, showing greed is cooling off from extreme levels. Four of the seven components are showing greed signals (stock price strength, put/call ratios, and junk bond demand), while three are neutral.

The contrarian insight: When greed moderates from extreme levels, it often creates sustainable buying opportunities. You're not buying at the peak of euphoria, but you're still riding positive momentum.

What this means: This moderate greed level suggests the market has room to run higher without being dangerously overheated.

2) AAII Investor Index (6-Month Outlook) = Bearish

Individual investors are scared. Really scared. With bearish sentiment at 44.8% versus the historical average of 31.0%, retail investors are more pessimistic than they've been in most of the past year.

This is exactly what contrarian investors pray for. Remember, individual investors have a terrible track record of timing markets. They bought tech stocks at the peak in 2000, real estate at the top in 2006, and sold everything at the bottom in 2009. When retail investors are bearish, it often signals an opportunity.

A valuable Peter Lynch lesson applies here: "The real key to making money in stocks is not to get scared out of them." Right now, regular investors are getting scared out of stocks while the Fear & Greed Index shows institutional money is still cautiously optimistic.

What this divergence tells you: Professional money (Fear & Greed Index) sees opportunity while amateur money (AAII survey) sees danger. This is a classic market setup for patient investors who can think independently.

3) Economic Indicators = Mixed/Neutral

The economic indicators are telling a "not too hot, not too cold" story:

VIX at 10.13: Ultra-low volatility suggests calm markets ahead

Inflation at 2.73%: Right at the Fed's target, reducing pressure for aggressive rate hikes

Unemployment at 4.20%: Full employment without being too tight

GDP at 3.00%: Solid growth without overheating

10-Year Treasury at 4.37%: Reasonable interest rates in historical context

What this stability means: Unlike 2008 (financial crisis) or 2020 (pandemic panic), the economic foundation is solid. This gives the Federal Reserve flexibility and reduces the chance of external shocks derailing the market.

Benjamin Graham’s advice: "In the short run, the market is a voting machine, but in the long run, it's a weighing machine." Right now, the weighing machine (economic fundamentals) shows a healthy economy supporting current market levels.

4) What I Think

This setup reminds me of late 2016, when individual investors were nervous about Trump's election but institutional money saw opportunity in tax cuts and deregulation. The market climbed steadily higher as individual pessimism gradually gave way to reality.

The Fear & Greed Index says investors are still leaning bullish.

The AAII survey shows that everyday investors remain fearful.

The economic dashboard shows the economy is slowing but not collapsing.

This mix often creates short-term volatility but long-term opportunity. In plain terms: the crowd is confused, and confusion breeds price swings that disciplined investors can profit from.

Remember Jesse Livermore's advice: "Money is made by sitting, not trading." Right now, all three indicators suggest this is a time for sitting long, not sitting out.

13. Important Economic Events This Week:

This week gives us the roadmap for September — rates, growth, and sentiment. If inflation keeps easing and growth holds steady, markets will likely push higher into fall. If not, expect volatility and rotation into safety.

1) July PCE Inflation Data – Friday, August 29

This is the Fed’s favorite inflation gauge, and it will set the tone for September’s rate decision. If PCE keeps drifting lower toward 2%, the Fed has room to cut rates, which would push stocks higher and mortgage rates lower. If it surprises higher, expect volatility and a selloff in rate-sensitive sectors.

Advice: Traders should watch bond yields — they’ll move first. Long-term investors should be ready: falling PCE is your green light to add to growth stocks and real estate plays. Rising PCE means defensive sectors (healthcare, utilities, staples) may be safer near-term.

2) US Q2 2025 GDP Data – Thursday, August 28

GDP shows the real strength of the economy. A solid number confirms growth is holding up despite higher rates, which supports corporate earnings. A weak print would signal a slowing economy — raising recession fears.

Advice: If GDP comes in hot, focus on cyclical stocks (industrials, financials, energy). If weak, shift toward tech and defensive names. For traders, GDP surprises often trigger big swings in futures before the cash market opens — that’s where you can capture quick moves.

3) Nvidia Earnings – Wednesday, August 27

Nvidia is the heartbeat of the AI trade. Its results won’t just move NVDA, but the entire tech sector and broader indexes. Strong guidance could fuel another AI-driven rally. Weak numbers could crack the AI bubble narrative and drag down the Nasdaq.

Advice: For traders, NVDA earnings are a volatility event — consider options strategies if you know how to hedge risk. For long-term investors, don’t chase blindly. Remember Cisco in 2000: great company, but even it couldn’t live up to endless hype. Use weakness to buy quality AI leaders, but avoid overexposure.

4) August Consumer Confidence – Tuesday, August 26

Confidence is a leading indicator of future spending, which makes up two-thirds of the U.S. economy. Rising confidence suggests strong retail sales ahead, while falling confidence hints at slower growth.

Advice: If confidence jumps, consumer stocks (retail, travel, leisure) benefit. If it drops, expect investors to rotate into defensive sectors. Long-term, confidence tells you how stretched households feel — watch debt and credit card usage for cracks beneath the surface.

5) Michigan Consumer Sentiment – Friday, August 29

This is similar to consumer confidence but more detailed on inflation expectations. It’s a key read on how households feel about the future. If sentiment improves, it supports spending. If it sags, it’s a drag on growth.

Advice: Treat this as confirmation. If PCE is cooling and sentiment is improving, that’s a bullish combo. If both go the other way, brace for turbulence.

👋Final Thoughts:

🙌Thank you for joining 108,000+ members and reading our newsletter! If you enjoyed reading it please:

Support us by sharing it with friends or family to help us grow, and become a paid subscriber to support our work (this newsletter takes many hours to research and write!):

Hit the LIKE button ❤️ on this post so more people can discover it on Substack 🙏

See you again next week! (Missed an issue? Read past issues here at TheFinanceNewsletter.com)

☺️ My goal is to help you get richer and smarter with money — Join 3 million and follow me across social media for daily insights:

Instagram Threads: @Fluent.In.Finance

Twitter/ X: @FluentInFinance

Facebook Page: Facebook.com/FluentInFinance

Linkedin: Linkedin.com/in/Lokenauth

Youtube: Youtube.com/FluentInFinance

Instagram: @Fluent.In.Finance

TikTok: @FluentInFinance

Facebook Group: Facebook.com/Groups/FinanceTalk

Reddit Community: r/FluentInFinance

➕Please add this newsletter to your contacts to ensure that none of our emails ever go to spam!

This content is for educational purposes only. Such information should not be construed as legal, tax, investment, financial, or other advice. See for Disclaimer, Terms and Conditions.

![May be an image of text that says 'EARNINGS WHISPERS Monday Open After PDO Tuesday Before Opeл After Close Most Anticipated Earnings Releases August 25, 2025 ENO ASEMTECH BMO Wednesday Before Open MNAPCO KES Close HEICO okta SAsOL Scotiabank KOHL'S Thursday Open mongoDB nVIDIA VAVL] Friday Before Open Ahenzrombask:Fioch 贝壳 BIFA MARVELL ※snowflake box WILLIAN-WINUBLA ecarж ncino DELL CROWDSTRIKE Bank PVH IrisEnergy TREN IZAR VICTORIA'S SECRET FRONTLINE CHA ELECTROMED, NC ULTA 海底捞 Haidilao CHAGEE SentnclOna Veeva Joyy nrЛ 자 CHAFNIA NUTANIX DLLI OLLiES affırm) CADELER PHOTRONICS 0ONA Ooma PURESTORAGE Ambarella http://eps.sh/cal Burlington five BELW tuya Fintech 老虎證券 DICK'S Gap Inc. ESTC elastic NUCH petco Whispers' May be an image of text that says 'EARNINGS WHISPERS Monday Open After PDO Tuesday Before Opeл After Close Most Anticipated Earnings Releases August 25, 2025 ENO ASEMTECH BMO Wednesday Before Open MNAPCO KES Close HEICO okta SAsOL Scotiabank KOHL'S Thursday Open mongoDB nVIDIA VAVL] Friday Before Open Ahenzrombask:Fioch 贝壳 BIFA MARVELL ※snowflake box WILLIAN-WINUBLA ecarж ncino DELL CROWDSTRIKE Bank PVH IrisEnergy TREN IZAR VICTORIA'S SECRET FRONTLINE CHA ELECTROMED, NC ULTA 海底捞 Haidilao CHAGEE SentnclOna Veeva Joyy nrЛ 자 CHAFNIA NUTANIX DLLI OLLiES affırm) CADELER PHOTRONICS 0ONA Ooma PURESTORAGE Ambarella http://eps.sh/cal Burlington five BELW tuya Fintech 老虎證券 DICK'S Gap Inc. ESTC elastic NUCH petco Whispers'](https://substackcdn.com/image/fetch/$s_!AgOi!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fa35330ac-e42f-4ef0-92ee-b5cbd1796da6_1920x1080.jpeg)

A 'perfect' newsletter... A must read for all MBA students.