💥Investing Insights and Market Analysis (Nov 4, 2025)

Massive layoff waves hit, Tech dominates earnings season, Buffett is sitting on record $344 billion cash, Michael Burry tweets for first time in years, and more!

🤝 Today’s newsletter is sponsored by RAD Intel — An AI company that reads real-world language and turns it into clear signals for brands to use.

👋Good morning my friend and thank you for joining 108,000 investors who trust our newsletter to get smarter with money, investing, and the economy! (get a free 30-day trial of our newsletter with this link)

📬 In today’s newsletter, we have lots of actionable advice to help you build wealth, but first, a quick message from today’s sponsor, RAD Intel:

RAD Intel reads millions of online conversations to spot patterns. It’s an AI company that reads real-world language—Reddit, TikTok, X, LinkedIn—and turns it into clear signals. Brands use it to find what people want. It’s backed by Adobe, NASDAQ ticker reserved, $RADI and now open for investors.

📬 What’s in today’s newsletter:

Part I — Market Update:

1) Market & Economic Analysis

2) Top 5 Finance Events this Week

3) 3 Important Charts

Part II — Stock Market Research:

4) My Stock Picks + Research

5) Insider Trades from Billionaires, Politicians & CEOs

6) Trade of the Week

7) Top 5 Stocks this Week

8) 5 Stocks to Watch (with Earnings this Week)

Part III — Real Estate Analysis:

9) Real Estate & Housing Market Analytics

10) Interest Rate Predictions

Part IV — Economic & Marco Insights:

11) Economic Outlook & Market Sentiment

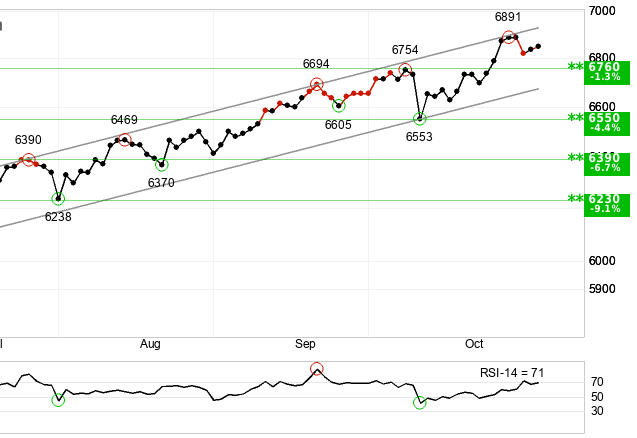

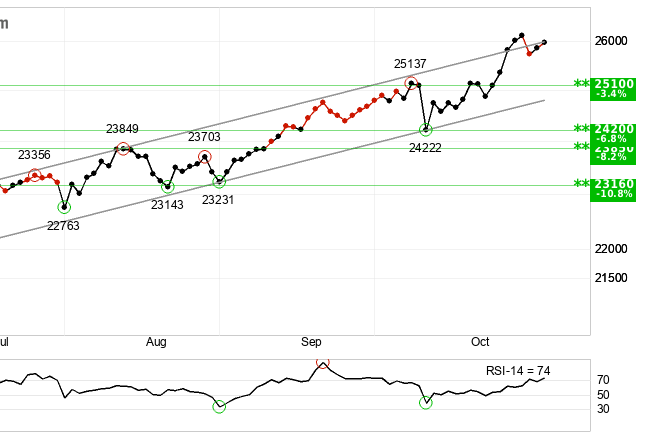

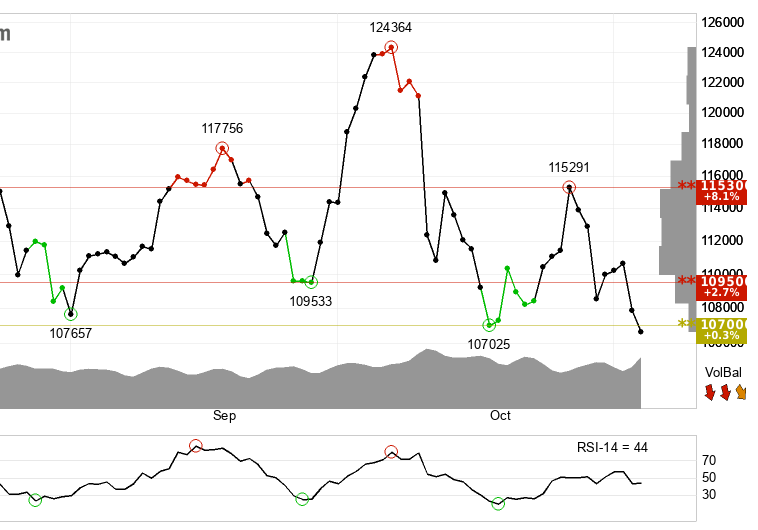

12) Technical Analysis [S&P 500, Tech Stocks, Bitcoin]

13) 3 Important Events this WeekBut before we get into it, please help us out and:

Hit the ❤️LIKE button on this post and help us grow on Substack 🙏

Share this newsletter with friends & family to help them get smarter with money, investing, and the economy!

1. Market & Economic Analysis:

Everything you need to know this week:

Macro/ Economy

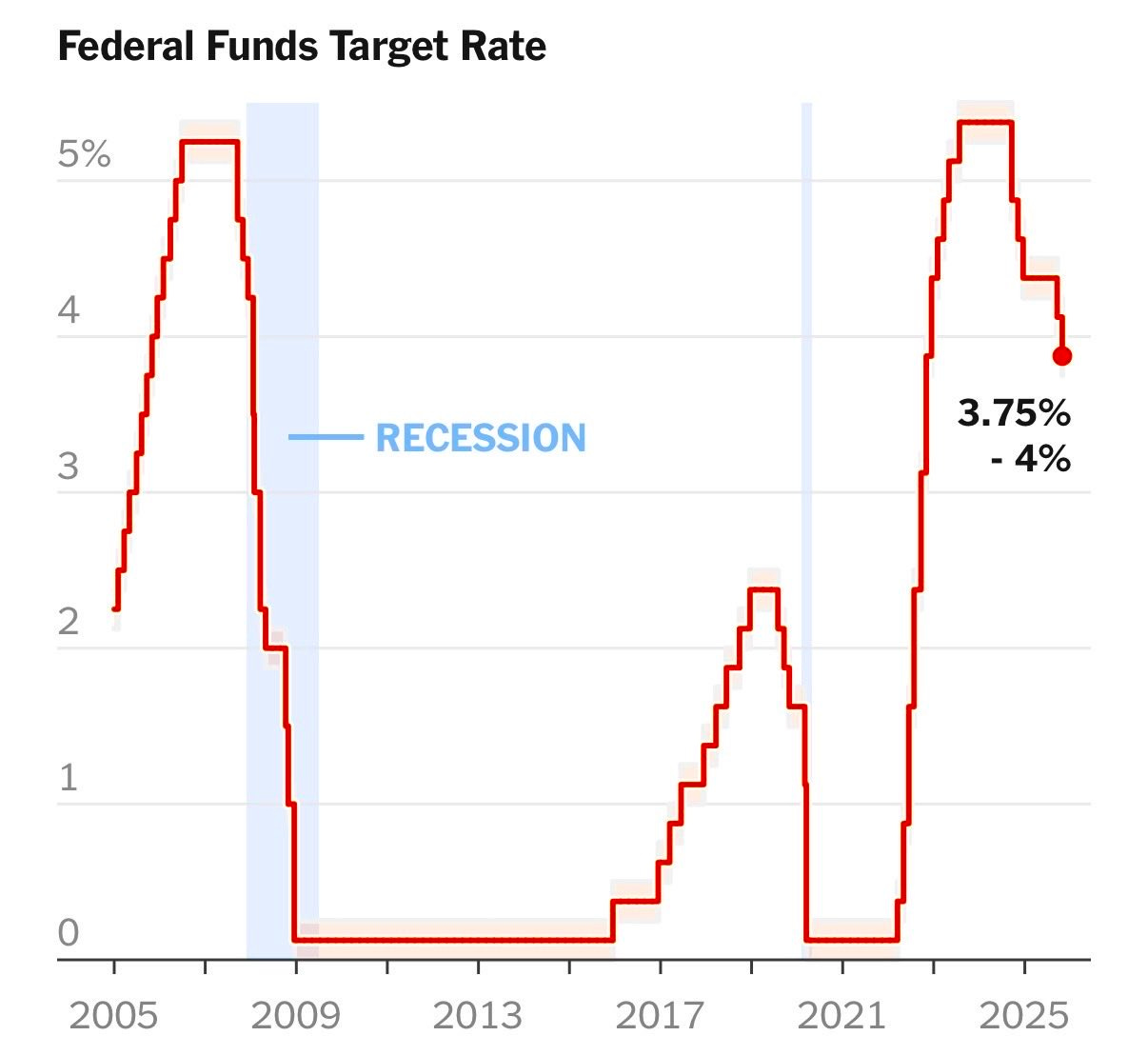

The Fed cut rates by 0.25% and will stop QT (balance-sheet runoff) on Dec 1 (that means fresh liquidity for markets).

November is historically one of the market’s strongest months.

US Markets

All three major indexes hit new record highs. The S&P 500 closed above 6,800 (best 6-month win streak since 2021). The Nasdaq is also at a fresh high (seven straight up months).

Drivers: strong mega-cap earnings, cooling inflation, and optimism about a US-China trade deal.

AI is the engine. Nvidia hit $5T. Microsoft and Apple are both above $4T. Alphabet posted its first $100B quarter. OpenAI is exploring an IPO near $1T. (It’s an AI-capex super-cycle.)

Earnings Season

Amazon: Beat on revenue and profit; AWS grew ~20%, ads strong. (Cloud momentum is back.)

Alphabet: Beat with a record $100B quarter; Cloud backlog $155B; 70%+ of Cloud customers use AI tools.

Microsoft: Beat; Azure +40%; higher AI capex made investors cautious.

Apple: Beat-and-raise; iPhone 17 demand strong; China softer but guidance upbeat.

Meta: Beat on revenue; stock fell after a $15.9B one-time tax charge and higher AI capex.

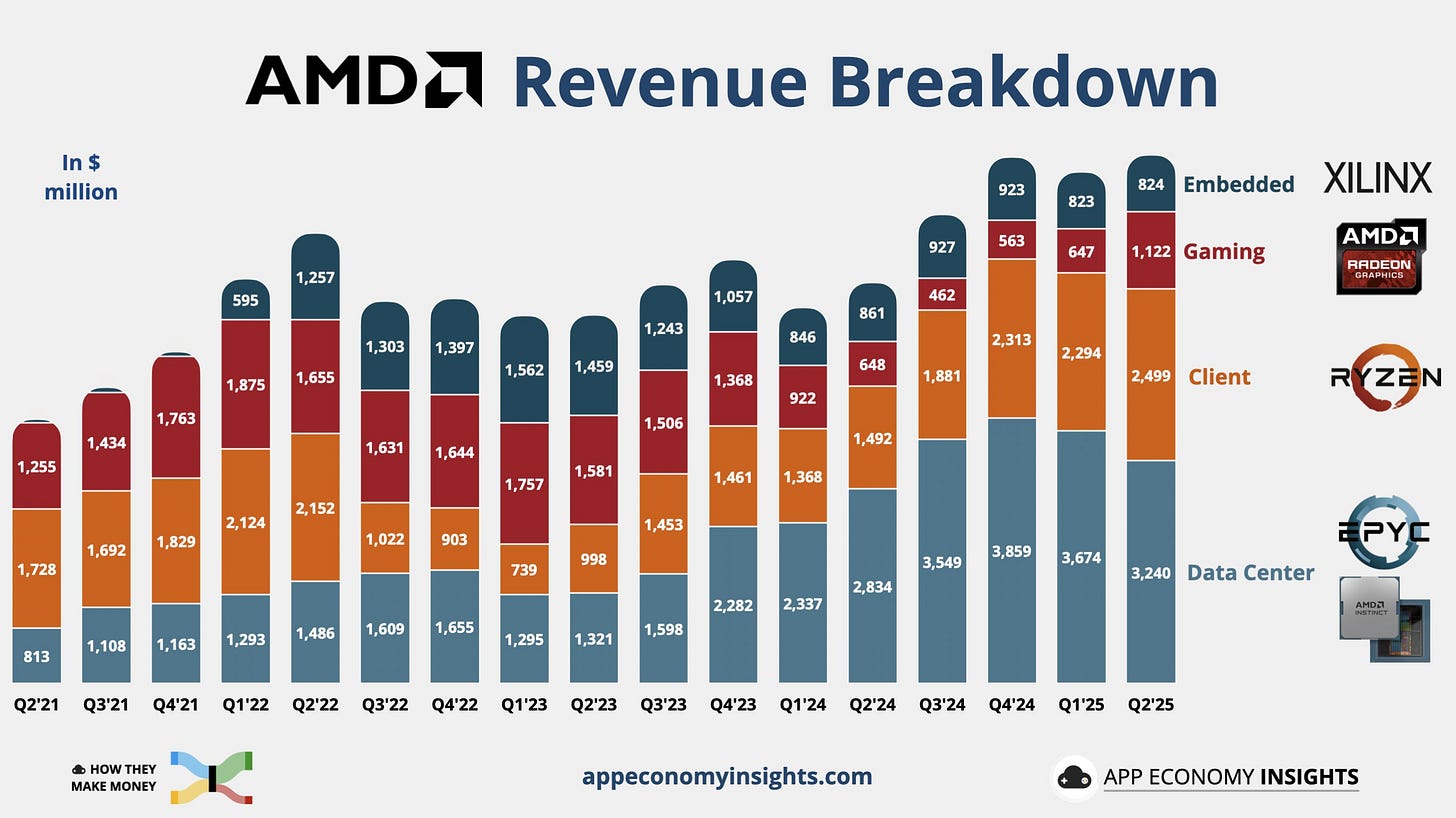

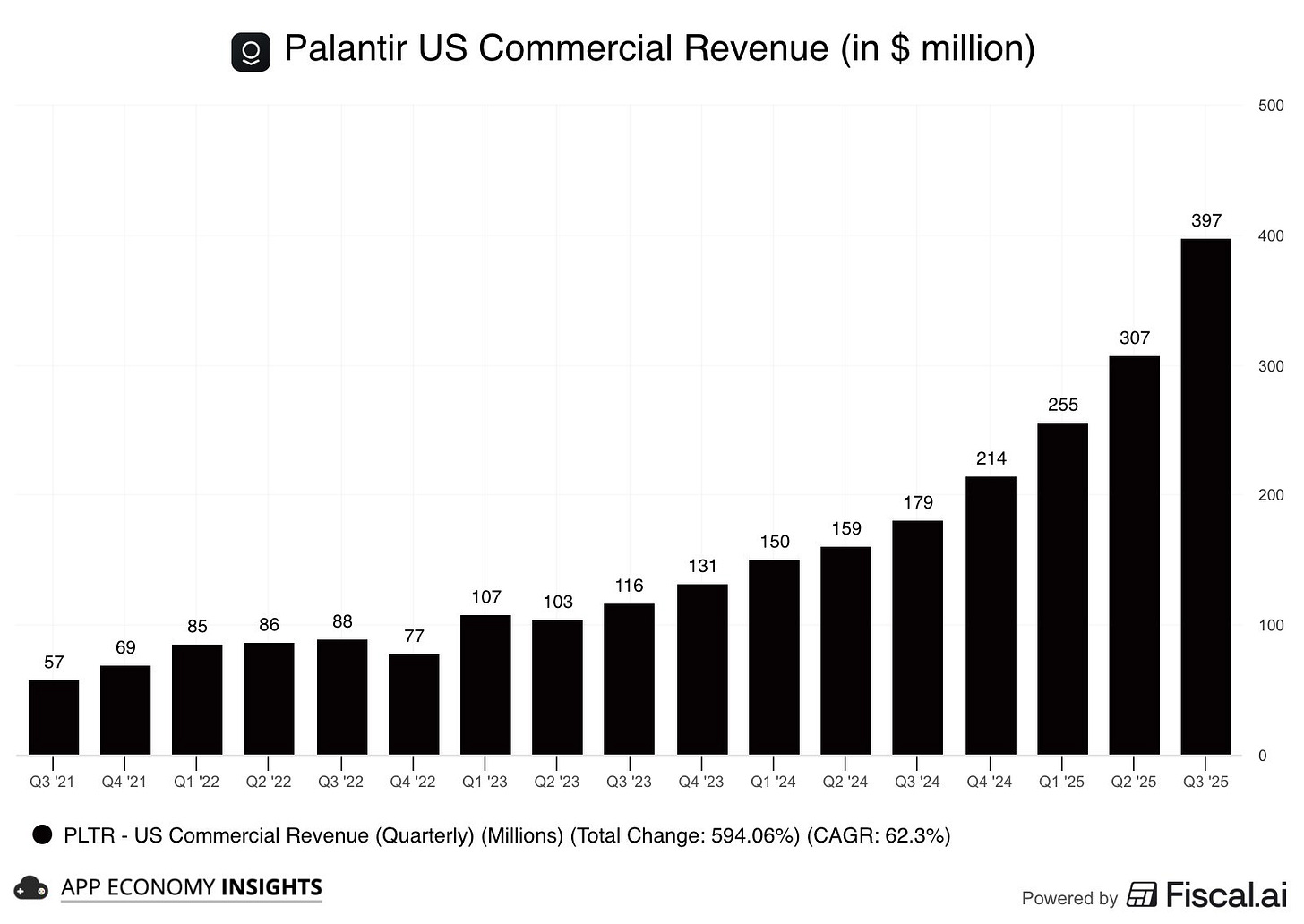

Palantir issued a beat, as government sales rose 52% due to strong AI adoption and the signing of major defense contracts.

Coinbase: Beat; revenue up ~55% YoY; tailwind from the new US stablecoin law (GENIUS Act).

Berkshire Hathaway: Beat; record ~$382B cash; Buffett steps down as CEO at year-end, Greg Abel next.

Geopolitics

US–China tone improved after a positive Trump–Xi meeting; China paused rare-earth export restrictions and bought US soybeans.

Commodities

Copper hit a record high on supply worries (a classic “early-cycle” signal).

Aluminum rose to its highest since May 2022

World

Global breadth is real. Japan’s Nikkei had its best month in 35 years; EM on a 10-month win streak (longest since the early ’90s); Europe at highs; Korea near +70% YTD; Spain back to an all-time high after 18 years.

💡Andrew’s Deep Dive & Analysis:

The Big Picture: What This All Means

We’re witnessing a rare moment in financial history where everything seems to be working together perfectly. The Fed is helping, companies are delivering, and global markets are celebrating. This creates what I call the “Golden Trinity” of investing: favorable policy, strong earnings, and positive sentiment.

Think of it like a perfect storm (but in a good way). When the central bank makes money cheaper, companies can borrow and expand more easily. When companies report great earnings (especially in tech), investors get excited and buy more stocks. When major economies like the US and China play nice, it reduces uncertainty and encourages more investment worldwide.

The tech sector is leading this charge with companies like Nvidia creating value at a pace we’ve never seen before. Going from $4 trillion to $5 trillion in market value in three months is like someone running a marathon in record time while everyone else is still tying their shoes.

Long-Term Significance: Why This Matters

This market behavior signals a major shift in how value is created in our economy. We’re moving from a world where physical assets (factories, land) created most wealth to one where digital assets (AI, cloud computing, data) are the new gold mines.

Warren Buffett once said, “Someone’s sitting in the shade today because someone planted a tree a long time ago.” The companies hitting record highs today planted their digital trees years ago. Amazon’s AWS, Microsoft’s Azure, and Alphabet’s Cloud are now bearing fruit after years of investment.

The global nature of this rally tells us something important: technology and money don’t care about borders anymore. When stocks in Japan, South Korea, Europe, and the US all rise together, it shows we’re truly in a global economy.

The Psychology Behind Market Movements

Understanding human behavior helps you make better decisions. Right now, we’re seeing several psychological principles at play:

Recency bias: People expect the recent good times to continue forever, which can lead to overconfidence.

FOMO (Fear Of Missing Out): When you see stocks hitting record highs, you might feel pressured to invest before you miss out.

Confirmation bias: If you believe the market will keep rising, you’ll notice all the positive news and ignore warning signs.

The smart investor acknowledges these biases but doesn’t let them drive decisions. Instead, create a plan based on your goals and stick to it regardless of market noise.

Contrarian Opportunities

While everyone celebrates, look for overlooked opportunities:

Value stocks: As growth stocks soar, some solid companies with reasonable prices might be ignored.

Emerging markets: While everyone focuses on US tech, some emerging markets might offer better value.

Sectors out of favor: Areas like energy or financials might offer opportunities if they’ve been overlooked in the tech rally.

Actionable Investing Advice

Here’s what you should do right now:

Diversify globally - With international markets beating US stocks by the widest margin since 2009, consider adding some international exposure to your portfolio. You can do this through international index funds or ETFs.

Focus on the “picks and shovels” - During the gold rush, the people who made the most consistent money weren’t the gold miners but those selling picks and shovels. In today’s tech boom, companies providing cloud services, chips, and AI infrastructure are the modern picks and shovels.

Keep some cash ready - Even Berkshire Hathaway is sitting on $382 billion in cash. Having cash on hand lets you buy quality assets when prices dip during inevitable market corrections.

Consider dollar-cost averaging - Instead of trying to time the market, invest a fixed amount regularly. This strategy works well in both rising and falling markets.

Personal Finance & Wealth Building Tips

Apply these lessons to your personal finances:

Invest in your own “cloud services” - Just as companies are investing in cloud infrastructure, invest in skills that will serve you in the digital economy. Learn about AI, data analysis, or digital marketing.

Build your “cash buffer” - Like Berkshire Hathaway’s $382 billion cash pile, maintain an emergency fund covering 3-6 months of expenses. This gives you flexibility during economic downturns.

Think long-term like Buffett - When everyone else is panicking during market drops, remember that November has historically been a strong month for stocks. Market timing is nearly impossible, but time in the market is what builds wealth.

Diversify your income - Just as you shouldn’t put all your investment eggs in one basket, don’t rely on a single income source. Consider side hustles, freelance work, or small business ideas.

Automate your finances - Set up automatic transfers to investment accounts. This removes emotion from your investing decisions and ensures consistent saving.

Final Thought: The “What To Do” Blueprint

Here’s your immediate action plan:

Review your portfolio - Check if you’re overexposed to any single sector or geography.

Set up automatic investments - If you haven’t already, arrange regular contributions to diversified funds.

Learn one new skill - Identify a digital skill that could increase your earning potential.

Build your emergency fund - If you don’t have 3-6 months of expenses saved, make this a priority.

Create a watch list - Identify 5-10 quality companies you’d want to own if their prices became more reasonable.

Remember what Steve Jobs said: “The only way to do great work is to love what you do.” Apply this principle to your financial life - find a strategy that works for you and stick with it through market ups and downs.

The market news this week is exciting, but your financial success depends on consistent habits, not reacting to headlines. Use this information as context for your decisions, not as a trigger for impulsive action.

👉 For daily insights, follow me on X/Twitter, Instagram Threads, or BlueSky, and turn on notifications!

2. Top 5 Finance Events this Week:

This week, we analyze:

1) Federal Reserve cuts interest rates and to ends quantitative tightening.

2) Massive layoff wave hits major companies.

3) Trump’s One Big Beautiful Bill will push US debt levels to record levels, IMF forecast predicts.

4) SNAP runs out of money Nov. 1. as Govenment shutdown continues. States are now figuring out how to feed millions of people.

5) Q3 2025 Earnings Season. Big tech dominates. 1️⃣ Federal Reserve cuts interest rates and to ends quantitative tightening.

What Happened:

The Federal Reserve cut interest rates by 25 basis points (that’s 0.25%) for the second time this year. The Fed also announced it’ll stop shrinking its balance sheet on December 1st. This process (called quantitative tightening) has been draining money from the system for years.

Here’s where it gets interesting: two Fed officials disagreed. One wanted a bigger cut. One wanted no cut at all. This split vote signals confusion about where the economy’s headed.

Why This Matters Long-Term:

Think of the Fed as the driver of a car (the economy). When they can’t agree on whether to speed up or slow down, that’s a problem. The rate sits at 3.75% to 4%. Inflation’s at 3%. That leaves almost no room for more cuts without risking an inflation comeback.

The Fed’s flying blind right now. The government shutdown means most economic data (jobs reports, retail sales) isn’t coming out. Making decisions without data is like driving with your eyes closed.

Warren Buffett’s famous advice applies here: “Only when the tide goes out do you discover who’s been swimming naked.” Right now, we can’t even see the tide because the data’s missing.

What This Means For You:

Lower rates make borrowing cheaper. But they also mean your savings earn less. High-yield savings accounts that paid 5% last year now pay 4.5% and dropping. Every Fed cut chips away at your returns.

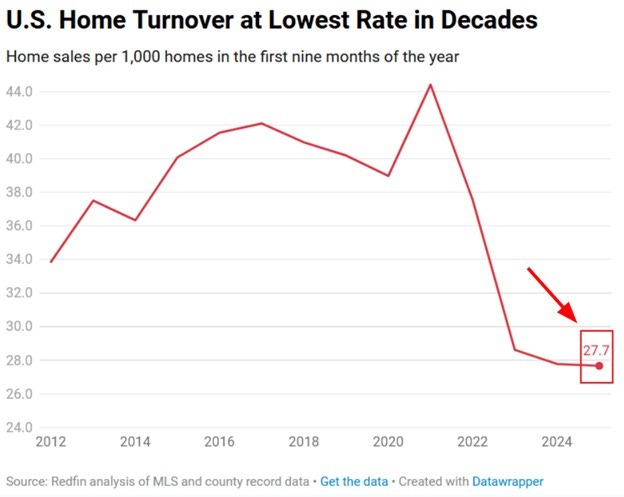

Mortgage rates have already fallen to their lowest in over a year. But don’t expect a flood of relief. Rates dropped from brutal to merely painful. A 7% mortgage is still expensive (just less expensive than 8%).

Auto loans and credit cards will drop slowly. Credit cards sit at 20% on average. Even after two Fed cuts, you’re still paying massive interest. The gap between what you earn on savings and what you pay on debt stays wide.

Actionable Advice:

This Week:

Lock in high-yield savings now. Open an account paying 4.5% or higher before rates drop further. Move your emergency fund there today.

Refinance your mortgage if you’re at 7% or higher. Run the numbers. If you can drop to 6.5% or below, the savings add up fast over 30 years.

Attack credit card debt. With rates at 20%, every dollar you pay saves you 20 cents in interest each year. Pay minimums on everything except your highest-rate card. Throw every extra dollar at that one.

Next 30 Days:

Consider a 0% balance transfer card. If you have good credit, transfer high-interest balances to a card offering 0% for 12-18 months. Just watch out for transfer fees (usually 3-5%).

Don’t buy a car yet. Auto loan rates haven’t budged much. Wait three to six months. Rates will drop more as Fed cuts filter through the system.

Build your cash position. The Fed’s divided. The economy’s uncertain. Keep six months of expenses in savings (not three). You’ll thank yourself later.

Long-Term Strategy: Think about what lower rates really mean: the Fed thinks the economy’s weakening. They don’t cut rates when things are great. They cut when they’re worried about jobs and growth.

History shows a pattern. When the Fed starts cutting after hiking, a recession often follows within 12-18 months. Not always. But often enough to pay attention.

The fact that they’re ending quantitative tightening sends another signal. They’ve removed $2.2 trillion from the system since 2022. Now they’re worried they went too far and sucked out too much money.

Your move: Don’t panic. But don’t ignore the warnings either. The Fed’s telling you (through their actions, not their words) that rough waters might be ahead.

2️⃣ Massive layoff wave hits major companies.

What Happened:

Forbes and CNBC reported that job cuts hit their highest levels since the pandemic. Over 696,000 layoffs announced so far this year. Here are the biggest:

UPS: 48,000 workers

Amazon: 30,000 workers

Intel: 24,000 workers

Nestlé: 16,000 workers

Accenture: 11,000 workers

Ford: 11,000 workers

The list goes on. Microsoft, Meta, Salesforce, Target, Kroger (all cutting thousands).

Why This Matters Long-Term:

Here’s what most people miss: these layoffs aren’t really about AI replacing workers (despite what companies claim). They’re about three things:

First, companies overhired during the pandemic. Remember 2021-2022? Everyone was desperate for workers. They paid crazy salaries and hired anyone with a pulse. Now they’re correcting that mistake.

Second, economic uncertainty is making CEOs nervous. Tariffs. Government shutdowns. Inflation that won’t die. When you don’t know what’s coming, you cut costs. People are the biggest cost.

Third, companies are using AI as an excuse. It sounds better to say “we’re cutting jobs because of AI innovation” than “we hired too many people and now we need to fix our balance sheet.”

Think about it like this: Remember when your friend bought a huge house during the boom, then couldn’t afford the payments? Companies did the same thing with employees.

What This Means For You:

If you have a job, your bargaining power just dropped. When 696,000 people are looking for work, employers don’t need to compete for you. They know you won’t leave because finding something new got harder.

For every job posting, companies are seeing twice as many applicants as last year. That’s supply and demand working against you.

Young workers (especially ages 25-35) are getting hit hardest. You’re expensive (companies pay more for experienced workers) but not yet essential (you haven’t been there long enough to be irreplaceable).

Actionable Advice:

This Week:

Make yourself indispensable. Take on the projects no one wants. Volunteer for the hard stuff. When layoffs come, managers protect the people who make their lives easier.

Document your wins. Keep a running list of every project you complete, every dollar you save the company, every problem you solve. You’ll need this when you negotiate or interview.

Start a side income stream. Freelance. Consult. Sell something online. Even $500 a month gives you breathing room if you lose your job.

Next 30 Days:

Build your network before you need it. Reach out to five people in your industry. Coffee chats. LinkedIn messages. Whatever works. Most jobs come through connections, not applications.

Update your resume and LinkedIn now. Don’t wait until you’re desperate. Polish your profile. Add recent achievements. Get recommendations from coworkers.

Increase your emergency fund from three months to six. With this many layoffs, finding a new job could take longer than usual.

Long-Term Strategy: The job market’s entering a “low hire, low fire” phase. Companies aren’t laying off masses of people every month. But they’re also not hiring replacements. Positions stay empty. Teams get stretched thin.

This creates a trap. You’re overworked because your team’s understaffed. But you can’t quit because jobs are scarce. And you can’t negotiate a raise because your boss knows you’re stuck.

Your best defense: become expensive to lose. Here’s how:

Own something critical. Be the person who knows the system no one else understands. Be the one with the client relationships. Make yourself hard to replace.

Build multiple income sources. If your job pays 100% of your income, you’re vulnerable. If it pays 70% and side work pays 30%, you’re resilient. You can survive a layoff longer. You have options.

Learn skills that transfer across industries. Don’t just be “good at your job.” Be good at sales. Or data analysis. Or project management. Skills that work anywhere give you mobility.

The companies doing these layoffs aren’t struggling. Amazon, Microsoft, Meta (they’re printing money). They’re cutting because they can. They’re optimizing. They’re getting leaner.

That tells you something important: your job security depends on you, not your company. No matter how well the company does, you could be next. Plan accordingly.

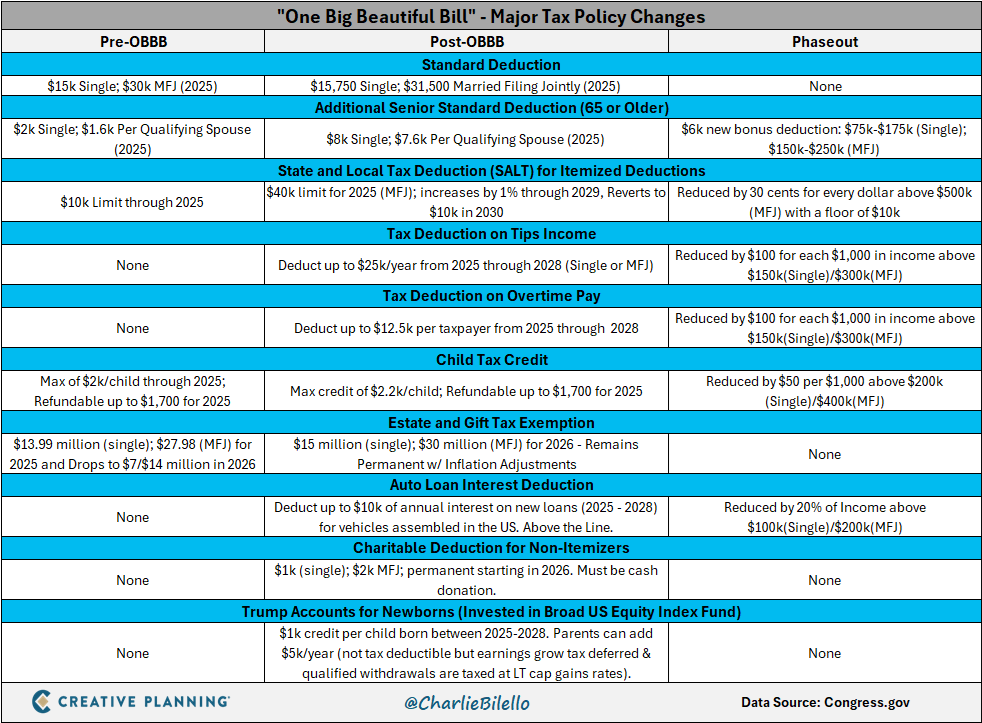

3️⃣ Trump’s One Big Beautiful Bill will push US debt levels to record levels, IMF forecast predicts.

What Happened:

The Independent reported that the IMF (International Monetary Fund) projects the US will have the highest debt-to-GDP ratio in the world by 2030. We’re talking worse than Greece or Italy (countries famous for debt disasters).

Trump’s “One Big Beautiful Bill” from earlier this year extended tax cuts for wealthy Americans and corporations. It also funded a massive expansion of deportation efforts. Total cost: trillions added to the deficit.

The US national debt just hit $38 trillion. The deficit this year will be between $1.7 trillion and $2.2 trillion. For six straight years, we’ve run deficits over $1 trillion.

Here’s the problem: interest payments on the debt will soon cost more than Social Security (the government’s biggest program). We’re spending $4 trillion on interest over the past decade. We’ll spend $14 trillion on interest over the next decade.

Why This Matters Long-Term:

Think about your own finances. If you’re drowning in credit card debt, every dollar goes to interest instead of building wealth. The US government’s doing the same thing on a massive scale.

When you owe too much, three bad things happen:

First, you pay more to borrow. Credit rating agencies already downgraded US debt three times. Each downgrade makes borrowing more expensive.

Second, you can’t invest in the future. Money that could fix roads, fund schools, or support research goes to interest payments instead.

Third, you become vulnerable to shocks. If a crisis hits (recession, war, pandemic), you can’t respond because you’re already maxed out.

Here’s a story that explains this perfectly: In the early 2000s, Greece ran up massive debts. Everything seemed fine until 2008. Then the financial crisis hit. Greece couldn’t pay its bills. The country went through brutal austerity. Unemployment hit 28%. Young people fled the country. It took over a decade to recover.

The US won’t collapse like Greece (we print our own currency, which helps). But we’re heading toward painful choices. Cut Social Security? Raise taxes dramatically? Let inflation run hot to make the debt worth less?

None of those options feel good.

What This Means For You:

Rising government debt affects you in ways most people don’t see:

Higher interest rates: When the government borrows trillions, it competes with you for money. That pushes rates up on your mortgage, car loan, and credit cards.

Higher inflation: One way to deal with debt is to let inflation run. Your paycheck buys less. Your savings lose value. The government wins (its debt becomes cheaper in real terms). You lose.

Higher taxes eventually: Someone’s paying for this. Future tax increases are almost guaranteed. Maybe income taxes. Maybe wealth taxes. Maybe both.

Weaker dollar long-term: As debt grows, other countries lose faith in the dollar. A weaker dollar means imports cost more. Everything from cars to electronics gets more expensive.

Actionable Advice:

This Week:

Lock in long-term debt at today’s rates. If you need a mortgage, get it now before rates rise further. Debt’s expensive today. It might be brutal tomorrow.

Don’t count on Social Security. If you’re under 50, assume you’ll get less than promised (or get it later). Plan your retirement savings accordingly.

Protect against inflation. Put some money (maybe 10-25% of your portfolio) in hard assets or assets that do well when inflation rises: real estate, commodities, Treasury Inflation-Protected Securities (TIPS), Bitcoin.

Next 30 Days:

Increase your 401(k) contributions. If the government needs money, they’ll look at tax-advantaged accounts eventually. Get as much in there as you can while the rules are favorable.

Consider Roth conversions. Pay taxes now at today’s rates. You’re betting that tax rates will be higher in the future. Given the debt situation, that’s a good bet.

Build multiple income streams. When governments need revenue, they raise taxes. The more ways you make money, the more flexibility you have to shift income to lower-tax sources.

Long-Term Strategy: The US debt problem won’t be solved quickly or painlessly. We’re past the point where small fixes work. The solutions are all bad. The question is which bad solution politicians pick.

Your defensive moves:

Own hard assets. Real estate. Commodities. Bitcoin. Things that hold value when currencies weaken. Not all your money (that’s crazy). But some.

Don’t be dollar-denominated exclusively. If you’re wealthy enough, consider some international exposure. Not to speculate. To diversify. If the dollar weakens significantly, you want some cushion.

Focus on skills over stuff. The best hedge against economic uncertainty isn’t gold or Bitcoin. It’s your ability to earn money no matter what happens. Invest in yourself. Learn. Grow. Adapt.

Stay politically aware. The next decade will bring big policy fights over debt, taxes, and spending. These decisions will affect your wealth. Pay attention. Vote. Speak up.

Think of it like this: You’re on a ship that’s taking on water. The captain (government) is arguing about whose fault it is instead of fixing the leak. You can’t fix the ship yourself. But you can make sure you know where the lifeboats are.

That’s what financial planning in a high-debt environment looks like: preparing for problems you can’t prevent.

4️⃣ SNAP runs out of money Nov. 1. as Govenment shutdown continues. States are now figuring out how to feed millions of people.

What Happened:

NPR reported that 42 million Americans who rely on SNAP (food stamps) won’t get their November benefits. The government shutdown means the program ran out of money on November 1st.

This has never happened before. SNAP dates back to the Great Depression. It’s survived every crisis, every recession, every shutdown (until now).

Some states are using their own money to fill the gap for a few days or weeks. Virginia’s spending $37.5 million per week. Louisiana declared a state of emergency. But most states can’t afford to replace $620 million per month in federal funding.

Two federal judges ordered the Trump administration to use emergency funds. But as of the reporting, it’s unclear what (if any) benefits will be paid.

Why This Matters Long-Term:

Here’s what makes this significant: this isn’t about the shutdown ending next week. This is about what happens when government programs that millions depend on suddenly stop working.

SNAP generates $1.50 to $1.80 in economic activity for every dollar spent. When 42 million people stop buying groceries, that doesn’t just hurt them. It hurts grocery stores. It hurts farmers. It hurts food manufacturers.

Think about your local grocery store. What happens when 12% of its customers (that’s the percentage of Americans on SNAP) suddenly can’t shop there? Sales drop. Hours get cut. Some stores close.

Food banks are already overwhelmed. During COVID, demand at food banks peaked at about 55% above normal. Right now, some food banks are seeing 58% more demand than during COVID. And they’re supposed to replace SNAP (which is nine times bigger than all food banks combined)?

That’s impossible.

Here’s a story that shows the ripple effect: In 2013, a computer glitch temporarily shut down EBT cards (the debit cards for SNAP) in Louisiana. Within hours, some Walmart stores looked like they’d been looted. People panicked. Shelves emptied. It was chaos. And that was just one state for a few hours.

What This Means For You:

Even if you don’t receive SNAP, this affects you:

Higher food prices: When millions of people can’t buy food through normal channels, demand shifts to food banks and charity. That creates shortages. Shortages drive prices up for everyone.

Economic slowdown: SNAP recipients spend every dollar they get (they have to). When you remove $620 million per month from the economy, growth slows. Jobs disappear. Your neighbors struggle. Your community hurts.

Social instability: Hungry people make desperate choices. Crime rises. Communities fracture. This isn’t speculation. This is what happens every time food insecurity spikes.

Political volatility: Major programs failing creates political backlash. Whoever voters blame (fairly or not) faces consequences. That means policy swings. Policy swings create uncertainty. Uncertainty hurts markets and economic growth.

Actionable Advice:

This Week:

Stock your pantry. Buy non-perishable food now. Not to hoard. But to have three months of basics (rice, beans, canned goods, pasta). If food prices spike or shortages hit, you’re covered.

Check on your neighbors. Seriously. If you know someone who might be struggling, reach out. Offer to share a meal. Give them info about local food banks. Small acts of community support matter.

Support local food banks. If you can afford $20 or $50, donate it now. Food banks are about to get crushed with demand. Your money buys food in bulk (more efficient than you buying groceries and donating them).

Next 30 Days:

Plan for higher grocery bills. Even when SNAP resumes, this disruption will cause price increases. Budget an extra 10-15% for food costs over the next few months.

Buy shelf-stable protein now. Canned chicken, tuna, beans. Protein’s expensive. If prices jump, you’ll be glad you bought at today’s prices.

Consider a small freezer. If you have space, a chest freezer lets you buy meat on sale and store it. When prices rise, your cost per meal stays low.

Long-Term Strategy: This SNAP crisis reveals a deeper problem: government services you count on can disappear suddenly. Social Security. Medicare. Veterans benefits. None of them are guaranteed if the political system breaks down.

This sounds dramatic. But it’s real. We just watched a program that’s existed since the 1930s get shut off. If SNAP can fail, anything can fail.

Your defensive strategy:

Build self-sufficiency. Learn to garden (even a small one). Learn to cook from scratch. Learn to preserve food. These aren’t doomsday prepper skills. They’re practical ways to reduce dependence on systems that might break.

Create community networks. Your neighbors are your safety net when government fails. Know the people on your street. Help each other. Share resources. Communities that stick together survive crises that break individuals.

Don’t assume programs will exist. Planning for retirement? Don’t count on Social Security being there in its current form. Saving for healthcare? Don’t assume Medicare will cover what it covers today. Plan for the worst. Hope for the best.

Stay politically engaged. This shutdown isn’t normal. Letting essential programs fail isn’t normal. Vote. Contact your representatives. Make noise. The squeaky wheel gets grease. Silent citizens get ignored.

Think about the psychology here: When you’re hungry, nothing else matters. You can’t focus on your job. You can’t help your kids with homework. You can’t plan for the future. You’re just surviving today.

Forty-two million Americans are now in survival mode. That’s one in eight people. Look around your neighborhood. Count eight houses. One of them is affected.

This is what system failure looks like in real time. Don’t forget it. Don’t assume it can’t happen to other programs. And don’t wait until you’re affected to care.

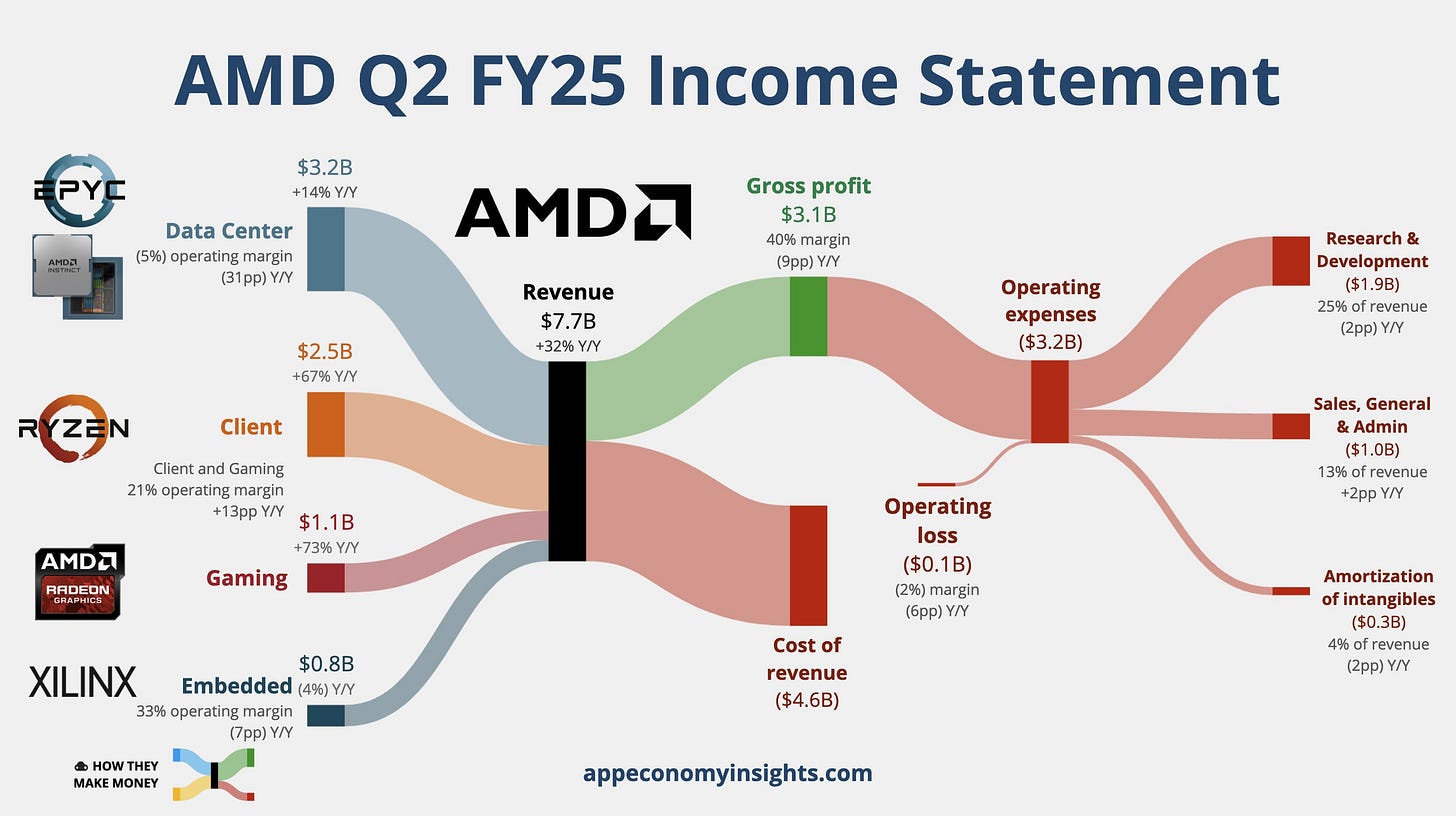

5️⃣ Q3 2025 Earnings Season. Big tech dominates.

What Happened:

Forbes and CNBC reported that 83% of companies beat earnings expectations this quarter. The S&P 500’s earnings grew 10.7% (better than the 7.9% expected).

The Magnificent Seven drove most of the growth:

Alphabet: Hit $100 billion in quarterly revenue for the first time. Cloud grew 34%.

Amazon: AWS (its cloud business) grew 20% (fastest in three years). But the company’s laying off 14,000 workers.

Microsoft: Azure grew 40%. But they took a $3.1 billion hit from their OpenAI investment.

Apple: iPhone 17 demand is “off the charts.”

Meta: Revenue grew 26%. But shares fell 9% after announcing a $15.9 billion tax charge and $70+ billion in AI spending next year.

Nvidia: Hit $5 trillion market cap in just three months.

Chipotle cratered 19% after cutting its forecast. Palantir surged on strong AI adoption. Berkshire Hathaway beat expectations (with cash holdings hitting a record $382 billion).

Why This Matters Long-Term:

Here’s the crucial insight everyone’s missing: these earnings are hiding two different stories.

Story one: AI is real and it’s making money. Not promises. Real dollars. Alphabet’s cloud grew 34%. Microsoft’s Azure grew 40%. Over 70% of cloud customers use AI tools. Companies are paying billions for AI infrastructure.

Story two: The cost of AI might not be worth it. Meta’s spending $70 billion on AI next year. Microsoft took a $3.1 billion loss on OpenAI. Amazon’s raising its spending forecast to $125 billion. At what point does spending $100 billion to make $10 billion stop making sense?

Think of it like the dot-com bubble. In 1999, internet companies spent billions building infrastructure. Some bets paid off (Amazon, Google). Most didn’t (Pets.com, Webvan). We’re in the “spending billions” phase now. We won’t know who wasted their money until later.

Buffett’s sitting on $382 billion in cash (his biggest cash pile ever). He’s not buying because he thinks everything’s overvalued. When the world’s best investor refuses to deploy capital, pay attention.

What This Means For You:

If you own tech stocks (and most people do through index funds), you’re betting on AI paying off. Your retirement account is riding on whether Microsoft’s $70 billion AI spend generates $140 billion in revenue.

Here’s the uncomfortable truth: nobody knows if AI spending will pay off. Not the CEOs. Not the analysts. Not you. Not me.

But markets are pricing in success. The S&P 500 trades at its highest valuation in two years. Tech stocks trade at 30-40 times earnings (historically, 15-20 is normal). You’re paying premium prices for uncertain outcomes.

The Chipotle story is the warning sign everyone’s ignoring. They cut their forecast. Traffic’s dropping. Young people (ages 25-35) aren’t eating out as much. If people can’t afford a $10 burrito, how long can they afford $100 subscription services or $1,000 phones?

Actionable Advice:

This Week:

Check your tech exposure. Look at your 401(k) or investment accounts. What percentage is in tech stocks? If it’s over 75%, you’re concentrated. Consider trimming to 10-20%.

Take profits on your biggest winners. If you own Nvidia, Alphabet, or Microsoft shares that have doubled or tripled, sell 20-30%. Lock in gains. You can’t go broke taking profits.

Set up a cash position. Move 10-15% of your portfolio to cash or money market funds. Earnings are great now. That won’t last forever. Cash gives you ammunition when opportunities arise.

Next 30 Days:

Rebalance toward value. Tech stocks are expensive. Other sectors are cheaper. Look at healthcare, consumer staples, utilities. They’re boring. They’re also on sale.

Add some defense. Consider buying puts on your biggest tech positions (insurance against drops). Or buy inverse ETFs that go up when tech goes down. Not with a lot of money. Just enough to cushion a crash.

Research smaller companies. Everyone’s focused on the Magnificent Seven. That creates opportunities in overlooked stocks. Find three companies trading at reasonable valuations with solid earnings growth.

Long-Term Strategy: AI will change everything. That part’s true. But not every company spending billions on AI will win. Most will waste money. Some will go broke. A few will dominate.

Your job isn’t to pick the winners. It’s to avoid the losers and capture the overall growth.

Here’s your playbook:

Own the infrastructure, not the apps. Nvidia sells the shovels (chips). Microsoft and Amazon sell the picks (cloud services). These companies win regardless of which AI app succeeds. The AI apps themselves (ChatGPT competitors, AI writing tools) might fail.

Don’t chase performance. Stocks that went up 170% this year (like Palantir) probably won’t repeat that next year. When everyone loves a stock, it’s time to be cautious.

Watch the canaries in the coal mine. Chipotle’s warning about weak consumer demand matters. If people are cutting back on basic purchases, they’ll cut back on expensive tech products next. Pay attention to consumer discretionary stocks. They signal recessions early.

Follow Buffett’s lead (partially). You don’t need $382 billion in cash. But building cash when everyone else is fully invested is smart. Buffett’s waiting for better prices. You should too.

Set price targets and stick to them. Decide now: if the S&P 500 drops 10%, I’ll buy more. If it drops 20%, I’ll deploy most of my cash. Having a plan stops you from panicking or freezing when markets move.

Think about this carefully: earnings are backward-looking. They tell you what happened last quarter. They don’t predict what happens next quarter.

Right now, earnings look great. Stock prices are high. Confidence is high. This is usually when things start going wrong.

I’m not saying sell everything and hide in cash. I’m saying be smart about risk. Take some profits. Build some cash. Diversify away from pure tech bets. Prepare for volatility.

The investors who make money in the next five years won’t be the ones who chase the highest-flying stocks today. They’ll be the ones who position defensively now and pounce aggressively when everyone else panics.

Be that investor.

*️⃣ Other important headlines:

President Trump says he may announce a new Federal Reserve Chair by the end of the year to replace Jerome Powell.

OpenAI prepares for IPO at $1 trillion valuation

Nvidia $NVDA becomes the first company in history to reach a $5 trillion market cap.

Amazon $AMZN to lay off 30,000 employees

President Trump pardons Binance founder CZ

Mastercard to acquire crypto startup Zerohash for nearly $2 billion

👉 For daily insights, follow me on X/ Twitter, Instagram Threads, or BlueSky, and turn on notifications!

3. 3 Important Charts this Week:

This week, we analyze:

1) Federal Reserve pumped $125 Billion over the last 5 days into the U.S. Banking System amid liquidity crisis fears. This amount far surpasses even the peak of the Dot Com Bubble.

2) Warren Buffett’s Berkshire Hathaway is now sitting on a record high $344 Billion in Cash. Buffett sold a net -$6.1 billion worth of stock last quarter. Warren Buffett’s cash pile is now larger than the market cap of all but 30 public companies in the world.

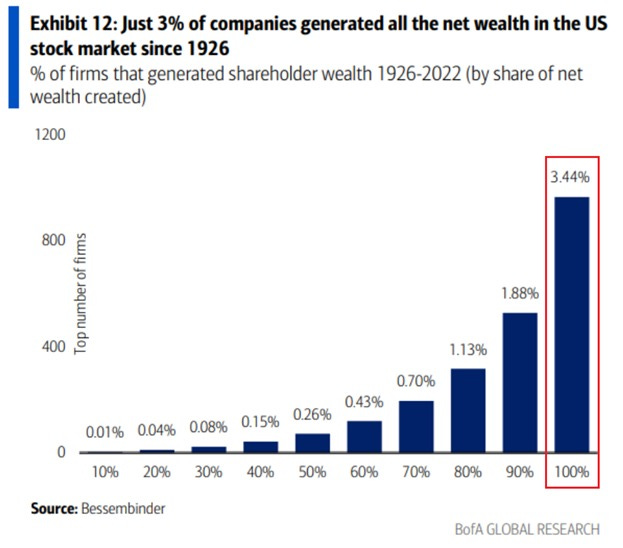

3) ALL net wealth in the US stock market since 1926 has been generated by just 3.44% of companies. The top 1.88% of companies reflect 90% of total gains.

Bonus: Michael Burry has tweeted for the first time in years.1️⃣ Federal Reserve pumped $125 Billion over the last 5 days into the U.S. Banking System amid liquidity crisis fears. This amount far surpasses even the peak of the Dot Com Bubble.

💡Andrew’s Analysis:

What You’re Looking At:

This first chart shows the Fed pumping $23.8 billion into the banking system on November 3rd alone. Over five days, they injected $125 billion total through “reverse repos.” This is more than they pumped during the peak of the dot-com bubble.

Think of reverse repos like this: Banks need cash overnight to meet their obligations. When they’re desperate for money, they go to the Fed and borrow it. The more they borrow, the more scared they are.

Why This Is Terrifying:

The banking system is supposed to have plenty of cash flowing through it (like water through pipes). When banks suddenly need $125 billion from the Fed, the pipes are clogged. Something’s broken.

This happened in September 2019 (right before COVID crashed everything). It happened in 2008 (right before the financial crisis). It’s happening again now.

Here’s the pattern: Everything looks fine on the surface. Stock market’s making new highs. Everyone’s celebrating. Then suddenly, banks can’t get cash. The Fed has to step in.

Ray Dalio (the hedge fund billionaire) calls this “the plumbing breaking.” Most investors never see it coming because they’re watching stock prices, not bank liquidity. But the plumbing always breaks before the building collapses.

What This Means For You:

When the Fed pumps emergency cash into banks, it’s admitting two things:

First, the system is fragile. Banks don’t have enough liquid assets. They’re stretched thin. One shock (bank failure, government default, major company bankruptcy) could start a domino effect.

Second, something’s coming. The Fed doesn’t inject $125 billion for fun. They see something in the data that scares them. Maybe it’s commercial real estate loans going bad. Maybe it’s derivatives blowing up. Maybe it’s something we don’t know about yet.

But they’re preparing for a crisis. You should too.

Long-Term Implications:

Every time the Fed injects emergency liquidity, it creates two problems:

Problem one: Moral hazard. Banks take bigger risks because they know the Fed will bail them out. This makes the next crisis worse.

Problem two: Currency debasement. The Fed creates money out of thin air. More dollars chasing the same goods means inflation. Your savings lose value.

Over the long term, this creates a cycle: Crisis → Fed prints money → Banks take more risk → Bigger crisis → Fed prints more money. Each cycle makes the eventual crash bigger and more painful.

Actionable Advice:

This Week:

Check your bank’s health. Look up your bank on Bankrate’s financial strength ratings. If it’s not rated “A” or better, consider moving your money to a stronger institution.

Spread your deposits. FDIC only insures $250,000 per account per bank. If you have more, split it across multiple banks. Don’t assume your money’s safe just because it’s in a bank.

Build a cash cushion at home. Keep $1,000-$2,000 in physical cash somewhere safe. If ATMs stop working (it’s happened before), you need cash for food, gas, and essentials.

Next 30 Days:

Open accounts at credit unions. They’re safer than big banks during crises because they’re more conservative with lending. Plus, they’re not chasing quarterly profits that push risky behavior.

Move emergency funds to Treasury money market funds. These invest only in US government debt. They’re safer than bank deposits during a banking crisis (because the government won’t fail before the banks do).

Reduce leverage everywhere. Pay down credit card debt. Refinance adjustable-rate mortgages to fixed rates. Lock in car loans. When liquidity dries up, credit disappears. Secure your financing now.

Long-Term Strategy: Think about what happens when the banking system gets stressed:

Credit becomes scarce (harder to get loans)

Interest rates spike (whatever you can borrow costs more)

Asset prices crash (stocks, real estate, everything goes down)

Cash becomes king (liquidity is the only thing that matters)

Defensive playbook:

Own hard assets. When banking systems fail, hard assets holds value. Keep 5-25% of your net worth in hard assets.

Diversify internationally. Don’t keep everything in US banks. Open a foreign bank account (Schwab International or Interactive Brokers make this easy). If the US banking system freezes, you have access to money elsewhere.

Build real skills. If financial systems break, your ability to create value matters more than your bank balance. Learn to fix things. Grow food. Provide services people need. Skills are the ultimate insurance policy.

Think of it like this: You’re on a boat. Everyone’s partying on deck. But down in the engine room, water’s pouring in. The captain (the Fed) is frantically pumping water out. Most passengers don’t notice until the boat starts sinking.

You’re noticing now. Act on it.

2️⃣ Warren Buffett’s Berkshire Hathaway is now sitting on a record high $344 Billion in Cash. Buffett sold a net -$6.1 billion worth of stock last quarter. Warren Buffett’s cash pile is now larger than the market cap of all but 30 public companies in the world.

💡Andrew’s Analysis:

What You’re Looking At:

This second chart shows Berkshire Hathaway’s cash position over time. Notice the dramatic vertical spike in 2024-2025? Buffett went from holding around $150 billion to $382 billion in less than two years.

He’s not just holding cash. He’s actively selling stocks. Last quarter alone, he sold a net $6.1 billion. His cash pile is now bigger than the market cap of all but 30 companies in the world.

Why:

Warren Buffett doesn’t hold cash because he’s scared. He holds cash because he can’t find anything worth buying at current prices. This is a man who’s invested through every crisis since the 1950s. He knows value. And he’s telling you (through his actions) that there is no value left.

Let me tell you a story. In 1999, Buffett refused to buy tech stocks during the dot-com bubble. Everyone called him washed up. Outdated. Past his prime. He sat on cash while the Nasdaq soared. Then March 2000 hit. The Nasdaq crashed 78%. Buffett deployed his cash into bargains and crushed the market for the next decade.

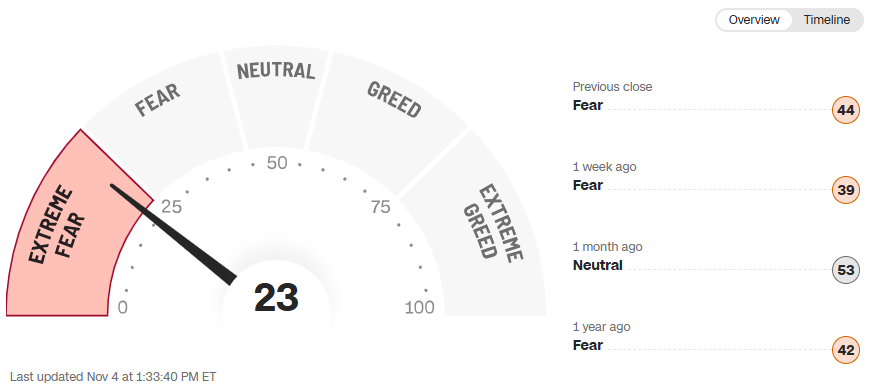

In 2008, Buffett’s famous quote was: “Be fearful when others are greedy, and greedy when others are fearful.” Right now, he’s fearful. Others are greedy. History says he’s right to be fearful.

What This Means For You:

When the world’s greatest investor is 50% in cash, you should ask yourself: “What does he see that I don’t?”

Here’s what he sees:

Stocks trading at valuations last seen in 1999 (right before the dot-com crash) and 1929 (right before the Great Depression)

Corporate profit margins at all-time highs (which always revert to the mean)

Consumer debt at record levels (people can’t keep spending)

Government debt spiraling out of control (fiscal crisis is coming)

AI hype driving valuations that assume perfect execution for decades (which never happens)

Buffett’s not timing the market. He’s assessing risk versus reward. Right now, the risk is massive and the reward is tiny. So he’s waiting.

Long-Term Implications:

Buffett’s cash pile matters because it shows you how cycles work:

Phase 1 (Expansion): Stocks are cheap. Buffett buys aggressively. His cash pile shrinks.

Phase 2 (Peak): Stocks get expensive. Buffett stops buying. His cash pile grows.

Phase 3 (Crash): Stocks collapse. Buffett deploys cash into bargains.

Phase 4 (Recovery): Buffett’s purchases soar. He makes billions.

Right now, we’re in Phase 2 heading into Phase 3. Buffett’s preparing for the crash. He’s raising cash so he can buy aggressively when everyone else is panic-selling.

The long-term implication: Massive wealth transfer is coming. Money will flow from people who chase expensive stocks today to people who buy cheap assets tomorrow. Buffett will be on the receiving end.

Actionable Advice:

This Week:

Calculate your cash position. Add up checking accounts, savings accounts, money market funds. What percentage of your net worth is in cash? If it’s under 5%, you’re too aggressive for this environment.

Review your portfolio for overvalued positions. Anything that’s tripled in two years is probably overvalued. Consider taking profits on 20-30% of those positions.

Next 30 Days:

Build toward 10-20% cash. Follow Buffett’s playbook. Raise cash by trimming your winners. Set a target: “I want $X in cash by December 31st.” Then execute.

Create a shopping list. Write down 5-10 stocks you’d love to own at cheaper prices. Set target buy prices (maybe 10-30% below current levels). When the crash comes, you’ll know exactly what to buy.

Set up limit orders. Most brokers let you place “good til cancelled” limit orders. Put in bids for your target stocks at your target prices. If markets crash overnight, you’ll automatically buy at the prices you wanted.

Long-Term Strategy:

Here’s how to think like Buffett:

Returns come from buying cheap, not selling high. Most people focus on exit strategies. Buffett focuses on entry prices. The money’s made when you buy, not when you sell.

Be patient. Buffett’s been waiting two years for better prices. He might wait two more. Cash earns 5% right now in money markets. That’s not exciting. But it beats losing 30% in a crash.

Think in decades, not days. Buffett’s 94 years old. He’s thinking about what Berkshire looks like in 2035. If you’re younger, think about what your portfolio looks like in 2045. From that perspective, waiting a year or two for better prices is nothing.

Strike when others are bleeding. The time to deploy cash isn’t when things feel good. It’s when things feel terrible. In March 2020, Buffett deployed billions into airlines and energy stocks when everyone thought they were done. He made a fortune.

Here’s a mental model: Imagine you’re a farmer. You don’t plant seeds whenever you feel like it. You plant when conditions are right. Right now, the soil is dry and hard (valuations are expensive). Buffett’s waiting for rain (a market crash) to soften the soil. Then he’ll plant aggressively.

You should do the same.

One more thing: Don’t confuse Buffett’s cash position with fear. He’s not scared. He’s excited. He knows a crash is coming. He knows he’ll make billions buying bargains. His cash pile is his weapon. He’s sharpening it while he waits.

You should be excited too. Yes, a crash will hurt. But it’ll hurt the people who stay fully invested. If you build cash now, you’ll be thrilled when stocks go on sale. Crashes create more millionaires than bull markets. They just create them for people who prepared.

Be one of those people.

3️⃣ ALL net wealth in the US stock market since 1926 has been generated by just 3.44% of companies. The top 1.88% of companies reflect 90% of total gains.

💡Andrew’s Analysis:

What You’re Looking At:

This third chart shows something shocking: Only 3.44% of companies have generated all the wealth in the US stock market since 1926. The other 97% contributed nothing (or less than nothing).

Even crazier: The top 1.88% of companies created 90% of all gains. And just 0.26% (that’s one in every 400 companies) created half of all wealth.

Why This Changes Things:

This chart contradicts the most common investing advice we hear: “Just buy index funds and hold forever.”

Here’s the problem: If only 3.44% of stocks create all the returns, that means when you buy an index fund, you’re buying 97% garbage mixed with 3% gold. You’re diluting your winners with massive dead weight.

Think about it like this: Imagine you’re buying a basket of fruit. But 97% of the fruit is rotten. Only 3% is fresh. Would you buy that basket? Of course not. But that’s what you do when you buy an index fund at any price.

The chart reveals a deeper truth: Stock picking matters. Maybe not the way most people think (trading in and out constantly). But picking the right companies to hold for decades matters enormously.

What This Means For You:

Here’s what most investors do wrong: They diversify into 50, 100, or 500 stocks thinking it reduces risk. But this chart shows it also reduces returns. You’re diluting your winners with losers.

Warren Buffett says: “Diversification is protection against ignorance. It makes very little sense for those who know what they’re doing.” This chart proves him right.

The math is brutal: If you own 100 stocks, and only 3-4 of them generate all the returns, you better hope you picked the right 3-4. If you missed them, you made nothing for decades.

Look at the real-world examples:

If you owned the S&P 500 from 2010-2020 but didn’t own Apple, Amazon, Microsoft, Google, and Facebook, you underperformed dramatically

If you owned 1,000 stocks from 1990-2000 but didn’t own Microsoft, Cisco, Intel, and Oracle, you made almost nothing

If you owned the market from 1970-1990 but didn’t own Walmart, McDonald’s, and Coca-Cola, you missed most of the gains

This is the central problem of investing: Finding the 3.44% before they become obvious.

Long-Term Implications:

This concentration of returns has massive implications:

First, passive investing works until it doesn’t. Index funds have crushed active managers for 15 years. But that’s because the winners (big tech) got bigger. When those winners stop winning (and they will), passive investors will be stuck holding expensive stocks that go nowhere.

Second, timing matters more than people admit. Buying the right company at the wrong price still loses money. Ask anyone who bought Cisco in 2000 at $80. It hit $19 by 2002. It’s still under $80 today (25 years later).

Third, concentration builds wealth. Every billionaire investor (Buffett, Munger, Bezos, Musk) got rich by concentrating in a few big winners. They didn’t diversify into 500 stocks. They picked 5-10 great companies and bet big.

Actionable Advice:

This Week:

Audit your portfolio. List every stock you own. For each one, write down why you own it. If your answer is “it’s in an index fund,” that’s not good enough. Figure out what each company actually does.

Identify your top 5. Which five holdings do you have the most conviction in? Which five do you understand best? Which five have the best long-term prospects?

Calculate your concentration. What percentage of your portfolio is in your top 5? If it’s less than 50%, you’re over-diversified.

Next 30 Days:

Research the historical winners. Study Apple, Microsoft, Amazon, Alphabet, Nvidia. What made them successful? What patterns can you spot? Create a checklist of traits that winners share.

Build a concentrated portfolio. Build a portfolio that includes 8-12 individual stocks. Only buy companies you understand deeply. Only buy at reasonable prices.

Accept the risk. Concentrated portfolios are volatile. Your account will swing. But if you pick right, you’ll crush index funds long-term. Buffett’s Berkshire owns about 45 stocks total. That’s not diversification. That’s concentration.

Long-Term Strategy:

Here’s your framework for finding the 3.44%:

The Winner’s Checklist:

Durable competitive advantages (brand, network effects, switching costs, patents, scale advantages)

Growing markets (sailing with the wind at your back, not against it)

Excellent management (passionate founders or long-tenured CEOs who own lots of stock)

Strong financials (consistent revenue growth, expanding margins, high returns on capital)

Reasonable valuation (don’t overpay even for great companies)

Let me tell you a story about Peter Lynch (the legendary Fidelity manager). He managed the Magellan Fund from 1977-1990 and returned 29% annually. How? He owned 1,000+ stocks but concentrated 40% of his money in his top 10 holdings. He diversified broadly but bet big on his best ideas.

That’s your playbook:

Own 8-15 stocks

Put 50-60% of your money in your top 5

Hold for decades

Only sell if the business breaks or you find something better

Mental models to remember:

The Baseball Model: Buffett says investing is like baseball with no called strikes. You can watch pitches forever until you get one right down the middle. Then you swing hard. Don’t swing at bad pitches just because you’re bored.

The Kelly Criterion: This is a math formula gamblers use. It says: bet more when you have an edge, bet less (or nothing) when you don’t. Most investors bet equally on every idea. That’s backwards. Bet big on your best ideas.

The Barbell Strategy: Put 80% of your money in 5-8 ultra-high-conviction stocks. Put 20% in the rest. Don’t hold anything in the middle. Either you love it (bet big) or you don’t (bet small).

How to do this practically:

Let’s say you have $100,000 to invest:

Put $50,000 in your top 5 stocks ($10,000 each)

Put $30,000 in your next 5 stocks ($6,000 each)

Keep $20,000 in cash for opportunities

Review quarterly. If one stock doubles, trim it back to $10,000 and add the profit to cash or your other positions. If one stock falls 50%, either double down (if you still believe) or sell and move on.

This is hard. You’ll be wrong sometimes. But if you’re right on 2-3 positions out of 10, you’ll beat the market by huge margins. And that’s all you need.

Remember: The goal isn’t to be right on every stock. The goal is to be really right on a few stocks and not really wrong on the others.

P.S. Index funds are still the best choice for the majority of people.

*️⃣ Michael Burry has tweeted for the first time in years.

💡Andrew’s Analysis:

What You’re Looking At:

Michael Burry (the guy from “The Big Short” who made billions betting against subprime mortgages in 2008) just broke years of silence. His tweet says:

“Sometimes, we see bubbles.

Sometimes, there is something to do about it.

Sometimes, the only winning move is not to play.”Why This Matters:

Burry doesn’t tweet casually. He only speaks publicly when he sees something truly dangerous. And he’s saying the only winning move is not to play.

Let me explain what he means. In the movie “WarGames,” a computer learns that the only way to win global thermonuclear war is not to launch the missiles. Burry’s saying the same thing about markets: The way to win right now isn’t to pick stocks or time the market. It’s to step aside and wait.

What This Means For You:

Burry called the 2000 dot-com bubble. He called the 2008 housing bubble. He called the 2021 meme stock bubble. He’s batting 1.000 on bubble calls.

When he says “sometimes, there is something to do about it,” he’s talking about shorting (betting against) the bubble. He made billions shorting subprime mortgages. But he’s also saying “sometimes, the only winning move is not to play.” That means this bubble’s too dangerous even to short.

Think about what that implies. Shorting can make unlimited losses (if stocks keep going up forever). If Burry thinks this bubble is too dangerous to short, he’s saying: The bubble might get bigger before it pops. Trying to time it could bankrupt you. So don’t play.

Long-Term Implications:

Bubbles create two groups of people:

Group 1: Those who rode it up and rode it down (made nothing)

Group 2: Those who stepped aside, waited for the crash, then bought bargains (made fortunes)Burry’s telling you which group to be in.

History repeats: After the 1929 crash, stocks didn’t reach new highs until 1954 (25 years later). After the 2000 crash, the Nasdaq didn’t reach new highs until 2015 (15 years later). After the 2008 crash, it took until 2013 (5 years later).

If you buy at bubble prices and hold through the crash, you could wait a decade or more to break even. Is that a risk you can afford?

Actionable Advice:

This Week:

Accept reality. You’re in a bubble. Denial won’t help you. Stocks are expensive by every historical measure (price-to-earnings, price-to-sales, price-to-book, market cap to GDP). This is not normal.

Do the math on your timeline. If you’re 25 and won’t touch this money for 40 years, you can probably hold through a crash. If you’re 55 and retiring in 5 years, you cannot afford a 50% drawdown. Adjust accordingly.

Make one decision today: Are you going to ride this bubble or step aside? Don’t waffle. Pick a strategy and commit.

Next 30 Days:

If you’re stepping aside: Raise cash aggressively. Put proceeds in Treasury money market funds earning 5%. Yes, you’ll miss gains if the bubble continues. But you’ll avoid the crash.

If you’re riding it: Buy put options for insurance. Spend 2-3% of your portfolio on out-of-the-money puts on the S&P 500. If the market crashes 30%, your puts will explode in value and offset losses.

Track the warning signals: Watch the Fed’s reverse repo chart. Watch Buffett’s cash pile. Watch insider selling. When all three accelerate, the end may be near.

Long-Term Strategy:

Here’s how to survive and profit from bubbles:

Phase 1 (Recognition): You’re here now. You see the bubble. Most people don’t.

Phase 2 (Decision): Choose your strategy. Either step aside entirely or reduce exposure and buy protection.

Phase 3 (Patience): Bubbles can last longer than you expect. The dot-com bubble lasted 3 years after Greenspan warned about “irrational exuberance.” Stay disciplined.

Phase 4 (The Pop): One day (usually when everyone’s most confident), the bubble pops. It’ll be fast and brutal. 20-30% drops in weeks.

Phase 5 (The Bargains): This is where you make your fortune. While everyone’s panicking, you deploy your cash into world-class companies at fraction prices.

Real-world example: Let’s say you have $100,000 in stocks today. Here are your two paths:

Path 1 (Ride it out):

Market goes up 20% over next year: You have $120,000

Market crashes 50%: You have $60,000

Market recovers 50%: You have $90,000

Net result after 3 years: You lost $10,000

Path 2 (Step aside):

$50,000 in cash, $50,000 in stocks

Market goes up 20%: Your stocks are worth $60,000, total: $110,000

Market crashes 50%: Your stocks are worth $30,000, total: $80,000

You buy bargains with your $50,000 cash

Market recovers 100%: Your new purchases double to $100,000

Your old stocks recover to $60,000

Net result: $160,000

By stepping aside partially, you turned $100,000 into $160,000 instead of $90,000. That’s a $70,000 difference from one decision.

How to execute this:

Sell in tranches. Don’t sell everything in one day. This protects you if the bubble keeps inflating.

Keep a watch list. Write down companies you’d love to own at 20-40% discounts. Examples: Microsoft under $300, Apple under $150, Alphabet under $120, Amazon under $120. When the crash comes, you know exactly what to buy.

Stay unemotional. During the crash, you’ll feel sick watching your remaining stocks fall. During the recovery, you’ll feel smart watching your bargain purchases soar. Emotions are the enemy. Stick to your plan.

Don’t short. Burry’s warning applies: This bubble could get bigger first. Shorting can bankrupt you. Just step aside. Cash is a position.

The psychology:

Remember: You’re playing a different game than everyone else. They’re trying to make money in the bubble. You’re trying to preserve capital for the crash.

When your friends brag about their gains, you’ll feel stupid. When stocks keep going up, you’ll question your decision. When CNBC shows charts of all-time highs, you’ll feel like you’re missing out.

That’s the cost of being disciplined. But the payoff is massive. While your friends ride their gains back to zero (or worse), you’ll have cash to buy at fire-sale prices.

Think about this: After 2008, houses sold for 50% off. Stocks sold for 60% off. The people who had cash made generational wealth. The people who stayed fully invested lost half their net worth.

P.S. This is not about timing the market. This is about locking in some gains, and having some cash on the sidelines.

👉For more charts, follow me on Instagram, Facebook, LinkedIn, and turn on notifications!

🤝 Today’s premium research is made free by our sponsor RAD Intel!

A quick message from today’s sponsor, RAD Intel:

RAD Intel reads millions of online conversations to spot patterns. It’s an AI company that reads real-world language—Reddit, TikTok, X, LinkedIn—and turns it into clear signals. Brands use it to find what people want. It’s backed by Adobe, NASDAQ ticker reserved, $RADI and now open for investors.

4. My Stock Picks + Research:

Warren Buffett: “The stock market is a device for transferring money from the impatient to the patient.”

Charlie Munger: “The big money is not in the buying and selling, but in the waiting.”

The core idea is simple: Invest in companies with unshakable competitive advantages that are also riding massive, long-term growth waves. You don’t have to choose between safety and growth. With these picks, you get both.

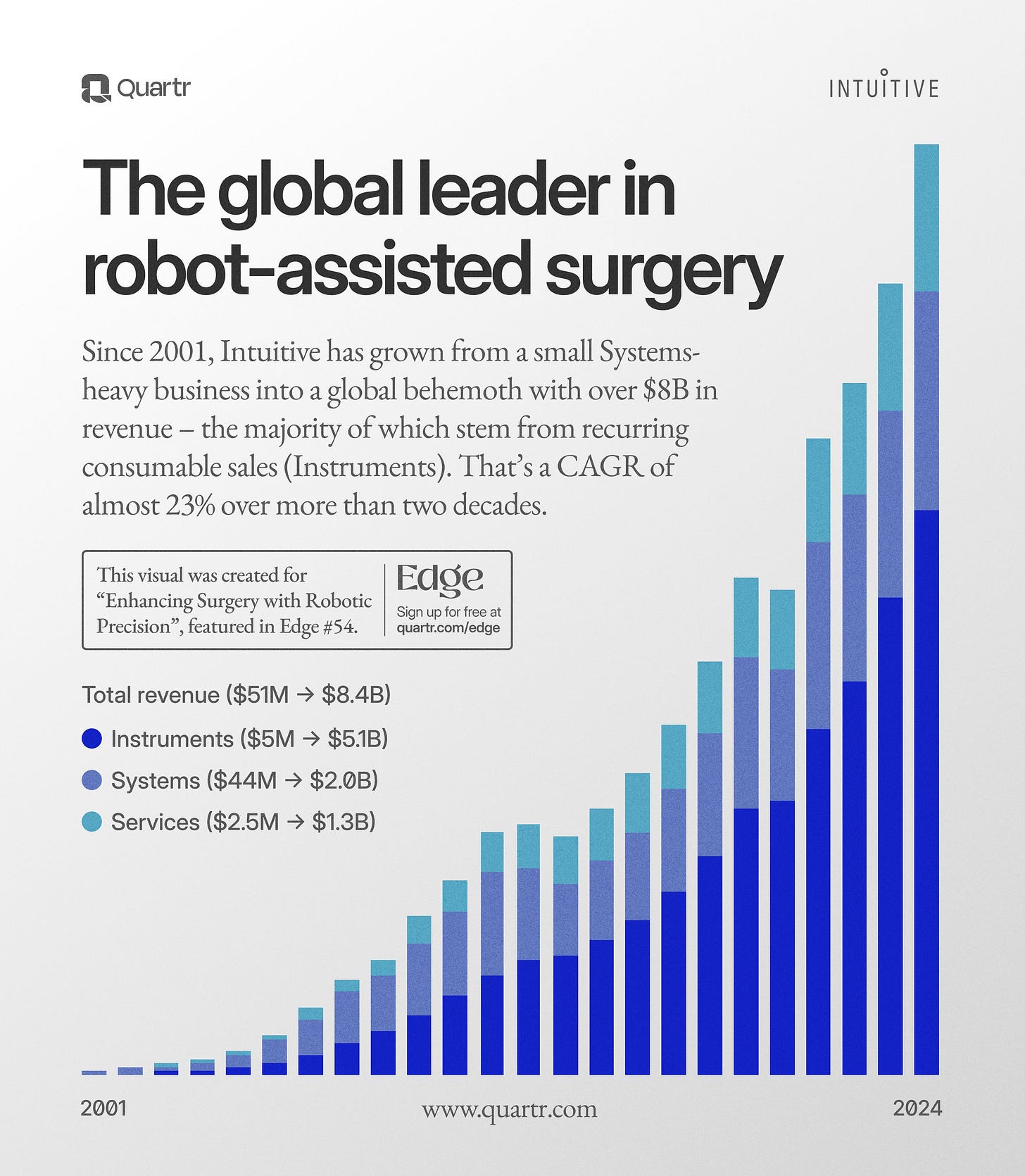

This week, we analyze:

1) Intuitive Surgical (ISRG)

2) Costco (COST)

3) Meta Platforms (META)

4) Amazon (AMZN)1) Intuitive Surgical (ISRG)

The Simple Story:

Intuitive Surgical sells surgical robots. But here’s the twist: only 25% of revenue comes from selling the actual robots. The other 75% comes from instruments, accessories, and services that hospitals need every single time they use the robot.

Think about this like Gillette. Gillette doesn’t make money selling you the razor handle. They make money selling you blades every month for years. Intuitive Surgical does the same thing, except instead of $5 blades, they’re selling surgical instruments that cost thousands per procedure.

Right now, they have 10,763 da Vinci systems installed worldwide (up 13% from last year). Each one is a money printer. Every surgery done on that robot generates recurring revenue for Intuitive. As more robots get installed, that recurring revenue stream grows automatically.

Why This Matters Long-Term:

Healthcare is the ultimate defensive business. People need surgery regardless of recessions, inflation, or market crashes. And once a hospital invests $2 million in a da Vinci robot and trains its surgeons to use it, they’re locked in. Switching costs are enormous. The surgeons know this system. The patients want this system (because it’s less invasive). The hospital can’t just swap it out.

This creates what Warren Buffett calls an “economic moat.” Your competitors can’t easily steal your customers even if they wanted to. And in Intuitive’s case, the moat gets wider every year because:

More surgeons get trained on da Vinci (making it the industry standard)

More procedures get approved for robotic surgery (expanding the market)

More hospitals buy systems (creating network effects where surgeons expect to find da Vinci everywhere)

Here’s a story: Imagine you’re a hospital administrator. You bought a da Vinci system five years ago for $2 million. Now you need instruments and accessories. Do you go to Intuitive (who made the robot and guarantees compatibility) or risk buying cheaper alternatives that might not work perfectly during a life-or-death surgery? You pay Intuitive. Every time.

That’s why this business compounds. The installed base grows. The procedures per system grow. The revenue per procedure grows. It’s a triple compounding effect.

The Valuation Question:

Yes, the stock trades at 71x earnings. That’s expensive. But here’s the context: That’s actually below its five-year average P/E ratio. The market’s been valuing Intuitive at these levels for years because the business model deserves it.

Let me explain with a mental model. Would you rather buy:

A business growing 5% annually at 15x earnings?

Or a business growing 15% annually at 71x earnings?

Most people instinctively pick the first one because the P/E looks cheaper. But run the math. The second business will be worth more in 10 years even though you paid a higher multiple today. Growth compounds. The entry multiple doesn’t.

Charlie Munger said: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” Intuitive is a wonderful company at a fair price (given its historical valuation range).

Actionable Advice:

The long-term opportunity: As surgical techniques advance and more procedures become robot-assisted, Intuitive’s recurring revenue streams will grow exponentially. Each new machine installation is like planting a money tree that bears fruit for years.

How to profit from this:

Buy on any market dips below current levels

Plan to hold for 5+ years to benefit from the recurring revenue growth

Consider dollar-cost averaging over the next 6 months to build your position

Risk management: While the stock appears expensive at 71x earnings, it’s actually trading below its 5-year average. This premium is justified by the company’s dominant market position and predictable revenue streams.

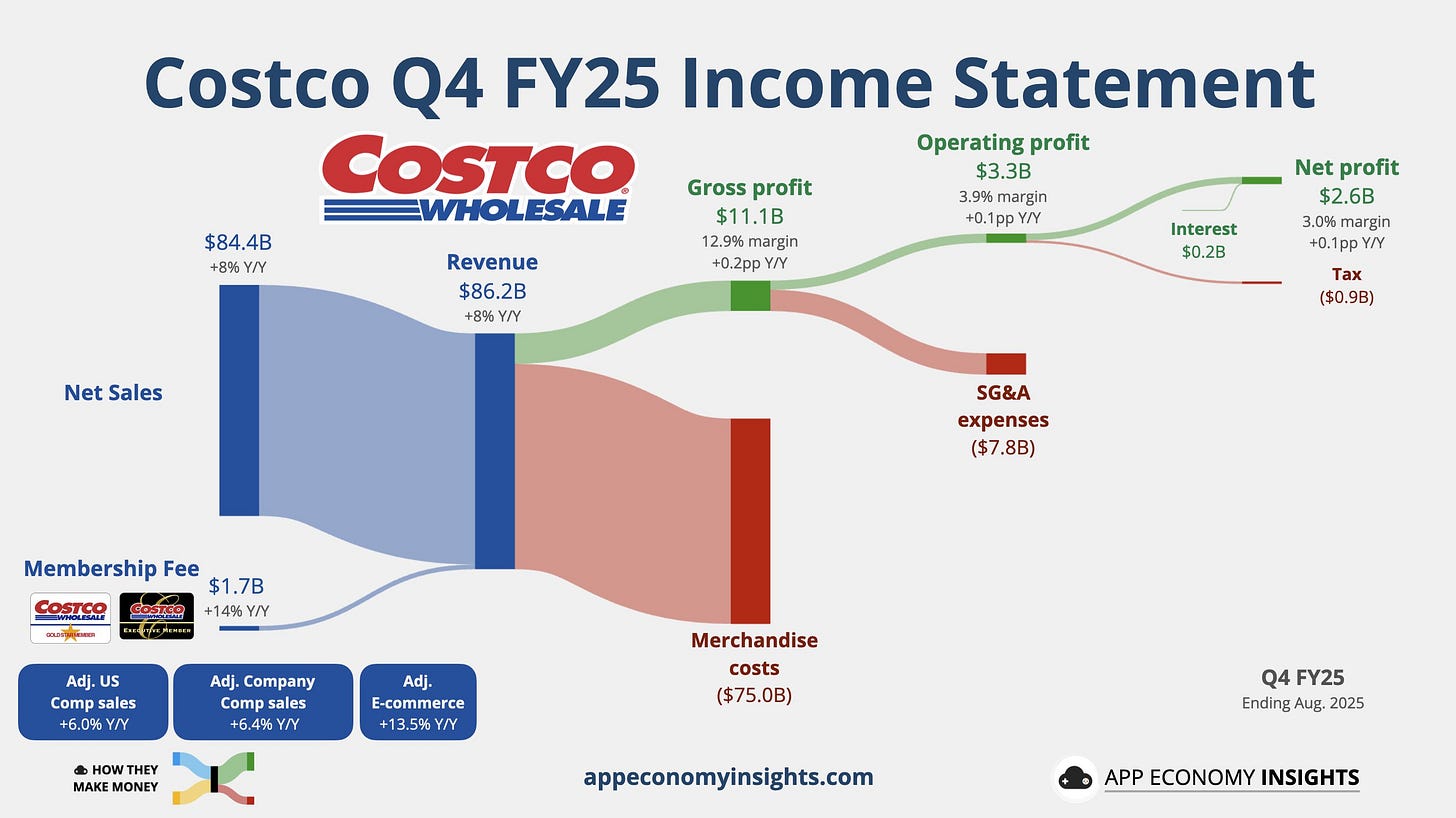

2) Costco (COST)

The Simple Story:

Costco makes almost all its profit from membership fees, not from selling you stuff. Think about that. When you buy a TV at Costco, they make almost nothing on that TV. But your $65 annual membership? That’s nearly 100% profit margin.

Last year, 90%+ of memberships got renewed. That’s insane loyalty. And with 130+ million members paying $65-120 annually, you’re looking at $5+ billion in pure profit before they sell a single item.

Why This Business Model Is Genius:

Most retailers play a simple game: Buy products for $X, sell for $X+profit margin. Their incentive is to mark things up as high as possible before you stop buying.

Costco flipped this completely. They charge you upfront for access (membership). Then they have zero incentive to mark up products because they already got paid. In fact, they have an incentive to keep prices as low as possible so you keep renewing your membership.

This creates a flywheel:

Low prices attract members

More members mean more buying power

More buying power means better deals from suppliers

Better deals mean lower prices

Lower prices attract more members

Jeff Bezos studied this model intensely when building Amazon Prime. He understood that membership models create customer loyalty that transaction-based models can’t match.

Why This Crushes in Tough Times:

Here’s what happens during a recession or inflation spike:

Regular retailers suffer because people buy less. Costco thrives because:

People hunt for value (bulk buying saves money)

They double down on memberships (paying $65 to save $500+ annually is a no-brainer)

They switch from premium brands to Kirkland (Costco’s private label)

The numbers prove it. This year:

Revenue: $269.9 billion (up 8.1%)

Net income: $8.1 billion

Online sales: up 15.6%

During COVID lockdowns when other retailers went bankrupt, Costco’s stock hit all-time highs. During the 2008 financial crisis while everyone else crashed, Costco kept growing. This business is anti-fragile (it gets stronger during chaos).

The Long-Term Secular Tailwinds:

Three massive trends are pushing wind at Costco’s back:

Trend 1: Value consciousness is permanent now. After two years of 7%+ inflation, consumers changed their behavior permanently. Even wealthy people now comparison shop and hunt for deals. This isn’t going away.

Trend 2: Bulk buying saves time. In our busy world, making fewer shopping trips is valuable. Costco lets you buy a month’s worth of stuff in one trip. Time savings are becoming more valuable than money savings for many people.

Trend 3: International expansion. Costco only has 880 warehouses globally. Walmart has 10,500+ stores. There’s decades of growth runway just copying the US model internationally.

Think about this: China has 1.4 billion people and rising middle class wealth. Costco has 37 warehouses there. Even getting to 200+ warehouses in China alone would take 15+ years and drive enormous growth.

The Valuation Seems Crazy (But Isn’t):

The stock trades at $928 per share. Some people say that’s expensive. But here’s what they miss:

Costco hasn’t split its stock in decades. If they did a 10-for-1 split, the stock would be $92.80 per share and people would call it “cheap.” The absolute price per share is meaningless. What matters is the valuation relative to earnings and growth.

Look at the business results:

Operating margins stayed stable despite inflation

Membership renewal rates above 90%

Same-store sales growth positive every quarter

International expansion accelerating

This isn’t expensive for what you’re getting (a recession-proof, inflation-proof, high-moat business growing 8%+ annually with a sticky customer base).

Actionable Advice:

The long-term opportunity: Costco is expanding beyond groceries into gas, pharmacies, travel services, and more. Each new service increases the value of a membership and gives customers more reasons to renew. Their online sales grew 15.6% last year, showing they’re successfully adapting to digital shopping.

How to profit from this:

Add during market panics. Costco is one of those stocks that goes on sale during crashes. When the market drops 20%+, add to your position. This stock always recovers because the business model is bulletproof.

Ignore the stock price in dollar terms. Don’t let $928 per share scare you. One share of Costco at $928 is the same investment as 10 shares at $92.80 (if they split). Focus on valuation metrics, not the absolute price.

Risk management: Costco’s valuation isn’t cheap, but quality rarely is. Think of it as paying a premium for a business that has proven it can weather economic storms while competitors struggle.

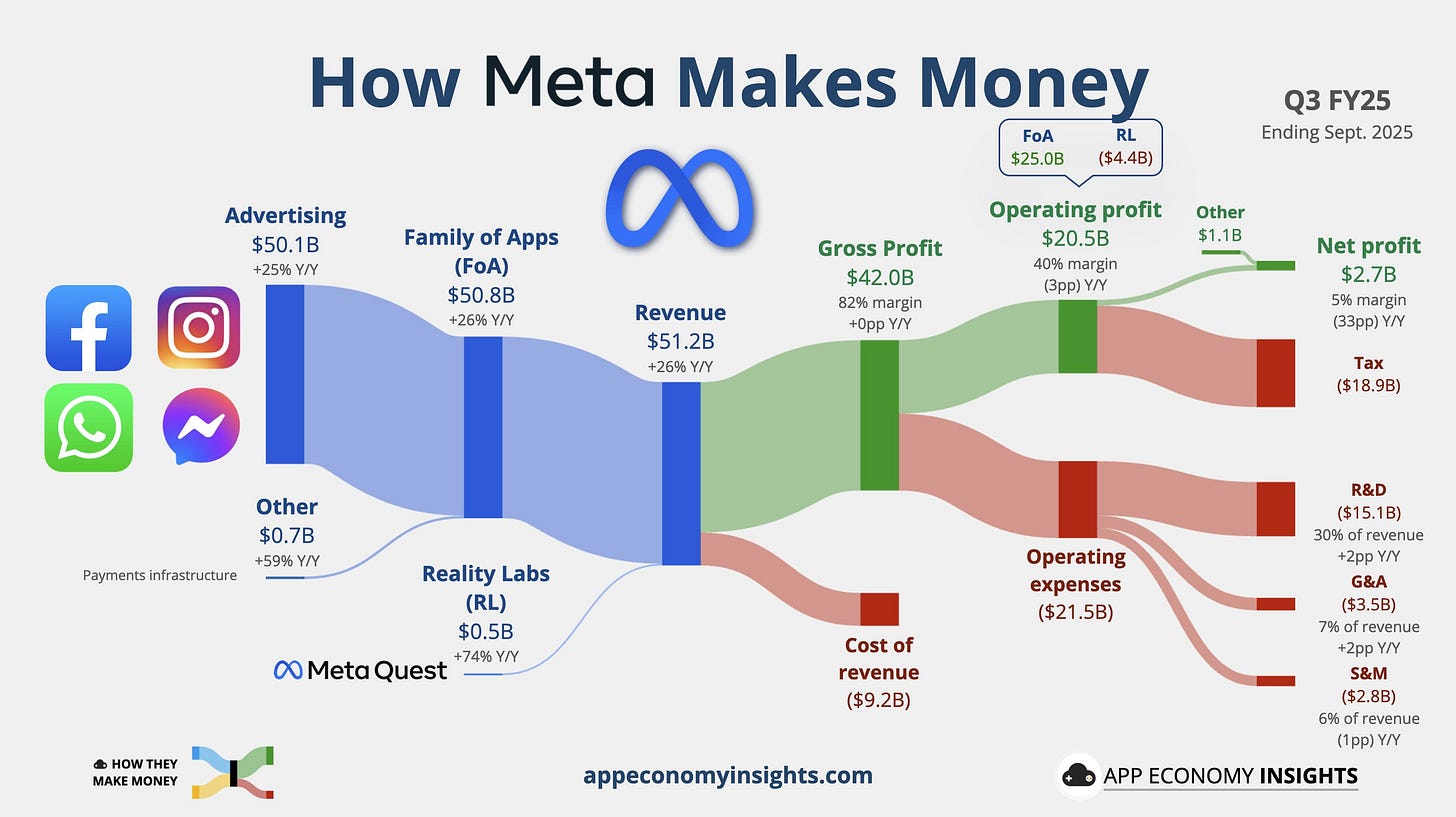

3) Meta Platforms (META)

The Simple Story:

Meta’s stock dropped 8% after earnings because they reported EPS of $1.05 (way below the $6.67 expected). But here’s what really happened: They took a one-time $15.9 billion tax charge. Without that, EPS was $7.25 (beating expectations).

The market panicked. Smart investors saw an opportunity.

Why The Panic Was Irrational:

Let me explain the tax charge in simple terms. The Trump administration passed a new tax law (the One Big Beautiful Bill). Meta had set aside certain tax assets expecting to use them under the old tax law. Under the new law, they can’t use them. So they had to write them off.

This is an accounting adjustment. It’s not real cash leaving the company. In fact, Meta said they’ll save significant cash on taxes going forward under the new law.

Think of it like this: You set aside $100 expecting to use a coupon at the grocery store. The store changes its coupon policy. Your coupon’s now worthless, so you write off the $100 in your budget. But the store’s new policy actually saves you $50 every month going forward. Did you lose money or make money? You made money. But the one-time write-off looked bad on paper.

That’s what happened to Meta.

The Advertising Business Is Dominant:

Meta owns the attention economy. Between Facebook, Instagram, WhatsApp, and Threads, they have 3.54 billion daily active users. That’s nearly half the planet logging in every single day.

For advertisers, this is priceless. If you want to reach customers, you can’t ignore Meta. And the numbers show it:

Ad impressions up 14% (they’re serving more ads)

Price per ad up 10% (they’re charging more per ad)

Revenue up 19% to $51.24 billion

This means Meta has pricing power (they can raise prices without losing customers). That’s the hallmark of a monopoly.

Here’s a story that shows the power: You’re a small business owner selling handmade jewelry. You can:

Option A: Buy a newspaper ad reaching 10,000 local people (cost: $500)

Option B: Run a Facebook/Instagram ad reaching 50,000 targeted people who’ve shown interest in jewelry (cost: $200)

Which do you choose? Obviously Option B. That’s why Meta dominates. They offer better targeting, better reach, and better prices than traditional advertising. And there’s no substitute.

The CapEx Concern (And Why It’s Not A Problem):

Meta’s spending $70-72 billion on infrastructure this year (mostly AI data centers). Some analysts worry this is too much. But look at the return on invested capital (ROIC): 33.7%.

That means for every dollar Meta spends, they’re generating 33.7 cents in annual profit. That’s exceptional. For context, most companies would be thrilled with 15% ROIC.

Warren Buffett’s favorite metric is ROIC. He says: “The best business is one that can deploy more capital at high rates of return.” Meta’s doing exactly that. They’re spending billions and generating incredible returns.

Think about what they’re building:

AI recommendation systems that keep people scrolling longer (more ad views)

AI ad targeting that converts better for advertisers (they’ll pay more)

Infrastructure that locks in their dominance for decades

This isn’t wasteful spending. It’s building a bigger moat.

Reality Labs (The “Problem” That Isn’t):

Reality Labs (Meta’s VR/AR division) lost $4.4 billion this quarter. Critics call this a money pit. But let me reframe it:

Meta generates $51 billion in revenue per quarter. Spending $4.4 billion on R&D for the next computing platform is less than 9% of revenue. That’s cheap insurance against missing the next big thing.

Remember what happened to Blackberry and Nokia? They dominated phones, then Apple invented the iPhone and they went bankrupt because they didn’t invest in the next platform. Meta’s spending $4-5 billion quarterly to make sure that doesn’t happen to them.

Here’s the bet: If VR/AR becomes the next computing platform (replacing phones), Meta’s investment will look genius. If it doesn’t, they’ve spent $20 billion annually from a company generating $200+ billion in revenue. That’s 10% of revenue on moonshots.

Apple spends similar amounts on R&D and nobody calls it wasteful. Why? Because people understand Apple’s bets. Meta’s bet on VR/AR isn’t as obvious yet, but the logic is sound.

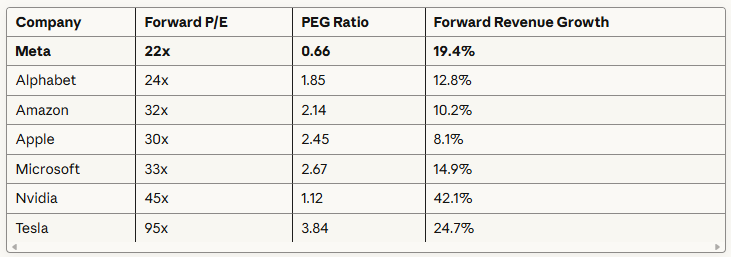

Why Meta’s The Cheapest Magnificent 7:

Compare Meta to its peers:

Meta trades at the lowest forward P/E (22x) and by far the lowest PEG ratio (0.66) among all Magnificent 7 stocks. A PEG ratio under 1.0 signals undervaluation. Meta’s at 0.66.

Translation: Meta’s the cheapest high-growth stock in big tech.

Actionable Advice:

The long-term opportunity: Meta is currently the most undervalued stock among the Magnificent 7, with a PEG ratio of just 0.66. That’s like buying a dollar for 66 cents. While Reality Labs continues to lose money ($4.4 billion last quarter), the core advertising business is a cash machine that funds these long-term bets.

How to profit from this:

Buy the dip created by the misunderstood earnings report

Set a 12-18 month timeline for the market to recognize the true value

Set price targets: $850 (12 months), $1,000 (24 months). These assume Meta maintains current growth rates and the market rerates the stock to fair value (25x forward earnings instead of 22x).

Use covered calls to generate income. Meta’s volatile, which means options premiums are rich. Sell covered calls 10% above current price 30-60 days out. You’ll collect 2-3% premiums monthly while holding the stock.

Risk management: The biggest risks are heavy reliance on advertising (97.7% of revenue) and continued Reality Labs losses. However, with $44.5 billion in cash, Meta has plenty of runway to figure out the metaverse while the advertising business prints money.

The contrarian take:

Everyone’s worried about Meta’s spending. Nobody’s worried about their revenue growth or profitability. That’s backwards. The spending is strategic. The revenue and profitability prove the strategy’s working.

When a stock drops 8% on a one-time accounting charge while the underlying business beat expectations and raised guidance, you buy, not sell.

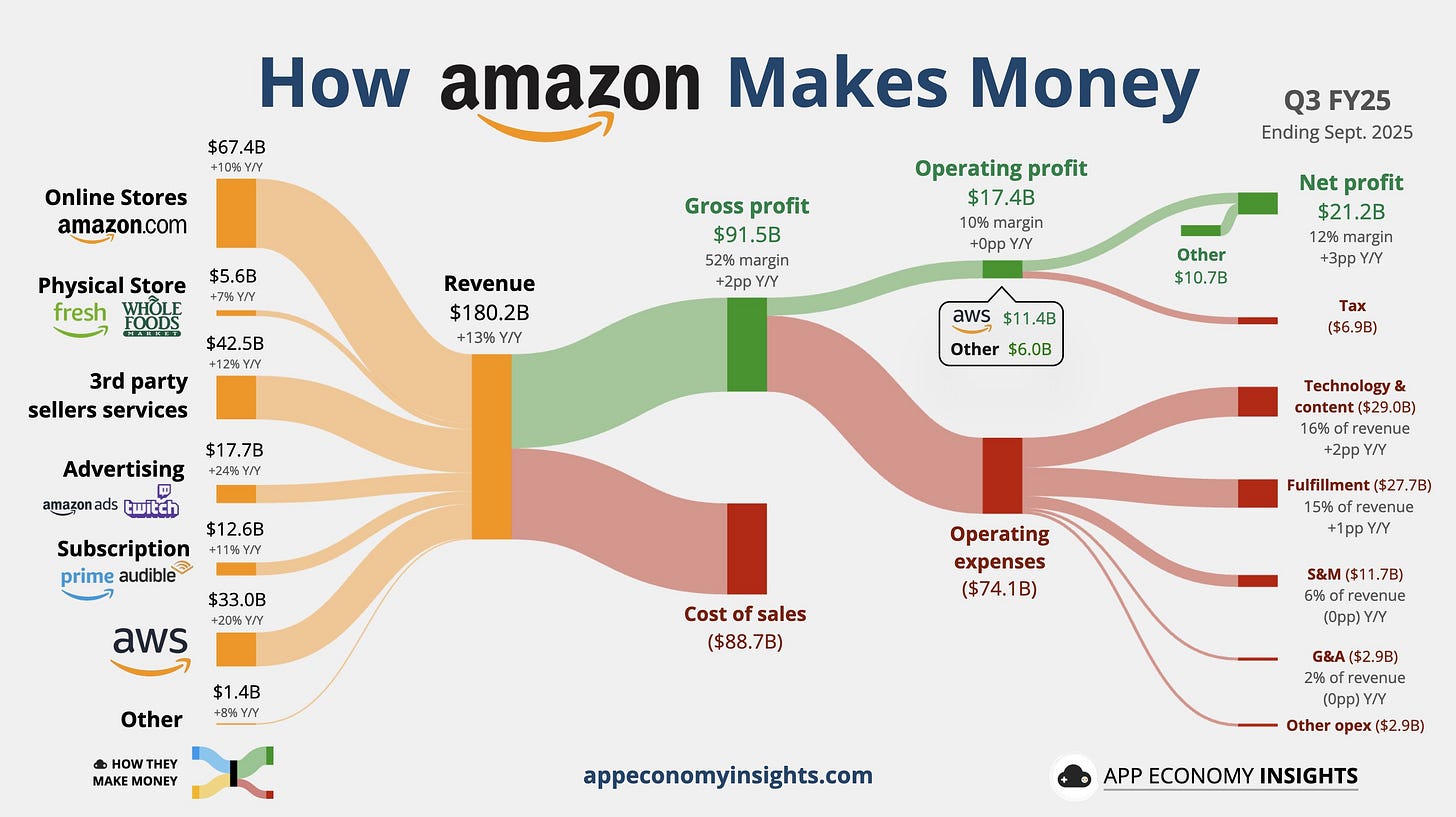

4) Amazon (AMZN)

The Simple Story: