💥Investing Insights & Market Analysis [October 6, 2025]

Recession probability is now 48%, Job postings fall -8%, Crypto adoption is about to surge, CrowdStrike is building the future of cybersecurity, and much more!

👋Good morning my friend and thank you for joining 108,000 investors who trust our newsletter to become smarter with money, investing, and the economy! I hope you had a wonderful week!

If you enjoy reading our newsletter, please hit the ❤️LIKE button on this post to help us grow on Substack (and get a 30-day free trial of our newsletter with this link)

📬This week, we discuss:

Part I — Market Analysis:

1) Market & Economy Update

2) Important Financial News

3) Important Charts & Numbers

Part II — Stock Market Research:

4) Stock Picks & Research

5) Billionaire, Politician & CEO Insider Trading

6) Trade of the Week

7) Top Performing Stocks

8) Stocks to Watch & Important Earnings

Part III — Real Estate Insights:

9) Real Estate & Housing Market Update

10) Interest Rate Predictions

Part IV — Economic & Marco Analysis:

11) Market Sentiment & Economic Outlook

12) Technical Analysis [S&P 500, Tech Stocks, Bitcoin]

13) Important EventsBut before we get into it, please help us and:

Hit the ❤️LIKE button on this post and help us grow on Substack 🙏

Share this newsletter with family & friends to help them get smarter with money, investing, and the economy!

1. Market & Economy Update

Here’s everything important that’s happening:

Stocks ended the week on a strong note, with all three major indexes — the S&P 500, Nasdaq, and Dow — closing at all-time highs. The S&P completed its longest winning streak since July and finished its best September in 15 years, up more than 4%. That’s impressive because September is normally one of the weakest months for stocks.

For the third quarter, the run continued: the S&P jumped 7%, the Nasdaq rose 10%, and the Dow gained 5%, marking five straight quarters of growth. Even talk about a possible government shutdown hasn’t shaken Wall Street’s confidence yet.

Looking ahead, the fourth quarter is often the strongest of the year, thanks to holiday spending, end-of-year optimism, and portfolio rebalancing. But October can be tricky — it’s known for wild swings and corrections (remember the 2008 crash?).

Treasury Secretary Scott Bessent did warn that a long government shutdown could slow the economy by dragging down GDP growth. Meanwhile, gold prices keep climbing, posting their seventh week of gains, as investors look for safety in uncertain times.

The S&P 500’s price-to-earnings ratio (P/E) is way above normal. Over the past hundred years, it’s usually around 15. Right now, it’s 25.7. And it’s not just one measure—Bank of America says that 19 out of the 20 ways they check value show stocks are much pricier than usual. Four are setting records. The bank says maybe today’s prices are the new normal.

Bank stocks in the US are up 20% since January, and European bank stocks are up even more—40%.

Silver’s price jumped to $45—the highest since 2011. (Investors feel silver is safer when things feel risky.)

Outside the U.S., markets are booming too. Europe’s Stoxx 600 and UK’s FTSE 100 both hit record highs. Canada’s TSX index hit its highest level ever, lifted by energy, miners, and banks (Investors are confident in Canadian companies.) China’s CSI 300 is up 21% this year — its highest level since early 2022 — and Israel’s TA-35 just surged nearly 3% to a new high. Emerging-market stocks have now rallied for nine straight months, their best run in over 20 years.

💡Andrew’s Deep Dive:

October is historically the most volatile month. Think back to October 1987 (Black Monday), October 1929 (the start of the Great Depression), and October 2008 (the financial crisis). The month has a reputation.

But here’s the thing: volatility isn’t the same as losses. Volatility just means big swings up and down. You can make money in volatile markets if you don’t panic.

An all-time high isn’t just a number. It’s a psychological barrier being broken. When the market hits a new record, it creates a “wealth effect.” People see their 401(k)s and brokerage accounts go up, and they feel richer. This makes them more confident and more likely to spend money, which can boost the economy even more.

But here’s the secret very few people talk about. All-time highs are also a test of your discipline. They trigger a powerful emotion: FOMO, or the Fear Of Missing Out. You see everyone else making money, and you get the urge to jump in with both feet, often by buying the most popular stocks at their highest prices.

This reminds me of the dot-com bubble in the late 90s. Everyone was throwing money at any company with “.com” in its name, convinced it could only go up. They were greedy. Meanwhile, Warren Buffett was sitting on the sidelines, getting criticized for being out of touch. He famously said, “Be fearful when others are greedy, and greedy when others are fearful.” When the bubble burst, his patience paid off.

Right now, people are getting greedy. That doesn’t mean you should sell everything and hide. It means you should be smart, calm, and strategic.

Whenever markets get this expensive, you’ll hear the phrase, “This time is different.” People said it during the dot-com bubble in the late 1990s. They argued that the internet had created a “new economy” where old valuation rules no longer applied. We all know how that story ended—with a crash that wiped out fortunes.

Is today the same? Not exactly. The big tech companies leading the market today are wildly profitable, unlike many of the profitless dot-com companies. This is the core of Bank of America’s “new normal” suggestion.

However, a key psychological trap to avoid is “Recency Bias”—the belief that what has been happening lately will continue to happen forever. Just because U.S. stocks have been on an incredible run doesn’t guarantee they will continue to outperform everything else. History teaches us that leadership in the market always changes. The winners of the last decade are rarely the winners of the next.

The long-term significance is clear: Relying solely on the same strategy that worked for the past ten years could be a risky bet for the next ten. It’s time to think more like a global investor, not just a U.S. one.

Here’s something most Americans miss: the whole world is rallying, not just the US. Europe, China, Israel, emerging markets—they’re all up big this year.

For the last 15 years, US stocks crushed everything else. If you only owned American companies, you did great. But patterns don’t last forever. (Just ask anyone who thought Japanese stocks would dominate forever in the 1980s. They’ve underperformed for 35 years.)

The lesson: Don’t get too comfortable. When everyone piles into the same trade (US tech stocks), that’s when reversals happen.

Advice for global exposure:

Put 20-30% of your stock portfolio in international stocks. You can do this with a simple ETF like VXUS or VEU.

Don’t try to pick winning countries. Nobody knows if China or Europe will do better next year. Buy a broad international fund and let the winners take care of themselves.

Rebalance once a year. If US stocks outperform and grow to 85% of your portfolio, sell some and buy more international. This forces you to “sell high, buy low” automatically.

Bank Stocks

The stunning rise of bank stocks, especially in Europe, is a hugely positive sign that many people are missing. Banks don’t thrive in a vacuum. They thrive when:

People and businesses want to take out loans.

Fewer people are defaulting on their debts.

Interest rates are set in a way that lets them make a profit.

This tells me the foundation of the global economy is sturdier than the scary “high valuation” headlines suggest. Healthy banks mean a healthy flow of money, which fuels growth.

Gold

Gold rises for three main reasons fear of inflation, fear of economic trouble, or fear of political chaos. Right now, it’s a mix of all three. The government shutdown creates uncertainty. The Fed’s rate cuts suggest economic weakness might be coming. And gold doesn’t pay you interest (unlike bonds), so it only makes sense when people think cash and bonds are risky.

Here’s what this means for you: A small allocation to gold (maybe 5-10% of your portfolio) acts like insurance. When stocks crash, gold usually holds steady or rises. It’s boring, it doesn’t pay dividends, but it protects you when everything else falls apart.

Silver is a Crystal Ball for the Future Economy

Silver’s story is my favorite. It’s not just a commodity; it’s a narrative. Its price is being pushed by two powerful forces:

The Green Revolution: This is the big one. Silver is essential for solar panels and electric vehicles. Its rise is a direct bet on a tech-driven, sustainable future.

The Safety Net: It’s still a precious metal. When people are nervous about inflation or the economy, they buy silver and gold.

This makes silver a unique hedge. You’re essentially making a bet on economic progress while holding an insurance policy against economic trouble.

My Advice

Make Your “Opportunity” Shopping List Now.

What to do: October is famous for volatility (big swings up and down). A market dip is not a time to panic; it’s a time to buy great companies on sale. But you have to be prepared.

How to do it: Right now, while things are calm, identify 3-5 fantastic companies you’d love to own for the long term if they were 15% cheaper. Do your research now. Write them down. When the market inevitably has a bad day or week, you won’t react with emotion. You’ll act with a plan. You’ll be the one buying when everyone else is fearfully selling.

Smart moves for Q4:

Max out your retirement accounts before year-end. If you haven’t hit your 401(k) or IRA contribution limits, do it now. Tax-deferred growth is free money.

Tax-loss harvest. If you have stocks that lost money this year, sell them before December 31st. You can use those losses to offset gains and reduce your tax bill. (Then buy them back after 30 days to avoid the wash-sale rule.)

Review your beneficiaries. Boring but critical. Make sure your retirement accounts and life insurance have the right people listed. You’d be shocked how many people forget to update this after major life changes.’s

Don’t panic about high stock prices but be careful. Instead of putting all your money in at once, try dollar-cost averaging. This means investing the same amount regularly, whether prices are high or low.

Consider value over hype. When the market is expensive, look for companies that are priced reasonably compared to their earnings and growth. Warren Buffett made his fortune by buying good companies at fair prices, not by following the crowd.

Diversify beyond stocks. With silver rising and banks doing well, consider having a mix of investments. This could include some precious metals, bank stocks, and international investments (like Canada’s market). Think of it as not putting all your eggs in one basket.

Build an emergency fund first. Before investing, make sure you have 3-6 months of living expenses saved.

Pay off high-interest debt. If you have credit card debt at 20% interest, paying it off is like getting a 20% return on your money - much better than most investments.

Keep investing simple. You don’t need to understand every market detail. A simple mix of low-cost index funds often beats complex strategies. As Buffett advises, most investors would be best off putting their money in an S&P 500 index fund and leaving it alone.

Focus on what you can control. You can’t change PCE numbers or stock market valuations, but you can control how much you save, what you invest in, and keeping your costs low.

👉 For daily insights, follow me on Twitter/ X, Instagram Threads, or BlueSky, and turn on notifications!

2. Important Financial News:

This week, we analyze:

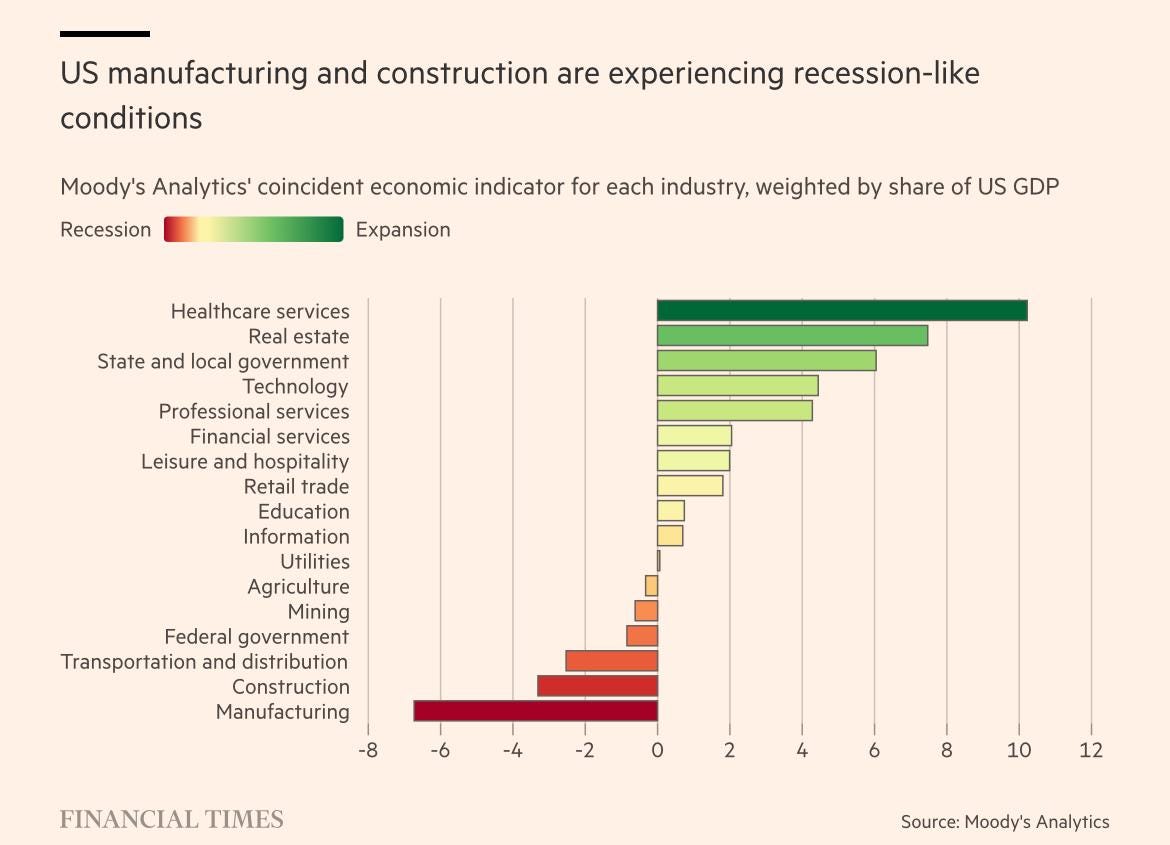

1) US manufacturing and construction are experiencing recession like conditions

2) A third of US states may already be in a recession

3) President Trump imposes $100,000 fee on H-1B visas

4) Trump announces tariffs on pharmaceuticals, heavy trucks, kitchen cabinets, bathroom vanities, and upholstered furniture starting Oct. 1st

5) US Treasury announces full-scale bailout for Argentina: bond purchase, swap, and credit line1️⃣ US manufacturing and construction are experiencing recession like conditions

The Financial Times reported that key sectors of the U.S. economy, like manufacturing and construction, are showing recession-like conditions. While the overall economy might look okay on the surface (thanks to hot areas like AI), the sectors that build physical things are struggling. Think of it this way: the digital economy is booming, but the tangible economy of factories and building sites is contracting. These areas are often the first to feel the pinch from economic uncertainty and are sensitive to policy changes, like tariffs.

Here’s what’s really happening: The Federal Reserve’s higher interest rates (designed to fight inflation) act like putting a heavy weight on these two sectors. Construction companies can’t afford to borrow money for new projects when rates are high, and manufacturers face higher costs for materials due to tariffs plus reduced demand from overseas customers who can’t afford American-made goods at current prices.

Long-term significance: This creates a domino effect that investors need to understand. When construction slows, it affects everything from steel demand to lumber prices to appliance sales. Manufacturing weakness signals that business investment is declining—companies aren’t building new factories or buying equipment. This pattern historically precedes broader economic slowdowns by 6-12 months.

My Advice

If you have a high risk tolerance, look into inverse ETFs that bet against the industrial (

$SIJ) or homebuilder ($HBUD) sectors. This is a high-risk strategy not suitable for newer investors.Avoid taking on debt for home renovations right now—wait for prices to come down as the construction sector weakens further.

Update Your Resume. It’s always a good idea, but especially when you see warning signs in the economy. Make sure your skills are sharp and your resume is ready. Your ability to earn an income is your most valuable asset.

Build an emergency fund - Aim for 3-6 months of living expenses in case you lose your job.

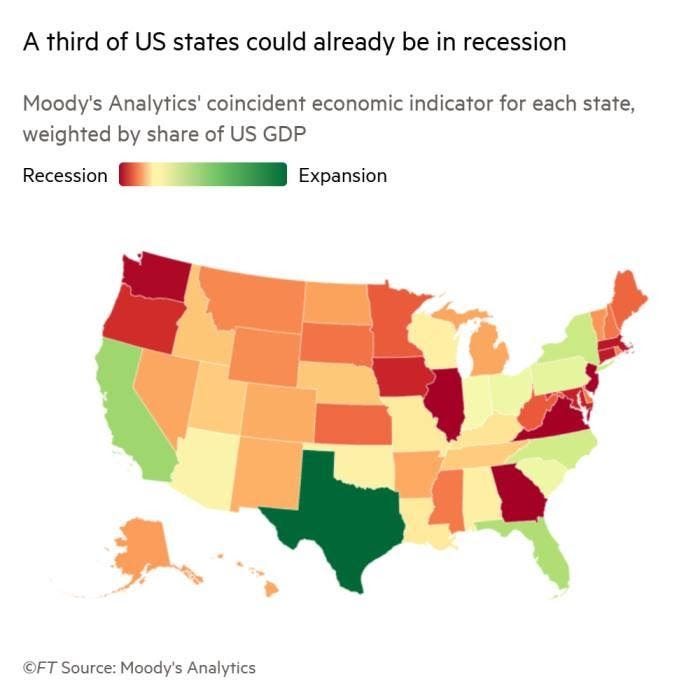

2️⃣ A third of US states may already be in a recession

Moody’s Analytics chief economist Mark Zandi warned that states making up nearly one-third of the U.S. economy are already in or at high risk of a recession. The report paints a picture of a fractured economy: 22 states (including places like Washington, Illinois, and Georgia) are contracting, while 16 states (like Texas, Florida, and Arizona) are still expanding. The economic health of the nation is being held up by a few key regions, while many others are already struggling.

Long-Term Significance & Why It Matters: We’re witnessing the creation of two Americas—one that prospers and one that struggles. This divide will drive internal migration patterns, real estate prices, and political outcomes for years. States losing population will see property values stagnate while growing states face housing shortages and rising costs.

This trend highlights that your economic reality is becoming increasingly dependent on where you live. Averages are misleading; the “U.S. economy” isn’t a single entity but a collection of dozens of regional economies moving at different speeds. The long-term implication is a potential acceleration of migration from weaker economic states to stronger ones, which will reshape the country’s political and cultural landscape for decades to come.

Think of the U.S. economy like the three-legged stool Mark Zandi described: one leg is broken (the recession states), one is wobbly (the stagnating states), and the last one is holding everything up. The critical question is: how long can one leg support the entire stool?

Advice:

Assess Your “Geographic Risk”. Objectively evaluate the economic trajectory of your state and city. Is your industry growing or shrinking in your area? This isn’t about packing your bags tomorrow, but about strategic career planning.

Build Portable Skills. Focus on developing skills that are in high demand everywhere, not just in your local market. Tech skills, healthcare expertise, and skilled trades are often transferable. Make your talent, not your location, your primary source of job security.

Consider “Geo-Arbitrage”. If you have the flexibility of remote work, you could consider living in a lower-cost area while earning a salary competitive with a major hub. This can dramatically accelerate your ability to save and invest.

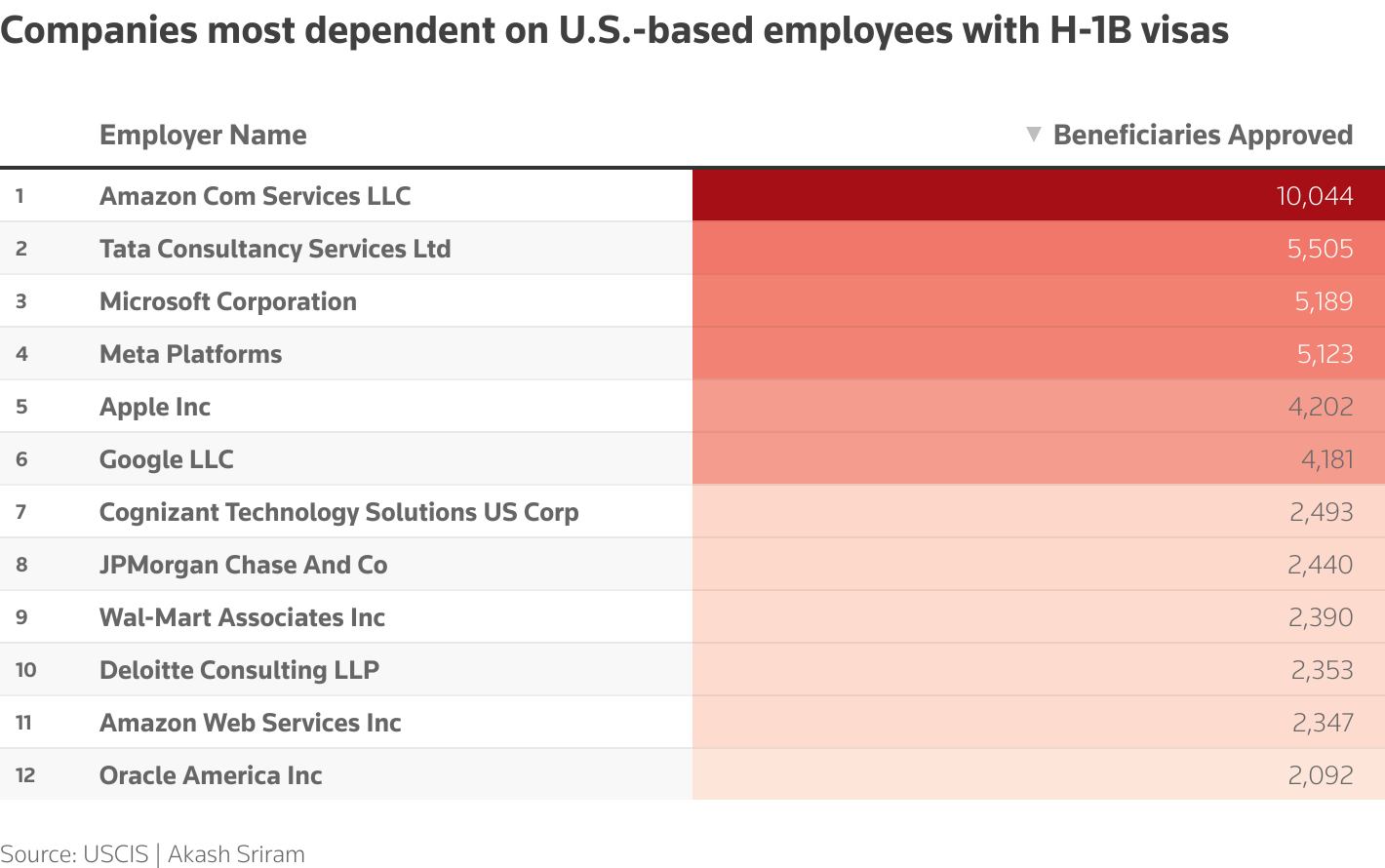

3️⃣ President Trump imposes $100,000 fee on H-1B visas

President Trump signed an executive action imposing a new $100,000 fee on H-1B visas, which are used by companies to hire highly skilled foreign workers. This is a massive increase from the few thousand dollars it cost before. The policy is aimed at forcing companies to hire Americans first. In a related move, he also created a “gold card” to fast-track visas for wealthy individuals who can pay a $1 million fee.

Long-Term Significance & Why It Matters: This is a seismic shift in U.S. policy, moving the country away from attracting the world’s best talent to attracting the world’s wealthiest people. The long-term risk is a “brain drain,” where the next generation of brilliant engineers and entrepreneurs from around the world choose to build their companies in more welcoming countries like Canada or the UK. While it might protect some U.S. jobs in the short term, it could severely damage America’s long-term innovation engine, especially for startups and smaller companies that can’t afford the new fee.

This is like a top university suddenly deciding to raise tuition by 5,000% for international students. They might get more money from a few ultra-rich applicants, but they’d lose out on a huge pool of brilliant minds who would have become Nobel laureates and industry leaders.

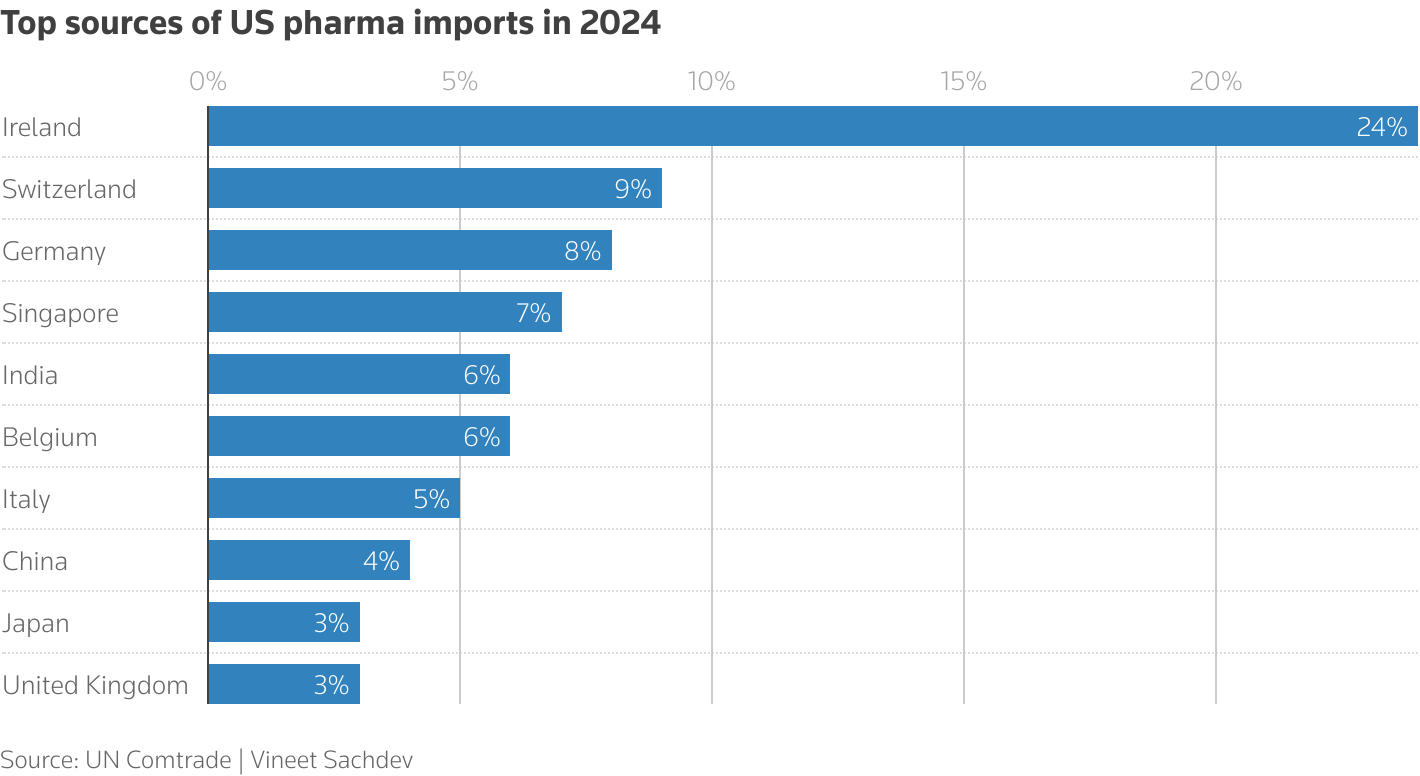

4️⃣ Trump announces tariffs on pharmaceuticals, heavy trucks, kitchen cabinets, bathroom vanities, and upholstered furniture starting Oct. 1st

President Trump announced a new wave of steep tariffs effective October 1st. The list includes a 100% tariff on imported patented drugs, a 25% tariff on heavy trucks, a 50% tariff on kitchen cabinets and bathroom vanities, and a 30% tariff on upholstered furniture. The stated goal is to protect U.S. manufacturing. For pharmaceuticals, the tariff is waived if the foreign company is already building a factory in the U.S.

Long-Term Significance & Why It Matters: This action signals that the trade war is not over; it’s entering a new, more targeted phase. The long-term implication is the “reshoring” of critical supply chains, but this process is slow and expensive. In the meantime, these tariffs act as a direct tax on American consumers and businesses. This is a government-induced shot of inflation, creating price pressure on everything from life-saving medicines to home renovations.

This is a powerful lesson in Second-Order Thinking, a mental model used by great investors like Howard Marks.

First-Order Thinking: Tariffs on foreign goods will help American companies.

Second-Order Thinking: But tariffs will raise prices for American consumers, increase costs for American businesses that use those imported goods, and likely cause other countries to retaliate against American exports. You need to think past the initial, obvious effect to see the full picture.

Understanding the pharmaceutical tariff crisis: Doubling the price of imported medicines affects $233 billion worth of annual imports. While Trump exempts companies building US factories, most production can’t be moved overnight. This means prescription drug costs could spike dramatically for millions of Americans, especially seniors on Medicare.

The furniture and home goods impact: With 60% of all furniture being imported, mainly from Asia, these tariffs will make home renovations and new furniture purchases significantly more expensive. This hits right as the housing market is already struggling with affordability issues.

Long-term transformation ahead: Trump is essentially forcing a reshoring of American manufacturing through price pressure rather than incentives. This could work over 5-10 years but creates massive short-term inflation and supply disruptions. Companies will either move production to America (expensive and slow) or pass costs to consumers (immediate but painful).

5️⃣ US Treasury announces full-scale bailout for Argentina: bond purchase, swap, and credit line

The U.S. Treasury has announced a full-scale bailout package for Argentina. This includes the U.S. government buying Argentine bonds, opening a currency swap line, and providing a standby credit line. The move comes after President Trump gave a rare and enthusiastic endorsement to Argentina’s President Javier Milei, signaling strong political alignment.

Long-Term Significance & Why It Matters: This is geopolitics played with dollars. The U.S. is using its immense financial power to support a politically friendly, free-market government in its hemisphere, partly as a way to counter the growing influence of China in South America. The long-term implication is that access to the U.S. dollar and financial system can be used as both a carrot and a stick in foreign policy. For Argentina, this is a desperately needed lifeline that pulls it back from the brink of financial collapse, but it also deepens its reliance on the United States.

Think of this as a powerful billionaire (the U.S.) co-signing a massive loan for a brilliant but volatile startup founder (Argentina). The billionaire does it because they believe in the founder’s new direction and, crucially, they don’t want a rival investor (China) to gain control of the promising venture. It’s a strategic investment with both financial and political returns.

*️⃣ Other important headlines:

Nvidia $NVDA becomes the first company in history to reach a $4.5 trillion market cap.

Bitcoin reaches new all-time high of $125,000

Trump administration considers raising retirement age to save Social Security from insolvency, per FOX

Reporters at the Pentagon have been told they can no longer report information which has not been approved. Those who refuse will lose their press credential, per WaPo

Elon Musk becomes first person in history to surpass $500 billion net worth.

👉 For daily insights, follow me on X, Instagram Threads, or BlueSky, and turn on notifications!

3. Important Charts & Numbers:

This week, we analyze:

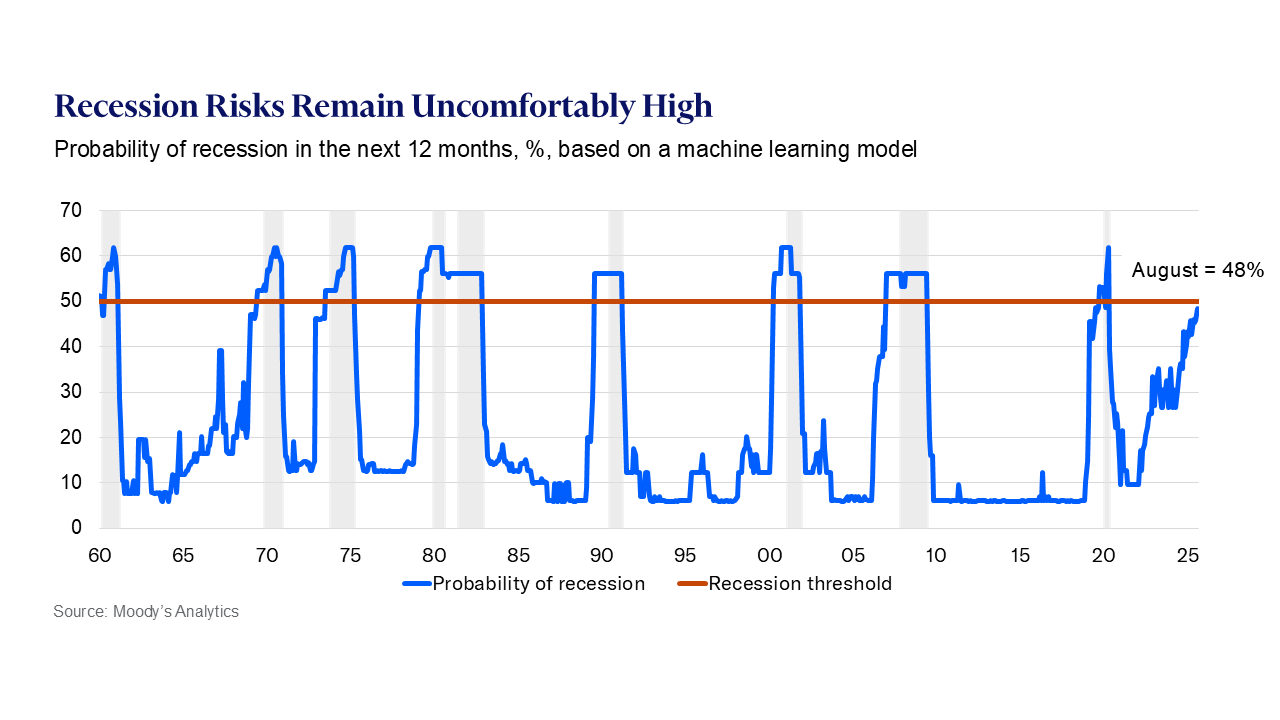

1) US recession probability jumped to 48%, the highest since the 2020 pandemic

2) The home affordability nightmare

3) Job postings on Indeed fell -8% YoY, the second-lowest level since February 2021

4) Crypto adoption is about to SURGE

5) Gold hits most overbought level in 45 years

6) U.S. M2 Money Supply jumps to a new all-time high of $22.2 TrillionMy thoughts on this week’s most important charts and numbers:

These six economic indicators paint a picture of an economy at a crossroads. The recession warning is flashing, housing is unaffordable, jobs are getting scarcer, yet money keeps flooding the system. Meanwhile, crypto stands on the brink of mainstream adoption, and gold signals fear in the markets.

We’re moving from a growth-driven expansion to a policy-constrained contraction while dealing with the aftereffects of unprecedented monetary stimulus.

The economy moves in cycles. This challenging period won’t last forever. Those who prepare now will be positioned to thrive when the cycle turns. Your financial future isn’t determined by what happens in the economy, but by how you respond to it.

1️⃣ US recession probability jumped to 48%, the highest since the 2020 pandemic

💡Andrew’s Analysis:

Moody’s machine learning model just flashed a 48% recession probability - the highest since the 2020 pandemic. But here’s what makes this scary: every time this indicator hit similar levels in the past 60 years, a recession always followed. The chart shows spikes above 50% preceded every major downturn since 1960.

What makes this different: Previous recessions were often triggered by external shocks (oil crisis, financial crisis, pandemic). This time, we’re creating our own recession through policy choices - tariffs raising costs, immigration restrictions shrinking the workforce, and interest rates staying high to fight persistent inflation.

The job market has been weakening for months. The government revised job numbers down by nearly a million - the biggest correction ever. This isn’t just a math error; it shows the job market wasn’t as strong as we thought.

When recessions hit, they affect everything. Jobs become harder to find, investments can lose value, and businesses struggle.

Advice: