💥Investing Insights & Market Analysis [Oct 14, 2025]

The AI bubble, US dollar predicted to drop 10%, 100% tariff on China, Gold crosses $4,000, Credit scores are falling, America saw no job growth, IRS releases new tax brackets, and much more!

👋Good morning my friend and thank you for joining 108,000 investors who trust our newsletter to become smarter with money, investing, and the economy!

Each issue takes a few days to research and write, so if you enjoy reading, please hit the ❤️LIKE button on this post to help us grow on Substack (and you can get a 30-day free trial of our newsletter with this link)

Did you know that your job can pay for this newsletter with its employee development budget? To make the process easy, we’ve created this email template to send to your manager.

📬This week, we discuss:

Part I — Market Update:

1) Market & Economic Analysis

2) Important Financial News

3) Important Charts

Part II — Stock Market Research:

4) My Stock Picks & Research

5) Billionaire, Politician & CEO Insider Trading

6) Trade of the Week

7) Top Stocks this Week

8) Stocks to Watch & Important Earnings

Part III — Real Estate Insights:

9) Real Estate & Housing Market Update

10) Interest Rate Predictions

Part IV — Economic & Marco Analysis:

11) Market Sentiment & Economic Outlook

12) Technical Analysis [S&P 500, Tech Stocks, Bitcoin]

13) Important EventsBut before we get into it, help us and:

Hit the ❤️LIKE button on this post and help us grow on Substack 🙏

Share this newsletter with friends & family to help them get smarter with money, investing, and the economy!

1. Market & Economic Analysis:

Everything you need to know:

Stocks are having a wild ride. The S&P 500 and Nasdaq hit record highs last week, but then fell sharply on Friday, posting their biggest one-day drop since April. $1.65 trillion wiped out from the US stock market on Friday. This drop was fueled by investor worry about a potential new phase in the US-China trade war .

A big warning sign. Jamie Dimon, the CEO of JPMorgan Chase (America’s largest bank), said he sees a 30% chance of a significant market drop in the next six months to two years. He’s worried about things like global politics and government spending, and believes the risk is higher than most people think .

Precious metals are shining. Gold hit a record high, continuing a spectacular three-year rally. Silver also jumped to a 45-year high . When these “safe haven” assets rise, it often means investors are getting nervous about the stability of other parts of the market.

Bitcoin hit a new all-time high recently, but its price has been fluctuating. The market is currently in a period of consolidation, with traders waiting for the next big catalyst.

International markets are moving. China’s main stock index hit a ten-year high, and Japan’s Nikkei 225 also reached a fresh peak. In the US, stocks of companies that mine “rare earth” minerals (critical for technology) surged after China, a major supplier, moved to tighten its control over these resources

Big picture: Two bull markets are running at once—one in innovation (U.S. tech) and one in scarcity (gold/silver/Bitcoin/critical minerals). Trade tensions link them: more friction → more demand for safe havens and strategic materials, even while AI spending keeps lifting tech.

💡Andrew’s Deep Dive:

This market action is a warning, a lesson, and a roadmap for what’s coming.

1. The Trade War Isn’t Over—It’s Evolving

The U.S. and China are in a long-term economic cold war. Tariffs, bans on technology (like TikTok or Huawei), and fights over rare earth minerals are just the beginning.

Long-term impact: Companies will move factories out of China (to places like India or Mexico). Supply chains will get more expensive. Some industries (like semiconductors or electric cars) will win; others (like cheap consumer goods) will lose.

What to do:

Diversify your investments—don’t put all your money in U.S. stocks. Look at international markets (like Japan or Europe) or commodities (gold, silver, or even farmland).

Watch for winners: Companies that help businesses move out of China (like logistics firms) or produce rare earths (like MP Materials) will boom.

2. Gold and Silver are Insurance

Gold’s record high isn’t just about fear. Central banks (including the U.S. Federal Reserve) are printing more money to keep the economy afloat. When money loses value, gold holds its worth.

Long-term impact: If inflation (rising prices) kicks in, cash in your bank account will buy less over time. Gold and silver protect against that.

What to do:

Own some gold or silver—even 5-10% of your portfolio. You can buy physical metal (coins or bars) or ETFs (like GLD or SLV).

Don’t chase Bitcoin blindly. It’s volatile. Only invest what you don’t need in the immediate future.

3. Stock Market Corrections Are Normal (and Healthy)

Jamie Dimon’s 30% correction warning isn’t fear-mongering. The market always has pullbacks. Since 1950, the S&P 500 has dropped 10% or more about once a year on average. Yet, over time, it always recovers and grows.

Long-term impact: If you’re investing for retirement, corrections are your friend. They let you buy stocks at a discount.

What to do:

Keep investing regularly (dollar-cost averaging). Don’t try to time the market—even the pros fail at that.

Have cash ready. When the market drops, you can scoop up great stocks cheaply. (Imagine Black Friday sales, but for investments.)

4. China and Japan’s Rise Shows the World Is Changing

The U.S. isn’t the only stock market. China’s stock market hitting a 10-year high proves that emerging markets can outperform the U.S. for years.

Long-term impact: The global economy is shifting. By 2030, Asia could make up 50% of the world’s GDP. Ignoring international stocks is like ignoring half the playing field.

What to do:

Add international stocks to your portfolio. ETFs like VXUS (global stocks) or EWJ (Japan) make it easy.

Learn about global trends. Which countries are growing? Which industries? (Example: India’s middle class is exploding—companies selling phones, cars, or food there will win big.)

5. Rare Earths Are the New Oil

China controls 80% of the world’s rare earth supplies. These minerals are in every smartphone, electric car, and missile. The U.S. is finally waking up to this risk.

Long-term impact: Companies that mine, recycle, or find alternatives to rare earths will be huge. Think of it like the oil boom of the 1800s—whoever controls the resource controls the future.

What to do:

Invest in rare earth stocks (like Lynas Corporation or MP Materials).

Watch for government policies. If the U.S. starts subsidizing rare earth mining, those stocks could skyrocket.

My Advice

Rebalance your portfolio. If U.S. stocks have grown to 80% of your investments, trim them back to your target (say, 60%). Move the extra into gold, Bitcoin, international stocks, or cash.

Buy the dip (smartly). If the market drops 10%, have a shopping list of stocks you want to own. (Example: If Apple drops 20%, would you buy? Decide now, not in the heat of the moment.)

Think like an owner. When you buy a stock, ask: “Would I want to own this company forever?” (Buffett’s rule.) If not, don’t buy it.

Avoid panic selling. The worst thing you can do is sell when the market crashes. (Remember 2008? People who sold lost everything. Those who held on—or bought—made fortunes.)

Build a cash cushion. Aim for 3-6 months of living expenses in savings. If you lose your job or the market crashes, you won’t be forced to sell investments at a loss.

Psychological Traps to Avoid

Recency Bias: Just because stocks did well last year doesn’t mean they will this year. (Remember 2000? Tech stocks crashed after years of gains.)

FOMO (Fear of Missing Out): Don’t buy Bitcoin or gold just because they’re hitting records. Have a plan before you invest.

Loss Aversion: People hate losing money twice as much as they love gaining it. That’s why they sell in panics. Stick to your plan.

Final Thought - The Best Investors Are Like Farmers

Farmers don’t plant seeds in spring and dig them up in summer to check if they’re growing. They wait, nurture, and trust the process. Investing is the same.

Plant seeds (invest regularly).

Water them (reinvest dividends).

Wait for harvest (let compounding work over decades).

This week’s chaos is just weather. The seasons (long-term trends) are what matter. Stay patient, stay disciplined, and act when others won’t.

👉 For daily insights, follow me on Twitter/ X, Instagram Threads, or BlueSky, and turn on notifications!

2. Important Financial News:

This week, we analyze:

1) The US dollar is predicted to depreciate another 10% next year, after already depreciating 11% in the first half of 2025.

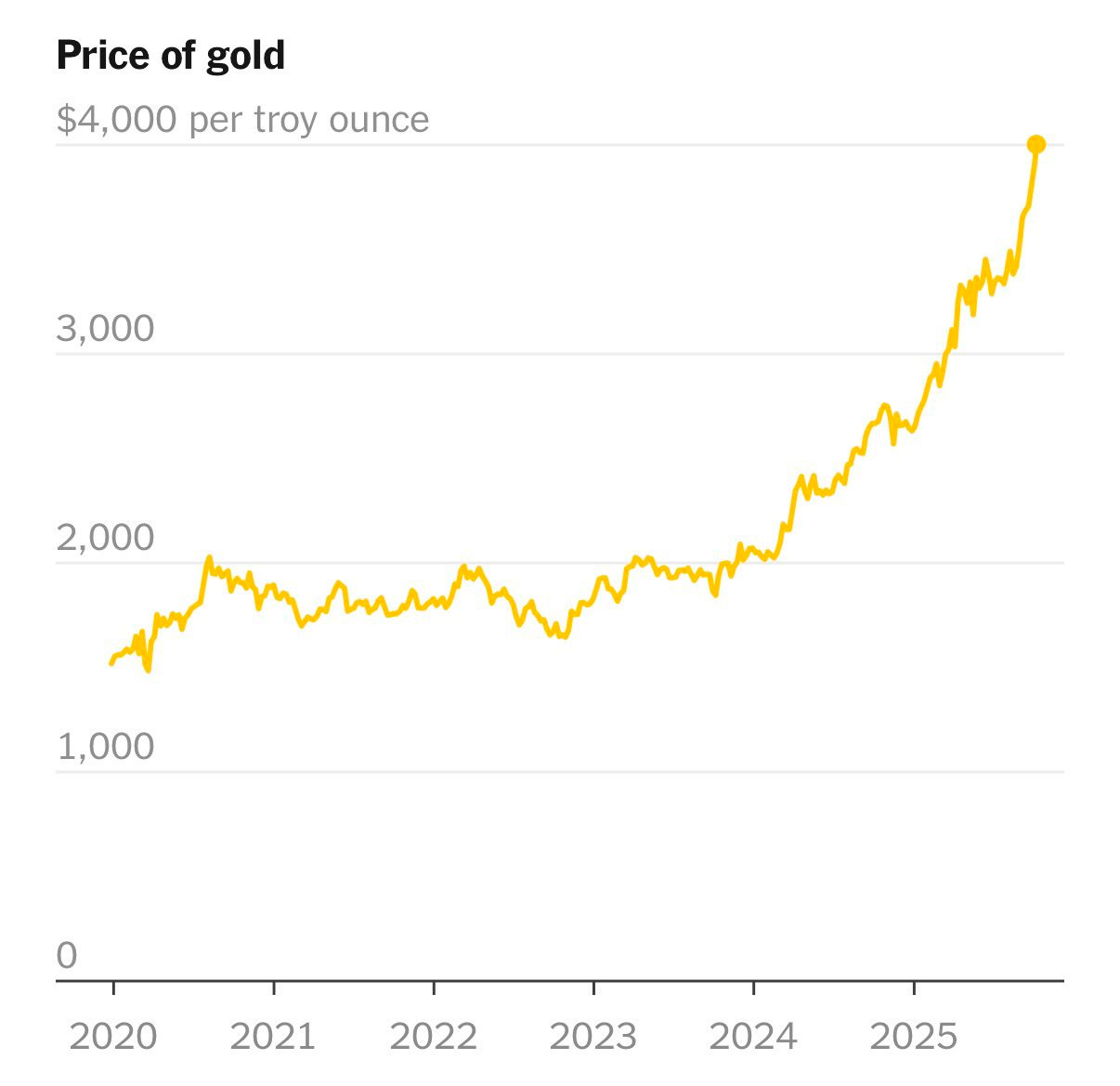

2) Gold officially crosses above $4,000/oz for the first time in history.

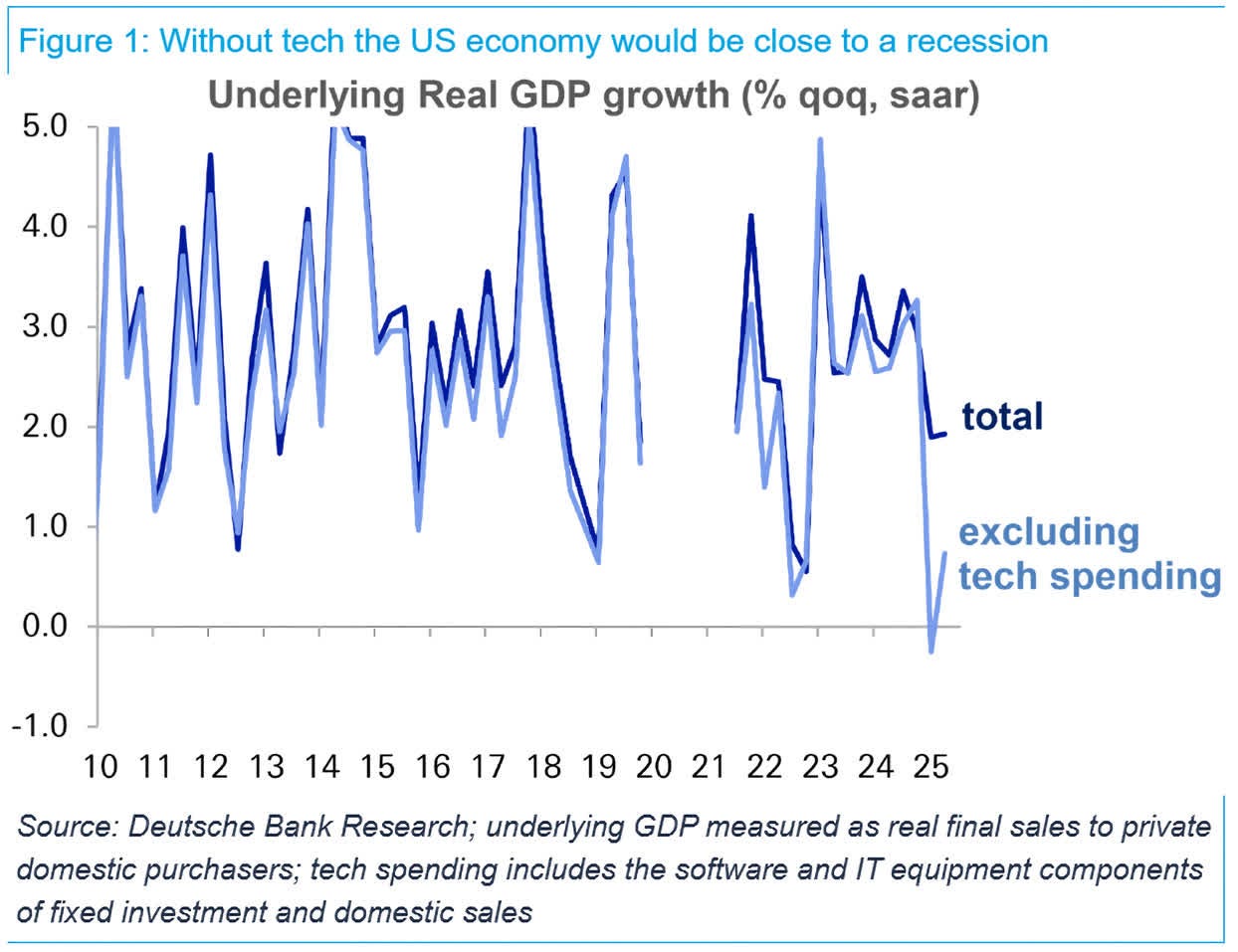

3) The AI bubble is the only thing keeping the US economy together.

4) President Trump to impose 100% tariff on China starting November 1st.

5) Credit scores are now falling at the fastest pace since the Great Recession.

6) America saw ‘essentially no job growth’ last month.

7) IRS releases new tax brackets.1️⃣ The US dollar is predicted to depreciate another 10% next year, after already depreciating 11% in the first half of 2025.

The U.S. dollar just had its worst first half of a year since 1973, losing 11% of its value. Experts at Morgan Stanley say it could drop another 10% by the end of 2026. Why? Slower U.S. growth, falling interest rates, and foreign investors dumping dollar assets.

The best-case scenario? The Fed gets inflation under control, trade deals stabilize things, and the dollar only loses another 5-7% instead of 10%. Your purchasing power shrinks, but not catastrophically.

The worst-case scenario? The dollar keeps falling 10% year after year. Your $100,000 savings becomes worth $70,000 in real purchasing power within three years. Foreign investors dump U.S. assets. Interest rates spike to attract them back. Recession follows.

What I think

Step 1: Stop keeping all your wealth in dollars. Diversify your currency exposure. Here’s how:

Buy international stocks. When you own shares of a European or Asian company, you’re indirectly holding foreign currency. If the dollar falls, those stocks go up in dollar terms (even if the company doesn’t grow).

Invest in hard assets. Gold, silver, real estate, Bitcoin — are things that hold value regardless of what paper currency does. (More on gold in the next section.)

Step 2: Understand what gets more expensive. A weaker dollar means:

International travel costs more. That Europe trip you’ve been planning? Book it now or pay 20% more next year.

Imported goods cost more. Electronics, cars, coffee, chocolate — most consumer goods have imported components.

Step 3: Take advantage of the upside. A weak dollar helps:

U.S. exporters. Companies that sell products overseas make more money. Look for stocks like Boeing, Caterpillar, and agricultural companies.

Your salary if you work remotely for a foreign company. Getting paid in euros while living in the U.S.? You just got a 10% raise.

2️⃣ Gold officially crosses above $4,000/oz for the first time in history.

Gold just smashed $4,000 an ounce, up 50% in 2025. Why? Investors are scared. The U.S. economy is slowing, the government shut down, and the Fed is cutting rates. Gold is the ultimate “safe haven.”

Here’s a story that explains what’s happening: In 1971, President Nixon ended the gold standard (meaning the dollar was no longer backed by gold). At that moment, gold was $35 per ounce. Today it’s $4,000. That 114x increase isn’t because gold got better—it’s because the dollar got worse.

Ray Dalio (the billionaire hedge fund manager who called the 2008 crash) told Bloomberg this week that there’s potential for a “civil war of sorts” in the U.S., and he’s urging investors to buy gold. When a guy who manages $150 billion in assets says that, you listen.

Think about what gold represents. For 5,000 years of human civilization, gold has been the ultimate fallback. When governments collapse, currencies fail, or wars break out, gold keeps its value. Right now, the smartest investors in the world are buying gold like their lives depend on it—and that should terrify you about what they see coming.

Here’s the truth nobody wants to hear: stocks and gold both hitting all-time highs at the same time is extremely rare and usually signals trouble. It means investors don’t trust traditional safe assets like bonds or cash anymore. They’re buying everything that could preserve wealth.

Central banks around the world are buying nearly 1,000 tons of gold per year right now. Why? Because they saw what happened when the U.S. froze Russia’s foreign reserves in 2022. Every central bank thought: “That could be us next.” So they’re dumping dollars and buying gold.

Goldman Sachs predicts gold could hit $4,900 by December 2026. But here’s the scarier part: if things really unravel (depression-level crisis), some analysts think gold could go to $10,000. At that point, you’re not making money—you’re surviving.

What I think

Step 1: Start building a gold position (but do it smart). Here’s the biggest mistake people make: they see gold at $4,000 and either buy nothing (because it feels too expensive) or buy everything (because of FOMO). Both are wrong.

Use dollar-cost averaging:

Month 1: Buy $500 worth of gold

Month 2: Buy another $500

Month 3: Buy another $500

Continue for 12 months

This way, you average out the price. If gold drops to $3,700, you buy more at the dip. If it hits $4,500, you already own some at lower prices.

Step 2: Decide between physical gold or ETFs.

Physical gold (coins or small bars):

Pros: You can hold it. No counterparty risk. If the financial system has trouble, you actually have it.

Cons: Storage and insurance costs. Harder to sell quickly. You might pay 3-5% premiums over spot price.

Gold ETFs (like GLD or IAU):

Pros: Easy to buy and sell. No storage headaches. Liquid.

Cons: You don’t actually own gold—you own a claim on gold the fund holds.

My recommendation: Do both. Put 70% in ETFs for easy trading, and 30% in physical coins you store somewhere safe.

Step 3: Treat gold as insurance, not speculation.

The goal isn’t to get rich from gold. The goal is to not get poor when everything else crashes. Think of it like homeowner’s insurance. You pay the premium hoping you never need it, but you sleep better knowing it’s there.

Target allocation: 5-15% of your total investment portfolio in gold. If you’re young and aggressive, maybe 5%. If you’re within 10 years of retirement, lean toward 10-15%.

Step 4: Watch these warning signs:

If gold breaks above $4,500, buy more (momentum is accelerating)

If it falls below $3,500, buy aggressively (it’s a gift)

If it stays flat while stocks crash, gold is working as designed

The framework here: Gold isn’t about making money—it’s about not losing it. In every major crisis (1929, 2008, COVID), the people who owned gold beforehand had options. The people who didn’t had regrets.

3️⃣ The AI bubble is the only thing keeping the US economy together.

Big Tech (Nvidia, Microsoft, Google) is spending billions on AI data centers. This is half of all U.S. growth in 2025. Problem? Most AI companies won’t make money. Deutsche Bank sent a warning to its clients this week: “The AI bubble is the only thing keeping the US economy together, and when it bursts, reality will hit far harder than anyone expects.”

George Saravelos, Deutsche Bank’s Global Head of FX Research, said something remarkable: the U.S. would already be in recession right now if Big Tech wasn’t spending billions building AI data centers.

Let me put this in perspective with a story. In 1999, my friend’s uncle quit his job to day-trade internet stocks. He made $300,000 in six months. Then the dot-com crash hit in 2000, and he lost everything plus his life savings. He’s still working today at age 60, with no retirement saved.

The AI boom right now looks exactly like the dot-com bubble looked in 1999. Everyone’s convinced AI will change everything (it probably will). But that doesn’t mean every AI stock at today’s prices is worth it.

Here’s the scariest stat from Deutsche Bank’s research: AI spending needs to stay “parabolic” (meaning exponentially increasing forever) just to keep contributing to GDP growth. But as Saravelos said, “This is highly unlikely.”

Think about what that means. Right now, half of all the gains in the S&P 500 have come from AI-related tech stocks. If that AI spending slows down even a little bit, the entire market drops.

Analysts at Bain & Company ran the numbers and found that by 2030, AI needs to generate $2 trillion in annual revenue just to justify current spending levels. But there’s an $800 billion shortfall globally. Translation: a lot of money being invested today will disappear.

Even OpenAI’s CEO Sam Altman admitted that “AI investors are behaving irrationally, and some will inevitably lose significant sums of money.” When the guy running the hottest AI company admits his own investors are crazy, you should pay attention.

Robin Li, the CEO of Chinese tech giant Baidu, predicted that 99% of so-called AI companies will not survive the bubble. Think about that. If you own AI stocks, there’s a 99% chance you picked a loser.

Best-case scenario? AI delivers on its promise over the next decade. Some companies make it, most don’t. If you picked the winners (like betting on Amazon in 1999), you’ll be rich. If not, you’ll lose 50-90% of your investment.

Worst-case scenario? The AI bubble pops hard in 2026-2027. The S&P 500 drops 40%. Recession follows. Unemployment spikes. Your 401(k) gets cut in half. It takes 10 years to recover (like after 2000 and 2008).

What I think

Step 1: Audit your portfolio TODAY for AI exposure.

Open your brokerage account right now. Look at your holdings. Add up everything tied to AI:

Nvidia

Microsoft

Google/Alphabet

Amazon

Meta

Any AI-specific ETFs

If AI stocks make up more than 50% of your portfolio, you’re dangerously exposed. Remember: diversification isn’t owning 10 tech stocks—it’s owning different types of assets that don’t all crash together.

Step 2: Sell winners, not losers (this is counterintuitive but critical).

Let’s say you bought Nvidia at $400 and now it’s at $800. Your instinct says “hold it—it’s winning!” That’s exactly wrong. When something doubles, take some profit. This way, you’ve locked in gains but still participate if AI goes higher.

Step 3: Learn from history—don’t be my friend’s uncle.

In the dot-com crash (2000-2002):

Amazon fell 95% (from $107 to $5)

Cisco fell 88%

Most internet companies went to zero

But here’s the key: Amazon survived and eventually became the best stock of the century. Cisco is still around. The companies with actual revenue and profits survived. The ones with just hype died.

So ask yourself: Does this AI company I own have real revenue? Real profits? Or just promises?

Step 4: Set up protective stop-losses.

Here’s how to do this:

Log into your brokerage account

Find your AI stocks

Set stop-loss orders at 20% below current price

This means if the stock falls 20%, it automatically sells

Example: You own Nvidia at $800. Set a stop-loss at $640. If it crashes, you’re out automatically with 80% of your money saved. If it keeps going up, the stop-loss moves up with it.

Step 5: Build a “bubble defense portfolio”.

Move money into assets that do well when bubbles pop:

Cash (10-20% of portfolio—sounds boring, but it’s ammunition for buying crashes)

Short-term bonds (they’re safe and pay 4-5% right now)

Defensive stocks: think Johnson & Johnson, Procter & Gamble, Coca-Cola—companies that sell stuff people need whether the economy booms or crashes

My mental model: Bull markets make you feel smart. Bear markets show who actually is. Right now, anyone who bought AI stocks in 2023 feels like a genius. But when bubbles pop, 90% of those geniuses lose everything because they don’t take profits or diversify.

4️⃣ President Trump to impose 100% tariff on China starting November 1st.

President Trump sent shockwaves through markets on Friday when he announced on Truth Social that starting November 1st, the United States will impose a 100% tariff on all Chinese goods, on top of existing tariffs. The S&P 500 dropped over 70 points in seconds.

Let me tell you what a 100% tariff means in practice. Imagine you own a store that sells iPhones. Today, an iPhone costs you $700 wholesale from China. With a 100% tariff, that same phone now costs you $1,400 wholesale. You either double your prices (and lose customers) or eat the cost (and go broke). There’s no good option.

This isn’t Trump’s first trade war. In 2018, he slapped tariffs on China, and the S&P 500 dropped 20% in a matter of months before recovering when tensions eased. But this time feels different.

Here’s what nobody’s talking about: tariffs don’t work the way most people think. The common assumption is “tariffs punish China.” But here’s the reality: American companies and consumers pay the tariff, not China.

When Apple imports iPhones from China with a 100% tariff, Apple pays U.S. Customs $700 extra per phone. China doesn’t pay a penny. Then Apple raises prices, and you pay more. That’s how tariffs work—they’re a tax on Americans disguised as punishment for foreigners.

Studies from Trump’s first trade war (2018-2019) found that tariffs cost the average American household $1,300 per year in higher prices. Now double that estimate for 100% tariffs.

But here’s where it gets even worse: China will retaliate. They already announced new rare earth export restrictions this week (see earlier sections). This is shaping up to be the biggest trade war since the 1930s Smoot-Hawley Tariff Act—which many historians blame for turning a recession into the Great Depression.

Think about global supply chains like a spider web. You can’t just cut one thread without the whole thing collapsing. Apple makes iPhones in China, using parts from Japan, Korea, and Taiwan. With 100% tariffs, does Apple move production to Vietnam? That takes 3-5 years and billions in upfront costs. In the meantime, chaos.

Best-case scenario? This is negotiating theater. Trump uses the threat of 100% tariffs to force China to the negotiating table. They make a deal by mid-November. Markets recover. Crisis averted.

Worst-case scenario? Neither side backs down. Trade between the world’s two largest economies grinds to a halt. Inflation spikes. Recession hits. Unemployment jumps. Your cost of living increases 20-30% while your paycheck stays flat.

What I think

Step 1: Prepare for higher prices immediately.

Here’s your shopping strategy for the next 30 days:

Buy durable goods NOW: new laptop, phone, TV, appliances—anything made in China or with Chinese components. Prices will spike 20-100% once tariffs kick in.

Stock up on non-perishables: vitamins, batteries, tools, clothing. If it’s imported and you’ll need it in the next year, buy now.

Don’t wait to see what happens. Even if the tariffs get delayed or negotiated down, prices have already started rising because retailers are pricing in the risk.

Step 2: Reposition your investment portfolio for a trade war.

Stocks to avoid:

Retailers heavily dependent on Chinese imports: Target, Walmart, Best Buy, Home Depot

Tech companies with Chinese manufacturing: Apple, Dell, HP

Apparel companies: Nike, Gap, Lululemon (most clothes come from China)

Stocks that will benefit:

U.S. manufacturers: Companies that make things domestically get more competitive when imports get taxed

Automation companies: If labor moves from China to the U.S., companies invest in robots to keep costs down

Commodity producers: Steel, aluminum, lumber—U.S. production becomes more valuable

Step 3: Hedge with international exposure.

Not all countries are in this trade war. Consider:

European stocks: European companies can buy from China without U.S. tariffs

Emerging markets (excluding China): Countries like Vietnam, India, Mexico benefit as manufacturing shifts out of China

Step 4: Build an inflation protection strategy.

When tariffs cause inflation, you need assets that rise with inflation:

Real estate (property values typically rise with inflation)

Commodities (gold, silver)

Step 5: Plan your personal budget for 20-30% higher prices.

Go through your monthly expenses right now:

Groceries: expect +15-25% (imported coffee, chocolate, certain produce)

Electronics: expect +30-100% (almost everything has Chinese components)

Clothing: expect +25-50% (most apparel comes from Asia)

Home goods: expect +20-40% (furniture, appliances, tools)

Cut discretionary spending NOW to build a cash buffer. Cancel subscriptions you don’t use. Eat out less. The money you save today will help when prices spike next month.

Trade wars have no winners, only different degrees of losing.

5️⃣ Credit scores are now falling at the fastest pace since the Great Recession.

CNN reported a devastating trend this week: the national average FICO credit score dropped to the biggest decline since the 2009 Great Recession. And for Gen Z, 14% of Gen Zers saw their credit scores fall by 50 points or more.

Let me tell you why this matters from a real story from the CNN article. Dimitri Tsolakis, 22, who graduated from American University. He applied to hundreds of jobs for 14 months before landing a position. The job he got paid so little he had to pause his $35,000 in student loan payments just to afford his car and rent. His credit score crashed.

This is happening to millions of young Americans right now. And here’s the terrifying part: once your credit score tanks, everything gets more expensive—car loans, credit cards, even rent and insurance. It’s a downward spiral.

Tommy Lee, senior director at FICO, told CNN we’re in a “K-shaped economy”—meaning wealthy people with stock portfolios are doing great, while everyone else is drowning.

Here’s the data that should scare you:

Delinquency rates on auto loans, credit cards, and personal loans are at their highest levels since 2009

29% of student loan borrowers with payments due are currently delinquent (a record high)

6.1 million Americans had a student loan delinquency added to their credit file between February and April alone

Think about what this means. The Great Recession was triggered by subprime mortgages—people who couldn’t pay their home loans. Today, we’re seeing the same warning signs, but with credit cards, car loans, and student debt instead. Different crisis, same pattern.

A Federal Reserve survey found that 19% of consumers say they paid less or skipped bills to get by in the past year (up from 17% a year earlier). Meanwhile, 47% cut discretionary spending and 23% reduced essential spending like food and utilities.

This isn’t just about numbers—this is about people choosing between groceries and credit card payments, between rent and car payments. And when enough people make those choices, the whole credit system breaks.

Best-case scenario? The economy stabilizes. The Fed cuts rates further. Job market improves. Credit scores gradually recover over 2-3 years (like they did after 2009).

Worst-case scenario? Recession hits. Unemployment spikes. Mass defaults on credit cards and auto loans. Banks tighten lending. Nobody can borrow money. Consumption collapses. The economy enters a full-blown credit crisis worse than 2008.

What I think

Step 1: Check your credit score TODAY

Go to one of these sites:

AnnualCreditReport.com (free official site)

Credit Karma (free, updates weekly)

Your credit card app (most now show scores)

Write down your score. You need a baseline to measure against.

Step 2: If your score is above 700, protect it. The rules:

Never miss a payment (set up automatic payments for minimum amounts at least)

Keep credit card balances below 30% of your limit (ideally below 10%)

Don’t close old credit cards (length of credit history matters)

Don’t apply for new credit unless absolutely necessary (each application hurts your score)

Step 3: If your score is between 600-700, take action.

You’re in the danger zone. Here’s your 90-day repair plan:

Week 1: Call every creditor you’re behind on. Most will work with you if you’re proactive. Say: “I’m struggling financially and want to avoid defaulting. Can we discuss a payment plan?”

Week 2-4: Use the debt avalanche method:

List all debts by interest rate (highest to lowest)

Pay minimums on everything

Put any extra money toward the highest interest rate debt

Once it’s paid, move to the next one

Month 2: Increase income. I know that sounds obvious, but you need more money coming in:

Take a side gig (DoorDash, Uber, freelancing)

Sell stuff you don’t need (aim for $1,000 in 30 days)

Ask for overtime at work

Month 3: Set up automatic savings. Even $50/month creates a buffer so you don’t miss payments next time something breaks.

Step 4: If your score is below 600, you’re in crisis mode.

You can’t fix this overnight. It takes 6-12 months of perfect behavior to recover. But here’s how:

Priority #1: Housing. Never miss rent. Eviction ruins your credit for 7 years.

Priority #2: Transportation. If you need your car for work, make that payment. If you can get by with public transit, sell the car and eliminate the payment.

Priority #3: Minimum payments. Pay the minimum on every debt. Don’t pay extra on anything—you need to stop the bleeding first.

What NOT to pay: Credit cards before housing/food/utilities. I know that sounds wrong, but you can survive with bad credit. You can’t survive without shelter or food.

Step 5: Learn from Sue Murphy’s story (a nurse in the CNN article).

Sue took out $70,000 in student loans to help her daughter. Now she works 12 days straight with only 1 day off just to make the $500 monthly payment. She told CNN: “It almost feels like it doesn’t pay to be an honest hardworking citizen in this country anymore.”

Here’s the brutal lesson: Don’t co-sign or take parent PLUS loans for your kids’ college. I know that sounds harsh. But your retirement is more important than their degree. They can work through school, start at community college, or take their own loans. You can’t retire on your child’s degree—they need to fund their own education.

Step 6: Build the one thing that protects you from all of this.

It’s called an emergency fund, and here’s how to build one even when you’re broke:

Month 1: Save $100 (sell something, skip one night out, do one gig job) Month 2: Save another $100 Month 3-12: Keep going until you have $1,000

That $1,000 stops you from missing payments when your car needs repairs or your kid gets sick. It’s the difference between a bad month and a destroyed credit score.

My framework: Your credit score is your financial reputation. Once it’s trashed, rebuilding takes years. Prevention is 100x easier than recovery.

6️⃣ America saw ‘essentially no job growth’ last month.

According to Moody’s Analytics, the U.S. saw “essentially no job growth” last month. Mark Zandi, Moody’s chief economist, said bluntly: “This data shows that the job market is weak and getting weaker.”

ADP (the payroll processing company) reported that the U.S. actually lost 32,000 private-sector jobs in September—and that number doesn’t even include government job cuts happening right now. Meanwhile, Revelio Labs estimated we added only 60,000 jobs, but almost all of them were in California, New York, and Massachusetts—meaning the rest of the country saw zero job creation.

Here’s the problem: we’re flying blind. The Bureau of Labor Statistics didn’t release official jobs data last week because of the government shutdown. Policymakers are making decisions about interest rates without knowing what’s actually happening in the job market.

Why This Matters Long-Term

Think about what “no job growth” really means. It means:

College graduates can’t find entry-level jobs (like Dimitri from the previous section, who took 14 months to find work)

Laid-off workers stay unemployed longer

People working part-time can’t get full-time hours

Wage growth stalls (no new jobs = no competition for workers = no raises)

Mark Zandi pointed out something critical: “Smaller companies are getting hit hardest by the tariffs and restrictive immigration policies.” Big companies with 500+ employees are still hiring (barely). Everyone else is cutting.

This creates a huge problem for the Fed. They’re stuck between two terrible choices:

Cut interest rates to help the job market (but inflation is still above their 2% target)

Keep rates high to fight inflation (but unemployment could spike)

Austan Goolsbee, president of the Federal Reserve Bank of Chicago said: “We’ve been 4½ years above 2% inflation and now inflation is rising. That makes me nervous about front-loading too many rate cuts.”

Translation: the Fed might prioritize fighting inflation over saving jobs. If you’re unemployed or underemployed, you’re on your own.

Here’s the historical parallel: In late 2007, the job market looked fine. Unemployment was only 4.7%. Everyone said the economy was strong. Then the Great Recession hit in 2008, and we lost 8 million jobs in two years.

Right now, unemployment is 4.2%—almost identical to late 2007. Job growth is stalling. Credit scores are falling. Sound familiar?

Best-case scenario? This is just a temporary soft patch. The Fed cuts rates. Job growth rebounds by Q1 2026. Crisis averted.

Worst-case scenario? We’re already in the early stages of a recession, and no one realizes it yet. By the time official data confirms it, mass layoffs have already started. Unemployment hits 6-7%. Your job (or someone in your family’s job) disappears.

What I think

Step 1: Recession-proof your career TODAY.

If you’re currently employed:

Document your achievements. Keep a running list of everything you’ve accomplished, with numbers. “Increased sales 23%” or “Reduced costs by $50K.” You’ll need this for your resume if layoffs come.

Build relationships across departments. People who get laid off first are isolated and unknown. Make sure executives above your boss know your name and value.

Cross-train. Learn skills adjacent to your role. If you only do one thing and that thing becomes unnecessary, you’re gone. If you do three things, you’re harder to replace.

Start saving like crazy. Aim to have 6-12 months of expenses saved. I know that’s hard, but losing your job with zero savings is catastrophic.

Step 2: If you’re unemployed or underemployed, shift your strategy.

The old advice (”send out resumes and wait”) doesn’t work anymore. Here’s what does:

Use the “direct outreach” method:

Find 20 companies you want to work for

Research who makes hiring decisions (LinkedIn is your friend)

Send personalized messages (not generic applications) explaining exactly how you can solve their problems

Follow up every 7-10 days

Dimitri (from the credit score article) applied to “hundreds of jobs” and it took 14 months. That’s the old way. The new way is fewer, better-targeted outreach. Quality over quantity.

Step 3: Hedge your income with side hustles.

Sue Murphy (the nurse from the credit score article) took a second job to make loan payments. You might need to do the same. But be strategic:

Good side hustles (skills-based, higher pay):

Freelance writing, design, coding

Consulting in your area of expertise

Teaching online courses

Building and selling digital products

Bad side hustles (time-for-money, low pay):

DoorDash, Uber (unless you need cash THIS WEEK)

Retail/food service part-time jobs

Anything that destroys your schedule and health

The goal: Build a side income stream that could replace 30-50% of your main income. If you lose your job, you’re not at zero.

Step 4: Position your investments for a recession.

When job growth stalls, recession usually follows within 6-12 months. Here’s how to protect your portfolio:

Defensive sectors that do okay in recessions:

Healthcare (people still get sick)

Utilities (people still need electricity)

Consumer staples (people still buy toilet paper and soap)

Discount retailers (Dollar General, Walmart—people trade down when times get tough)

Sectors to avoid:

Discretionary spending (restaurants, luxury goods, travel)

Construction and real estate (first to crash in recession)

Automotive (people delay buying cars)

Small-cap stocks (small companies fail in recessions)

Step 5: Update your LinkedIn profile and network NOW (not after you lose your job).

Checklist:

Upload a professional photo

Write a compelling headline (not just your job title)

Fill out every section completely

Post valuable content once a week (industry insights, lessons learned)

Connect with 5 new people in your industry every week

When layoffs hit, people with strong networks find new jobs 3x faster than people who scramble to build networks after getting laid off.

Step 6: Learn the skill that’s recession-proof.

In every recession, one skill remains valuable: sales. Companies always need revenue, even when they’re cutting costs. If you can prove you can bring in money, you’re the last person they’ll fire.

Take a sales job, or add sales to your current role. Learn:

Cold outreach (email, phone, LinkedIn)

Objection handling

Closing techniques

Pipeline management

My framework: Recessions separate the prepared from everyone else. The prepared lose jobs too, but they find new ones fast. Everyone else panics.

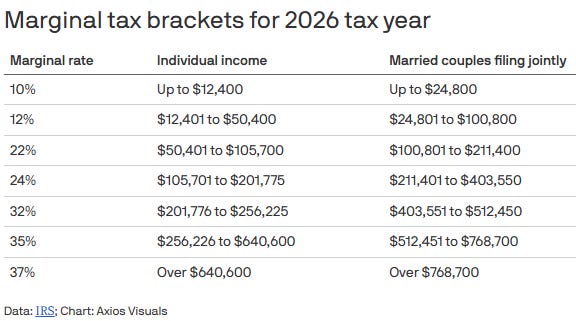

7️⃣ IRS releases new tax brackets.

The IRS announced Thursday that tax brackets are shifting up about 2-4% for 2026, and the standard deduction is rising to $16,100 for single filers and $32,200 for married couples.

Here’s what this means: you’ll pay slightly less in taxes next year—but only if you understand how to use these changes strategically. Most people will miss the opportunity completely.

The IRS makes these adjustments every year to prevent “bracket creep” (where inflation pushes you into higher tax brackets without you actually earning more real income). But thanks to Trump’s “One Big Beautiful Bill Act” passed earlier this year, there are new deductions and loopholes you need to know about.

Let’s be honest: taxes are probably your single biggest expense. The average American household pays 15-25% of their income in federal taxes, plus state taxes, property taxes, and payroll taxes. Over your lifetime, you’ll pay $500,000 to $2 million in taxes. Small changes compound massively.

Here’s a Warren Buffett story that explains this perfectly. He famously said his secretary pays a higher tax rate than he does. How? Because the tax code rewards people who understand it. Buffett’s income comes from capital gains (taxed at 20%) while his secretary’s comes from salary (taxed at 22-37%).

The new changes create opportunities:

Seniors get a $6,000 extra deduction (per person, up to $12,000 per couple)

Tipped workers don’t pay federal income tax on tips (up to $25,000)

Higher standard deductions mean more people should take the standard deduction instead of itemizing

But here’s the catch: if you don’t proactively plan for these changes, you won’t benefit from them.

What I Think

Step 1: Run a tax projection for 2026 TODAY.

Here’s how:

Go to a free tax calculator online (SmartAsset has a good one)

Plug in your expected 2026 income

See what bracket you’ll be in

Compare to 2025 to see your savings

Why this matters: If you’re close to a bracket threshold, you might be able to lower your income slightly and save thousands. More on that below.

Step 2: Claim the new senior deduction if you qualify.

If you’re 65+ with income under $75,000 (single) or $150,000 (married), you get an extra $6,000 deduction. But you need to claim it—it’s not automatic.

Action item: If you’re close to the income threshold, consider:

Maxing out retirement contributions (401k, IRA) to lower your adjusted gross income below the threshold

Timing income (if you do consulting or have bonuses, push income to 2027 if possible)

Converting to Roth IRA (but only if it keeps you under the limit)

Step 3: If you’re a tipped worker, restructure your pay ASAP.

Tipped workers now pay ZERO federal income tax on tips up to $25,000. This is huge.

If you’re a server, bartender, hairstylist, or anyone who gets tips, here’s your strategy:

Maximize your tips, minimize your hourly wage (talk to your employer about restructuring pay)

Report all tips accurately (the IRS will audit this heavily)

Save the tax money you would have paid (don’t spend it—invest it)

Example: A server making $45,000 ($20,000 hourly + $25,000 tips) previously paid about $3,500 in federal tax on the tips. Now they pay zero. That’s a $3,500 raise.

Step 4: Max out retirement contributions to drop into lower brackets.

Here’s a trick most people miss: retirement contributions lower your taxable income.

Let’s say you’re single, earning $100,000 in 2026:

Without retirement contributions: You pay 22% on income from $47,150 to $100,000

With $23,000 in 401k contributions: Your taxable income drops to $77,000, and some of your income moves from the 22% bracket to the 12% bracket

That’s a tax savings of $2,300 JUST from maxing your 401k, plus the benefit of having $23,000 growing tax-deferred.

Step 5: Use the higher standard deduction to your advantage.

The standard deduction is now $32,200 for married couples. That means:

Your first $32,200 of income is tax-free

Only income above that gets taxed

Most people should take the standard deduction now (about 90% of taxpayers do). But if you’ve been itemizing, recalculate to make sure itemizing still makes sense.

You should only itemize if your deductions exceed:

$16,100 (single)

$32,200 (married)

$24,150 (head of household)

Itemized deductions include:

Mortgage interest

State and local taxes (capped at $10,000)

Charitable donations

Medical expenses over 7.5% of income

Add up your potential itemized deductions. If they’re below the standard deduction, don’t waste time itemizing.

Step 6: Time your income and deductions strategically.

If you have any control over when you receive income or when you pay deductible expenses, timing matters:

Delay income to 2027 if possible:

Bonuses: Ask your employer to pay in January instead of December

Consulting payments: Bill in late December for January payment

Capital gains: Wait until January to sell winning investments

Accelerate deductions into 2026:

Charitable donations: Give in December instead of January

Medical expenses: Schedule procedures before year-end

Property taxes: Pay in December if you’re itemizing

Step 7: Set up a tax-advantaged strategy for 2026.

Here’s your tax minimization plan:

Q4 2025 (Do these NOW):

Max out 2025 401k/IRA contributions before year-end

Make charitable donations before December 31

Harvest tax losses (sell losing investments to offset gains)

Q1 2026 (January-March):

Set up automatic 401k/IRA contributions to max out by year-end

Open an HSA if you have a high-deductible health plan (triple tax advantage)

Review if you should convert Traditional IRA to Roth IRA

Throughout 2026:

Track all potentially deductible expenses

Keep receipts for charity, medical, business expenses

Monitor your income to stay in optimal tax brackets

My framework: The tax code is a game, and the rules are written by Congress. You can either complain about it or learn to play it. The people who win are those who understand the rules and use them legally to their advantage.

*️⃣ Other important headlines:

IRS to furlough 46% of staff

China says it will stand firm against US tariffs.

President Trump says “don’t worry about China, it will all be fine.”

Nvidia $NVDA CEO Jensen Huang says he wants to be involved in nearly everything Elon Musk does.

Nvidia $NVDA to take up to $2 billion equity stake in Elon Musk’s xAI.

Patient deaths increased in the emergency rooms of hospitals that were bought by private equity firms, per Harvard University.

👉 For daily insights, follow me on X, Instagram Threads, or BlueSky, and turn on notifications!

3. Important Charts:

This week, we analyze:

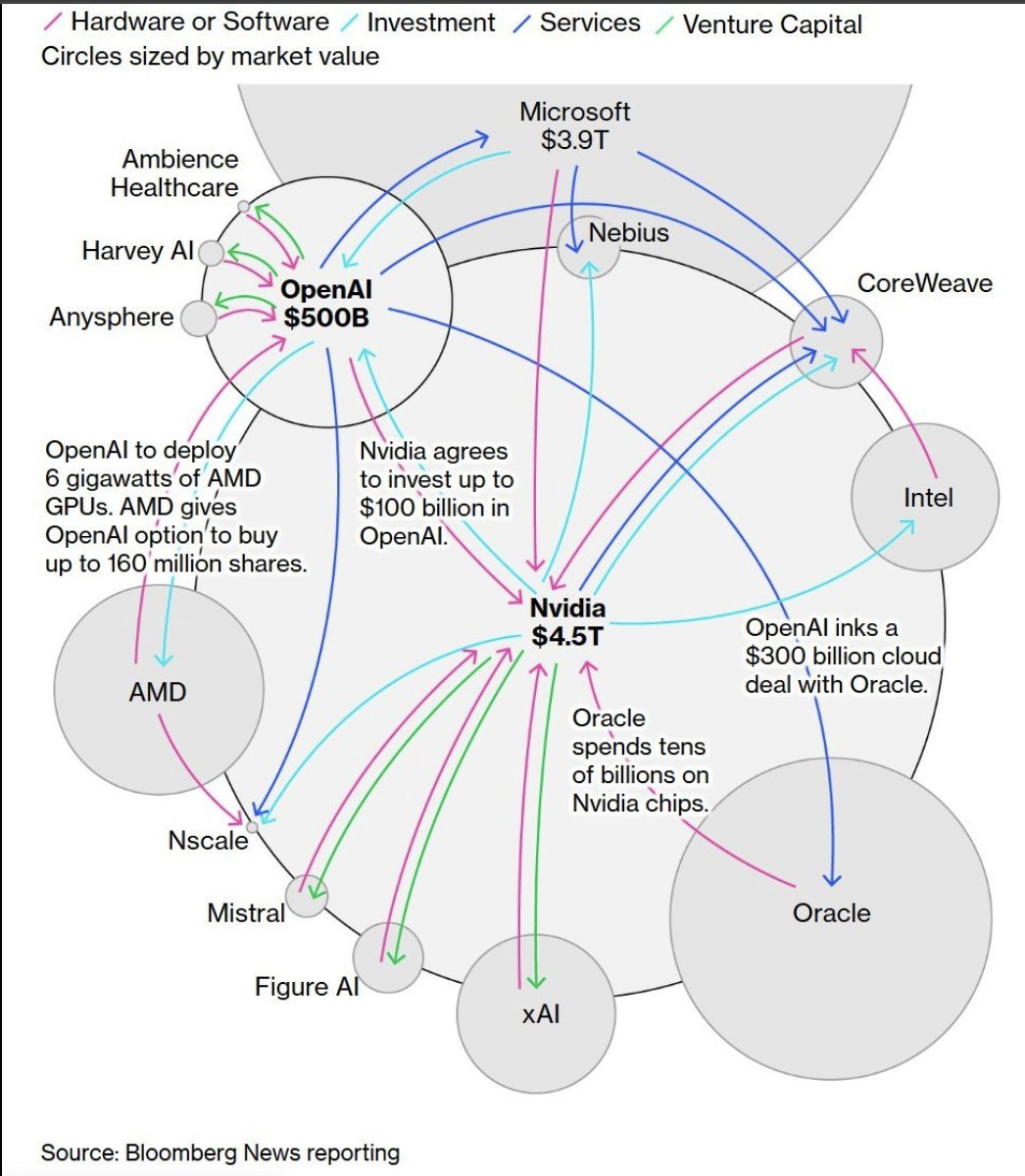

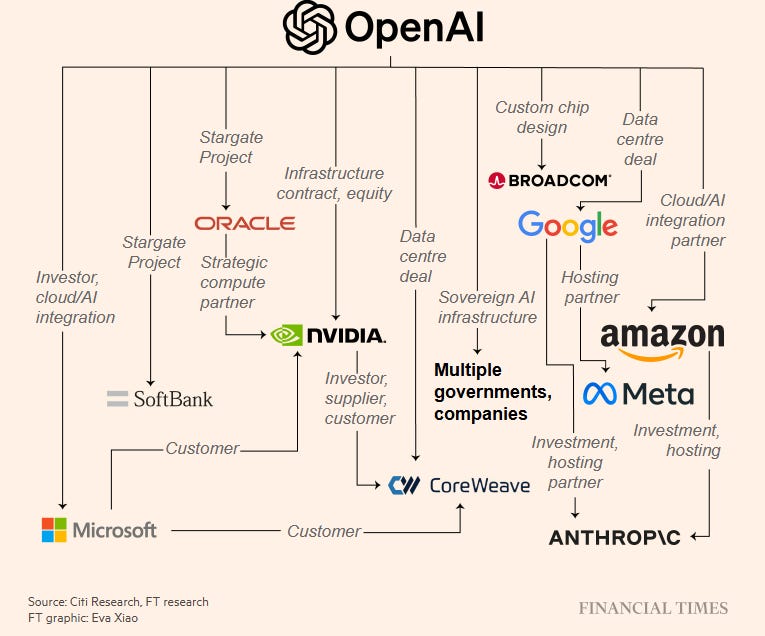

1) OpenAI’s recent partnerships.

2) Gold has crushed the U.S. stock market over the last 25 years.

3) Office CMBS Delinquency Rate jumps to 11.7%, the highest level in history.

4) Power demand from AI data centers is set to QUADRUPLE over the next 10 years, to 4.4% of global electricity.

5) AI compute demand is now growing at over 2 TIMES the rate of Moore’s Law, creating a massive shortage.1️⃣ OpenAI’s recent partnerships.

💡Andrew’s Analysis:

What you’re seeing is the single most concentrated power structure in modern business history.

Every major tech company—Oracle, Nvidia, Microsoft, Google, Amazon, Meta, SoftBank, Broadcom—is orbiting around OpenAI like planets around the sun. And here’s what nobody’s telling you: this level of concentration has only happened twice before in history, and both times it ended badly.

The Historical Pattern

In 1999, Cisco Systems had partnerships with virtually every major internet company. Everyone needed Cisco’s routers to build the internet. The stock hit $80. Then the dot-com crash happened, and Cisco fell to $8. It took 17 years to recover.

In 2007, Countrywide Financial had partnerships with every major bank for mortgages. Everyone needed Countrywide’s loan origination. The stock hit $45. Then the housing crash happened, and Countrywide went bankrupt. Shareholders lost everything.

Today, OpenAI has partnerships with every major tech company for AI. When one company becomes essential to everyone, that’s not strength—that’s systemic risk.

Why This Matters

Notice the relationships in that chart. Nvidia is both an investor and a supplier. Microsoft is a customer and an investor. Google is both a competitor and a partner through their data center deal. These circular relationships are exactly what caused the 2008 financial crisis.

Remember AIG in 2008? They sold insurance to all the major banks. When AIG failed, all the banks failed together because they were interconnected. OpenAI is becoming the AIG of artificial intelligence.

Here’s the cognitive bias at play: availability cascade. Because everyone’s talking about OpenAI, and every major company is partnering with them, it feels safe. But concentration equals fragility. When everyone’s in the same boat and that boat springs a leak, everyone drowns together.

Warren Buffett has a saying: “Only when the tide goes out do you discover who’s been swimming naked.” Right now, the AI tide is high. But what happens when:

OpenAI’s technology disappoints?

A competitor builds something better?

Regulations crack down on AI?

The $100 billion in spending doesn’t generate enough revenue?

Every company in that chart takes a hit simultaneously. Your portfolio (which probably owns many of these stocks through index funds) crashes together.

The Contrarian Truth

The best investment opportunities are usually found where everyone ISN’T looking. Right now, every dollar, every engineer, every investor is chasing AI through these same companies. That’s usually when you should be running in the opposite direction.

Think about it: When Blockbuster was partnering with every movie studio in 2004, Netflix was building streaming in obscurity. When Nokia was partnering with every telecom company in 2006, Apple was building the iPhone in secret. The next big winner usually isn’t the company everyone’s partnering with—it’s the company working alone on something different.

My Advice: