💥 Investing Research & Market Analysis [November 10, 2025]

Layoffs in October are highest since 2003, U.S. now has record $18.6 trillion in household debt, Michael Burry of ‘The Big Short’ shorted Palantir & NVIDIA, 70% of tariffs passed to consumers & more!

👋 Good morning my friend, I hope you had a great week! Welcome back to the #1 finance newsletter! Today’s issue has so much great advice to help you build wealth.

And thank you for joining the 108,000 investors who trust this newsletter to get smarter with money, investing, and the economy! Each issue takes a few days to write and research, so if you enjoy reading, please hit the ❤️ LIKE button on this post to help us grow on Substack (and you can get a 30-day free trial of our newsletter with this link)

📬This week we discuss:

Part I — Markets & Economy:

(1) Market & Economic Analysis (and how it impacts YOU)

(2) Top 5 Finance Events of the Week (and what it means for you)

(3) 3 Important Charts this week (and why they matter)

(4) Economic Outlook & Market Sentiment

Part II — Stocks:

(5) Stock Picks + Research (what every investor needs to know)

(6) Insider Trades from Billionaires, Politicians & CEOs

(7) Top 5 Stocks this Week

(8) Trade of the Week

(9) 5 Stocks to Watch (Earnings this Week)

Part III — Real Estate:

(10) Real Estate Market Analytics & Predictions

(11) Interest Rate Predictions

Part IV — Marco:

(12) Technical Analysis (S&P 500, Tech, Bitcoin)

(13) 3 Important Events this WeekBut before we get into it, please help us and:

Hit the ❤️ LIKE button on this post and help us grow on Substack 🙏

Share this newsletter with friends & family to help them get smarter with money, investing, and the economy!

Become a paid subscriber to support our writing and research! (Get a 30-day free trial with this link) (learn about all the benefits here)

(1) Market & Economic Analysis (and how it impacts YOU):

Here’s everything you need to know that’s happening right now:

Tech stocks took their biggest hit in months. The Nasdaq posted its worst week since April as investors worry AI valuations have gotten too hot. (Translation: People are wondering if we’re in an AI bubble that’s about to burst.)

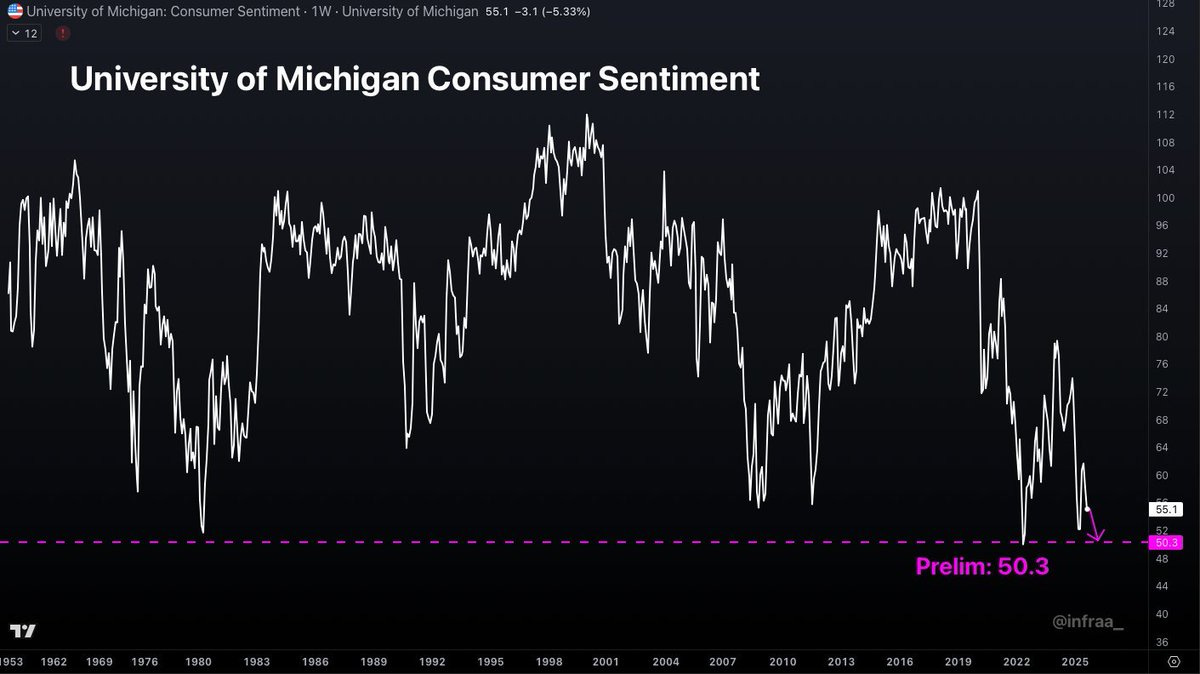

Consumer confidence is cracking. The University of Michigan sentiment index fell to a 3.5-year low. Americans are nervous about the government shutdown and where the economy’s headed.

Earnings

Palantir crushed expectations with government sales jumping 52% on AI contracts.

AMD beat estimates but barely met margin targets while chasing Nvidia’s lead (and just landed a deal with OpenAI).

Berkshire Hathaway beat forecasts and now sits on a record $382 billion in cash after Buffett sold another $6 billion in stock. (He’s stepping down as CEO at year-end, with Greg Abel taking over.)

International markets are thriving. South Korea’s KOSPI rallied to an all-time high and is up 76% this year—the world’s best-performing index. The UK’s FTSE 100 also hit a record.

Aluminum prices surged to their highest level since May 2022 as China tightens supply and global demand picks up.

💡Andrew’s Deep Dive & Analysis:

What’s happening right now tells a deeper story about cycles, confidence, and opportunity hiding beneath the noise. Markets move in waves (hype draws crowds, reality clears them out). What we’re seeing now, especially with AI stocks, fits that pattern.

When investors start fearing a bubble, it’s not just about “AI being overhyped.” It’s about expectations getting ahead of earnings. Warren Buffett says the market is “a voting machine in the short term and a weighing machine in the long term.” Last year, investors were voting with excitement, and this week, they started weighing the actual results. That’s healthy. It means the market’s shifting back toward companies that can prove their worth.

The big drop in consumer sentiment signals something deeper too. When people feel unsure about the economy, they cut back on spending, and that lowers corporate profits. But here’s the key lesson: markets usually bottom before consumers feel better. So for investors, fear isn’t always a warning. It can also be a time to prepare.

Palantir’s and AMD’s results highlight a split in the AI race. Palantir’s success with defense contracts shows how AI is moving from flashy consumer products to real, revenue-backed tools. AMD’s slower growth compared to Nvidia shows competition is heating up (a classic shakeout phase when weaker players fall and strong ones consolidate).

Berkshire Hathaway’s record cash pile of $382 billion says a lot. Buffett’s keeping cash ready, waiting for mispriced assets when fear takes over. His move reminds investors that patience is a position. When others rush into hype, great investors wait for bargains. Greg Abel stepping up as CEO marks a generational handoff, but the strategy remains the same: discipline over drama.

The global picture matters too. South Korea and the UK hitting market highs show that not all parts of the world move in sync. Capital often flows to where growth and stability meet. As U.S. tech cools, foreign markets might see more investor interest. That’s worth watching and even investing in.

Aluminum’s rally shows how much industrial momentum still matters. If AI represents the digital world’s demand, aluminum reflects the strength of the physical economy. When both start moving up, even slightly, it signals that the global economy isn’t slowing down. It’s simply rebalancing.

My advice

Reframe Market Pullbacks. See a drop not as a threat, but as a sale. Would you be upset if the TV you wanted was 10% off? No. Apply that logic to stocks you believe in long-term. This is your chance to buy great companies at better prices.

If you’re heavily invested:

Take some profits in your biggest tech winners (anything up 100%+ in the past year)

Build cash to 15-20% of your portfolio

Add international exposure if you don’t have it

Set stop-losses on speculative positions

If you’re sitting on cash:

Don’t deploy it all at once

Create your wish list of quality companies you want at lower prices

Start dollar-cost averaging into international funds

Be patient—Buffett’s patience usually pays off

If you’re starting from scratch:

Build your emergency fund first (6 months of expenses)

Max out retirement accounts (don’t try to time the market with tax-advantaged money)

Dollar-cost-average monthly regardless of what headlines say

Mindset Shift

Here’s the mental model that’ll serve you for decades: Markets don’t move in straight lines. The AI boom will have corrections. Consumer confidence will recover. Buffett will eventually deploy that cash.

The question isn’t whether volatility happens. It’s whether you’re positioned to benefit from it.

As Howard Marks (another legendary investor) says: “You can’t predict. You can prepare.”

So prepare. Build cash. Diversify globally. Take some profits. Set your shopping list. And remember that the best investors aren’t the ones who never face losses—they’re the ones who position themselves to win over the long haul.

👉 For daily insights, follow me on X/Twitter, Instagram Threads, or BlueSky, and turn on notifications!

(2) Top 5 Finance Events of the Week (and what it means for you):

This week, we analyze:

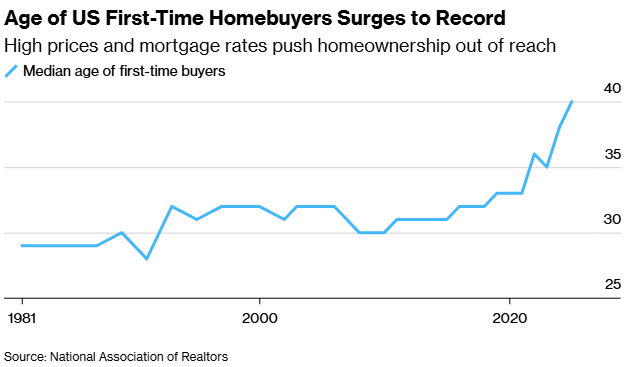

(1) The median age of a first-time homebuyer in the US is now at a record 40 years, up from 33 in 2021 and 29 in 1981.

(2) Michael Burry of ‘The Big Short’ has shorted Palantir and NVIDIA.

(3) 70.5% of new tariffs were passed onto consumers.

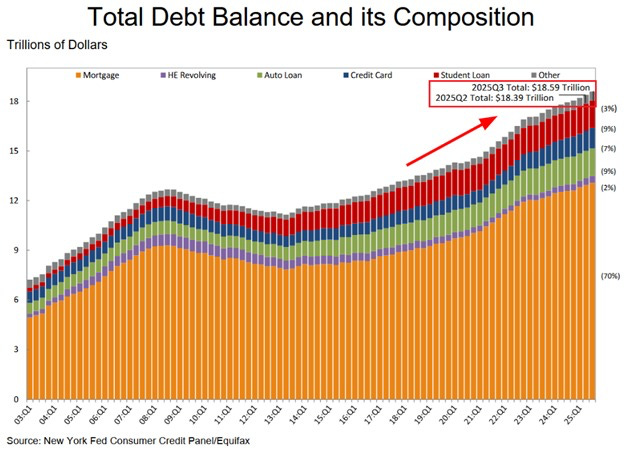

(4) The U.S. now has a record $18.6 trillion in household debt.

(5) OpenAI’s $1 Trillion Dream: Revolution or Bubble?1️⃣ The median age of a first-time homebuyer in the US is now at a record 40 years, up from 33 in 2021 and 29 in 1981.

The Wall Street Journal reported that the median age of first-time homebuyers in the US has climbed to a record of 40 years. This is up from 33 in 2021 and 29 in 1981. High home prices and mortgage rates are making it harder for younger people to buy homes. The National Association of Realtors (NAR) warns that delaying homeownership could cost Americans about $150,000 in equity on a typical starter home. First-time buyers now account for only 21% of the market, the lowest since 1981.

Why This Matters: Buying a home is a key way to build wealth. If people are buying homes later in life, they have less time to build equity and save for retirement. This shift can also affect the housing market and economy.

My Advice:

If you’re trying to buy: Stop waiting for a crash that might never come. Instead, focus on what you can control:

Get creative with location. That trendy neighborhood? You can’t afford it. But the area 15 minutes away? That might work. (Early buyers in Brooklyn bought in neighborhoods that are now worth millions.)

Consider a fixer-upper. Homes that need work sell for 15-20% less. If you can paint, do minor repairs, and handle some sweat equity, you’ll build instant equity. (HGTV made this look easy, but it’s actually a solid wealth-building strategy.)

House hack your way in. Buy a duplex or triplex. Live in one unit, rent out the others. Your tenants pay your mortgage while you build equity. This is how millions of landlords got started. (I did this in my 20s.)

Lock in what you can afford. Don’t stretch for your dream home. Buy what makes financial sense now. You can always trade up later when you have more equity and income.

If you’re already a homeowner: Congratulations. You’re winning. But don’t get complacent:

Don’t cash out your equity for stupid stuff. I see people pulling equity to buy boats and RVs. That’s wealth destruction. Your home equity is your retirement plan. Treat it like gold.

Consider buying a rental property. With first-time buyers priced out, rental demand is sky-high. If you can afford a second property, you’re building wealth while others build your equity for you.

If you’re years away from buying: Start preparing now:

Save aggressively. Aim for 10-20% down. Yes, you can buy with less. But higher down payments mean better rates and lower monthly costs.

Fix your credit. Every 20 points on your credit score saves you thousands in interest. Pay bills on time. Keep credit card balances below 30% of limits. Dispute errors on your credit report.

Increase your income. This is the variable you can actually control. Ask for raises. Switch jobs for better pay. Start a side hustle. Every extra $10,000 in annual income increases your buying power by about $40,000 in home price.

Final thought: The housing market is telling you something important. If you wait for “perfect” conditions, you’ll be 50 years old and still renting. Buy when you can responsibly afford it. Build equity while you sleep. And remember that time in the market beats timing the market (that’s true for homes just like stocks).

2️⃣ Michael Burry of ‘The Big Short’ has shorted Palantir and NVIDIA.

Michael Burry (the guy who predicted the 2008 housing crash) just disclosed bets against Palantir and Nvidia. His hedge fund bought put options on Palantir and Nvidia, worth about $1.1 billion.

If you don’t know Burry, watch “The Big Short.” Christian Bale played him. He’s the investor who made hundreds of millions betting against subprime mortgages when everyone thought he was crazy. Now he’s doing it again with AI stocks.

Here’s the thing about Burry: He’s been wrong before. In 2021, he shorted Tesla. The stock doubled in six months. He’s a contrarian who makes big bets.

But here’s what you need to understand: Burry doesn’t short stocks because he thinks the companies are bad. He shorts them because he thinks they’re overvalued. There’s a massive difference.

Nvidia makes great chips. Palantir has real government contracts. But are they worth their current prices? That’s the $1 trillion question. (Literally. Some analysts think OpenAI could IPO at $1 trillion.)

The long-term significance: We might be in an AI bubble. We might not. But here’s what history teaches us: Every transformational technology goes through a hype cycle.

The internet was real. But that didn’t stop the dot-com bubble from popping in 2000. Cisco, the darling of the internet boom, peaked at $80 in March 2000. It took 24 years to get back to that level. (If you bought at the top, you waited until 2024 to break even.)

Amazon survived the crash. But it still fell from $107 to $6. That’s a 94% drop. Even the winners got crushed.

The pattern repeats: Railroad boom. Bust. Radio boom. Bust. Internet boom. Bust. Each time, the technology was real. The speculation was too much too fast.

Psychological insight to remember: There’s a cognitive bias called “recency bias.” It tricks you into thinking recent trends will continue forever. AI stocks went up 100-200% this year. Your brain assumes they’ll keep going up. But markets don’t work that way.

John Templeton (another legendary investor) said: “Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.” Where are we now with AI? (Feels like euphoria to me.)

My advice:

If you own AI stocks: Don’t panic sell because Burry’s shorting them. But do think critically:

Check your cost basis. If you’re up 100-200%, consider taking some profits. You don’t have to sell everything. But locking in gains protects you from giving them all back. (I learned this the hard way.)

Set stop-losses. Decide your pain threshold. If Nvidia drops 20% from here, will you hold or sell? Make that decision now, not in panic when it’s dropping.

Rebalance if overweight. If AI stocks are more than 50% of your portfolio, you’re taking concentrated risk. Trim to a reasonable allocation.

If you’re thinking about buying AI stocks: Slow down. Ask yourself these questions:

Am I chasing performance? If you’re buying because stocks went up (not because of fundamentals), that’s speculation, not investing.

Do I understand the business? Can you explain how Palantir makes money? Do you know Nvidia’s competitive position?

What’s my time horizon? If you’re buying for the next 10 years, short-term volatility doesn’t matter. If you need this money in 2 years, AI stocks are too risky right now.

The contrarian play: When everyone’s betting on AI, look at what they’re ignoring:

International markets. While everyone obsesses over Nvidia, South Korea’s market is up 76% this year. Diversification matters.

Cash and short-term bonds. With rates still elevated, cash pays 4-5%. That’s not exciting. But it’s a guaranteed return while you wait for better opportunities.

The real lesson from Burry: He’s not telling you to short AI stocks. (Most people shouldn’t use options or short selling.) He’s telling you to think independently. When everyone’s bullish, be skeptical. When everyone’s bearish, be greedy.

As Buffett says: “Be fearful when others are greedy. Be greedy when others are fearful.” Right now, people are pretty greedy about AI.

Final thought: Review your AI holdings this week. Calculate your unrealized gains. If you’re up big, sell 25-50% and lock in profits. Keep the rest if you believe long-term. But protect yourself from giving back all your gains if Burry turns out to be right.

3️⃣ 70.5% of new tariffs were passed onto consumers.

CNBC reported that 70.5% of new tariffs were passed directly onto consumers in June 2025. Translation: When Trump’s tariffs went into effect, companies didn’t eat the costs. You did.

LendingTree estimates these tariffs cost shoppers an extra $132 per person during the holiday season. Multiply that by every shopping trip throughout the year, and you’re looking at serious money.

Here’s what’s happening behind the scenes: Tariffs are taxes by another name. When the government puts a 25% tariff on Chinese goods, importers pay that tax at the border. Then they pass it on to retailers. Then retailers pass it on to you. It’s just a sales tax with extra steps.

Bank of America estimates tariffs are adding 0.5 percentage points to inflation. That might not sound like much. But the Fed’s trying to get inflation down to 2%. These tariffs are keeping it stuck at 2.5-3%. (That’s why some Fed officials voted against cutting rates last week.)

The political reality: Tariffs are popular with politicians because they sound tough. “I’m protecting American jobs!” But the costs are hidden. You don’t see “tariff tax” on your receipt. You just see higher prices and wonder why everything costs more.

As economist Milton Friedman said: “There’s no such thing as a free lunch.” Tariffs might protect some jobs. But they cost consumers far more in higher prices. You’re the one paying for it.

The long-term damage: Tariffs don’t just raise prices. They change your spending behavior in ways that hurt wealth-building.

Think about it: You’re planning to save $500 this month. But coffee prices jumped. Furniture costs more. Your kid’s winter coat is 20% more expensive than last year. Suddenly, that $500 savings plan becomes $300. Or nothing.

This is what economists call “inflation erosion.” Your paycheck stays the same. Prices go up. Your purchasing power shrinks. And your ability to save and invest vanishes.

The psychological trap: There’s a concept called “money illusion.” You see your bank account balance and think you’re doing fine. But if prices rose 3% and your savings grew 2%, you actually lost purchasing power. You’re poorer, but your brain doesn’t register it because the number in your account went up.

Real-world impact: Clothing prices jumped 0.7% in September alone. That’s 8.4% annualized. Artificial Christmas trees (almost all imported from China) will cost more this year. Coffee, furniture, electronics - all more expensive.

Bank of America economist Aditya Bhave put it bluntly: “We think there’s no debate - tariffs have pushed consumer prices higher.”

TD Cowen analysts noted something smart: Even if a product is a tiny part of the Consumer Price Index, if you buy it frequently, it shapes your perception of inflation. When eggs cost more every week, you feel inflation even if the overall rate is modest.

My advice:

Short-term actions:

Buy durable goods before prices rise more. If you need a new refrigerator, TV, or furniture, buy it now. Prices are going up, not down. Waiting costs you money.

Stock up on holiday items early. Christmas trees, decorations, gifts. Buy in November, not December. You’ll save 10-20% compared to last-minute shopping.

Use cash-back credit cards strategically. If prices are higher, at least get 2-5% back. Pay the balance in full to avoid interest. (This is one of the few times I recommend using credit cards for everything.)

Medium-term strategies:

Negotiate raises more aggressively. If tariffs are adding 0.5% to inflation, your raise needs to be at least 3% just to keep pace. (Inflation plus tariffs equals 3%+.) Ask for 5-7% if you want to actually get ahead.

Adjust your budget for reality. If groceries cost 5% more than last year, your budget needs to reflect that. Don’t blame yourself for “overspending” when prices are actually higher.

Seek out substitutes. If beef is expensive, eat more chicken. If name brands are pricey, try generics. Every dollar you save on inflated goods is a dollar you can invest.

Long-term wealth protection:

Invest in inflation-resistant assets. Stocks (especially companies that can raise prices), real estate, and commodities tend to preserve purchasing power better than cash during inflationary periods.

Increase your savings rate. If tariffs are stealing $132 per year from you, you need to save an extra $132 to break even. Aim for $200-300 extra to actually get ahead.

Build multiple income streams. You can’t control tariff policy. But you can control your income. Side hustles, freelancing, investing - anything that generates extra cash helps offset the hidden tax of tariffs.

Final thought: This week, go through your budget from last year. Compare what you paid then versus now for the same items. You’ll probably find you’re spending 5-10% more for the same lifestyle. That’s your real inflation rate. Adjust your savings goals and raise requests accordingly.

4️⃣ The U.S. now has a record $18.6 trillion in household debt.

The U.S. now has a record $18.6 trillion in household debt. That breaks down to:

$13.1 trillion in mortgages (record high)

$1.7 trillion in auto loans (record high)

$1.7 trillion in student loans (record high)

$1.2 trillion in credit card debt (record high)

Total household debt is up 60% in the last 10 years. Credit card debt is up 50% since 2020. And delinquency rates on subprime auto loans hit a record 6.1%.

Here’s what this means in plain English: Americans are drowning in debt. And it’s about to get worse.

The long-term crisis: Debt is a wealth destroyer. Every dollar you pay in interest is a dollar you can’t invest. Every debt payment is money you’ll never see compound.

Let me put this in perspective: If you carry $10,000 in credit card debt at 22% interest (the current average), you’re paying $2,200 per year in interest. Do nothing for 10 years, and you’ve given the bank $22,000. That same $22,000 invested in the S&P 500 would grow to about $45,000 over 10 years. (That’s the real cost of debt - lost opportunity.)

But the problem is bigger than individual debt. When an entire country is overleveraged, bad things happen:

Consumer spending falls. When 30-40% of your paycheck goes to debt payments, you can’t spend on other things. That hurts businesses. Which leads to layoffs. Which leads to more defaults.

Financial stress increases. People make terrible decisions under financial pressure. They raid retirement accounts. They fall for scams. They destroy relationships. (Money stress is the leading cause of divorce in America.)

Economic fragility rises. One shock - a recession, job loss, medical emergency - and millions of Americans can’t make payments. That cascades through the financial system.

The psychological trap: There’s a bias called “present bias.” Your brain values stuff today more than financial security tomorrow. That’s why you swipe the card for a vacation you can’t afford. Future You will deal with the consequences. (Spoiler: Future You will hate Present You.)

Ray Dalio’s debt cycle model: The legendary investor Ray Dalio explains how debt cycles work. Debt allows you to consume more than you earn today. But eventually, you have to consume less than you earn to pay it back. The longer you borrow, the more painful the payback period.

We’re at the “consume more than you earn” phase. The payback phase is coming. And it won’t be pretty.

My advice:

If you have high-interest debt:

Step 1: Stop digging. Cut up credit cards if you have to. No more debt. Period. You can’t get out of a hole while you’re still digging.

Step 2: List every debt. Amount owed, interest rate, minimum payment. Write it all down. You can’t fix what you don’t measure.

Step 3: Choose your attack method.

Avalanche method: Pay off highest interest rate debt first. (Mathematically optimal.)

Snowball method: Pay off smallest balance first. (Psychologically motivating.)

Pick one and stick with it. Consistency beats perfection.

Step 4: Find extra money to attack debt.

Cancel subscriptions you don’t use. (Average American wastes $200/month on forgotten subscriptions.)

Sell stuff you don’t need. (That treadmill collecting dust? Someone will buy it.)

Take a side gig temporarily. (Drive Uber on weekends. Walk dogs. Anything for extra cash.)

Every extra $100 per month on a $10,000 credit card balance at 22% interest saves you $4,800 in interest and gets you debt-free 3 years faster.

If you have student loans:

Investigate income-driven repayment plans. Your payments should be manageable based on your income, not a burden that prevents you from saving.

Consider refinancing if you have good credit. Dropping from 7% to 4% on a $50,000 loan saves you $8,000+ over 10 years.

Don’t neglect retirement to pay off loans. If your employer matches 401(k) contributions, contribute enough to get the match. That’s free money you’ll never get back.

If you have a car loan:

Don’t trade up. That 6.1% delinquency rate on subprime auto loans? Those are people who bought cars they couldn’t afford. Don’t be them.

Pay extra on the principal. Most car loans are front-loaded with interest. Extra payments go straight to principal and save you massive interest.

Drive it until the wheels fall off. The average car payment is $750/month. If you pay off your car and keep driving it for 3 more years, that’s $27,000 you can invest. (Enough to completely change your financial trajectory.)

If you’re debt-free:

Congratulations. You’re in the minority. Now protect yourself:

Build a 12-month emergency fund. With this much consumer debt in the system, the next recession will be brutal. Cash is king during chaos.

Invest the difference. If the average American pays $1,000/month in non-mortgage debt payments, you have $1,000/month to invest. Over 20 years at 10% returns, that’s $750,000. (That’s your retirement right there.)

Don’t get cocky. Debt is easy to accumulate and hard to eliminate. One medical emergency. One job loss. One bad decision. Stay vigilant.

The big picture lesson: Warren Buffett’s business partner Charlie Munger once said: “A lot of people with high IQs are terrible investors because they’ve got terrible temperaments. And that’s why we say that having a certain kind of temperament is more important than brains.”

Avoiding debt isn’t about intelligence. It’s about temperament. It’s about delaying gratification. It’s about living below your means even when everyone around you is living above theirs.

Final thought: Calculate your debt-to-income ratio. Add up all monthly debt payments. Divide by your gross monthly income. If it’s above 36%, you’re in the danger zone. Make a plan to get it below 30% within 12 months.

The debt crisis is coming. Make sure you’re not one of the casualties.

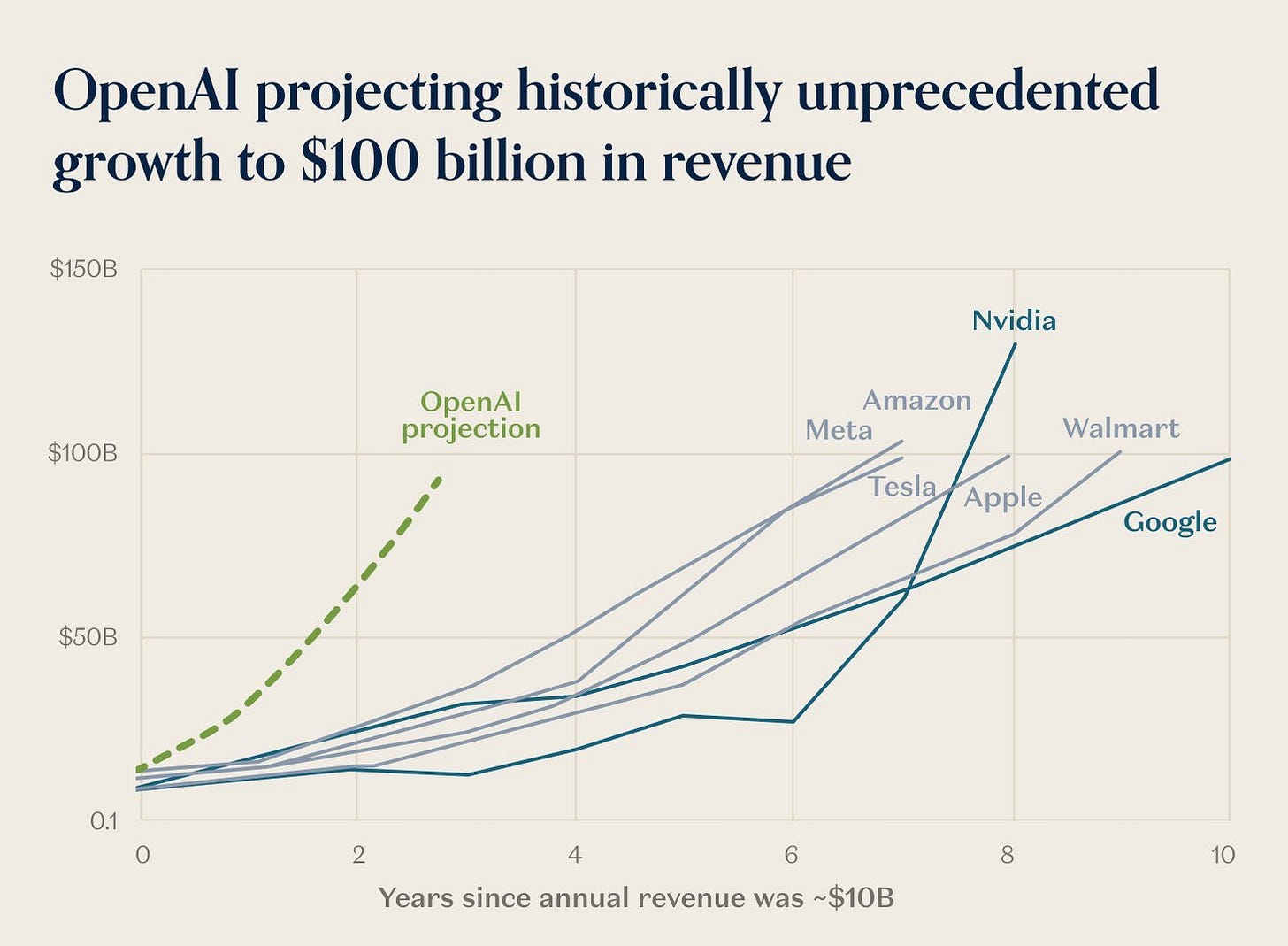

5️⃣ OpenAI’s $1 Trillion Dream: Revolution or Bubble?

OpenAI just went on the biggest corporate deal spree in history. The numbers are mind-boggling:

$500 billion Stargate deal

$100 billion Nvidia deal

$100 billion AMD deal

$38 billion Amazon deal

$25 billion Intel deal

$20 billion TSMC deal

$13 billion Microsoft deal

$10 billion Oracle deal

Multi-billion dollar Broadcom deal

Launched a browser to compete with Google Chrome

Became the world’s most valuable private company

Considering a $1 trillion IPO by 2027

The claim is we’re in “the midst of a generational technological revolution.”

Maybe. Or maybe we’re in the midst of a generational bubble.

The case for revolution: AI is real. ChatGPT has 200+ million users. Businesses are implementing AI everywhere. Companies are spending hundreds of billions on infrastructure. This could be as transformational as the internet.

The case for bubble: Look at those numbers again. OpenAI isn’t making $100 billion in revenue. They’re spending it. On chips. On data centers. On computing power. The burn rate is astronomical.

And here’s the dirty secret: OpenAI’s main customers are the same companies investing in them. Microsoft invests in OpenAI. Then buys OpenAI’s services. Nvidia invests in OpenAI. Then sells OpenAI chips. It’s circular financing. (Sound familiar? That’s what happened before the dot-com crash.)

The long-term significance: One of two things will happen:

Scenario 1: AI delivers. OpenAI and competitors create products that generate hundreds of billions in revenue. The infrastructure pays for itself. Early investors make fortunes. This becomes the next Google/Amazon/Microsoft.

Scenario 2: AI disappoints. The technology is useful but not profitable at this scale. Companies can’t generate enough revenue to justify the investment. The bubble pops. Billions are lost. (This is what Michael Burry is betting on with his Nvidia/Palantir shorts.)

Historical parallel: In 1999, Pets.com raised $82.5 million in an IPO. Nine months later, it was bankrupt. The idea was good (buying pet supplies online). The execution and economics didn’t work. The stock went from $11 to $0.

But Amazon also lost 90% of its value in the dot-com crash. And it eventually became one of the most valuable companies on earth. The technology was real. The speculation was excessive. Both can be true.

What you need to understand: A $1 trillion IPO would make OpenAI worth more than most countries’ GDPs. For context:

ExxonMobil (125 years old, massive global operations): $420 billion

Costco (profitable, loyal customers, proven business): $380 billion

OpenAI (founded 2015, losing billions annually): $1 trillion?

Does that math make sense? (Only if you believe AI will be worth $10-20 trillion within a decade.)

The contrarian argument: Let’s say AI is revolutionary. Does that mean OpenAI wins? Google has AI. Microsoft has AI. Amazon, Meta, Apple - they all have AI. Competition is fierce. Winner-takes-all isn’t guaranteed.

Plus, there’s a fundamental problem: Training AI models costs billions. But giving away AI to gain users means no revenue. ChatGPT is free for most users. How does OpenAI make enough money to justify a $1 trillion valuation?

My advice:

If you’re an accredited investor who might access the IPO:

Don’t get caught up in hype. Remember the rules:

Never invest money you can’t afford to lose.

IPOs often pop, then drop. Facebook’s IPO took months to recover. Uber and Lyft are still below their IPO prices years later.

Wait for the lock-up period to expire. When insiders can sell (usually 180 days after IPO), prices often fall as early investors cash out.

If you’re a regular investor:

You probably won’t get IPO access anyway. (Those shares go to institutions and wealthy clients.) But you can learn from this:

Watch the AI infrastructure plays. Companies selling picks and shovels (Nvidia, AMD, data center REITs) might be safer than betting on who wins the AI race.

Be skeptical of valuations. A $1 trillion private company should have revenue and profit to justify it. If it doesn’t, you’re buying hope, not a business.

Remember that most transformative technologies have multiple winners. If AI is real, lots of companies will benefit. You don’t need to pick the single winner.

The diversification strategy:

Instead of betting everything on one AI company, spread your bets:

Cloud infrastructure: Amazon (AWS), Microsoft (Azure), Google (Cloud)

Chip makers: Nvidia, AMD, Broadcom

Data centers: Digital Realty, Equinix

Established tech: Companies already using AI to improve margins

This way, if AI delivers, you win. If one company fails, you’re protected.

The waiting game:

Here’s what Jeff Bezos figured out early: You don’t have to be first to win. You have to be best. Amazon wasn’t the first online bookstore. Google wasn’t the first search engine. Facebook wasn’t the first social network.

If OpenAI IPOs at $1 trillion and you miss it, don’t panic. If they’re successful, you can buy shares later at reasonable prices after the hype dies down. If they’re not successful, you just dodged a bullet.

The Charlie Munger principle: Charlie Munger (Warren Buffett’s partner) had a rule: “If something is too hard, move on to something easier.” Understanding whether OpenAI is worth $1 trillion is too hard. There’s no comparable company. No proven business model. Too many unknowns.

Instead, invest in things you understand. Boring companies making boring profits. They’ll never 100x your money overnight. But they also won’t go to zero.

My advice: Don’t chase the OpenAI IPO or any AI stock just because of FOMO (fear of missing out). Instead, if you want AI exposure, buy a diversified tech fund. Something like QQQ (Nasdaq 100) or VGT (Vanguard technology fund). You’ll get exposure to AI leaders without betting the farm on speculation.

And remember what legendary investor Peter Lynch said: “The real key to making money in stocks is not to get scared out of them.” Focus on long-term wealth building, not lottery tickets.

Final thought: OpenAI’s growth is impressive. But impressive doesn’t always equal profitable. And profitable doesn’t always justify any valuation. Be excited about the technology. Be skeptical about the price. That’s how you survive bubbles and profit from revolutions.

*️⃣ Other important headlines:

Senate reaches deal to end US Government shutdown

President Trump announces that he will be paying a “tariff dividend” of at least $2,000 per person.

Tesla $TSLA shareholders approve Elon Musk’s $1 trillion pay package.

👉 For daily insights, follow me on X/ Twitter, Instagram Threads, or BlueSky, and turn on notifications!

(3) 3 Important Charts this Week (and why they matter):

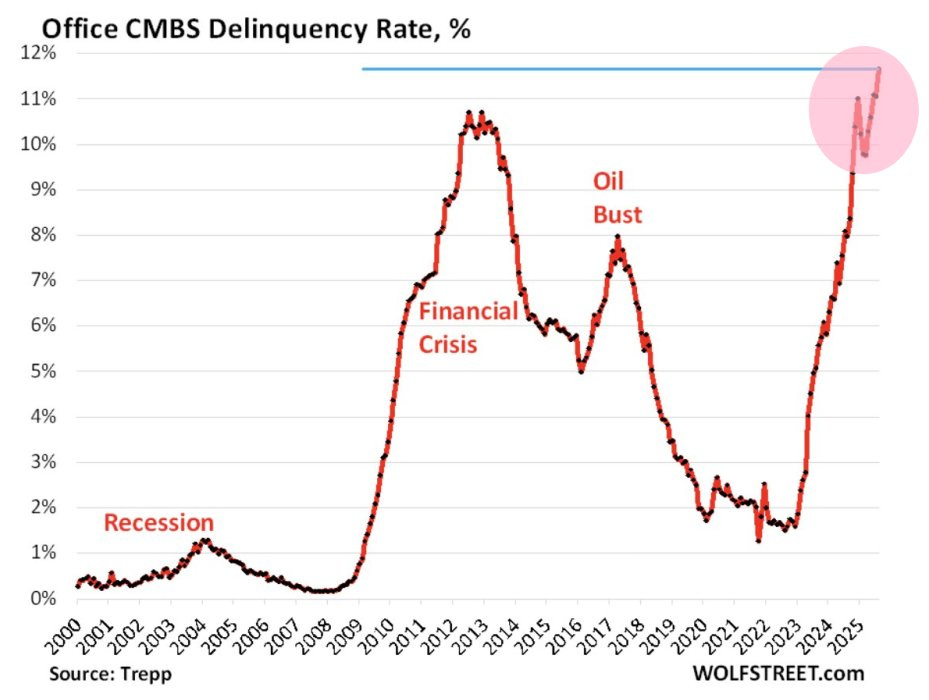

This week, we analyze:

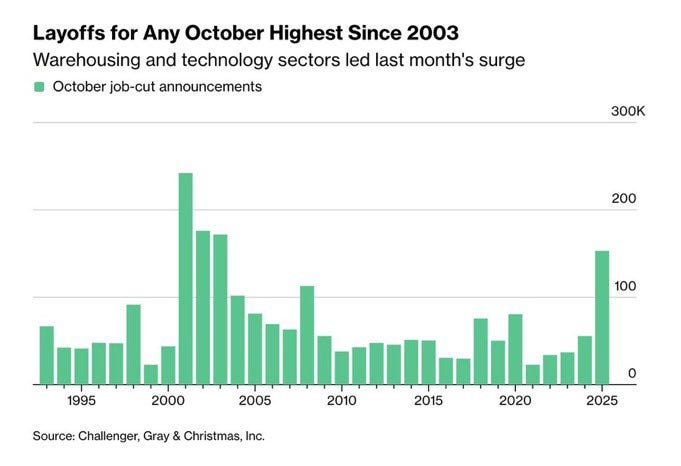

(1) Layoffs in October were the highest since 2003.

(2) US consumer sentiment falls to its 2nd lowest level on record.

(3) Office CMBS Delinquency Rate jumps to 11.7%, the highest level in history.1️⃣ Layoffs in October were the highest since 2003.

💡Andrew’s Analysis:

October 2025 saw about 150,000 job cuts announced, the highest for any October since 2003. That was right after the dot-com bubble burst and before the economy started recovering. Technology and warehousing sectors led the carnage.

Look at the pattern. The only time October layoffs were higher was during the 2001-2003 period (the dot-com crash and 9/11 aftermath). That cluster of massive bars represents economic pain. Lost jobs. Lost income. Lost security.

What’s really happening: This isn’t a random blip. When companies announce layoffs, they’re telling you they see trouble ahead. They’re cutting costs because they expect sales to fall. They’re preparing for a recession before it shows up in the official data.

And it’s not just any sectors getting hit. Technology companies are slashing jobs after years of hiring. Remember when tech workers could hop between companies for 30% raises? Those days are over. The AI gold rush created too many jobs chasing too little sustainable revenue. Now reality is hitting.

Warehousing layoffs tell an even grimmer story. These are Amazon distribution centers, logistics companies, and supply chain operations. When they cut workers, it means consumers are buying less stuff. Period.

The long-term significance: Job losses don’t happen in isolation. They cascade through the economy like dominoes:

First, laid-off workers stop spending. (You can’t buy stuff without income.)

Second, businesses lose customers. (Those laid-off workers were someone’s customers.)

Third, more businesses cut jobs. (Because they’re losing revenue.)

Fourth, the cycle repeats and deepens.

This is how recessions start. Not with a bang. With quiet layoff announcements that barely make the news.

The psychological trap: There’s a bias called “optimism bias.” Your brain thinks bad things happen to other people, not you. You see layoff headlines and think: “That won’t affect me. I’m valuable. My company is solid.”

Maybe you’re right. But probably you’re not as safe as you think. During the 2008 crisis, people said the same thing. Until they didn’t have jobs anymore.

Warren Buffett’s lesson: Buffett’s famous quote applies here: “Only when the tide goes out do you discover who’s been swimming naked.” Right now, the economic tide is going out. Companies that looked healthy during the boom are exposing their problems.

What this means for you:

If you have a job, it might not last as long as you think. If you’re in tech or warehousing, the risk is even higher. But every industry connects. Tech companies cut jobs, those workers stop eating at restaurants, restaurants lay off servers, servers stop shopping at retailers, and so on.

My advice:

1: Build your emergency fund immediately. This isn’t optional anymore. You need 6-12 months of expenses in cash. Not next year. Not next month. Now.

Here’s how to do it:

Open a high-yield savings account (currently paying 4-5%)

Calculate your monthly expenses (rent, food, utilities, insurance, debt payments)

Multiply by 6 (minimum) or 12 (ideal)

That’s your target number

Automate transfers every paycheck until you hit it

If you can’t save 6 months right away, start with one month. Then two. Progress beats perfection.

2: Make yourself indispensable at work. Layoffs aren’t random. Companies cut the people they can afford to lose first.

How to become indispensable:

Document your wins. Keep a list of projects you completed, money you saved the company, problems you solved.

Build relationships across departments. The person everyone knows is harder to cut than the person nobody talks to.

Learn skills your company needs. If your company is investing in AI, learn AI tools. If they’re cutting costs, become the efficiency expert.

Ask for more responsibility. Sounds counterintuitive, but people managing critical projects survive layoffs.

3: Prepare your exit plan before you need it. Don’t wait until you’re laid off to update your resume.

Do this today:

Update your LinkedIn profile

Refresh your resume

Reach out to your professional network (just checking in, not asking for jobs yet)

Research what jobs in your field are paying

Identify companies you’d want to work for

Connect with recruiters in your industry

This takes 2-3 hours. It could save you months of panic and financial stress later.

4: Cut discretionary spending now. Every dollar you’re not spending is a dollar in your emergency fund.

Here’s how:

Cancel subscriptions you rarely use (average person wastes $200/month on forgotten subscriptions)

Pause big purchases (new car, expensive vacation, home renovation)

Switch to generic brands at the grocery store (saves 30-40% with zero difference in quality)

Cook at home instead of restaurants (one family dinner out costs what five home-cooked meals cost)

This isn’t forever. This is survival mode until the job market stabilizes.

5: Consider a side income stream. If your main job disappears, having a backup matters.

Quick side hustle ideas:

Freelance your main skill (if you’re a marketer, do freelance marketing)

Rent out a spare room on Airbnb

Sell stuff you don’t need on Facebook Marketplace

Walk dogs or pet-sit through Rover

Tutor students in subjects you know

Drive for Uber/Lyft on weekends

You don’t need to make thousands. Even an extra $500/month gives you breathing room.

The contrarian opportunity: Here’s what most people miss. Layoffs create opportunities if you’re prepared.

When companies cut jobs, they also cut salaries. Talented people become available. If you have cash saved and job security, you might be able to hire contractors or partners cheaply. Small businesses can scale up when big companies are scaling down.

Also, when everyone’s scared, asset prices drop. Real estate gets cheaper. Stocks go on sale. If you have cash while everyone else is panicking, you can buy quality assets at discount prices.

But only if you’re prepared. Only if you have savings. Only if you kept your job because you made yourself valuable.

Final thought: October’s layoff numbers aren’t just statistics. They’re warnings. The economy is weakening. Your job is less secure than you think. The time to prepare isn’t when you get the pink slip. It’s today.

Take action this week. Start building that emergency fund. Update that resume. Cut that unnecessary spending. Because the people who survive economic downturns aren’t the ones with the best jobs. They’re the ones who prepared before the storm hit.

2️⃣ US consumer sentiment falls to its 2nd lowest level on record.

💡Andrew’s Analysis:

The University of Michigan Consumer Sentiment Index just hit 56.1, with a preliminary reading of 50.3. That pink dotted line around 50? That’s only been breached once before in 70+ years of data.

Look at the chart. Consumer sentiment has been tracked since 1953. That’s 72 years of data. And we’re now at the second-lowest point in history. The only time it was worse was the depths of the 2008 financial crisis (and possibly the early 1980s recession with 15%+ inflation).

What this actually means: Consumer sentiment isn’t just a feeling. It’s a leading indicator of economic disaster.

When consumers are confident, they spend money. They buy houses. They take vacations. They upgrade their phones and cars. That spending employs millions of people and keeps the economy growing.

When consumers are terrified (like now), they stop spending. They hoard cash. They cancel purchases. They prepare for the worst.

And here’s the vicious cycle: Consumer spending is 70% of the U.S. economy. When consumers stop spending, businesses lose revenue. When businesses lose revenue, they lay off workers (see the previous chart). When workers lose jobs, they can’t spend money. Which makes everything worse.

The long-term implications: We’re not just looking at low sentiment. We’re looking at historically catastrophic sentiment. The only other time it was this bad, we had:

The 2008 financial crisis (housing market collapse, bank failures, Great Recession)

Possibly the 1980-1982 recession (interest rates at 20%, unemployment at 11%)

Both times, the stock market crashed. Both times, millions lost their jobs. Both times, it took years to recover.

Why this is different (and possibly worse):

In 2008, consumer sentiment crashed after the crisis started. Banks failed first, then people got scared.

This time, sentiment is crashing before the obvious crisis. People are scared, but we haven’t seen the full economic damage yet. That means the worst is still coming.

Think about it: We already have record household debt ($18.6 trillion). We have the highest October layoffs since 2003. We have consumers who are terrified. What happens when something breaks?

The psychological insight: Consumer sentiment isn’t random emotion. It’s collective wisdom. Millions of people going about their daily lives, noticing that groceries cost more, job offers are fewer, friends are getting laid off, and their 401(k)s aren’t growing like they used to.

When 300+ million Americans all feel pessimistic at once, they’re probably onto something.

The Steve Jobs paradox: Jobs famously said: “You can’t just ask customers what they want and then try to give that to them. By the time you get it built, they’ll want something new.”

He was talking about innovation. But the principle applies to economics too. By the time economists officially declare a recession (usually after two quarters of negative GDP), we’re already deep into one.

Consumer sentiment tells you now what official data will confirm later. And right now, consumers are screaming that something is very wrong.

What this means for you:

When consumer sentiment is this low, stocks usually fall. Not always immediately. But eventually. Because if consumers stop spending, corporate earnings collapse. And stock prices follow earnings.

The S&P 500 dropped 57% from 2007-2009 when sentiment was this bad. The Nasdaq fell 78% from 2000-2002. These aren’t small corrections. These are wealth-destroying events.

My Advice:

Action 1: Reduce your risk exposure immediately. This is the most important action you can take.

If you’re within 5 years of retirement:

Get conservative

Move 40-60% of your portfolio to cash and bonds

You can’t afford to lose 40-60% and recover before you need the money

Miss some upside? Sure. But you also miss the downside that destroys your retirement.

If you’re 10-15 years from retirement:

Move to a 70/30 portfolio (70% stocks, 30% cash/real estate/gold/bitcoin)

This gives you exposure to any remaining upside but protects against catastrophic loss

Rebalance back to stocks only after sentiment recovers and valuations drop

If you’re 20+ years from retirement:

You can stay mostly invested (70-80% stocks)

But shift from aggressive growth stocks to defensive positions

Think utilities, consumer staples, healthcare

Companies people need regardless of the economy

2: Increase your cash position beyond your emergency fund. Your emergency fund covers job loss. This is opportunity cash.

Target: Have 20-30% of your investable assets in cash right now.

Why? Because when the market crashes (and at these sentiment levels, it usually does), you want ammunition. Warren Buffett didn’t make his fortune buying at all-time highs. He made it buying when everyone else was panicking.

His Berkshire Hathaway has $382 billion in cash right now. He’s waiting for the sale. You should be too.

How to do it:

Take some profits from stocks that are up big

Don’t sell everything, just trim positions

Park that cash in a high-yield savings account

When the S&P 500 drops 30-40%, you’ll have cash to buy

3: Protect your job more aggressively. When consumers stop spending, companies stop hiring and start firing.

Review the job security steps from the layoffs section. But add this:

Network externally right now. Join industry groups. Attend conferences. Connect with competitors. Not because you’re looking to leave. Because if your company fails, you need options fast.

4: Delay major purchases. Planning to buy a house? Wait. Looking at a new car? Drive the old one longer. Thinking about a bathroom renovation? Pause.

When consumer sentiment is this low, big ticket items often get cheaper as demand collapses. The patient buyer wins.

Exception: If you need something and can pay cash, buy it now. Once recession hits officially, your job might not be safe. But if you have cash and stability, waiting might save you 20-30%.

5: Review your debt situation urgently. In good times, debt is manageable. In bad times, it destroys you.

Do this today:

List all debts with interest rates

Focus on paying off high-interest debt (credit cards, personal loans)

Refinance adjustable-rate debt to fixed rates if possible

Stop taking on new debt completely

When consumer sentiment is at crisis levels, banks stop lending. Credit card companies lower limits. If you need credit later, you might not get it. Pay down what you have while you still have income.

6: Check your industry’s recession resistance. Some sectors get crushed in recessions. Others barely feel it.

Vulnerable sectors:

Retail (people stop buying non-essentials)

Restaurants (people eat at home)

Travel and hospitality (vacations get canceled)

Luxury goods (first thing people cut)

Real estate and construction (nobody’s buying houses)

Resistant sectors:

Healthcare (people still need doctors)

Utilities (people still need electricity)

Food and grocery (people still need to eat)

Government jobs (harder to eliminate)

Discount retailers (people trade down)

If you’re in a vulnerable sector, take the job security steps even more seriously.

The contrarian insight: Consumer sentiment is a contrary indicator at extremes. When everyone is euphoric, the market tops. When everyone is terrified, the market bottoms.

We’re at terrified. That means we’re probably closer to a bottom than a top. But “closer” doesn’t mean “at.” Sentiment can stay low for months or years during recessions.

So the smart play isn’t to panic sell everything. It’s to:

Protect what you have (reduce risk)

Build cash (prepare for opportunities)

Wait patiently (don’t catch a falling knife)

When sentiment recovers and everyone’s confident again, that’s when you shift back to aggressive growth.

Final thought: Consumer sentiment at 50 is a fire alarm. It’s not telling you there might be a fire. It’s telling you the building is already burning. You just can’t see the flames yet.

The people who survive economic crises aren’t the ones with the highest risk tolerance. They’re the ones who see the warning signs and act before the crowd panics.

This chart is the warning sign. Reduce risk. Build cash. Protect your income. And prepare to buy when everyone else is selling in pure terror.

3️⃣ Office CMBS Delinquency Rate jumps to 11.7%, the highest level in history.

💡Andrew’s Analysis:

The Office CMBS (Commercial Mortgage-Backed Securities) Delinquency Rate just hit 11.7%, the highest in history. Higher than the 2008 financial crisis. Higher than the oil bust. Higher than any previous crisis.

Let me explain what this means in simple terms. CMBS are bundles of commercial real estate loans that get sold to investors. When the delinquency rate hits 11.7%, that means nearly 12% of office building loans aren’t being paid.

Look at the chart’s history:

During the 2008 financial crisis, the rate peaked around 10.7%

During the oil bust (2015-2017), it hit about 8%

Today: 11.7% and climbing

Why this is happening: The work-from-home revolution destroyed office demand. Companies realized they don’t need massive headquarters when half their workers are remote. Office vacancy rates in major cities are 20-30%. Some buildings are nearly empty.

Think about the math from a building owner’s perspective:

You own a 20-story office building

Your mortgage payment is $500,000 per month

Pre-2020, the building was 95% full at $60 per square foot

Today, it’s 60% full and you had to drop rents to $40 per square foot to keep tenants

You’re bringing in $200,000 per month but owe $500,000

You can’t pay the loan. You default.

Multiply this by thousands of office buildings across America, and you get 11.7% delinquency.

The long-term catastrophe: This isn’t just about office buildings. This is a systemic financial crisis in the making.

Here’s the cascade:

Stage 1 (where we are now): Building owners can’t pay mortgages. They default. Banks try to work out deals, but there’s no solution when buildings can’t cover their debt.

Stage 2 (coming soon): Banks foreclose and take ownership of buildings. But the buildings are worth far less than the loans. A building that was worth $100 million in 2019 might be worth $40 million today. The bank eats a $60 million loss.

Stage 3 (the crisis): Regional banks that specialize in commercial real estate start failing. They have billions in bad commercial loans. When enough banks fail, you get 2008 all over again. (Remember, 2008 started with real estate defaults too. Just residential instead of commercial.)

Stage 4 (economic contagion): Failed banks stop lending. Small businesses can’t get loans. Construction stops. Developers go bankrupt. Unemployment spikes. The recession deepens.

The historical parallel: In 2008, residential mortgages were the problem. Banks created subprime mortgage-backed securities, sold them to investors, and when homeowners stopped paying, the whole system collapsed.

Today, it’s commercial real estate. Same structure. Different property type. Potentially same outcome.

The scary part? The 2008 crisis didn’t fully hit until delinquencies crossed 8-10%. We’re already at 11.7% and climbing.

Who gets hurt:

Bank stockholders: Regional banks with heavy commercial real estate exposure will see their stock prices collapse. Some will go bankrupt. (Think Silicon Valley Bank, but for commercial real estate.)

CMBS investors: Pension funds, insurance companies, and individual investors who bought these securities will lose money. Maybe a lot of money.

Commercial real estate owners: Anyone who owns office buildings is watching their net worth evaporate. Forced sales at 40-60 cents on the dollar.

Adjacent industries: Construction workers, architects, property managers, real estate agents - all see demand collapse.

Psychological insight: There’s a concept called “debt deflation spiral.” When asset prices fall below their debt levels, owners default. When they default, banks sell assets. When banks sell, prices fall more. Which causes more defaults. The cycle feeds on itself.

Irving Fisher, an economist who lived through the Great Depression, documented this. He called it “the debt-deflation theory of great depressions.” We’re watching it happen in real-time with office buildings.

The contrarian opportunity: Commercial real estate crashes create generational wealth-building opportunities. But only if you have cash and patience.

In 2009-2010, savvy investors bought office buildings for 30-50 cents on the dollar. Those buildings are worth 2-3x what they paid today. Sam Zell (the famous real estate investor who died in 2023) made billions buying distressed properties during downturns.

The same opportunity exists today. But probably not for another 12-24 months. We’re at the “everything’s going wrong” phase. We haven’t reached the “capitulation and forced selling” phase yet.

My advice:

1: Check your bank’s commercial real estate exposure. If you have more than $250,000 in a regional bank (above FDIC insurance limits), you might be at risk.

How to check:

Google: “[Your bank name] + commercial real estate exposure”

Look at their annual report (usually available on their website)

Check what percentage of their loan book is commercial real estate

If it’s above 30%, consider moving some money to a larger bank

Why it matters: When banks fail, deposits above $250,000 can be at risk. FDIC insurance covers the first $250k per account. Above that, you might wait months or years to get your money back (or lose some).

2: Avoid CMBS investments. If you own mutual funds or ETFs with CMBS exposure, sell them.

How to check:

Look at your bond fund holdings

Search for terms like “commercial mortgage,” “CMBS,” or “real estate debt”

If your bond funds have more than 5% in CMBS, consider switching

Safer alternatives:

U.S. Treasury bonds (backed by government)

High-grade corporate bonds (from companies like Apple, Microsoft)

Municipal bonds (from cities with strong finances)

3: Short regional bank stocks (advanced investors only). If you’re comfortable with options and understand the risks, buying put options on regional banks with heavy commercial real estate exposure could be profitable.

But be warned: This is speculation. You can lose 100% of what you invest in options. Only do this with money you can afford to lose completely.

Safer version: Just don’t own regional bank stocks. If you have them in your portfolio, sell them and move to larger, diversified banks like JPMorgan or Bank of America (which have less commercial real estate concentration).

4: Prepare for the buying opportunity. If you’re interested in real estate investing, this crash will create chances to buy office buildings (or buildings being converted to apartments) at massive discounts.

But don’t buy yet. Prices are still falling. Wait until:

Delinquency rates peak and start declining

Banks finish foreclosing and dumping properties

Prices stabilize for 6+ months

This might take 1-3 years. Be patient. The people who bought too early in 2008-2009 still lost money. The people who waited until 2010-2011 made fortunes.

What to do now to prepare:

Build a cash reserve specifically for real estate opportunities

Study markets you’d want to invest in

Connect with commercial real estate brokers

Learn about property analysis and cash flow calculations

Consider forming an LLC for future purchases

When the time comes, you’ll be ready while others are still panicking.

5: Understand the ripple effects on your city. Office buildings pay huge property taxes. When they lose value, cities lose revenue.

What this means:

Cities will raise taxes on homeowners to compensate

Public services might get cut

Property values in downtown areas will fall

If you own a home near struggling office districts, your property value could be affected. If you’re considering buying downtown, wait. Prices will likely fall further.

6: Position defensively in your investment portfolio. Commercial real estate crashes correlate with stock market crashes. Not always immediately, but eventually.

Your defensive positioning:

Reduce exposure to regional bank stocks

Reduce exposure to REITs (Real Estate Investment Trusts)

Reduce exposure to construction and building materials companies

Increase cash and treasury bonds

Consider consumer staples and utilities (defensive sectors)

7: The warning signs of bank problems. If commercial real estate defaults trigger bank failures, you want to know early.

Warning signs to watch:

Your bank’s stock price falling rapidly

News of commercial real estate losses

Executives suddenly leaving

Unusual account restrictions or delays

FDIC warnings or bank downgrades

If you see these signs, move your money immediately. Don’t wait. In 2008, some people lost access to funds for months when banks failed.

The Warren Buffett lesson: Buffett loves crises. His famous quote: “Be greedy when others are fearful.”

But notice what he’s doing now. He’s sitting on $382 billion in cash. He’s not buying yet. He’s waiting for the fear to peak. For prices to hit rock bottom. For the blood to be in the streets.

You should do the same. Don’t try to catch a falling knife. Wait for it to hit the ground, stop bouncing, and sit there for a while. Then pick it up and profit.

The multi-year view: This commercial real estate crisis won’t resolve quickly. It took 5-7 years after 2008 for commercial real estate to fully recover. It might take that long again.

But for patient investors with cash, this will be the buying opportunity of a lifetime. Office buildings at 50% discounts. Some will be converted to apartments (housing shortage means huge demand). Some will be demolished and rebuilt. Either way, those who buy at the bottom will make generational wealth.

Final thought: An 11.7% delinquency rate isn’t just a number. It’s a financial crisis unfolding in slow motion. It’s 2008 with a different trigger.

Most people won’t see it coming until it’s too late. Banks will fail. Investors will lose money. Property owners will go bankrupt.

But you’ve seen the chart. You understand what’s happening. Now you can prepare. Protect your deposits. Avoid the risk. Build cash for the opportunity. And position yourself to profit when the dust settles.

👉For more charts, follow me on Instagram, Facebook, LinkedIn, and turn on notifications!

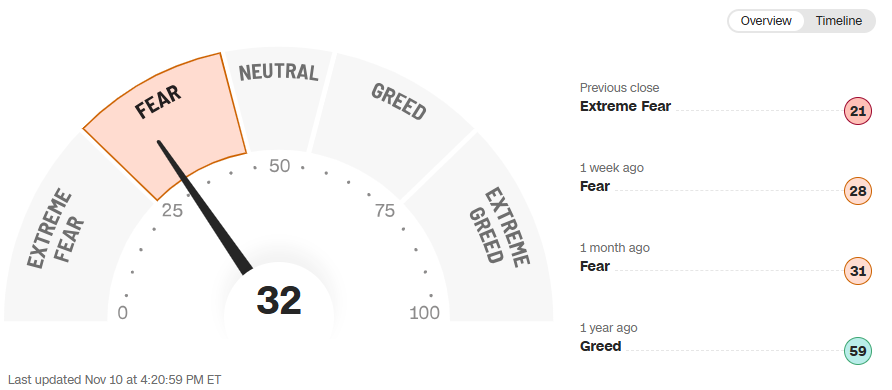

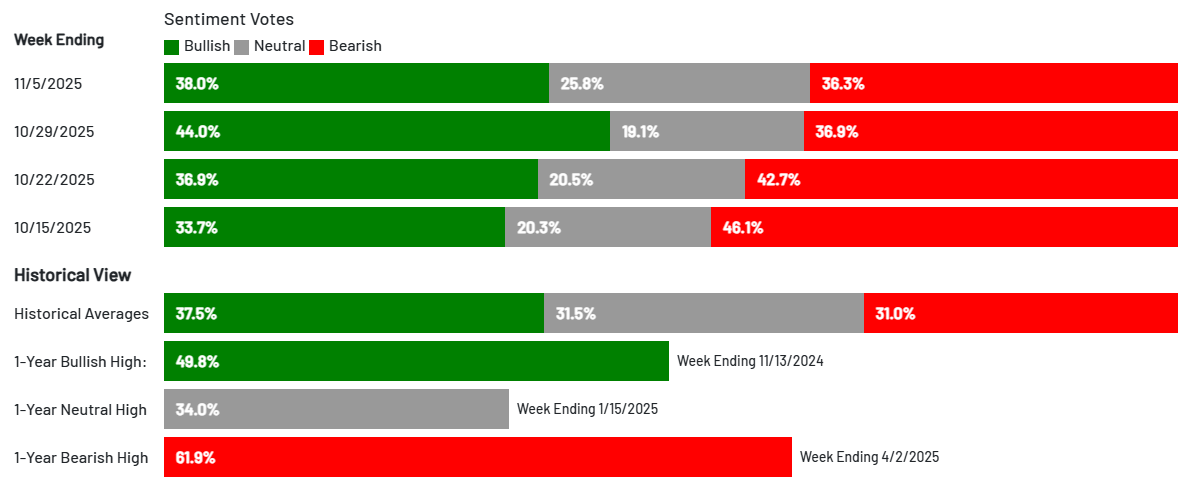

(4) Economic Outlook & Market Sentiment:

How do you cut through the noise and understand what’s really happening?

The secret is to look at three different types of information: the feelings people, the actions of investors, and the facts about the economy. When you put them together, you get a clear picture.

1) Fear & Greed Index

Fear -The Fear & Greed Index currently sits at 32, signaling that fear dominates market sentiment. This number falls in the “fear” category, which historically has been a buying opportunity for patient investors. Think of it like shopping during a clearance sale - when others panic, you can find quality stocks at discounted prices.

The index measures seven factors including market momentum, stock strength, breadth, options activity, volatility, and safe-haven demand. Currently, market momentum and stock breadth show weakness, while safe-haven demand remains elevated. This combination suggests investors are selling stocks and moving toward safer investments like bonds.

Advice: When fear dominates like this, consider gradually buying quality stocks you’ve researched thoroughly. Warren Buffett famously said, “Be fearful when others are greedy and greedy when others are fearful.” This might be your moment to be selectively greedy while others panic.

2) AAII Investor Index

Neutral - The latest AAII survey shows neutral sentiment increased to 25.8% while bullish and bearish views both declined. This creates an interesting picture where individual investors aren’t strongly committed to either direction, suggesting uncertainty about short-term market direction.

The survey also revealed that 54.2% of AAII members supported the Fed’s recent rate cut, while 29.6% thought rates should have remained unchanged. This division shows even informed investors disagree about the Fed’s path forward.

Advice: Neutral sentiment often precedes market turning points. Consider watching for confirmation signals before making large moves.

3) Economic Indicators

Mixed - The economic indicators present both positive and concerning signals. While consumer spending, retail sales, and wage growth show expansion, some warning signs have emerged in job sentiment, ISM new orders, and profit margins.

The government shutdown has created data gaps, making it harder to assess the economy accurately. This uncertainty itself becomes a market factor as investors hate flying blind. The yield curve also shows caution, which has historically preceded economic slowdowns.

Advice: In mixed environments like this, diversification becomes crucial. Consider spreading investments across sectors that perform differently in various economic conditions. Also, maintain some cash reserves to take advantage of opportunities that clearer economic data might reveal.

4) What All This Means

These three indicators create a comprehensive picture of market psychology. When they align, they provide stronger signals; when they conflict, they suggest uncertainty. Currently, the Fear & Greed Index shows fear, AAII shows neutrality, and economic indicators show mixed signals - creating a complex but potentially advantageous environment for patient investors.

Think of these indicators like weather tools - one measures temperature, another humidity, another wind speed. Together, they help predict whether to expect storms or sunshine. The current mix suggests cloudy skies with possible clearing ahead.

Advice: When indicators conflict, focus on fundamentals rather than trying to time the market perfectly. Look for quality companies with strong balance sheets that can weather various economic conditions. Consider using dollar-cost averaging to take advantage of volatility while reducing timing risk.

The key insight is that market emotions create opportunities for rational investors. By understanding these indicators, you can position yourself to benefit from others’ emotional reactions rather than becoming part of the crowd psychology.

👉For more insights, follow me on X, Instagram Threads, or Facebook, and turn on notifications.

(5) My stock picks, research, and analysis (what every investor needs to know):

Warren Buffett: “The stock market is a device for transferring money from the impatient to the patient.” The core idea is simple: Invest in companies with unshakable competitive advantages that are also riding massive, long-term growth waves.

This week, we analyze:

(1) Vanguard Information Technology ETF (VGT) - AI Exposure Without the Headache

(2) Taiwan Semiconductor (TSMC) - The Company That Makes Everyone Else’s Chips

(3) NextEra Energy (NEE) - Powering the Digital Revolution1) Vanguard Information Technology ETF (VGT) - AI Exposure Without the Headache

VGT gives you exposure to 300+ tech stocks in one trade. It’s averaged 20% annual returns for 15 years. Its top holding is Nvidia. You get the entire tech sector, diversified, in a single ticker.

Why this matters: Remember Peter Lynch’s advice? “Know what you own, and know why you own it.” Most people can’t explain why they own individual AI stocks. They just heard someone made money and jumped in. That’s gambling, not investing.

VGT solves this problem. You’re not betting on whether Palantir or C3.ai wins. You’re betting that technology companies will keep growing. (Much safer bet.)

The long-term thesis: Technology isn’t a sector anymore. It’s the entire economy. Every company is becoming a tech company. Banks use software. Retailers use algorithms. Manufacturers use robotics. The line between “tech” and “everything else” is disappearing.

VGT owns the companies building this infrastructure. Microsoft. Apple. Nvidia. Broadcom. AMD. Salesforce. Adobe. If technology keeps eating the world (and it will), VGT keeps going up.

The risks: VGT can drop 30-50% when the market crashes. It fell 33% in 2022. It dropped 50%+ in 2008. That’s the price of 20% average returns. You get higher rewards, but you also get bigger drops.

Think of it like surfing. Big waves create big rides. But if you panic and bail when the wave gets choppy, you wipe out. VGT is a big wave. You need the stomach to hold through drops.

The Warren Buffett lesson: Buffett doesn’t invest in tech much. He admits he doesn’t understand it. But even he owns Apple (VGT’s second-largest holding). His reasoning? “I don’t need to understand how a semiconductor works. I need to understand if the business has a competitive advantage and if people will keep buying the products.”

That’s the VGT thesis in one sentence. You don’t need to understand AI algorithms. You need to believe people will keep using technology. (Spoiler: They will.)

My advice:

For aggressive investors (20+ years until retirement):

Make VGT 15-25% of your portfolio

Buy it and hold it through volatility

Rebalance annually (sell some if it grows above 25%, buy more if it drops below 15%)

Don’t check it daily (you’ll panic sell during drops)

For moderate investors (10-20 years until retirement):

Make VGT 10-15% of your portfolio

Pair it with something stable (dividend stocks)

Accept that it’ll swing wildly but trend up over time

For conservative investors (under 10 years until retirement):

Keep VGT under 10% of your portfolio

You can’t afford a 50% drop right before retirement

Consider the Invesco S&P 500 Equal Weight ETF (RSP) instead for less volatility

Dollar-cost averaging strategy: Don’t dump all your money into VGT at once. Invest the same amount monthly. This averages out your entry price and removes emotion from the equation.

Example: You have $12,000 to invest. Instead of buying $12,000 of VGT today, buy $1,000 per month for 12 months. Some months you’ll buy high. Some months you’ll buy low. Over time, you’ll get a fair average price and avoid the pain of buying at the top.

The tax efficiency advantage: ETFs like VGT are more tax-efficient than mutual funds. They generate fewer capital gains distributions. This matters in taxable accounts. (In retirement accounts like 401(k)s or IRAs, it doesn’t matter.)

Final thought on VGT: It’s the lazy genius play. You get diversified tech exposure, strong historical returns, and you avoid the stress of picking individual stocks. The downside? Volatility. But if you can stomach 30-40% drops without selling, VGT has historically rewarded patient investors.

Advice: If you believe technology will keep growing (and you should), open a brokerage account, buy VGT, set up automatic monthly investments, and don’t look at it for 10 years. That’s it. That’s the whole strategy.

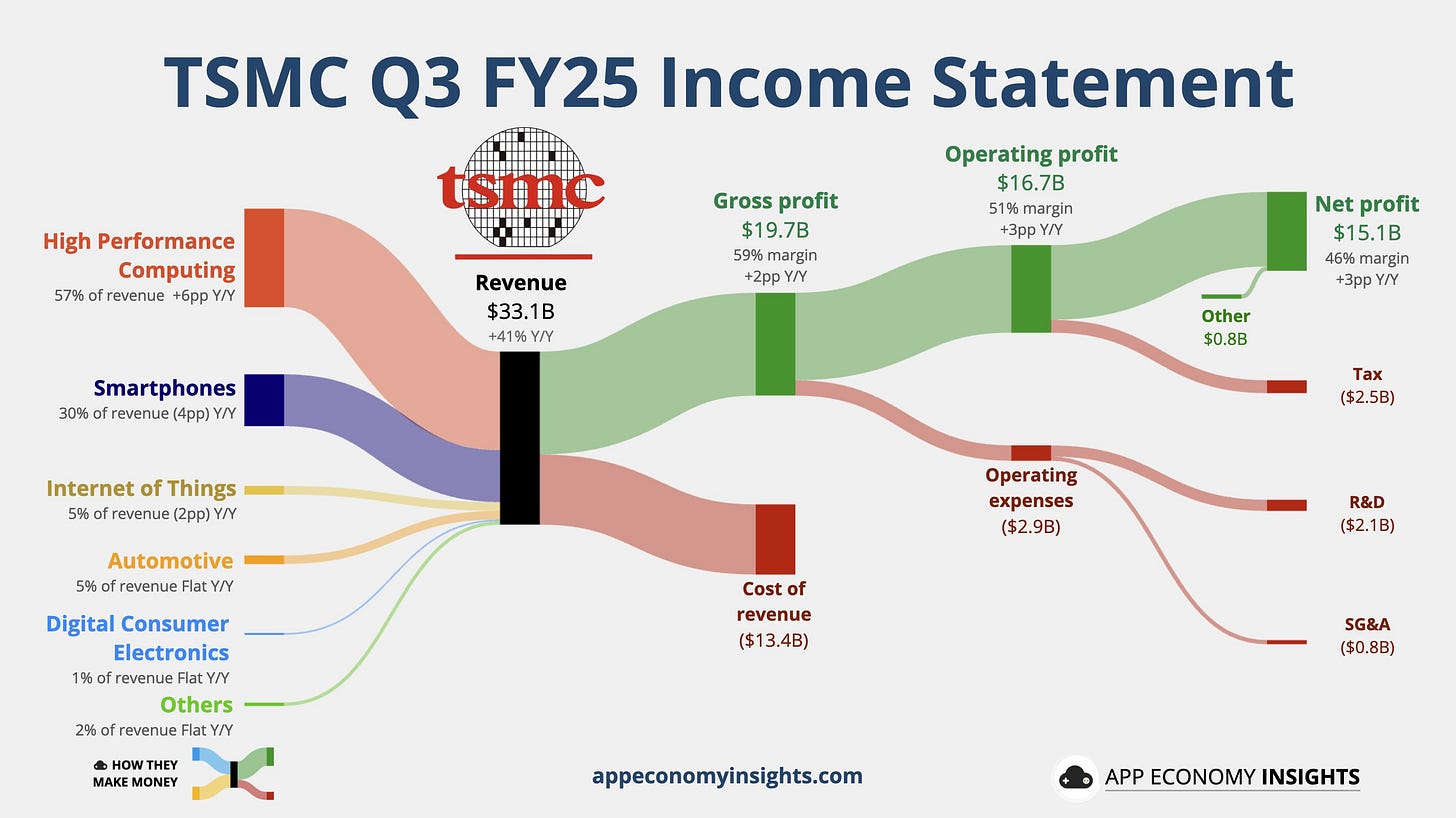

2) Taiwan Semiconductor (TSMC) - The Company That Makes Everyone Else’s Chips

TSMC manufactures 90% of the world’s most advanced processors. Revenue is up 30%. Earnings are up 39%. They make the chips for Nvidia, Apple, AMD, and basically everyone who matters. If AI is real, TSMC prints money. If AI is a bubble, TSMC still makes chips for phones, computers, and cars.

Why this is the perfect positioning: Investors are arguing about whether AI is worth trillions or nothing. You don’t need to have that argument. Because regardless of the answer, somebody has to manufacture the chips. And that somebody is TSMC.

It’s like the 1849 California Gold Rush. Some miners struck gold. Most went broke. But Levi Strauss sold jeans to all of them and became a legend. TSMC is Levi Strauss. They win either way.

The moat that matters: A “moat” in investing means a competitive advantage that’s hard to overcome. TSMC has the widest moat in semiconductors.

Samsung tried to compete. They’re 5+ years behind. Intel tried to compete. They’re failing and now begging TSMC to manufacture their chips. Why? Because building a state-of-the-art semiconductor facility costs $20-30 billion and takes 5-7 years. Even if you spend the money, you still need the expertise. TSMC has both.

Warren Buffett loves companies with moats. He once said: “In business, I look for economic castles protected by unbreachable moats.” TSMC’s moat is their manufacturing expertise and their relationships with every major tech company on earth.

The numbers that matter: TSMC just posted $33.1 billion in revenue. That’s real money. Real profits. Not projected earnings in 2030. Not “total addressable market” nonsense. Actual revenue. Today.

Compare this to companies like Palantir or C3.ai that are valued on future hopes. TSMC is making money now. And as AI spending explodes, they’ll make even more.

The long-term catalyst: Data center spending could hit $4 trillion over the next 5 years. Every dollar spent on data centers requires chips. Advanced chips. The kind only TSMC can make at scale.

Think about it: OpenAI needs chips to train models. Google needs chips for search. Microsoft needs chips for Azure. Amazon needs chips for AWS. Tesla needs chips for self-driving. Apple needs chips for iPhones. They all buy from TSMC.

The risks: TSMC has one massive risk: Geopolitics. The company is based in Taiwan. If China invades Taiwan (a real possibility), TSMC’s factories could be destroyed or seized. This would be catastrophic.

That’s why TSMC is building factories in Arizona and Japan. They’re diversifying away from Taiwan. But most of their production is still there. This geopolitical risk keeps the stock cheaper than it should be. (Which creates opportunity for investors who can handle the risk.)

The contrarian argument: Some investors say TSMC’s valuation is too high. “It’s priced for perfection,” they claim. But here’s the counterargument: If AI really takes off, TSMC is undervalued. If data center spending hits $4 trillion, TSMC could triple revenue. At that scale, today’s price looks cheap.

The question is: Do you believe AI is real? If yes, TSMC is a buy. If no, stay away.

My advice:

The bull case scenario:

AI spending explodes

TSMC captures most of the chip manufacturing revenue

They successfully diversify away from Taiwan geopolitical risk

Stock doubles or triples over 5 years

The bear case scenario:

AI spending disappoints

Competition catches up (unlikely but possible)

China invades Taiwan and destroys factories

Stock drops 30-50%

The Charlie Munger principle: Munger loved companies with “inevitability.” He’d ask: “What’s inevitable about this business?” For TSMC, the inevitability is this: Technology gets more advanced every year. More advanced technology requires more advanced chips. TSMC makes the most advanced chips.

That’s not a guarantee. But it’s about as close to inevitable as you get in technology.

Final thought on TSMC: If you believe AI infrastructure spending is real, TSMC is one of the safest ways to profit. They have the moat, the revenue, the earnings, and the relationships. The only real risk is geopolitical. If you can stomach that risk, TSMC belongs in your portfolio.

Advice: Do you believe advanced chips will remain important? (The answer is yes.) Then buy TSMC. If it drops and nothing fundamentally changes, add more. Over 5-10 years, you’ll likely be glad you did.

3) NextEra Energy (NEE) - Powering the Digital Revolution

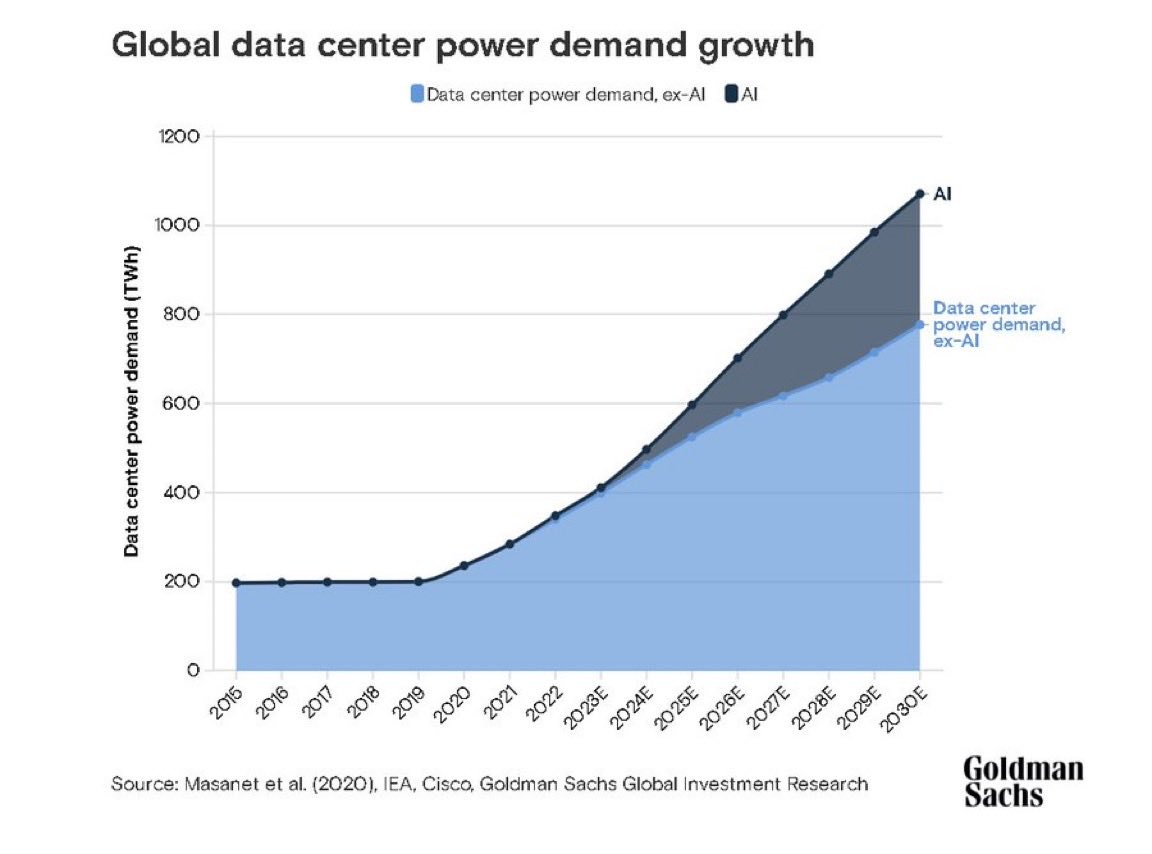

AI data centers consume staggering amounts of electricity. NextEra Energy is the largest clean energy producer in America. They own 39 gigawatts of power generation, with 30 more gigawatts in the pipeline. They’re spending $75 billion through 2028 to build the infrastructure AI needs.

Why everyone misses this play: Investors chase sexy AI stocks. Nvidia. OpenAI. Microsoft. Nobody thinks about where the electricity comes from to power all those servers.

But here’s reality: ChatGPT training runs use as much electricity as 1,000 homes for a month. Multiply that by thousands of AI companies training millions of models, and you’ve got an electricity crisis.

NextEra Energy solves that crisis. And they’re getting paid billions to do it.

The Peter Thiel framework: Thiel asks: “What important truth do very few people agree with you on?” Here’s mine: Energy infrastructure will be the biggest AI winner, not the AI software companies.

Why? Because software is infinitely scalable. Once you build ChatGPT, serving one million users costs almost the same as serving one billion users. Profit margins are insane.

But electricity? It’s the opposite. You need real infrastructure. Real power plants. Real transmission lines. Real capital expenditures. And real government approvals that take years. Supply is constrained. Demand is exploding. That’s the formula for pricing power.

NextEra owns the infrastructure everyone needs. They’re positioned at the bottleneck.

The long-term mega-trend: U.S. electricity demand has been flat for 20 years. Now forecasters expect it to go hyperbolic over the next 25 years. AI data centers are the main driver, but it’s also electric vehicles, crypto mining, and reshoring manufacturing.

This isn’t a 2-3 year trend. This is a multi-decade structural shift. NextEra is building for 2030, 2040, 2050. They’re thinking in decades while everyone else chases quarterly earnings.

The three-pronged advantage:

Advantage #1: Renewables Leadership NextEra operates more renewable energy than anyone in North America. Solar farms. Wind farms. Battery storage. They’re already building 6 gigawatts of renewable projects specifically for data centers.

Why this matters: Tech companies care about ESG (Environmental, Social, Governance). They don’t want to power AI with coal. They want clean energy. NextEra provides it at scale.

Advantage #2: Natural Gas Expertise Renewables are great, but they’re intermittent. (The sun doesn’t always shine. The wind doesn’t always blow.) You need backup power. That’s where natural gas comes in.

NextEra partnered with GE Vernova to build gas-fired power plants specifically for data centers over the next four years. This gives them speed to market that others can’t match.

Advantage #3: Nuclear Capability NextEra owns a large nuclear fleet. They’re restarting the Duane Arnold nuclear plant in Iowa to power AI data centers. They’re also exploring small modular reactors (SMRs) for future projects.

Nuclear is controversial. But it’s also the only carbon-free baseload power source that works 24/7. As AI power demands surge, nuclear becomes essential.

The Warren Buffett parallel: Buffett owns utilities through Berkshire Hathaway Energy. Why? Because utilities are regulated monopolies with predictable cash flows. They’re boring. But boring makes money.

Buffett famously said: “I try to buy stock in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will.”

Utilities are idiot-proof. People need electricity. The government guarantees you a profit. You invest in infrastructure, charge customers, and collect checks. It’s not sexy. But it works.

NextEra has that same boring stability. Except they also have the AI growth catalyst. You’re getting utility safety with tech growth. That’s rare.

The earnings growth story: NextEra expects earnings to grow 6-8% annually through 2027. That might not sound exciting compared to AI stocks promising 50% growth. But here’s the key: NextEra actually delivers. AI stocks promise 50% and often deliver zero.

Plus, 6-8% annual earnings growth usually translates to 10-12% annual stock returns when you include dividends. Do that for 20 years and you’ve tripled your money. With way less risk than betting on speculative AI companies.

The dividend advantage: NextEra pays a dividend (currently yielding around 2-3%). This might not seem like much, but it’s important for two reasons:

It forces discipline. Companies paying dividends can’t blow money on stupid acquisitions or executive bonuses. They have to generate real cash.

It compounds returns. If you reinvest dividends, you buy more shares. Those shares pay more dividends. Which buy more shares. Over decades, dividend reinvestment creates serious wealth.

The risks: NextEra’s main risks are regulatory and execution. They need government approval for new projects. They need to build massive infrastructure on time and on budget. If either fails, growth slows.

Also, if interest rates stay high, their borrowing costs increase. (They’re borrowing $75 billion to fund expansion.) Higher rates squeeze profit margins.

But compared to the risk of betting on which AI company wins, these risks are manageable.

10-year vision: Imagine it’s 2035. AI is everywhere. Data centers cover the landscape. Electricity demand has doubled. Where did all that electricity come from?

Companies like NextEra that built the infrastructure today. They’ll be worth multiples of their current value. And they’ll be paying fat dividends to shareholders who bought in 2025 and held on.

Final thought on NextEra: It’s the smartest “boring” play on AI. You’re not betting on which software wins. You’re betting that AI needs electricity. (Spoiler: It does.) And you’re buying the company best positioned to provide it.