💥Investing Insights & Market Analysis [Oct 20, 2025]

Government shutdown costs $15 billion per day, U.S. debt growing faster than the economy, Hiring at lowest since 2009, Gold now the most valuable asset, Regional banks are getting destroyed, and more!

👋Good morning my friend and thank you for joining 108,000+ investors who trust this newsletter to become smarter with money, investing, and the economy!

Each issue takes a few days to write and research, so if you enjoy reading, please hit the ❤️LIKE button on this post to help us grow on Substack (and you can get a 30-day free trial of our newsletter with this link)

📬This week, we discuss:

Part I — Market Update:

1) Market & Economic Analysis

2) Top 5 Finance Events this Week

3) 3 Important Charts

Part II — Stock Market Research:

4) My Stock Picks & Research

5) Billionaire, Politician & CEO Insider Trades

6) Trade of the Week

7) Top 5 Stocks this Week

8) 5 Stocks to Watch (Important Earnings this Week)

Part III — Real Estate Analysis:

9) Real Estate & Housing Market Analytics

10) Interest Rate Predictions

Part IV — Economic & Marco Insights:

11) Market Sentiment & Economic Outlook

12) Technical Analysis [S&P 500, Tech Stocks, Bitcoin]

13) 3 Important Events this WeekBut before we get into it, please help us and:

Hit the ❤️LIKE button on this post and help us grow on Substack 🙏

Share this newsletter with friends & family to help them get smarter with money, investing, and the economy!

1. Market & Economic Analysis:

Everything you need to know:

Banks took a big hit this week. The Nasdaq Banks index dropped 5.6% (that’s a lot!). Investors got nervous about regional banks having more trouble with loans. Think of it like when your friend borrows money and you start worrying they won’t pay you back - that’s what’s happening with these banks.

Three other things made investors worried too: a possible government shutdown, trade tensions with other countries, and two car companies going bankrupt. When investors worry, they often sell stocks, which pushes prices down.

Meanwhile, gold and silver hit record highs! Gold is now up 63% this year and became the first asset ever worth over $30 trillion. When stocks fall, many people buy gold because they see it as a safe place to put their money.

Here’s how it all connects: When people worry about banks and the economy, they often sell stocks and buy gold instead. This week, we saw that exact pattern play out.

💡Andrew’s Deep Dive:

Why This Week Matters More Than You Think

You just watched a massive trust crisis unfold in real time. And if you don’t understand what happened, you’re going to miss the bigger picture (and the money-making opportunities hiding inside it).

Two regional banks just revealed they’re holding bad loans. JPMorgan’s CEO Jamie Dimon said something that should make you listen: “When you see one cockroach, there are probably more.” He wasn’t joking. Regional banks are sitting on massive commercial real estate exposure (44% of their loan portfolios) while property values tank and interest rates stay high.

Here’s what bothers me: Over $1 trillion in commercial real estate loans come due by the end of this year. These loans were made when rates were low. Now? Companies can’t refinance without bleeding cash. Some won’t refinance at all. They’ll just default.

The Government Shutdown Isn’t Just Politics

The government shut down October 1st, and we’re now over two weeks in with no end in sight. Roughly 1.4 million federal workers aren’t getting paychecks. That might sound like Washington’s problem, but it’s yours too.

Think about it: When millions of people stop spending money (because they’re not earning any), the entire economy feels it. Restaurants see fewer customers. Retailers watch sales drop. Small businesses that depend on government contracts? They’re drowning.

Warren Buffett once said, “Only when the tide goes out do you discover who’s been swimming naked.” The government shutdown is that low tide. And we’re about to see which businesses have been operating without a safety net.

The Trade War Is Costing You Money

US-China trade tensions just escalated again. China expanded export controls on rare earth elements (the materials that goes into your phone, your car, and every piece of tech you own). They also launched an antitrust investigation into Qualcomm and slapped fees on US-owned ships.

What this means for you: Prices go up. Innovation slows down. Your investment portfolio takes a hit because companies can’t get the materials they need to build products.

J.P. Morgan downgraded global GDP growth to 2.2% for 2025. Translation? The world economy is about to pump the brakes hard.

Gold Just Hit $30 Trillion (And That’s a Warning Signal)

Gold’s market cap is now around $27-30 trillion. It’s up over 56% this year alone. Let me be clear: Gold doesn’t go up because the economy’s doing great. Gold goes up because people are terrified.

When you see gold prices exploding, it means investors don’t trust:

The dollar

The banks

The stock market

Politicians to fix anything

Central banks (especially in Asia and the Middle East) are buying gold hand over fist. They’re diversifying away from US dollars. That’s not a vote of confidence in America’s current economy.

What History Teaches Us

Remember 2008? It started with a few banks having “isolated” problems with subprime mortgages. Everyone said it was contained. Then Lehman Brothers collapsed, and the entire global financial system nearly died.

Office loan delinquency rates are now at 10.4% (approaching 2008 levels). This is the fastest spike in history. If you’re not paying attention, you’re making the same mistake people made in 2007.

Steve Jobs once said, “You can’t connect the dots looking forward; you can only connect them looking backward.” Well, here are the dots: failing regional banks + government dysfunction + trade wars + record gold prices + commercial real estate crisis. When you connect them, they spell recession.

How To Profit From This

Let’s get tactical. Here’s what you do right now:

1. Rebalance Your Portfolio Toward Safety

Move 10-15% of your stock holdings into defensive sectors. Think utilities, consumer staples, healthcare. These companies sell stuff people need no matter what the economy does. Utilities are up 22% this year and keep making new highs. There’s a reason.

2. Get Some Gold Exposure

You don’t need to buy physical gold bars and bury them in your backyard. Buy a gold ETF instead. It’s liquid, easy to trade, and you don’t have to worry about storage. Aim for 5-10% of your portfolio. This is your insurance policy.

Gold averaged 7.9% annual returns from 1971 to 2024. Not spectacular, but it protects you when everything else is burning down.

3. Short Regional Banks (Or Just Avoid Them Completely)

Regional banks like Zions, Western Alliance, Valley National Bank, and Synovus Bank are in serious trouble. Some are using “extend and pretend” strategies (basically kicking the can down the road by restructuring bad loans instead of admitting they’re worthless).

If you own regional bank stocks, sell them. If you’re feeling aggressive, you can buy put options on regional bank ETFs. Just know that timing the market is hard. The safer play? Stay away entirely.

4. Build Your Cash Position

I know, cash feels boring when stocks have been ripping higher. But 80% of S&P 500 companies closed lower on Thursday. The VIX (Wall Street’s fear gauge) jumped 22.6% and hit its highest level since May.

When fear spikes, you want cash sitting on the sidelines ready to buy great companies at fire-sale prices. Aim for 15-20% of your portfolio in cash or money market funds. When the crash comes (and it’s coming), you’ll be the one buying while everyone else is selling in a panic

7. Avoid Commercial Real Estate Like The Plague

More than $1 trillion in CRE loans mature by end of 2025. Delinquency rates for office loans are approaching 10.4%. If you own REITs (especially office REITs), get out now. The pain is just beginning.

7. Watch For Buying Opportunities In Tech

Here’s the contrarian play: Tech stocks got hammered this week on trade war fears. China’s rare earth export controls hurt semiconductor companies. But over the long term, AI and technology aren’t going anywhere.

Don’t buy yet. Wait for more blood. But start building a watch list. When fear peaks and everyone’s selling, that’s when you back up the truck and load up on quality tech companies at a discount.

Personal Finance Lessons

Build a 12-month emergency fund. Not six months. Twelve. 1.4 million federal workers just got a brutal reminder that your paycheck can disappear overnight.

Pay down high-interest debt. If you’re carrying credit card balances at 20% interest, you’re bleeding money. Consumer debt just hit an all-time high of $17.7 trillion. Don’t be part of that statistic. Kill your debt before it kills your wealth.

Diversify your income streams. Relying on one job is risky. Start a side hustle. Invest in dividend-paying stocks. Build something that generates passive income. When the economy tanks, you want multiple lifelines.

Stop trying to time the market. Instead, use dollar-cost averaging. Invest a fixed amount every month no matter what the market does. Over time, this smooths out volatility and keeps you from making emotional decisions.

Final Thoughts on This Week

We’re watching trust collapse in real time. Banks are failing. The government can’t function. Global trade is fracturing. And gold is screaming that something’s wrong.

This isn’t the time to be a hero. It’s the time to be smart, defensive, and patient. The investors who win over the next 12-24 months won’t be the ones chasing returns. They’ll be the ones who protected their wealth when everyone else was pretending everything was fine.

Remember: Every crisis creates opportunities. But only if you’re prepared. Only if you have cash ready. Only if you’re not overleveraged and desperate.

What you do right now matters. Adjust your portfolio. Build your cash position. Cut your debt. Diversify your income. And whatever you do, don’t stick your head in the sand and hope this all blows over.

It won’t.

The question isn’t whether things get worse. The question is whether you’ll be ready when they do.

👉 For daily insights, follow me on Twitter/ X, Instagram Threads, or BlueSky, and turn on notifications!

2. Top 5 Finance Events this Week:

This week, we analyze:

1) Without data centers, GDP growth was 0.1% in the first half of 2025.

2) U.S. Treasury Now Says Government Shutdown is Costing the Economy $15 Billion Daily.

3) 47% of Americans Say Groceries are Harder to Afford than They Were Last Year.

4) 58% of Students Who Graduated Within the Past Year are Still Looking for a Job. Hiring is at its Lowest Level since 2009.

5) Walmart Stock Hits All-time High after Announcing Partnership with OpenAI.1️⃣ Without data centers, GDP growth was 0.1% in the first half of 2025.

According to Harvard economist Jason Furman, if you remove data center construction and information technology investment from our economic growth, the U.S. economy barely grew at all in the first half of 2025 - just 0.1% annualized. This reveals something troubling: our entire economic engine is being pulled forward by the AI boom.

The economy is becoming increasingly dependent on a handful of tech giants building data centers. Companies like Microsoft, Google, Amazon, and Meta are spending hundreds of billions on AI infrastructure, which is essentially propping up our GDP numbers.

The long-term picture: This concentration of economic growth in one sector creates both opportunity and risk. Think of it like a table with one very long leg and three short ones - it might stand for now, but it’s not very stable. If AI investment slows down, our economy could stumble badly.

My Advice:

Consider diversifying beyond just big tech. While AI companies are driving growth, remember the old saying: “Don’t put all your eggs in one basket.” Look at companies in different sectors that might benefit from AI technology without being directly involved in building it.

Rotate into AI infrastructure plays that aren’t pure tech. Think utilities and energy companies. All those data centers need massive amounts of electricity. Companies providing power infrastructure (like NextEra Energy or Duke Energy) will make money whether AI succeeds or fails. The data centers still need to run.

If 92% of economic growth is coming from one sector, your career better not be in one of the other sectors. This is your signal to upskill. Learn AI tools. Get comfortable with ChatGPT, Claude, and other platforms. Even if your job has nothing to do with tech, the companies that survive the next decade will be the ones using AI.

Take an online course this month. Coursera, Udemy, and YouTube have thousands of AI tutorials. Spend 30 minutes a day learning. In six months, you’ll have skills that make you more valuable than 90% of your competition.

Develop skills that complement AI rather than compete with it. As data centers expand, there’s growing demand for technicians who can maintain them, project managers who can oversee construction, and specialists who can optimize energy usage. These jobs pay well and are less likely to be automated.

2️⃣ U.S. Treasury Now Says Government Shutdown is Costing the Economy $15 Billion Daily.

The Treasury Department reported that the ongoing government shutdown is bleeding our economy of $15 billion every single day. That’s like watching $625 million vanish every hour, or more than $10 million every minute.

When the government shuts down, it’s not just politicians who suffer. Federal workers go without paychecks, government contracts stall, and businesses that depend on government work face uncertainty. This creates a ripple effect that touches everyone.

The long-term picture: Government shutdowns have become political weapons in recent years. They’re like a game of chicken where both sides risk damaging the economy to prove a point.

Advice:

During government shutdowns, consider defensive sectors like utilities and consumer staples. These companies tend to hold their value better during political uncertainty. If you have a long investment horizon, market dips during shutdowns can actually present buying opportunities for quality stocks at temporary discounts.

Build an emergency fund that covers 3-6 months of expenses. Government shutdowns remind us how quickly income can disappear due to factors beyond our control. Having cash reserves means you won’t have to sell investments at the wrong time or go into debt during unexpected crises.

3️⃣ 47% of Americans Say Groceries are Harder to Afford than They Were Last Year

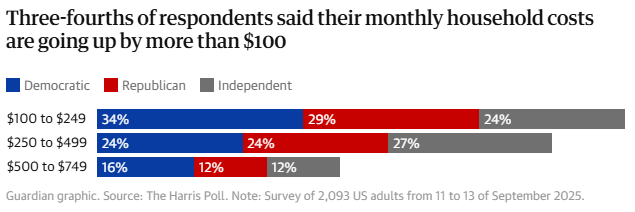

A Harris/Axios poll found that 47% of Americans say groceries are harder to afford than last year. A separate Guardian poll showed that 74% of Americans report their monthly household costs increased by at least $100. Some saw increases of $700+ per month.

The math is brutal. The Yale Budget Lab calculated that Trump’s tariffs alone will cost the average household $2,300 per year. That’s $191 per month. And that’s just tariffs. Add in regular inflation, and you’re looking at serious damage to family budgets.

Here’s what’s crazy: The official inflation rate is down to 2.9% annually. That sounds great until you remember that prices don’t go back down when inflation slows. If eggs cost $8 last year and “only” go up 3% this year, you’re still paying $8.24. They’re never going back to $3.

This creates a psychological phenomenon called “inflation memory.” People remember what things used to cost. Every time they buy groceries, they feel the pain of higher prices. Even if wages go up 4%, it doesn’t matter. The sticker shock at checkout makes people feel poorer.

When people feel broke, they change their spending habits fast. They trade down from name brands to store brands. They skip restaurants. They delay big purchases. This creates a vicious cycle where businesses see sales drop, so they cut workers, which means even fewer people can afford groceries.

We’re watching a slow-motion economic crisis unfold at the grocery store level. And it’s hitting everyone across political lines. Democrats, Republicans, and independents all report the same pain.

Advice

Buy shares in discount grocers. Walmart’s already hitting all-time highs because people are trading down. Aldi, Costco, and dollar stores are winning this fight. These stocks will keep climbing as long as inflation stays high.

Join a warehouse club. Costco or Sam’s Club memberships pay for themselves in three trips. Buying in bulk cuts your per-unit costs by 30-50%. Sign up this week. Yes, the $60 membership fee hurts. But you’ll save $200+ in the first month.

Use cash-back apps religiously. Ibotta, Fetch, and Rakuten give you money back on stuff you’re already buying. Download all three right now. Set up your accounts. Link your loyalty cards. This is free money you’re leaving on the table.

Embrace store brands. The store-brand cereal is made in the same factory as the name brand. You’re paying $3 extra for a box with Tony the Tiger on it. Switch five items to store brand this month. Track how much you save.

4️⃣ 58% of Students Who Graduated Within the Past Year are Still Looking for a Job. Hiring is at its Lowest Level since 2009.

Fortune reported that 58% of recent college graduates are still hunting for jobs. That’s more than double the 25% unemployment rate previous generations faced. Meanwhile, hiring is at its lowest level since 2009 (the peak of the financial crisis). Challenger, Gray & Christmas found that companies announced 946,426 layoffs through the first three quarters of 2025. That’s already 24% higher than all of 2024.

But here’s the real problem: Companies announced only 204,939 new hires this year. That’s down 58% from last year and the lowest since 2009.

Let that sink in. We’re not in a declared recession. The stock market keeps hitting record highs. And yet the job market looks like we’re in the middle of a financial crisis.

What’s happening? Companies are using AI to replace entry-level workers. They’re also getting pickier about who they hire. And the government shutdown is making everything worse because businesses can’t get clarity on contracts, regulations, or economic data.

There’s a concept called the “experience trap.“ Companies want people with experience. But you can’t get experience without getting hired. It’s a catch-22 that’s crushing young workers right now. And it’s not just them. Layoff rates are up across the board.

Advice

This job crisis creates investment opportunities. When hiring’s this bad, retailers that cater to budget-conscious consumers win. Walmart, Dollar General, and discount chains thrive when people have less money. They’re also the last to cut workers because they need bodies on the floor.

Consider shorting recruiting companies and HR software firms. If nobody’s hiring, companies aren’t paying for expensive recruiting tools. Companies like ZipRecruiter will see revenue craters.

If you’re job hunting right now, here’s what works: