💥Investing Insights and Market Analysis (Oct 27, 2025)

US debt hits $38 Trillion, Recession probability now at 93%, 67% of consumers now live paycheck to paycheck, Health insurance premiums are up 365%, Americans can no longer afford cars, and more!

👋Good morning my friend and thank you for joining 108,000+ investors who trust our newsletter to get smarter with money, investing, and the economy!

Each issue takes a few days to write and research, so if you enjoy reading, please hit the ❤️LIKE button on this post to help us grow on Substack (and you can get a 30-day free trial of our newsletter with this link)

📬This week, we discuss:

Part I — Market Update:

1) Market & Economic Analysis

2) Top 5 Finance Events this Week

3) 3 Important Charts

Part II — Stock Market Research:

4) My Stock Picks & Research

5) Insider Trades from Billionaires, Politicians & CEOs

6) Trade of the Week

7) Top 5 Stocks this Week

8) 5 Stocks to Watch (with Earnings this Week)

Part III — Real Estate Analysis:

9) Real Estate & Housing Market Analytics

10) Interest Rate Predictions

Part IV — Economic & Marco Insights:

11) Market Sentiment & Economic Outlook

12) Technical Analysis [S&P 500, Tech Stocks, Bitcoin]

13) 3 Important Events this WeekBut before we get into it, please help us and:

Hit the ❤️LIKE button on this post and help us grow on Substack 🙏

Share this newsletter with friends & family to help them get smarter with money, investing, and the economy!

1. Market & Economic Analysis:

Everything you need to know this week:

Markets are at record highs. The S&P 500, Dow, and Nasdaq all reached new peaks. Three things pushed stocks higher.

First, inflation came in lower than expected. This means the Federal Reserve will likely cut interest rates soon. (When rates drop, borrowing gets cheaper, and that’s good for business and stock prices.)

Second, President Trump will meet with China’s President Xi next Thursday. This gave investors hope that the trade war might cool down. Less tension with China means less uncertainty for businesses.

Third, the government shutdown looks like it’ll end this week. White House advisor Kevin Hassett said so, and that removed another worry from investors’ minds.

It wasn’t just the US hitting record highs. The UK’s FTSE 100, Europe’s Stoxx 600, and Japan’s Nikkei 225 all hit record highs too. Global markets moved together on political optimism.

The US national debt hit $38 trillion, a new all-time high. That’s a growing concern for the long term.

Corporate earnings:

Intel beat expectations and turned profitable for the first time since 2023. Its turnaround plan is working, helped by a partnership with the US government.

Tesla beat revenue targets as buyers rushed to use expiring EV tax credits. But profits dropped hard. The company’s spending billions on expansion (CapEx), cutting prices to compete, struggling in Europe due to political backlash, and losing over $400 million to tariffs.

Netflix missed earnings because of a Brazilian tax issue. But revenue grew 17%, ad sales hit records, and the company expects another 17% revenue jump next quarter.

American Express crushed it. Strong earnings, higher sales outlook, and demand for its redesigned Platinum card doubled in the US.

💡Andrew’s Deep Dive & Analysis:

Markets

The stock market right now is like a big party where everyone’s excited because things are going well. The S&P 500, Dow, and Nasdaq hitting new highs means people are feeling good about the economy. Why? Because inflation (that’s when prices go up) was lower than expected. This makes people think the Federal Reserve might lower interest rates soon. Lower interest rates make it cheaper to borrow money, which is good for businesses and consumers.

Think of it like this: If you’re thinking about buying a house and interest rates drop, you’ll be more likely to buy because your mortgage payments will be lower. The same goes for businesses—lower rates mean they can borrow money more cheaply to grow and hire more people.

The news about President Trump and President Xi meeting is also a big deal. When big countries get along, it’s good for trade and business. Remember the trade war a few years back? It was like a big fight that made things more expensive for everyone. If they can work things out, it could mean better deals and more stability for companies that do business in both countries.

And the government shutdown might end soon. That’s good news because when the government is open, it can keep doing its job, like paying workers and keeping services running.

National Debt

Here’s an uncomfortable truth: The US national debt keeps growing. It hit $38 trillion this week. Most people ignore this. That’s a mistake.

High debt means higher interest payments. (The government now spends more on interest than on defense.) That leaves less money for everything else. Eventually, something has to give—higher taxes, less spending, or inflation comes roaring back.

Global Markets

Over in Europe and Japan, their stock markets are also doing well. This is good because when other countries do well, it can help our economy too. For example, if Europe is doing well, they might buy more goods from the US, which helps American companies.

Corporate Earnings

Intel’s “Comeback”: Intel is a great story of a turnaround. They’re profitable again and partnering with the government. This shows the power of patience and investing in companies that are fixing their problems. It’s a lesson in not writing a good company off too soon.

Tesla’s Warning Signs: Tesla shows you can’t just read the headline “beat revenue estimates.” Buyers rushed because a government incentive was about to expire—that’s a one-time boost. Their earnings plunged because of price cuts and huge spending. This is a classic red flag. Rising competition is squeezing their profits. This teaches us to always look at how a company makes its money, not just if it makes money.

Netflix’s Adaptation: Netflix missed earnings because of a tax issue in one country, but its core business—subscriptions and ads—is growing strong. This shows the power of a durable business model. Even when they hit a bump, the engine is still running well.

My Advice

Don’t panic-buy. Never go “all in” at the top. The single best strategy for most people is dollar-cost averaging (DCA). This is simple. You invest the same amount of money every single month (like $200) into a simple, broad market index fund (like an S&P 500 fund). If the market is high, your $200 buys fewer shares. If the market drops, your $200 buys more shares at a discount. It’s automatic. It removes emotion. It’s how you build wealth slowly and surely.

Look for strength. When you look at companies, look for strength. Companies that need to borrow a lot of money will get crushed if rates stay high. Companies with lots of cash and low debt will win in any economy. They own themselves. They don’t need the bank.

Build your “anti-shutdown” fund. The government shutdown is a powerful lesson. What if your paycheck stopped for three weeks? You need an emergency fund. This is 3-6 months of your bare-bones living expenses. Keep it in a simple, high-yield savings account. This isn’t an investment. It’s insurance against life. It gives you the power to walk away from a bad job or survive a layoff.

Inflation is “tame,” not dead. The rate of price increases slowed, but prices are still high. Your cash in a checking account is still losing buying power every day. After you pay off bad debt and build your emergency fund, you must invest just to keep your purchasing power.

Fix your own debt. The government is a terrible role model. You must do the opposite. High-interest debt (like credit cards) is a five-alarm fire. Pay it off now. Getting rid of 22% interest debt is a guaranteed 22% return on your money. You can’t beat that in the stock market.

👉 For daily insights, follow me on Twitter/ X, Instagram Threads, or BlueSky, and turn on notifications!

2. Top 5 Finance Events this Week:

This week, we analyze:

1) US hits $38 trillion in debt, after the fastest accumulation of $1 trillion outside of the pandemic.

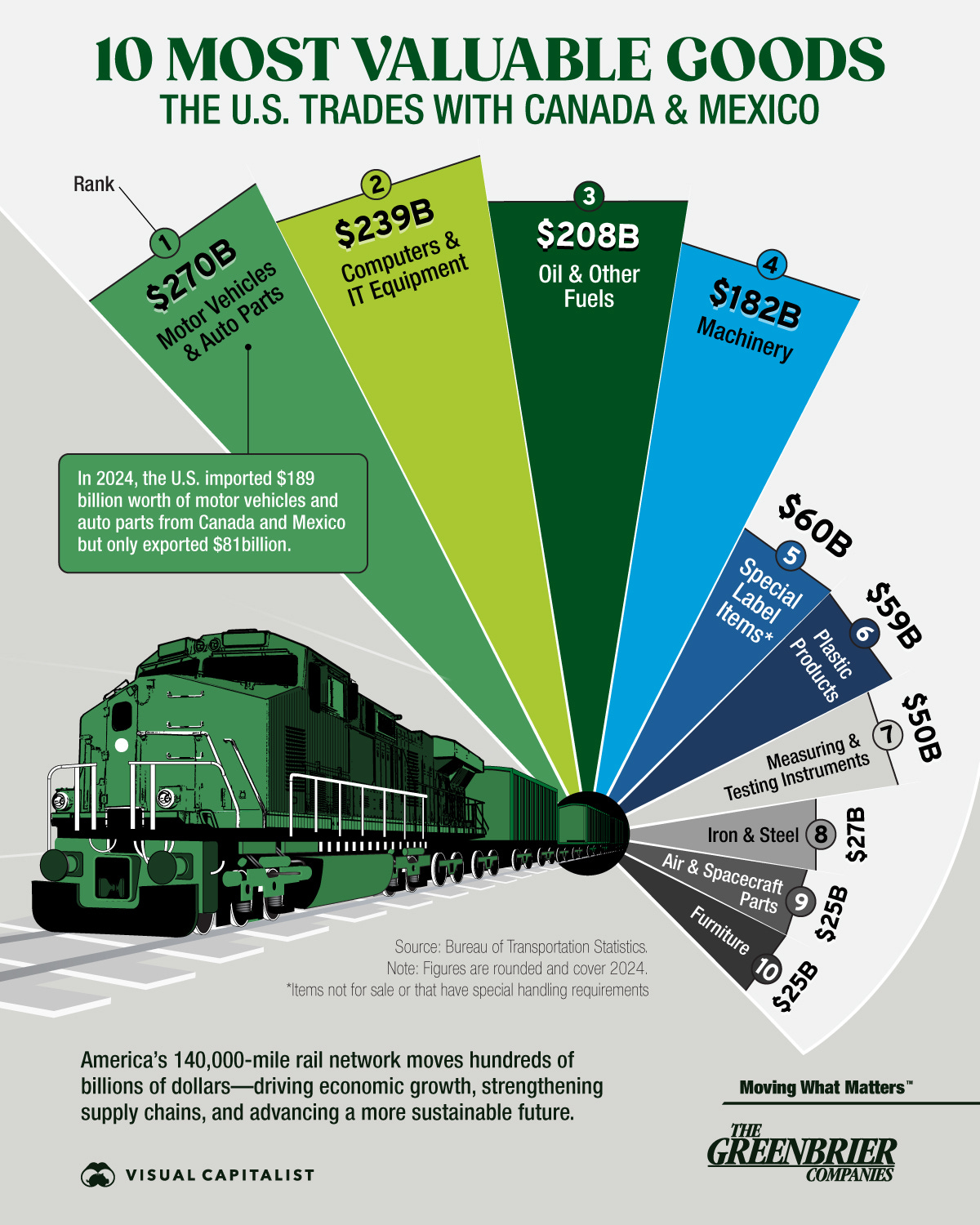

2) President Trump terminates all trade negotiations with Canada.

3) Recession warning: US recession probability now at a staggering 93%, says UBS.

4) Americans can’t afford their cars any more and Wall Street is worried. Goldman Sachs’ president warns ‘it’s not going to be pretty’ as default fears mount.

5) Intel stock jumps as Q3 earnings beat expectations, AI drives chip demand.1️⃣ US hits $38 trillion in debt, after the fastest accumulation of $1 trillion outside of the pandemic.

The US just crossed $38 trillion in debt. We added $1 trillion in debt faster than any time outside COVID. Think about that. A trillion dollars. In less than two months.

Here’s what nobody’s telling you: This isn’t just a government problem. It’s your problem.

When the government borrows this much money, someone has to lend it. That someone is often you—through your retirement accounts, your pension, your bank. And when debt piles up this fast, bad things follow.

The Three Paths Forward (None Are Great)

The government has three options when debt gets this high:

Option 1: Cut spending. But nobody wants to cut. Not defense. Not Social Security. Not Medicare. Every program has defenders. (Good luck telling grandma her benefits are shrinking.)

Option 2: Raise taxes. This slows the economy. People have less money to spend. Businesses have less money to invest. Growth stalls.

Option 3: Inflate the debt away. This is the sneaky option. Print more money. Let inflation eat away at the debt’s value. Your $100 today becomes worth $80 tomorrow, but the government’s $38 trillion debt also becomes worth less.

Guess which option governments usually pick? Option 3. Every time.

That’s why your grocery bill keeps rising. That’s why houses cost more. That’s why everything feels expensive. The government’s debt problem becomes your inflation problem.

Why This Matters to YOU

This is not some abstract government problem. This debt will hit your wallet in three ways:

Higher borrowing costs: Mortgages, car loans, and credit cards will get more expensive

Your money buys less: More debt often leads to higher inflation, which erodes your purchasing power

Future tax uncertainty: Eventually, someone has to pay this back, and that often means higher taxes down the road

What Warren Buffett Would Tell You Right Now

Buffett’s been through this before. He saw the 1970s when inflation hit 13%. He watched people’s savings get destroyed. And he learned a critical lesson: Own things that hold value when dollars lose value.

During high inflation, cash is trash. (If inflation runs 7% and your savings account pays 3%, you’re losing 4% per year.) But certain assets protect you:

Real estate. You can’t print more land. As inflation rises, so do rents and property values.

Stocks in the right companies.

Commodities. Gold and Bitcoin. These are real things with real value. Paper money comes and goes. Gold’s been valuable for 5,000 years.

My Advice: Three Moves to Make This Month

1. Stop holding too much cash. If you’ve got more than 6 months of expenses in savings, that’s too much. Move the excess into inflation-protected investments. Consider I-Bonds (currently paying 4.66%) or Treasury Inflation-Protected Securities (TIPS). These adjust with inflation so you don’t lose purchasing power.

2. Fix your debt costs now. If you’ve got variable-rate debt (credit cards, adjustable mortgages, variable student loans), lock in fixed rates while you can. When inflation rises, so do interest rates. The Federal Reserve will eventually have to fight inflation by raising rates. When that happens, your payments could double.

3. Buy assets that inflation can’t destroy. Start small. Maybe that’s a rental property. Maybe it’s a basket of dividend-paying stocks. Maybe it’s starting a side business. The point is: own things that generate income and appreciate in value. Don’t just save dollars that shrink.

2️⃣ President Trump terminates all trade negotiations with Canada.

Trump terminated all trade negotiations with Canada. Not paused. Not delayed. Terminated.

Canada’s our biggest trading partner. We buy $440 billion worth of stuff from them every year. Oil. Lumber. Cars. Food. All of it just got complicated.

The Domino Effect Nobody Sees

Here’s how trade wars work: Everyone loses, but some lose faster than others.

When we stop trading with Canada, three things happen immediately:

First, prices rise. That lumber for your house? More expensive. That oil heating your home? More expensive. Those auto parts in your car? You guessed it—more expensive.

Second, companies suffer. American businesses rely on Canadian supplies. Break that chain and production slows. Workers get laid off. Earnings drop. Stock prices fall.

Third, retaliation starts. Canada doesn’t just sit there. They hit back. They stop buying American goods. Our farmers can’t sell wheat. Our manufacturers can’t export. Jobs disappear.

The Historical Parallel That Should Terrify You

We’ve seen this movie before. In 1930, Congress passed the Smoot-Hawley Tariff Act. They wanted to protect American jobs by taxing foreign goods. Sounds good, right?

It destroyed the economy. Other countries retaliated. Global trade collapsed by 66%. The depression deepened. Unemployment hit 25%. It took a world war to recover.

I’m not saying we’re headed for another Great Depression. But I am saying trade wars have never—not once in history—made anyone richer.

What This Means for Your Investments

Diversification just became critical. If you’re heavy in US-only stocks, you’re exposed. When trade breaks down, domestic companies suffer.

The smarter play: Own international exposure. European companies. Asian businesses. Emerging markets. When one country’s fighting, others are trading. Don’t tie your wealth to one government’s decisions.

My Framework: The “Trade War Protection Portfolio”

Here’s how to protect yourself:

30% US stocks – But focus on companies that don’t rely on imports. Utilities. Healthcare. Domestic services.

30% International stocks – Get exposure to companies outside the trade war. Think European consumer goods, Asian technology.

20% Commodities and real assets (Gold, Real Estate, Bitcoin) – These hold value regardless of who’s trading with whom.

20% Cash – For stability when stocks crash.

This isn’t about getting rich quick. It’s about not going broke when politicians make stupid decisions.

3️⃣ Recession warning: US recession probability now at a staggering 93%, says UBS.

UBS just said there’s a 93% chance of recession. That’s not a guess. That’s their model screaming “danger.”

Let me be clear: Nobody can predict recessions perfectly. But when smart people with good track records raise alarms, you listen.

The Warning Signs Are Everywhere

Recessions don’t happen randomly. They follow patterns. And right now, those patterns are flashing red.

The yield curve inverted. When short-term bonds pay more than long-term bonds, recession usually follows within 18 months. (It’s been accurate for the last 7 recessions.)

Consumer debt hit record highs. People are maxing out credit cards. That’s desperation spending, not healthy growth.

Layoffs are accelerating. Tech companies cut 100,000 jobs. Banks announced more cuts. When companies shed workers, they see something coming.

Profits are shrinking. Corporate margins are at five-year lows. Companies can’t pass costs to customers anymore. That’s the first sign demand’s weakening.

The Cognitive Bias That’ll Destroy Your Wealth

Here’s the trap most people fall into: Recency bias. Because markets have been strong recently, they assume it’ll continue. “Stocks only go up,” they say. “We’ve recovered from every dip before.”

That’s how people lose fortunes. They stay fully invested until it’s too late. Then they panic-sell at the bottom.

The professionals do the opposite. They prepare when times are good. They raise cash. They get defensive. They wait for the storm. And when everyone else is panicking, they buy the bargains.