💥Investing Research & Market Analysis [September 2, 2025]

Stock Market hits most expensive valuation ever, Nvidia earnings disappoint, Cars are so expensive that buyers need 7-year loans — Plus stock picks, insider trades, interest rate predictions & more

👋 Good morning my friend and welcome back to the #1 finance newsletter! I hope you had a great week!

Thank you for joining 108,000+ readers who trust our newsletter, dedicated to helping you get richer and smarter with your money!

If you enjoy reading our newsletter, please tap the LIKE button❤️ on this post so we can grow on Substack 🙏

And FYI, your job can likely cover the cost of this newsletter subscription. This newsletter is an educational resource and can likely be expensed through your job’s training budget/ professional development budget. To make the expensing process as easy as possible, we’ve created this email template that you can send to your manager.

📬This week we discuss:

Part I — Financial Insights:

1) Stock Market & Economic Analysis (and how it impacts YOU)

2) Most Important Financial Events This Week (and what it means for you)

3) Important Charts & Numbers (and why they matter)

🎯Premium Research & Analysis:

Part II — Stock Market Insights:

4) Stock Picks, Research, and Analysis (what every investor needs to know)

5) Billionaires, Politicians and CEO Insider Trading

6) Trade of the Week (options trading)

7) Best Performing Stocks This Week (catalysts, earnings, and news)

8) Important Earnings & Stocks to Watch

Part III — Real Estate Insights:

9) Real Estate Market Analysis & Predictions

10) Interest Rate Predictions & Current Rates

Part IV — Economic & Marco Insights:

11) Market Sentiment & Economic Outlook

12) Technical Analysis (S&P 500, Tech Stocks, Bitcoin)

13) Important Economic EventsBut before we get into it, please help us and:

Hit the LIKE button❤️ on this post so we can grow on Substack 🙏

Share this newsletter with your friends and family to help them get richer and smarter with money!

Become a paid subscriber and support us! (this newsletter takes 6-8 hours to research and write!)

1. This Week’s Stock Market & Economic Analysis (and how it will impact YOU):

Here’s everything you need to know that’s happening now:

The S&P 500 and Dow made new records. The S&P crossed 6,500 for the first time, then pulled back a bit into Friday’s close.

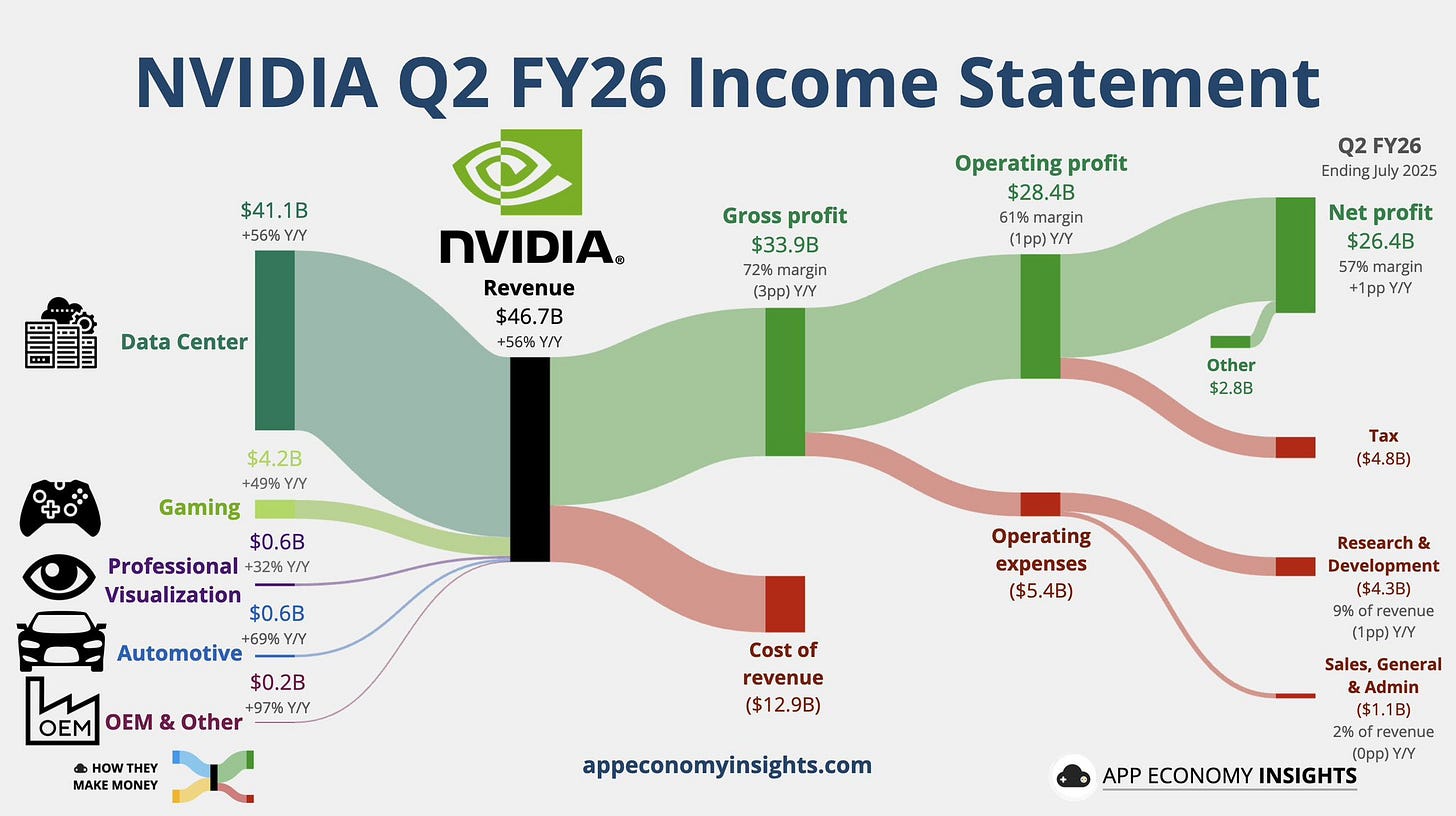

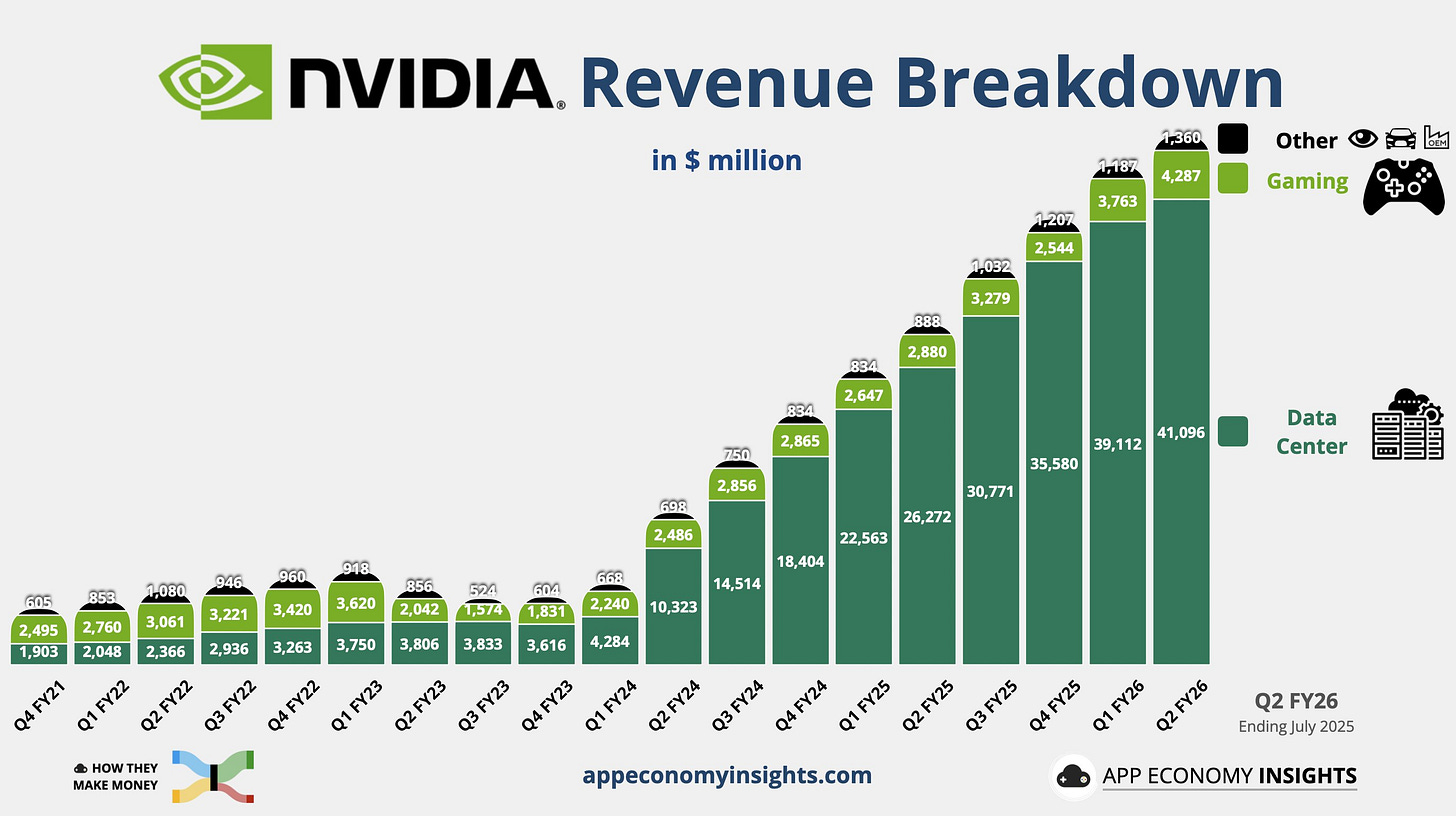

Nvidia: great results, mixed reaction. It beat on sales, profit, and guidance (+56% y/y revenue). But data center sales were a touch light, and the company excluded China from its outlook. The stock fell ~3%.

Gold prices reached record levels as traders worried about the Fed's independence.

Bitcoin hit a 7-week low.

Fertilizer prices jumped to the highest since at least 2016 on tariff uncertainty—squeezing U.S. farmers. (Higher farm costs can feed into food prices.)

China’s CSI 300 rally: up in 9 of the last 10 weeks, adding about $1.3T in value this month.

Japan hit fresh all-time highs in a “ninja stealth rally,” helped by reforms, a weak yen, and global money rotating in.

South Africa: Stocks and the rand had their best month in nearly 20 years.

💡Andrew’s Market Analysis:

We’re seeing a market that’s pressing the gas and the brake at the same time.

The Big Story: The Great Divergence

The main theme this week is divergence. This means different parts of the economy are moving in opposite directions. U.S. stocks are hitting highs, but so is gold (a sign of fear). A huge tech company like Nvidia is doing well, but farmers are getting squeezed. The U.S. market is strong, but global markets are even stronger.

This isn't a simple "everything is good" or "everything is bad" market. It's complicated. And in complication, there's opportunity.

Lesson 1: The Party at the Top (U.S. Stocks)

When you hear the S&P 500 is at an all-time high, it feels like you should be putting all your money in right now. This feeling has a name: FOMO (Fear Of Missing Out). It's a powerful psychological trap that causes people to buy high and sell low.

Think of the market highs like a popular party. Everyone is talking about it, and you feel like you have to go. But sometimes, the best parties are the ones that are just getting started, not the ones that are already loud and crowded. The U.S. market is the loud party right now.

Mental Model: The Warren Buffett Test. Warren Buffett once said, "Be fearful when others are greedy, and greedy when others are fearful." Right now, there's a lot of greed and excitement in U.S. stocks. That doesn't mean you should sell everything, but it's a signal to be cautious, not reckless.

What To Do: Automate your investing. Don’t try to time the market. Instead, use a strategy called Dollar-Cost Averaging (DCA).

How To Do It: Decide on a fixed amount you can invest every week or month (it can be as little as $50). Set up an automatic transfer from your bank account into a low-cost index fund, like one that tracks the S&P 500 (examples include VOO or SPY). This forces you to buy consistently, whether the market is high or low. You'll buy fewer shares when prices are high and more shares when prices are low. It’s the single best way to remove emotion and build wealth over time.

Lesson 2: The Nvidia Warning (Concentration Risk)

Nvidia's stock dipped even after great earnings. Why? Because it’s so big and so important that any tiny crack in its armor spooks investors. The U.S. stock market's success has been powered by just a handful of huge tech companies. This is called concentration risk. It's like building your entire house on one very thick pillar. If that pillar wobbles, the whole house shakes.

Historical Example: In the late 1990s, everyone was convinced that companies like Cisco and Intel were unstoppable. They were the "Nvidias" of their day. But after the dot-com bubble burst, their stocks fell dramatically and took over a decade to recover. No company is invincible.

What To Do: Diversify your investments. Don't bet your future on a single company or a single industry.

How To Do It: If you own individual stocks, make sure you own at least 15-20 different companies across various sectors (tech, healthcare, consumer goods, finance). An even easier way is to own index funds. An S&P 500 index fund gives you a small piece of 500 companies. An international index fund (like VXUS) gives you a piece of thousands of companies outside the U.S. Diversification is the only free lunch in investing.

Lesson 3: The Global Opportunity (Looking Beyond The U.S.)

The huge gains in China, Japan, and South Africa are not a fluke. For the last decade, U.S. stocks have been the star of the show. But historically, leadership rotates. There are long periods where international stocks outperform U.S. stocks. We might be entering one of those periods now.

Many U.S. investors have a "home country bias." They only invest in what they know. But that's like only eating food grown in your own state and ignoring all the amazing food from the rest of the world lol.

What To Do: Invest globally. Give yourself a chance to profit from growth wherever it happens.

How To Do It: Add an international stock index fund to your portfolio. A simple approach for a diversified portfolio could be a mix of a U.S. total stock market fund (like VTI) and an international total stock market fund (like VXUS). This ensures you have a stake in thousands of companies all over the world.

Lesson 4: The Real-World Connection (Your Personal Finances)

The news about soaring fertilizer prices might seem distant. It's not. It's a direct signal about inflation and your cost of living. When it costs farmers more to grow food, it eventually costs you more to buy groceries at the store.

This is the most crucial lesson: Your personal financial health is your first line of defense against a chaotic world. A strong stock portfolio is great, but cash in the bank is what protects you from life's emergencies.

Example: I have a cousin. His stock portfolio was up 30%. But when his car broke down ($5,000 repair), he had to sell some of his stocks to pay for it. He was forced to sell at a time he didn't want to, all because he lacked a simple cash cushion. Don't be that person.

What To Do: Build and protect your emergency fund. This is non-negotiable. It’s your financial foundation.

How To Do It: Open a high-yield savings account (HYSA). These are online savings accounts that pay much higher interest than traditional brick-and-mortar banks. Set up an automatic transfer from your checking to your HYSA every payday, even if it's just $25. Your goal is to have 3 to 6 months' worth of essential living expenses saved up. This fund is your safety net. It allows you to weather job loss, medical bills, or rising food prices without derailing your long-term investment plan.

👉 For daily insights, follow me on Twitter/ X, Instagram Threads, or BlueSky, and turn on notifications!

2. Most Important Financial Events This Week (and what it means for you):

This week, we analyze:

1) Cars are so expensive that buyers need seven-year loans

2) Gen Z are dipping into their retirements, skipping meals and selling their belongings just to get by, new reports find

3) Trump tariffs are a giant national sales tax that will hobble U.S. economic growth

4) U.S. agriculture’s worst labor shortage in 20 years

5) Nvidia earnings: good but not great

6) Chief economist is now warning a third of the U.S. is already in a recession1️⃣ Cars are so expensive that buyers need seven-year loans

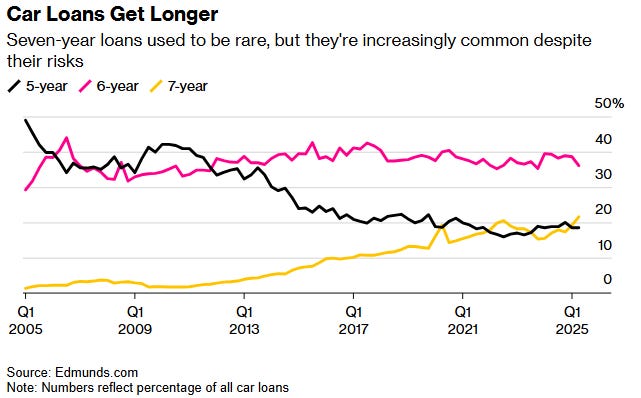

Seven-year auto loans now make up ~21.6% of new-car financing (six-year is most common). Prices sit near $ 50,000, so longer loans lower the monthly bill but increase total interest and the risk of being “upside down.” (This showed up clearly in Q2 2025 data.)

💡Andrew’s Analysis:

Cars now cost so much that 21.6% of buyers are taking seven-year loans just to afford monthly payments. The average new car costs nearly $50,000 (that's more than many people make in a year). A seven-year loan drops your payment from $1,000 to about $780, but here's the catch: you'll pay $15,460 in interest on that longer loan versus $10,860 on a five-year loan.

What This Really Means: Remember when your grandparents bought cars with cash? Those days are gone. We're turning cars into mortgages. This is exactly what happened with houses in the 2000s - when prices got too high, banks just extended the loans. (Spoiler: That didn't end well.)

The scary part? Eight-year loans are starting to appear. We don't learn our lessons from the past. These same super-long loans helped trigger the 2009 recession.

Advice:

Never finance a car for more than five years. If you can't afford it in five, you can't afford it

Consider a certified pre-owned car (2-3 years old). You skip the worst depreciation but still get warranty coverage

Try the 20/4/10 rule: Put 20% down, finance for no more than 4 years, keep total monthly vehicle costs under 10% of gross income

If you're already in a seven-year loan, make extra principal payments. Even $100 extra monthly can cut years off your loan

2️⃣ Gen Z is dipping into retirement, skipping meals, selling stuff to get by

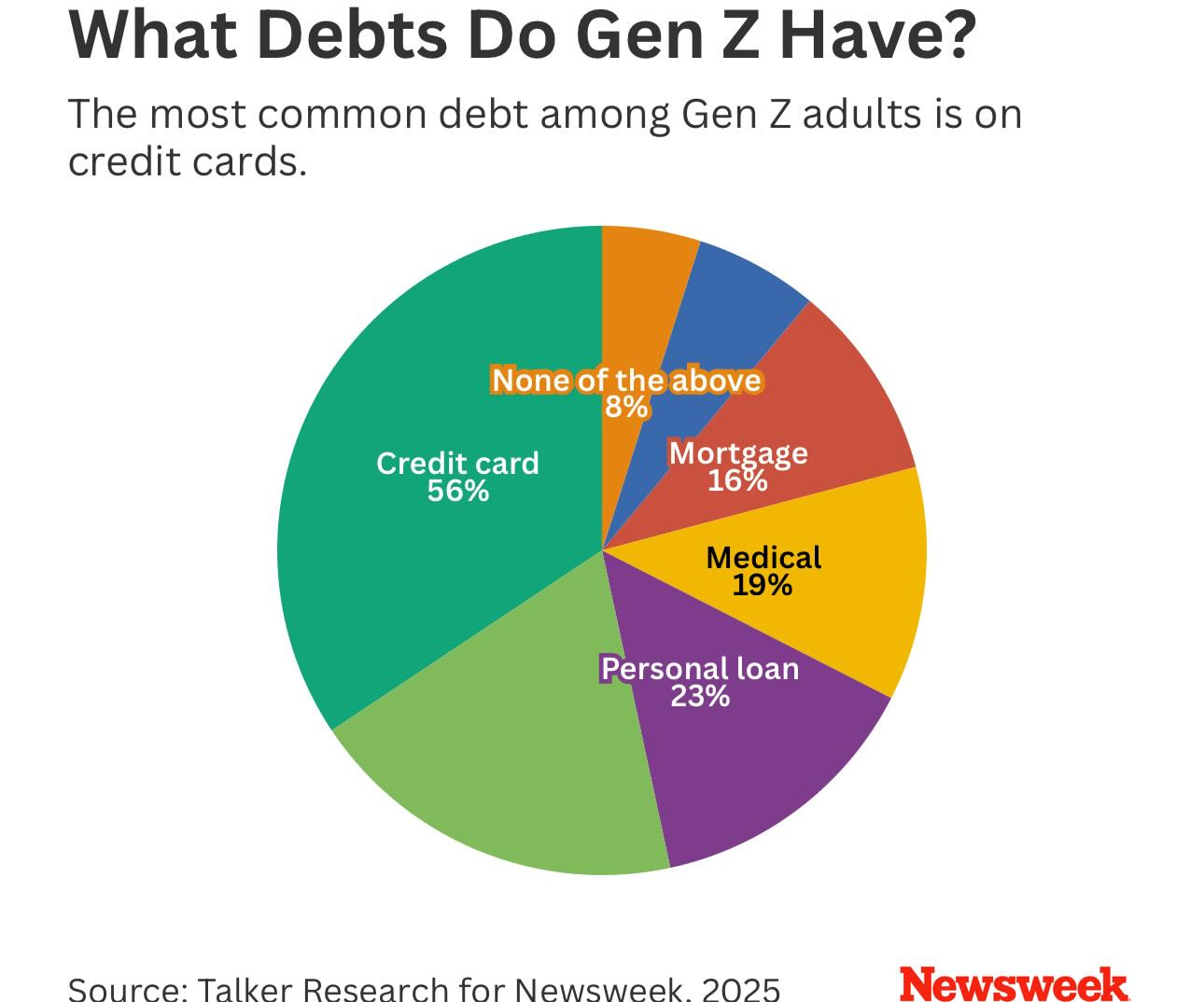

New surveys show that ~46% of Gen Z have tapped into their retirement funds early. Another report shows young renters skipping meals (22%) and delaying care to make rent. This isn’t about splurges—it’s survival.

💡Andrew’s Analysis:

Nearly half of Gen Z has already raided their retirement accounts - not for vacations, but to pay off debt. One in five young renters is literally skipping meals to make rent. They're carrying $94,000 in personal debt on average (that's $34,000 more than millennials had at the same age).

What This Really Means: Gen Z isn't bad with money - they're the generation that contributes most to 401(k)s. But they're getting crushed by a perfect storm: student loans averaging $526/month (double what other generations pay), credit card debt from covering basic expenses, and housing costs that require 80% more income than in 2020.

Think about this: They're more financially responsible than their parents were, yet they're worse off. That's not a personal failure - it's a systemic problem.

Advice:

Stop the bleeding first: List all debts by interest rate. Attack the highest rate first (probably credit cards at 24%)

Use the "Pay Yourself First" hack: Set up automatic transfers to savings the day after payday. Start with just $25 if that's all you can manage

Never touch retirement unless facing homelessness. You'll pay taxes plus a 10% penalty, losing about 40% immediately

Try the "52-Week Challenge": Save $1 the first week, $2 the second, etc. You'll have $1,378 by year-end

If you must skip something, skip subscriptions, not meals. Your health is your wealth

3️⃣ Trump tariffs = a giant national sales tax (court says most are illegal…for now)

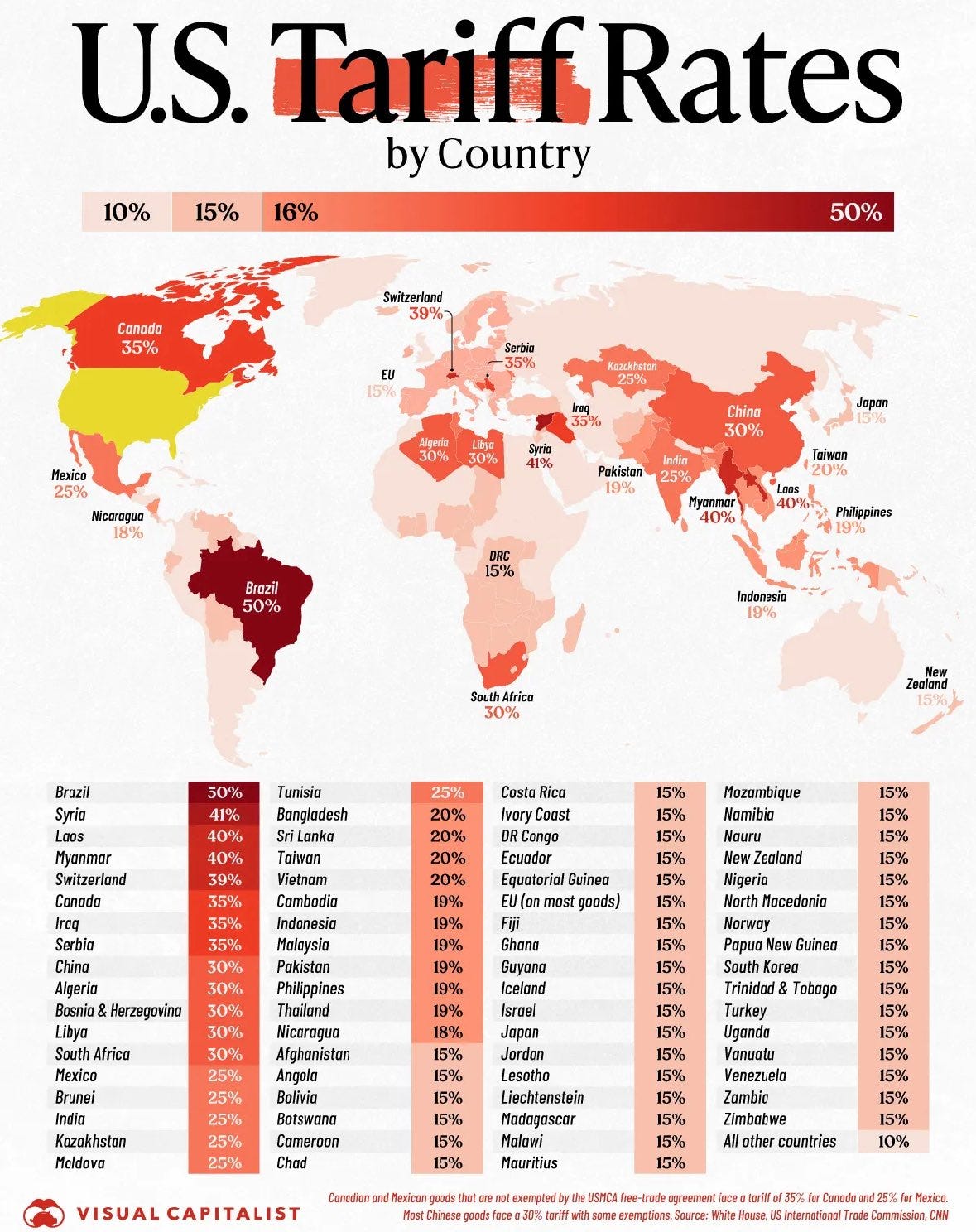

A federal appeals court ruled 7–4 that most of the new Trump tariffs exceeded presidential authority, but left them in place until Oct. 14 while a Supreme Court appeal is prepped. Think of tariffs like a hidden national sales tax—costs get passed to you at the checkout line.

💡Andrew’s Analysis:

Trump's tariffs have raised the average rate to 18.6% - approaching the catastrophic Smoot-Hawley tariffs of 1930 that helped cause the Great Depression. These tariffs will pull $210 billion annually from American wallets by end of 2025. That's eating up half the savings from Trump's tax cuts.

What This Really Means: Here's what politicians won't tell you: Tariffs are just sales taxes with better PR. When we slap a 50% tariff on Canadian aluminum, you pay 50% more for your next car. Foreign companies don't pay these taxes - American importers do, and they pass it straight to you.

Remember when Europe adopted VAT taxes? Government spending exploded and growth stalled. We're walking the same path. The Yale Budget Lab says this will slow GDP growth by 0.4% annually. (That's huge when we only grow 2.2% normally.)

Advice:

Buy durable goods now before prices spike further. That washer, laptop, or car will cost more next year

Shift investments toward domestic-focused companies that don't rely on imports

Consider I Bonds (inflation-protected savings bonds) for part of your emergency fund

Start a "Tariff Buffer Fund": Save an extra 5% of income to offset coming price increases

Learn to fix things instead of replacing them. YouTube University is free

4️⃣ U.S. agriculture’s worst labor shortage in ~20 years

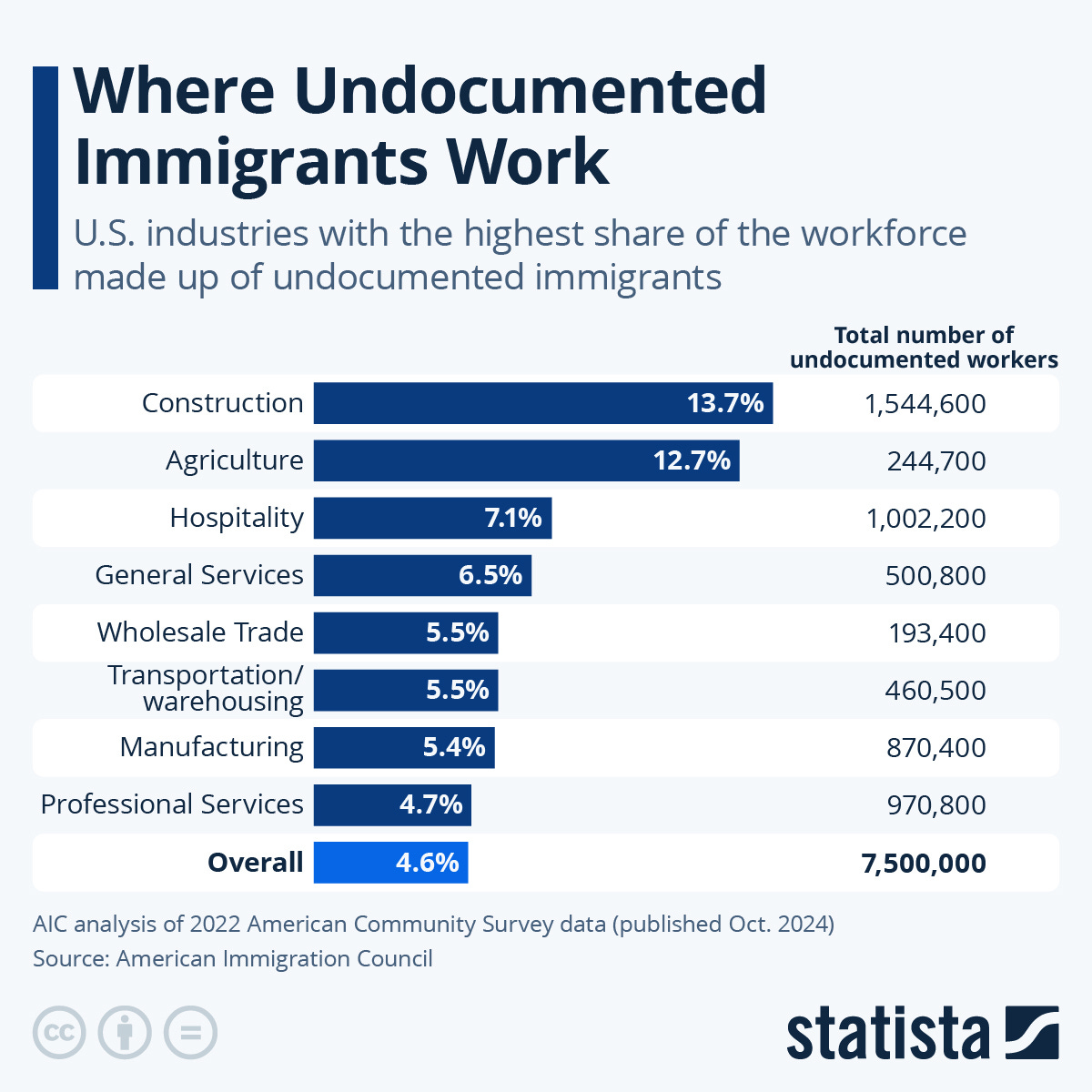

Farm employment has declined by ~155,000 workers since March, marking the sharpest drop in years. Farms are increasingly relying on H-2A guest workers; delays raise costs and increase the risk of smaller harvests. Less labor = less supply = higher prices.

💡Andrew’s Analysis:

Farms have lost 155,000 workers since March. Fertilizer prices hit their highest since 2016. Florida strawberry farms now depend 95% on temporary visa workers because Americans won't do the work.

What This Really Means: Your grocery bill is about to explode. When farms can't harvest crops, food rots in fields. Less supply plus steady demand equals higher prices at checkout. We're already seeing stores prepare to import more from Mexico (ironically defeating the purpose of protecting American jobs).

This is the "Jobs Paradox": We want to protect American jobs, but Americans won't take these jobs. So crops rot, prices rise, and we import the food anyway.

Advice:

Stock up on non-perishables now while prices are stable. Focus on rice, beans, pasta, canned goods

Start a small garden (even apartment dwellers can grow herbs and tomatoes in pots)

Join a CSA (Community Supported Agriculture) to lock in produce prices for the season

Buy a chest freezer and stock up when items go on sale

Research agricultural ETFs like MOO. When food prices spike, these stocks often follow

5️⃣ Nvidia earnings: good but not great

Nvidia beat earnings estimates again, driven by the demand for its AI chips. However, growth slowed compared to the previous quarters, and sales to China were halted. While the company remains a leader in tech, Wall Street is starting to worry that its rocket growth could hit speed bumps.

💡Andrew’s Analysis:

Nvidia beat earnings expectations with $46.7 billion in revenue (56% growth), but the stock dropped 3% anyway. Why? Wall Street wanted amazing, not just good. The company's guidance of $54 billion for next quarter didn't include any China sales.

What This Really Means: This is your "Perfection Premium" warning. When a company grows 56% and the stock still falls, it means all future growth is already priced in. Remember Cisco in 2000? Great company, but the stock took 20 years to recover because expectations were insane.

Warren Buffett says, "Be fearful when others are greedy." When everyone expects perfection, disappointment is guaranteed.

Advice:

Take profits on your biggest winners (sell 10-20%, not everything)

Look for "Boring Beautiful" stocks - profitable companies everyone ignores

Start researching Nvidia's customers' competitors. If everyone uses Nvidia, who's developing alternatives?

Set "Profit Trigger" rules: When any position doubles, sell 25% automatically

6️⃣ A chief economist warns that a third of the U.S. is already in recession

Moody’s Analytics’ Mark Zandi says about one-third of U.S. GDP comes from states already in recession or at high risk, with another chunk stagnating. He points to weak hiring, tariff drag, and flat consumer spend.

💡Andrew’s Analysis:

Moody's Mark Zandi says 17 states representing 29% of GDP are stagnating or contracting. Job growth came in at just 73,000 in July (expected 100,000). The yield curve has been inverted since June 2022 - the longest in history. Consumer spending (70% of the economy) has flatlined.

What This Really Means: We're in a "Rolling Recession" - different sectors collapse at different times, masking the overall decline. California, New York, and Illinois are struggling while Texas and Florida expand. It's like having a slow leak in your tire - you're still driving, but not for long.

The yield curve inversion has predicted 94% of recessions since 1955. We're now at the longest inversion ever.

Advice:

Build your "Recession Arsenal" immediately:

6-month emergency fund (non-negotiable)

List of expenses you can cut within 24 hours

Side income source (even $500/month helps)

Updated resume and LinkedIn profile

Follow the "60/30/10 Portfolio" for uncertain times:

60% stocks (diversified index funds)

30% bonds or cash equivalents

10% alternatives (Bitcoin, gold, commodities)

Start the "Skill Stack" strategy: Learn one new profitable skill every quarter. Free options: Excel mastery, basic coding, digital marketing

Create your "Personal Board of Directors": Connect with 5 people who could help you find work if needed

Use the "Recession Retailer" strategy: Buy stock in Dollar General, Walmart, McDonald's. These thrive when times get tough

*️⃣ Other important news this week:

President Trump says US will reduce drug prices by 1500%.

President Trump fires Federal Reserve Governor Lisa Cook

Federal Reserve Governor Lisa Cook says President Trump has "no authority" to fire her. "I will continue to carry out my duties."

Spirit Airlines files for Chapter 11 bankruptcy protection

Canada's economy declines 1.6% annualized in Q2, the biggest drop since the Covid pandemic.

👉 For daily insights, follow me on Twitter/ X, Instagram Threads, or BlueSky, and turn on notifications!

3. Important Charts and Numbers (and why they matter):

This week, we analyze:

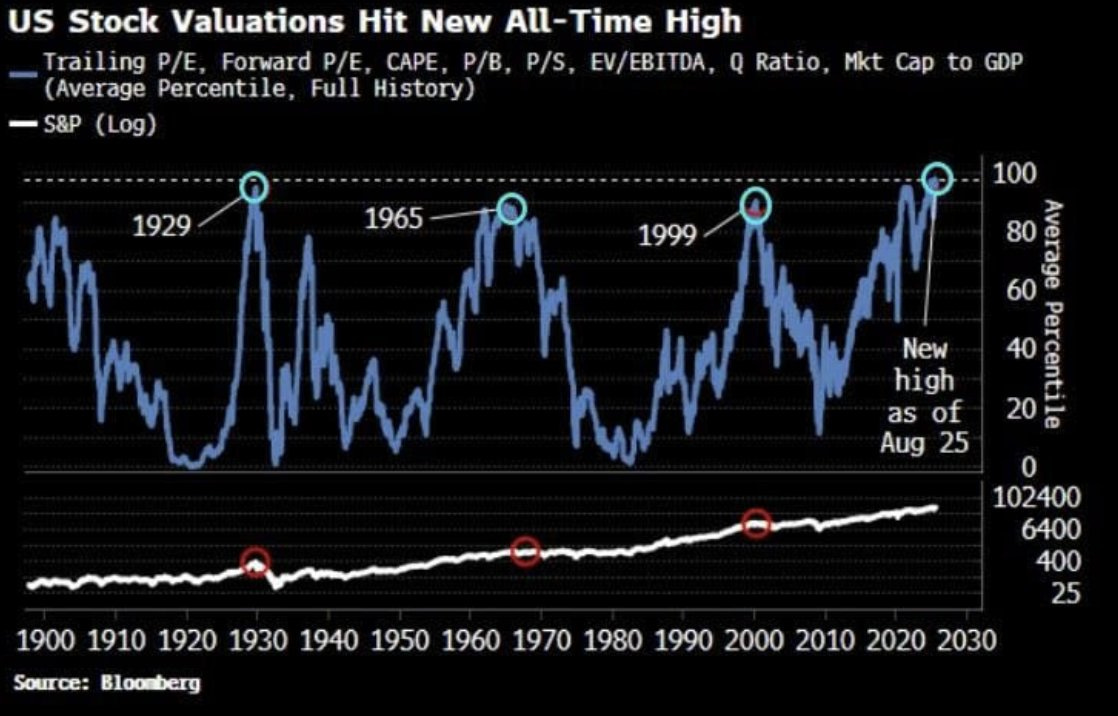

1) U.S. Stock Market hits its most expensive valuation in history, surpassing the Dot Com Bubble and the run-up to the Great Depression.

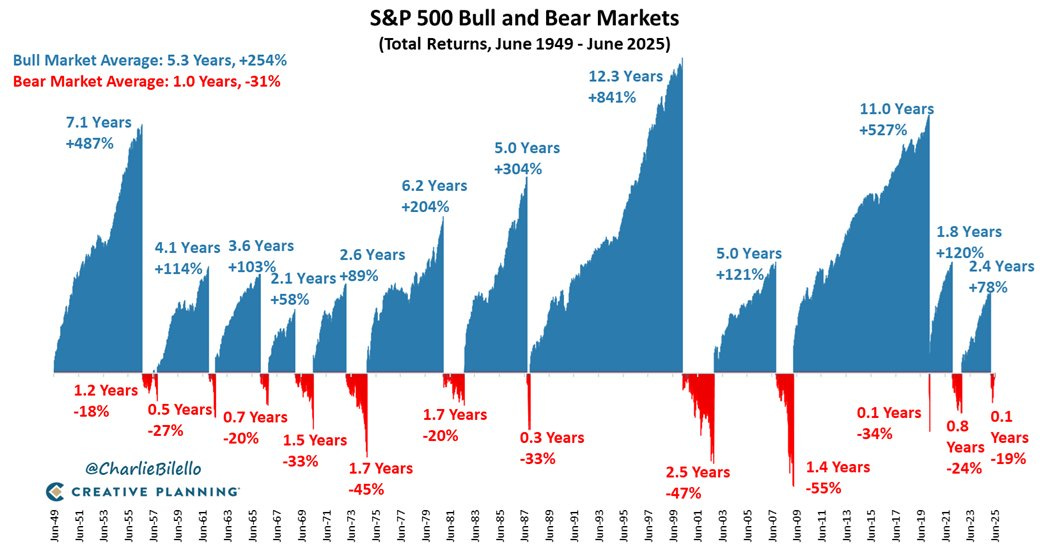

2) Bull markets have lasted 5x longer than bear markets on average.

3) Cattle Price hit a new all-time high.

4) Silver soars above $40 for the first time since 2011.

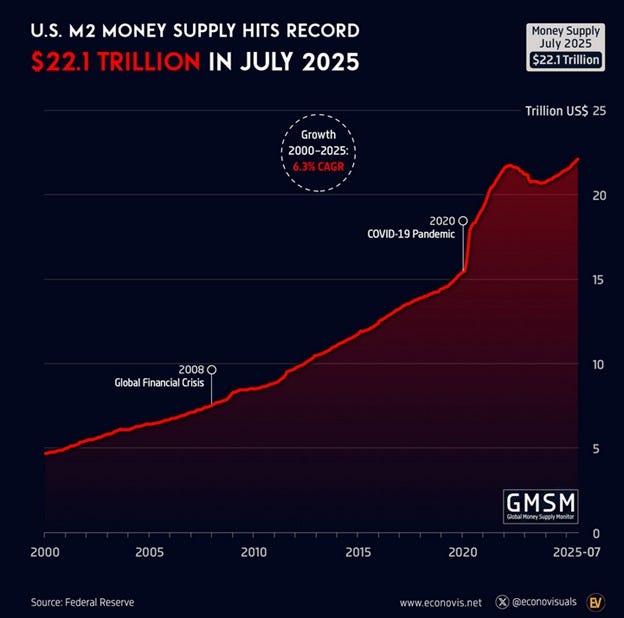

5) The US M2 money supply surged +4.8% YoY in July, to a record $22.12 trillion.

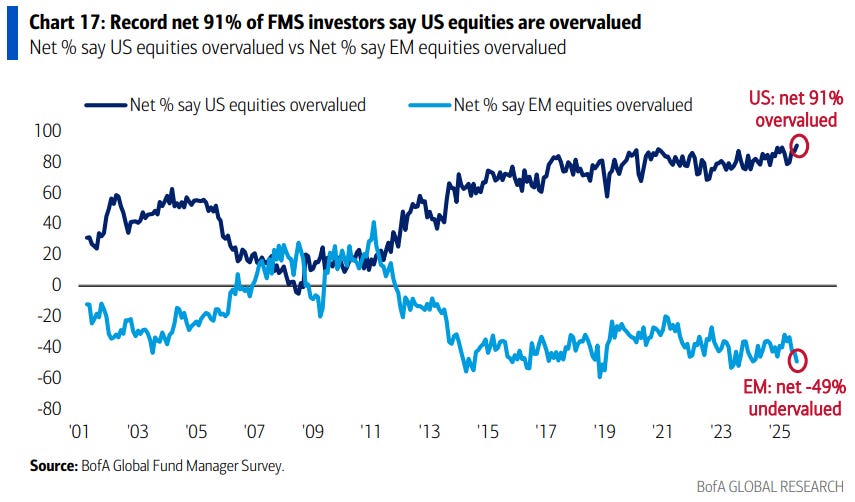

6) 91% of Fund Managers believe U.S. Stocks are overvalued, the most in history.These six charts are screaming the same message: We're at a historic turning point. Stocks are priced for perfection, commodities are surging, money printing's out of control, and even the professionals are scared.

Remember Jesse Livermore's wisdom: "There is nothing new on Wall Street. There can't be, because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again."

We’re in a pricey market with strong liquidity, rising input costs, and a one-sided crowd—trim to targets, add hedges, and keep compounding.

1️⃣ U.S. Stock Market hits its most expensive valuation in history, surpassing the Dot Com Bubble and the run-up to the Great Depression.

💡Andrew’s Analysis:

Look at that chart. See those peaks in 1929, 1999, and now? We're more expensive than both the Great Depression and the Dot-Com Bubble. The market's trading at a valuation percentile that's literally off the charts - we've never been here before.

Here's what this means in plain English: You're paying more for each dollar of company earnings than investors have ever paid in American history. It's like buying a house for $2 million when every similar house in history sold for $500,000 or less.

Warren Buffett has a rule: "Be fearful when others are greedy." Right now, greed's at an all-time high. His favorite valuation metric (market cap to GDP) is screaming "danger." Back in 1999, Buffett refused to buy tech stocks when everyone called him outdated. By 2002, he looked like a genius.

What happened after previous peaks?

1929: Stocks fell 89% over three years

1965: Sideways market for 17 years (adjusted for inflation, you lost money)

1999: Tech stocks crashed 78%, S&P 500 fell 49%

Adive:

Take some profits on your winners.

Set up a "Crash Shopping List" of 10 stocks you'd love to own 10% cheaper

Use the "10% Rule": Never have more than 10% in any single stock when valuations are this high

2️⃣ Bull markets have lasted 5x longer than bear markets on average.

💡Andrew’s Analysis:

This chart is the single best argument for being a long-term investor. Yes, bear markets (the red drops) are painful. They feel awful. But look at the blue mountains. The bull markets are dramatically longer and more powerful. On average, the market goes up five times longer than it goes down.

Why It Matters: This visual proves that the stock market is a wealth-creation engine that has occasional, temporary breakdowns. The biggest financial risk isn't a bear market; it's being out of the market and missing the powerful recovery that always follows. Interrupting the power of compounding is the costliest mistake you can make.

Mental Model: Climbing a Mountain. Investing is like climbing a mountain. You take many steps up, but sometimes you slip and slide back a bit. The slide hurts, but it's part of the journey. The chart shows that for every one step you slide back, you've already taken five steps up. The key is to stay on the mountain.

Advice:

Investing: Automate your investing and stay the course. Set up automatic contributions to your 401(k) or IRA every single payday. This forces you to buy consistently, whether the market is high or low. It turns volatility from your enemy into your friend.

Personal Finance: Your greatest asset is your ability to earn an income. Focus on growing your career and your salary. This gives you more money to invest, especially during bear markets when assets are on sale.

3️⃣ Cattle Price hit a new all-time high.

💡Andrew’s Analysis:

Cattle futures just hit $237.87 - an all-time record. When cattle prices rise, beef prices follow 3-6 months later. That $8 burger becomes $12. That $20 steak becomes $30.

Here's the chain reaction: Drought killed feed crops → Feed costs soared → Ranchers reduced herds → Fewer cattle → Higher prices. It's supply and demand at its most basic.

Remember 2014 when beef prices spiked? Families switched to chicken and pork. Smart investors bought Tyson Foods stock - it doubled over the next two years.

Advice:

Buy agricultural ETFs like MOO or COW - they track livestock prices

Consider Tyson Foods (TSN) or Pilgrim's Pride (PPC) - they win when people switch from beef to chicken

Stock up your freezer before retail prices catch up (buy in bulk at Costco)

Start that vegetable garden you've been thinking about

The "Protein Pivot": Learn five great bean/lentil recipes now. You'll need them

4️⃣ Silver soars above $40 for the first time since 2011.

💡Andrew’s Analysis:

Silver at $40 means something big's happening. It only breaks this level during major crises - 1980 (inflation panic), 2011 (debt ceiling crisis), and now.

Here's what most people miss: Silver's not just a precious metal - it's industrial. Solar panels, EVs, and electronics all need silver. So when silver spikes, it's telling you two things: People are scared (buying safety) AND they expect massive industrial demand.

In 1979, the Hunt Brothers tried to corner the silver market. It went from $6 to $50. When it crashed, they lost billions. But investors who bought silver miners early made fortunes.

The Gold/Silver Ratio: Historically, gold trades at 60X silver's price. Right now it's at 50X. When silver catches up, it could hit $50-60.

Advice:

Use the "Split Strategy": 70% physical silver (safety), 30% miners (leverage)

Set a selling target: When silver hits $50, sell half

Never use leverage to buy precious metals (that's how the Hunt Brothers went bankrupt)

Research silver miners: First Majestic (AG), Pan American Silver (PAAS)

Invest in SLV (silver ETF) with 5% of your portfolio

Buy physical silver coins (American Eagles) - start with 50-100 ounces

5️⃣ The US M2 money supply surged +4.8% YoY in July, to a record $22.12 trillion.

💡Andrew’s Analysis:

The Fed printed $7 trillion since 2020. That's a 46% increase in just five years. Every dollar in your wallet is worth less because there are so many more of them.

It's like this: Imagine you collect rare baseball cards. If suddenly millions of copies appear, yours aren't rare anymore. Same with dollars.

Milton Friedman said it: "Inflation is always and everywhere a monetary phenomenon." When money supply grows faster than the economy, prices rise. Period.

The Weimar Republic: In 1921 Germany, a loaf of bread cost 1 mark. By 1923? 200 billion marks. People burned money for heat because it was cheaper than buying wood. We're not there, but we may be on that path.

Advice:

Buy hard assets: Real estate, commodities, etc.

Get a 30-year fixed mortgage with a reasonable rate (inflation helps borrowers)

Invest in TIPS (Treasury Inflation-Protected Securities) - they adjust with inflation

Buy I Bonds (currently paying 5.27%) - maximum $10,000 per year

Consider Bitcoin (5-10% of portfolio) as "digital gold"

Lock in any long-term contracts at today's prices (insurance, subscriptions, services)

6️⃣ 91% of Fund Managers believe U.S. Stocks are overvalued, the most in history.

💡Andrew’s Analysis:

When 91% of professionals managing trillions agree on something, you'd should listen. These aren't Reddit traders - they're the people managing pension funds and university endowments.

Here's the paradox: They know it's overvalued but they keep buying. Why? Career risk. As Chuck Prince (Citigroup CEO) said before 2008: "When the music stops, things will be complicated. But as long as the music is playing, you've got to get up and dance."

John Templeton's advice rings true: "Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria." When 91% see overvaluation but markets keep rising? That's euphoria.

Advice:

Follow the smart money, not the crowd: Check what Warren Buffett's buying (hint: he's holding record cash)

Use the "Fund Manager Fear Index": When over 80% say overvalued, be defensive

Build a "Dry Powder Fund": Cash waiting for the crash

Study what these managers are actually buying: Value stocks, international markets, commodities

The "Opposite" Strategy: Do the opposite of retail investors, same as professionals

👉For more charts, follow me on Instagram, Facebook, LinkedIn, and turn on notifications!

🔒 Premium Research & Analysis 🔒

4. My stock picks, research and analysis (what every investor needs to know):

Each week, I invest around $5,000 into my long-term investments. Here’s where my money is going this week.

This week, we analyze:

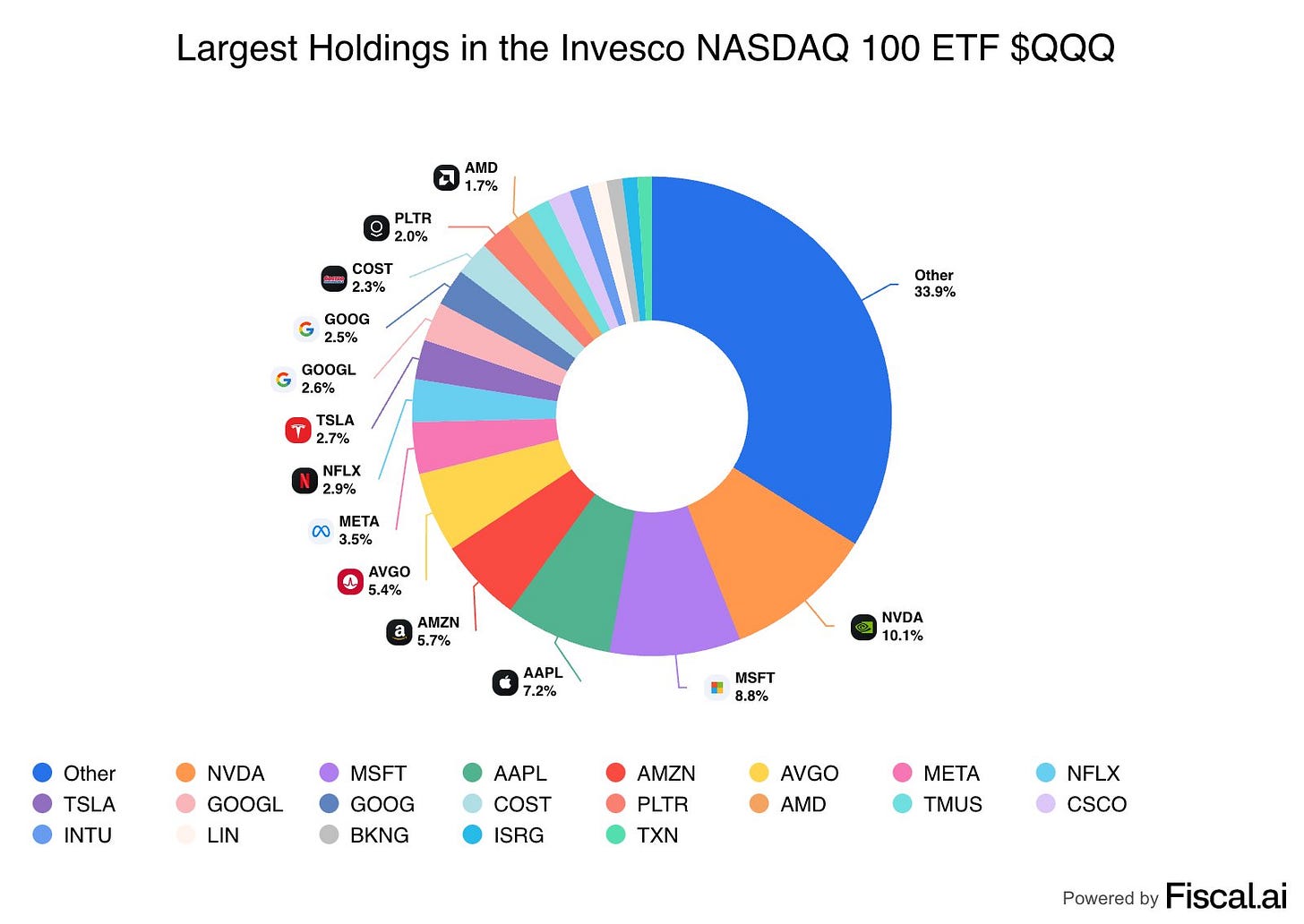

1) Invesco QQQ ETF (QQQ): Your One-Stop AI Shop

2) Invesco S&P 500 Equal Weight ETF (RSP): The "De-Risked" S&P 500

3) Vertiv Holdings (VRT): The "Shovel Seller" of the AI Gold Rush

4) Nvidia (NVDA): The New Intel (But Better)You don’t have to guess every AI winner. Own the basket where leaders live (QQQ), hedge concentration risk (RSP), and layer selective alpha in the “picks-and-shovels” and core compounders (MSFT, AAPL, NVDA). That mix lets you ride AI, defend against crowding, and compound through different market paths.

Buffett once said, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” This plan buys the wonderful basket and the few wonderful businesses powering the rails behind it.

Remember Peter Lynch's wisdom: "The key to making money in stocks is not to get scared out of them." The trajectory is clear: Technology keeps advancing and quality companies keep compounding.

The three megatrends of the next decade: AI dominance, market democratization, and infrastructure modernization.

1️⃣ Invesco QQQ ETF (QQQ): Your One-Stop AI Shop

Remember when people laughed at Jeff Bezos for selling books online in 1997? The QQQ launched just two years later, and anyone who bought and held turned $10,000 into $180,000 today. Now we're at another "Bezos moment" - but with AI.

Why This ETF Is Great: You don't need to pick the AI winner. QQQ owns them all. It's got Nvidia (9.9%), Microsoft (8.8%), Apple (7.3%), and 97 other tech giants. When ChatGPT exploded, QQQ holders made money. When Nvidia's chips became essential, QQQ holders made money. When Apple launches AI features next year, guess who makes money?

Here's what most people miss: 61% of this ETF is tech, but it's the RIGHT kind of tech. Not speculative startups - we're talking profitable giants with moats.

QQQ includes non-tech AI plays too. Intuitive Surgical makes AI-powered surgical robots. Amazon (5.5% weight) isn't just e-commerce - AWS powers half the AI startups on Earth. Even Starbucks uses AI for inventory and customer predictions.

Advice:

Start with 15-25% of your portfolio in QQQ

Set up automatic monthly purchases (dollar-cost averaging)

When QQQ drops 10%, double your purchase that month

Never sell for at least 5 years (compound growth is your friend)

Reinvest all dividends automatically

The Risk: If tech crashes 50%, QQQ crashes harder. But here's the thing - every tech crash in history has been a buying opportunity. Ask anyone who sold Apple in 2008 or Microsoft in 2001.

2️⃣ Invesco S&P 500 Equal Weight ETF (RSP): The "De-Risked" S&P 500

In 1999, everyone owned Cisco, Intel, and Microsoft. The "New Economy" couldn't fail, right? Wrong. Those who bought the equal-weight S&P 500 instead outperformed by 40% over the next decade.

We're in a similar spot today. The Magnificent Seven (Nvidia, Microsoft, Apple, Amazon, Meta, Alphabet, Tesla) make up 35% of the regular S&P 500. In RSP? They're just 2.18%.

Why This Matters More Than You Think: Warren Buffett says, "Be fearful when others are greedy." Right now, everyone's greedy for big tech. RSP lets you own America's 500 best companies without betting the farm on seven stocks.

Think about it: When was the last time the same leaders dominated for two decades straight? Never. IBM ruled the 1970s, then faded. GE dominated the 1990s, then collapsed.

The Math That'll Blow Your Mind: Since 2003, RSP has actually outperformed the regular S&P 500 (when you include dividends). During the 2000-2002 crash, equal-weight fell 30% less. During the 2008 recovery, it rose 40% more.

Advice:

Put 10-20% of your portfolio in RSP as your "hedge"

When everyone's panicking about tech, RSP holds steady

Pair it with QQQ - own both the leaders and the field

Add more when the Magnificent Seven hit new highs (contrarian buying)

This is your "sleep well at night" position

The Catalyst: When the Fed cuts rates, smaller companies in the S&P 500 benefit more than giants. They rely more on borrowing. RSP gives you 7X more exposure to these rate-sensitive winners.

3️⃣ Vertiv Holdings (VRT): The "Shovel Seller" of the AI Gold Rush

During the 1849 Gold Rush, miners went broke. You know who got rich? Levi Strauss selling jeans and Samuel Brannan selling shovels. Vertiv is selling the "shovels" for the AI gold rush - cooling and power systems for data centers.

The Problem Nobody's Talking About: AI computers use 10-15X more power than regular servers. They generate heat like a furnace. Every ChatGPT query, every AI image generation, every autonomous driving calculation needs Vertiv's equipment to not melt down.

Microsoft's building a $100 billion data center. Amazon's spending $150 billion on infrastructure. They all need Vertiv.

Why Wall Street's Missing This: The stock's up 400% in two years, but earnings are growing 42% annually. The multiple is 30X earnings - high, but Nvidia trades at 65X. For similar growth, Vertiv's half the price.

Management's sandbagging guidance. They raised revenue forecasts by $150 million but only projected flat growth next quarter. Every quarter for two years, they've beaten estimates. They're setting up for another beat.

Advice: