💥Market Update & Investing Insights [September 21, 2025]

Federal Reserve cut interest rates, Inflation and unemployment are up, Gold up over 40% in 2025, U.S. Dollar lost 10% of its value — Plus stock picks, insider trades, interest rate predictions & more

Good morning and thank you for joining 108,000+ readers who trust our newsletter to get richer and smarter with money, investing, and the economy!

If you enjoy reading, please hit the ❤️LIKE button on this post and help us grow on Substack (and get a 30-day free trial of our newsletter with this link)

Did you know that your job can pay for this newsletter with its professional development budget? To make this process easy, we’ve created this email template to send to your manager.

📬 What's in today's issue:

Part I — Market Analysis:

1) Market & Economy Update

2) Important Financial News

3) Important Charts & Numbers

Part II — Stock Market Research:

4) Stock Picks & Research

5) Insider Trading

6) Trade of the Week

7) Top Performing Stocks

8) Stocks to Watch & Important Earnings

Part III — Real Estate Insights:

9) Real Estate Market Analysis

10) Interest Rate Predictions

Part IV — Economy & Marco Analysis:

11) Economic Outlook & Market Sentiment

12) Technical Analysis

13) Important EventsBut before we get into it, help us and:

Hit the ❤️LIKE button on this post and help us grow our audience on Substack 🙏

Share this newsletter with friends and family to help them get richer and smarter with money!

1. Markets & Economy Update

Here’s everything you need to know this week:

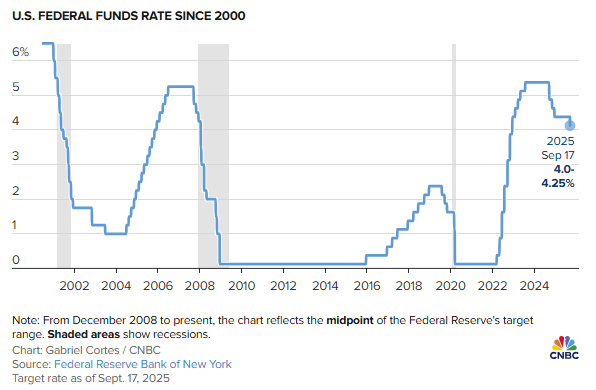

The Fed says more cuts are coming. Most Fed officials expect 1–2 more quarter-point rate cuts this year (likely October and December). That’s the market’s base case.

Stocks hit fresh records. The S&P 500 and Nasdaq posted new all-time highs, and the Russell 2000 (small caps) closed at a record for the first time since 2021. Global stocks (MSCI ACWI) also reached a record. (Tech led the move.)

Gold and silver broke out. Gold is up ~40% year-to-date and keeps setting new highs. Silver is up ~45% YTD and has outrun gold. (Many expect more upside.)

Copper perked up. Copper futures pushed to a 15-month high into the Fed week before cooling—still signaling tight supply vs. future demand.

Japan’s stock indexes recently hit records, and Japan’s 2-year government bond yield jumped near 0.88%—the highest since 2008.

💡Andrew’s Deep Dive:

Right now, the market believes the Federal Reserve is about to make money cheaper. The expectation of lower interest rates is the main driver behind everything. The Fed's expected rate cuts are the single most important factor driving stocks up. Cheaper money is like rocket fuel for stocks (both big and small, in the U.S. and globally) because it helps companies grow.

Tech and Small Caps Lead the Way: Lower rates are especially good for tech companies and smaller, fast-growing companies. These businesses live on borrowed money to fund their next big idea or expansion plan. Cheaper loans mean higher profits and more room to grow.

But here's the twist: gold and silver are also running higher. This is the really interesting part. Usually, when stocks go up, "safe" things like gold go down. Not this time. This tells us that big money isn't just optimistic; it's also nervous. They're buying stocks because rates are coming down, but they're also buying gold because they think all this money-printing and debt might lead to higher inflation down the road. They're hedging their bets.

The surge in copper and small US company stocks (the Russell 2000) is your clue that investors are betting on a strong, real economy. Small companies are more fragile—they need a good economy to thrive. Copper is used to build houses, cars, and phones. When both are rising, it signals people expect more building and buying.

Looking ahead, these market movements could signal several important trends:

The beginning of a new economic cycle where both stocks and commodities rise together - something we haven't seen in years.

A potential shift in global economic power as Japan's markets and borrowing costs rise to levels not seen in over a decade.

Broadening market participation as small caps finally join the rally, suggesting the bull market might have more room to run.

We're in a rare moment when almost everything is going up. History teaches us this doesn't last. The winners will be those who take profits gradually, stay diversified, and prepare for what comes next.

Don't get greedy when others are fearful, and don't get fearful when others are greedy. Right now, others are getting greedy. Act accordingly.

Advice:

Take some profits - When everything hits records at once, it's smart to sell some of your winners and rebalance. Don't get greedy - lock in some gains.

Buy strong tech stocks—they’re leading the market. Look for companies inventing new solutions, just like Apple or Microsoft did years ago.

Focus on quality over speculation. Buy companies with strong balance sheets and real profits

Own some small caps—when smaller companies boom, it means growth is spreading out, not just staying at the top.

Consider gold and silver for stability; they protect your wealth in uncertain times.

Consider global exposure - Japan's market hitting records suggests opportunities beyond US borders. Look at international funds that give you exposure to global growth.

Avoid FOMO (Fear Of Missing Out) - When everything hits records, it's tempting to chase performance. Don't buy at the top just because you're afraid of missing out. Stick to your plan.

Portfolio Ideas

Conservative Approach:

60% diversified index funds (US and international)

25% precious metals (gold and silver ETFs) / Bitcoin

15% cash for opportunities / bonds (mix of government and corporate)

Aggressive Approach:

40% growth stocks (focus on profitable companies)

30% small-cap value (Russell 2000 momentum play)

20% commodities (copper, oil, agricultural futures)/ Bitcoin

10% international markets (especially Japan and emerging markets)

👉 For daily insights, follow me on Twitter/ X, Instagram Threads, or BlueSky, and turn on notifications!

2. Important Financial News:

This week, we analyze:

1) Federal Reserve cuts interest rates for the first time this year.

2) Inflation and unemployment filings are up, with no silver lining this time.

3) Trump proposes to end to quarterly earnings reports.

4) US companies put brakes on hiring after Trump’s tariffs hit.

5) Tariffs help fuel biggest grocery price hike since 2022.

6) Nvidia has agreed to invest $5 billion into Intel.

7) Elon Musk just spent $1 billion to buy Tesla shares.1️⃣ Federal Reserve Cuts Interest Rates for the First Time This Year

The Federal Reserve cut interest rates by 0.25% this week, moving the benchmark rate to a range of 4% to 4.25%. This marks the first rate cut since December, as Chair Jerome Powell expressed concerns about a cooling labor market despite lingering inflation worries. The vote was 11-1, with newly appointed Governor Stephen Miran dissenting in favor of a larger half-point cut.

What this means for you: Rate cuts typically make borrowing cheaper, which can stimulate economic activity. For investors, this means companies might expand more easily, potentially boosting stock values. For everyday people, mortgages and car loans could become slightly more affordable. However, savings accounts and CDs will likely offer lower returns, impacting income-focused investors.

Long-term significance: The Fed's move signals a shift in priorities from fighting inflation to supporting employment. This could mean we're entering a period of economic uncertainty where traditional indicators behave unpredictably. Historically, when the Fed starts cutting rates outside of a crisis, it often indicates concerns about economic momentum slowing.

What you should do:

If you have debt: Great news. Credit card rates, HELOCs, and variable loans should start dropping

If you're a saver: Bad news. Your high-yield savings accounts won't be "high-yield" much longer. Consider locking in current CD rates before they drop further

If you're house hunting: Mortgage rates have already dropped in anticipation, hitting their lowest level in nearly a year at 6.35%. But don't expect massive drops - rates are sticky and influenced by many factors beyond the Fed

2️⃣ Inflation and Unemployment Filings Are Up, With No Silver Lining This Time

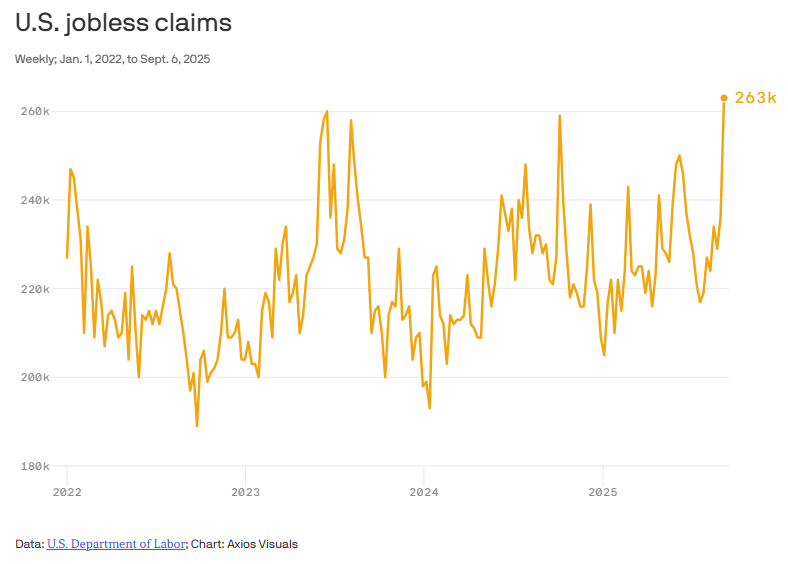

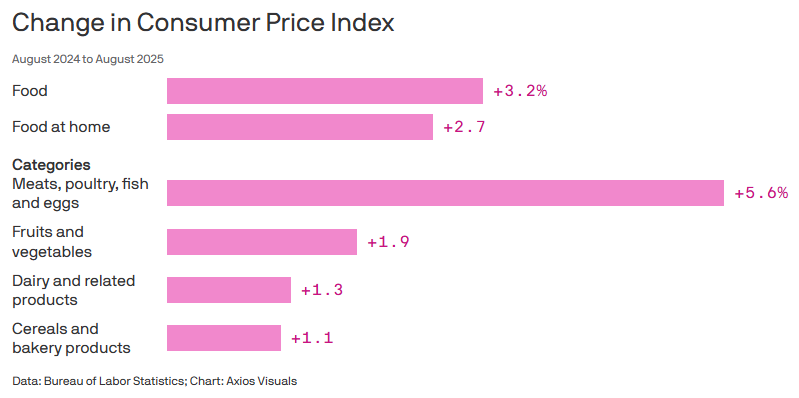

August inflation data shows concerning trends, with the Consumer Price Index rising 0.4% (double July's pace) and year-over-year inflation hitting 2.9%. Simultaneously, unemployment claims jumped to 263,000 - the highest level since October 2021. This combination of rising prices and weakening employment creates a challenging "stagflation-lite" environment.

What this means for you: Your grocery bill and everyday expenses continue to rise while job security becomes less certain. This squeeze on both sides of the household budget means families need to be more mindful about spending and saving.

Long-term significance: The economy might be entering a period where traditional relationships between inflation and employment break down. Typically, when unemployment rises, inflation falls, but tariffs and structural changes may have altered this dynamic.

What you should do:

Your number one priority should be your emergency fund. If you don't have 3-6 months' worth of living expenses saved in cash, start building that up immediately. You need a buffer in case of a job loss.

Get serious about your budget. Track every dollar. With grocery and gas prices climbing, you need to know exactly where your money is going so you can find places to cut back.

3️⃣ Trump Proposes End to Quarterly Earnings Reports

President Trump proposed on September 15 that companies should only report earnings every six months instead of quarterly, calling it a way to "save money and allow managers to focus on properly running their companies".

What this means for you: Less frequent reporting means less transparency for investors, potentially making it harder to assess company health. However, it might reduce short-term market volatility and allow management teams to focus on long-term value creation.

Long-term significance: If implemented, this change could fundamentally alter how investors interact with markets. Information asymmetry might increase, favoring institutional investors with better access to company data. Retail investors would need to become more diligent about fundamental research rather than relying on quarterly catalysts.

What could happen:

Pro: Companies might invest more in research, development, and long-term growth instead of financial engineering

Con: Less transparency means more potential for corporate shenanigans. Remember Enron?

Investment implications:

Active stock picking becomes harder: Less frequent updates mean less information to base decisions on

Volatility could increase: When earnings do come out, the surprises will be bigger

Long-term investing gets rewarded: This change favors buy-and-hold investors over day traders

What you should do:

If this happens, focus on companies with strong fundamentals and proven management teams. You'll need to rely more on annual reports and management quality than quarterly updates.

Consider investing through mutual funds or ETFs

Develop a long-term mindset for your investments rather than quarterly performance chasing

4️⃣ US Companies Put Brakes on Hiring After Trump's Tariffs Hit

The job market isn't just slowing - it's hitting a wall. Manufacturing shed 12,000 jobs in August, bringing total losses to 78,000 this year. Mining (including oil and gas) lost 6,000 jobs, and wholesale trade has fallen by 32,000 jobs.

What this means: Tariffs are just taxes on imported goods. When the government puts a tariff on steel, for example, it gets more expensive for a company like John Deere to build a tractor. That extra cost has to go somewhere. John Deere says tariffs have cost them $300 million this year, so they laid off over 200 workers. The costs also get passed down to you. That's why prices for coffee (up 21% in a year) and beef (up 17% in a year) are soaring.

The irony: Tariffs were supposed to bring manufacturing jobs back to America. Instead, they're pricing American manufacturers out of the market by making their raw materials more expensive.

Long-term implications: This could create a vicious cycle. Fewer jobs mean less consumer spending, which means less demand for products, which means more job cuts.

This is a real-world lesson in how trade policy directly impacts your job and your wallet. It's not some abstract political debate. The decision to impose tariffs creates winners and losers. While it may protect some jobs, it clearly puts pressure on others and acts as a hidden tax on every American family at the checkout line. It shows how interconnected the global economy is and how easily those connections can be disrupted.

What you should do:

Skill up immediately: Learn skills that can't be automated or outsourced

Network aggressively: Most jobs come through connections, not job boards

Consider industries less affected by tariffs: Healthcare, education, local services

For Investing: Pay close attention to companies that rely heavily on imported materials or have complex international supply chains (like manufacturers, retailers, and auto companies). They are the most vulnerable right now. Look for mentions of "tariffs," "input costs," or "margin pressure" in their earnings reports. Companies that have mostly domestic operations might actually have an advantage in this environment.

5️⃣ Tariffs Help Fuel Biggest Grocery Price Hike Since 2022

Grocery prices jumped 0.6% in August - the biggest monthly increase since August 2022. Coffee is up 20.9% year-over-year, beef steaks up 16.6%, and apples rose 9.6%.

Why this hurts so much: Food isn't optional. You can delay buying a car or new clothes, but you have to eat. Over half of Americans now say grocery costs are a major source of stress.

The tariff tax: When Trump slaps tariffs on imported goods, who pays? You do, at the grocery store. Brazil supplies much of our coffee, and it now faces a 50% tariff. Guess where that cost goes?

The compound effect: It's not just tariffs. Bad weather, labor shortages, and supply chain issues are all pushing prices higher. But tariffs are making everything worse.

What you should do:

Embrace store brands: They're often 20-30% cheaper and made by the same companies as name brands

Buy in bulk (smartly): Non-perishables like rice, beans, and canned goods when they're on sale

6️⃣ Nvidia Has Agreed to Invest $5 Billion Into Intel

Nvidia, the king of AI chips, is investing a massive $5 billion in its old rival, Intel, sending Intel's stock soaring over 30%. The two giants will now work together to co-develop new chips for data centers and PCs.

Investment perspective:

Consider both companies as long-term holds, especially given the current US policy's support for strategic domestic tech.

This validates Intel's turnaround story: After years of decline, Intel is becoming relevant again

It shows Nvidia's long-term thinking: They're not just riding the AI wave - they're building infrastructure for the future

American chip manufacturing is back: This partnership, plus government investment, signals a major shift

Risk factor: Intel still needs to prove it can execute. This investment gives them capital and credibility, but they still need to deliver on their manufacturing promises.

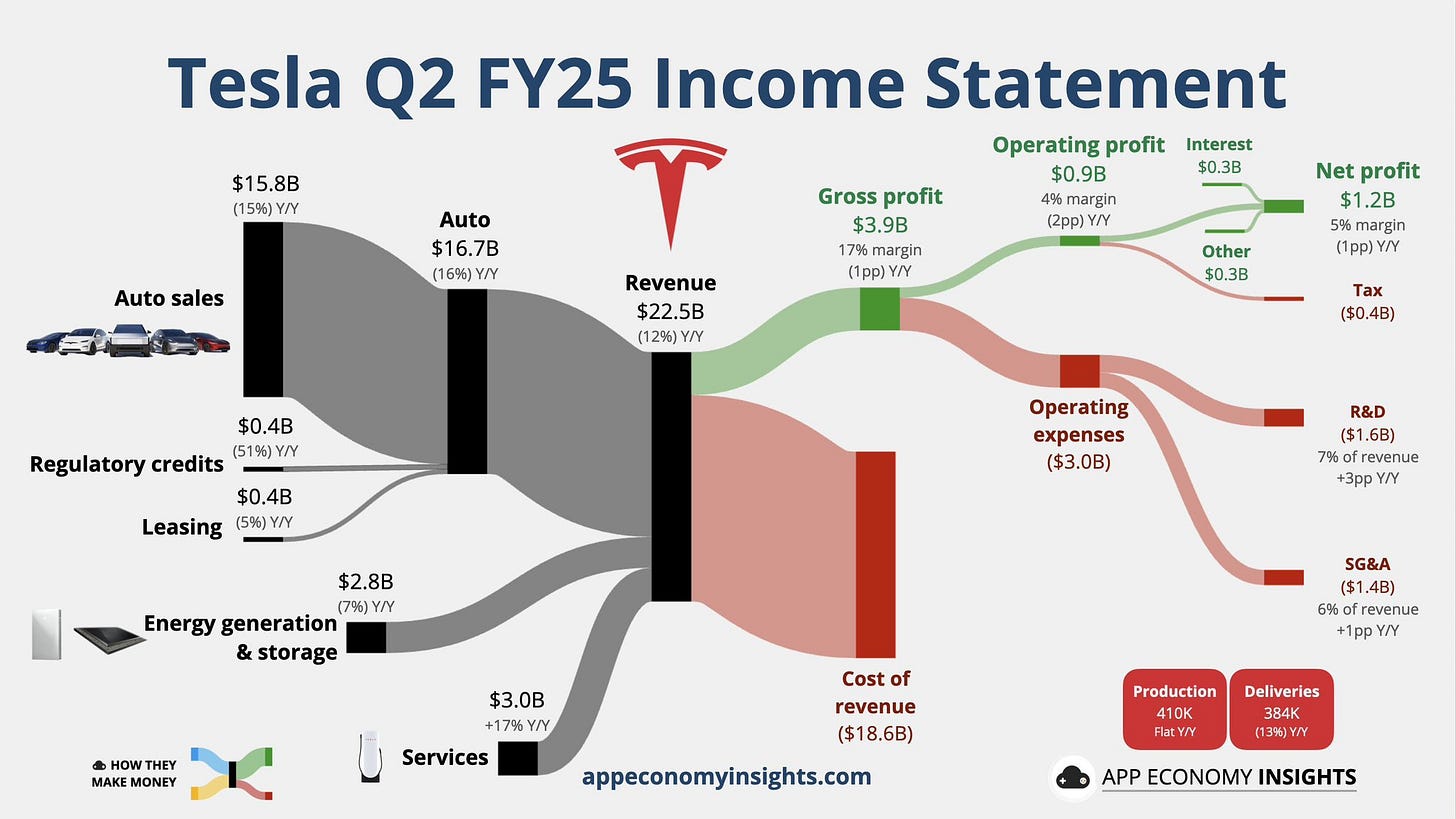

7️⃣ Elon Musk Just Spent $1 Billion to Buy Tesla Shares

Elon Musk spent $1 billion of his own money to buy Tesla shares on the open market. This is significant because it wasn't him exercising stock options; it was a direct cash purchase. It's the first time he's done this in over five years.

When the world's richest person puts his money where his mouth is, you should pay attention; it's a massive vote of confidence. It tells investors, "I believe our stock is cheap right now, and I'm willing to bet a billion dollars that it's going up." After a very rough year for Tesla stock, this was a clear message to silence the doubters.

What Musk sees that others don't:

Robotaxis are coming: Tesla's full self-driving technology is improving rapidly

AI beyond cars: Tesla's Optimus robots could be a massive new business

Energy storage: Tesla's battery business is growing faster than car sales

Manufacturing scale: Tesla's production efficiency gives them cost advantages

Investment perspective:

Bull case: If Tesla cracks robotaxis or humanoid robots, it could be worth $5-10 trillion

Reality: They're transitioning from a car company to an AI/robotics company

*️⃣ Other news this week:

Gold reaches new all-time high of $3,700

China bans companies from purchasing Nvidia $NVDA chips

President Trump says "we'll have more than $17 trillion invested in our country this year."

Gen Z and millennials are delaying traditional milestones like marriage, homeownership, and parenthood due to high housing costs and stagnant wages," per FORTUNE

U.S. Banks are now sitting on $395 Billion in unrealized losses as of Q2 2025

👉 For daily insights, follow me on X, Instagram Threads, or BlueSky, and turn on notifications!

3. Important Charts and Numbers:

This week, we analyze:

1) U.S. Dollar has now lost more than 10% of its value this year.

2) Gold is up over 40% in 2025, its best year since 1979.

3) Google Searches for "help with mortgage" has now surpassed the peak of the 2008 Global Financial Crisis.

4) The top 10% of income earners in the US now account for nearly half of all consumer spending, a record high.

5) Sales of Heavy Trucks are collapsing, which has *usually* foreshadowed an upcoming recession.My thoughts on this week’s most important charts and numbers:

The key takeaway from all these charts is that economic signals are flashing yellow and we're in the late stages of an economic cycle. The dollar is weakening, gold is soaring, mortgage distress is rising, spending is concentrating, and truck sales are falling. These indicators collectively suggest economic uncertainty ahead.

The smart money is already positioning defensively. The question isn't whether trouble is coming - it's whether you'll be ready to profit from it.

History shows that the biggest fortunes are made during economic transitions. The wealthy use crises to buy assets at fire-sale prices from people who waited too long to prepare.

Great investors win with process. Write down your moves, the reason, and the guardrails. When headlines get loud, your written plan will keep you calm and—more important—keep you invested in the right places.

1️⃣ U.S. Dollar has now lost more than 10% of its value this year.

💡Andrew’s Analysis:

The chart shows that the U.S. Dollar Index ($DXY) has has lost over 10% of its value this year - that's a massive decline for the world's reserve currency. This means your dollar is weaker against other major world currencies like the Euro and the Japanese Yen. Think of it this way: if you had $100 in January, it now buys what $90 used to buy internationally.

Advice: