💥 Rising Unemployment & The Truth About Inflation

4.6% Unemployment, Gold Prices Soar, and the Pentagon's $4.7 Trillion Problem Explained

👋 Good morning my friend and thanks for joining 108,000 subscribers who trust this newsletter to get smarter with money, investing, and the economy.

Our goal is simple: Make it easy to connect the dots on the economy, markets, and investing in 10 minutes or less!

📬 What's in today's issue:

Part I - Markets & Economy

1. Market Update & Analysis

2. The Most Important Finance News

3. Chart of the Day

Part II - Investing & Stocks

4. Top Stocks

5. Today's Trade

6. Fear & Greed Analysis

7. Technical AnalysisToday’s issue has a lot of great advice to help you build wealth but before we get into it please help us and hit the ❤️ LIKE button on this post and help us grow on Substack 🙏

(1) Market Update & Analysis

📈 Everything You Need to Know:

Inflation data came in softer than expected earlier this week, keeping hopes alive for Fed rate cuts in 2026. But there’s tension beneath the surface. Stocks are near all-time highs while the real economy shows cracks (weak jobs, falling consumer confidence).

Tech stocks bounced back hard this week. The Nasdaq jumped 1.3% and the S&P 500 climbed 0.9% as AI fears cooled off. Nvidia and Oracle led the charge after Trump gave the green light for advanced chip exports to China. Micron’s strong forecast added more fuel to the semiconductor rally.

Here’s what moved markets: Nvidia surged 4% on news that H200 chips can flow to China again. Oracle rocketed nearly 7% after securing a major stake in TikTok’s new U.S. operation. Micron jumped 7% on revenue guidance that beat expectations.

💡 Andrew’s Analysis:

Most people think bull markets mean everything’s fine. Here’s why they’re wrong.

When I worked on Wall Street, I learned something that most investors miss: the stock market and the economy aren’t the same thing. They can (and often do) move in opposite directions for months or even years.

Right now, we’re living through one of those moments. Tech stocks are partying like it’s 1999 while Main Street struggles to pay the bills. The unemployment rate hit 4.6% (more on this below), consumer sentiment keeps falling, and yet the S&P 500 sits near record highs. How?

Here’s the uncomfortable truth: The stock market doesn’t care about you. It cares about corporate profits. And guess what? Big tech companies are printing money while everyone else pinches pennies. In my 15 years doing this, I’ve watched this playbook before (2007, 2021). The disconnect doesn’t last forever.

What This Means for You

If you’re fully invested: Don’t panic, but don’t get greedy either. When tech stocks rally on “maybe China won’t ban our chips” news, that’s not conviction, that’s relief. Relief rallies fade. Set profit targets on your winners and stick to them. If Nvidia’s up 150% in your portfolio, taking 20-30% off the table isn’t timing the market, it’s basic risk management.

If you’re sitting on cash: This is where it gets interesting. The Fed’s still holding rates high, which means your savings account actually pays something for once (around 4-5% at most online banks). Don’t rush to deploy everything just because stocks went up this week. Dollar-cost average (invest the same amount every week or month regardless of price). When stocks are volatile and economic data’s mixed, consistency beats timing.

The AI chip story matters more than you think. Trump approving H200 exports to China isn’t just about Nvidia’s quarterly earnings. It signals that AI competition is becoming a geopolitical chess match. When governments pick winners in technology races, it creates massive investment opportunities (and risks). Remember, the internet boom wasn’t just about dot-coms. It was about telecom infrastructure, chip makers, and server companies. AI will follow the same pattern (we’re still in the infrastructure phase).

The Pattern You Need to Realize

Connect these dots: Soft inflation + weak jobs + high stock prices + geopolitical chip wars.

This combination typically doesn’t last. Either the economy strengthens (inflation picks back up, stocks rally harder), or stocks finally notice the economy’s struggling (market correction, Fed cuts rates faster).

My take? We’re probably somewhere in between. The Fed will cut rates in 2026, but slowly. Tech stocks will stay volatile as each AI headline whipsaws prices. The real economy will limp along, not great but not terrible.

My advice: Build a barbell portfolio. Keep safe money in high-yield savings or short-term Treasury bonds (4-5% with zero risk). Put growth money in quality companies that actually make money, not just promises. And keep some dry powder for when everyone else panics (that’s when real opportunities show up).

Warren Buffett says it best: “Be fearful when others are greedy, and greedy when others are fearful.” Right now? People are cautiously greedy. That means you should be cautiously prepared.

👉 For daily insights, follow me on X /Twitter; Instagram Threads; Facebook; or BlueSky, and turn on notifications!

(2) The Most Important Finance News

In this issue we analyze:

(1) Inflation Falls to 2.7%, But the Data's Messy

(2) Unemployment Rises to 4.6%, Highest in Four Years

(3) Pentagon Fails Audit for Eighth Straight Year

(4) Gold and Silver Hit Record High

(5) Bank of Japan Raises Rates to 30-Year High

(*) Andrew's AnalysisBut first, how do you feel about the economy?

1️⃣ Inflation Falls to 2.7% but the Data’s Messy

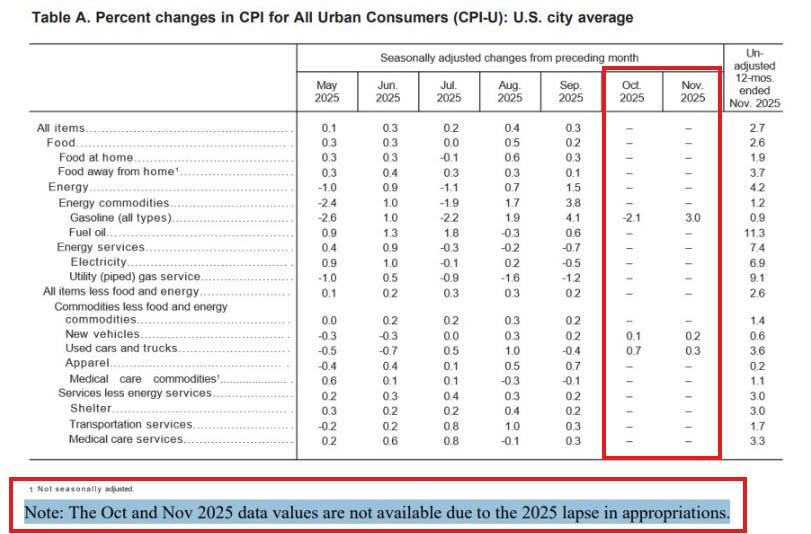

The Bureau of Labor Statistics reported that November’s consumer price index showed inflation falling to 2.7% year-over-year, below economists’ expectations of 3.1%. Core inflation, which excludes volatile food and energy prices, dropped to 2.6%. However, economists caution that the data may be unreliable due to disruptions from the recent government shutdown.

Long-term Significance:

This fuzzy inflation data creates uncertainty for the Federal Reserve’s rate decisions. If inflation is genuinely cooling, we might see rate cuts in 2026. But if the numbers are artificially low due to shutdown-related collection issues, the Fed might maintain higher rates longer than expected. For investors, this means volatility in rate-sensitive sectors like real estate and banking is likely to continue.

Why this matters:

The Fed uses this data to decide interest rates. If inflation's actually higher than reported, rate cuts get delayed. If it's actually lower, your mortgage and car loans get cheaper faster. Right now, nobody knows which version is true.

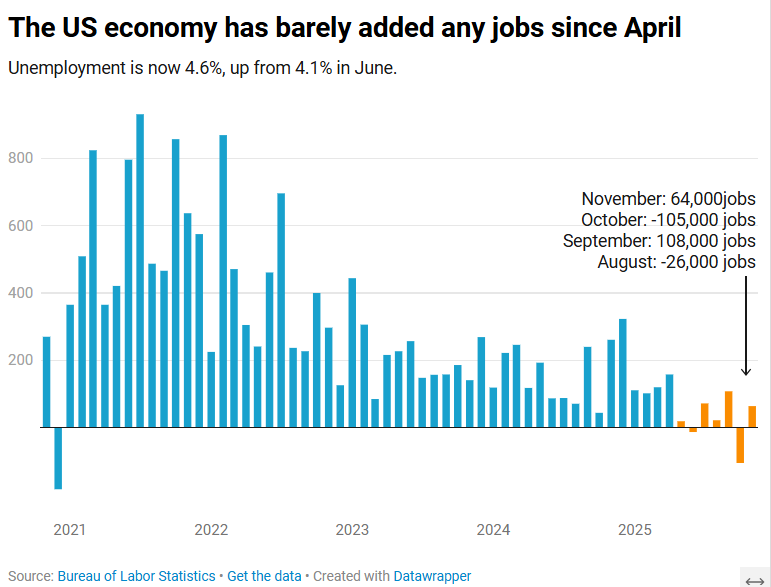

2️⃣ Unemployment Rises to 4.6%, Highest in Four Years

The Labor Department reported that the U.S. unemployment rate climbed to 4.6% in November, up from 4.4% in September. The economy gained 64,000 jobs in November but lost 105,000 in October, with job losses in three of the past six months. The data reveals particular weakness for young workers, with teenage unemployment reaching 16.3%.

Long-term Significance:

The rising unemployment rate signals potential economic weakness ahead. The combination of job losses, declining retail sales, and higher unemployment suggests we might be heading toward a slowdown. For investors, this means defensive sectors like healthcare and consumer staples might outperform growth stocks in coming months.

Why this matters:

If you’re employed: Now’s the time to build a bigger emergency fund. The old rule was 3-6 months of expenses. In this market, shoot for 9-12 months if you can. When I see unemployment rising and job losses spreading beyond one industry, I treat it like a fire alarm. Maybe it’s just a drill. Maybe it’s not. Either way, you want an escape route.

If you’re investing: Unemployment above 4.5% historically precedes either a recession or aggressive Fed rate cuts (sometimes both). Your move? Shift toward defensive stocks (healthcare, utilities, consumer staples). These companies sell things people need regardless of the economy. Think Procter & Gamble, Johnson & Johnson, Walmart. Boring, but stable.

If you’re job hunting: Prioritize companies with strong balance sheets over exciting startups. Check debt levels, cash reserves, and profitability. Use sites like Yahoo Finance to pull up basic financials before interviews. A company burning through cash with rising unemployment is a layoff waiting to happen.

The opportunity: Rising unemployment usually forces the Fed to cut rates faster. That means cheaper mortgages, cheaper car loans, and cheaper business loans. If you’ve been thinking about buying a house or starting a business, start preparing now. By the time rates actually drop, prices will already be rising. The smart money positions before the crowd arrives.

3️⃣ Pentagon Fails Audit for Eighth Straight Year

The Pentagon failed its financial audit for the eighth consecutive year. The Defense Department reported $4.65 trillion in assets and $4.73 trillion in liabilities, but auditors found 26 material weaknesses in how they track money.

Let that sink in. The Pentagon has more debt than assets and can’t account for where it all went.

The worst part? They couldn’t verify the existence, completeness, or value of assets in the Joint Strike Fighter Program’s Global Spares Pool. Translation: planes and parts worth billions might not exist, might be stolen, or might be sitting in a warehouse nobody knows about.

Long-term Significance:

The Pentagon's consistent audit failures highlight systemic issues in government financial management.

The Pentagon is the only one of 24 major federal agencies that's never passed an audit since Congress mandated them in 2018. Every other department figured it out.

Why you should care:

This is your money. Every tax dollar you pay funds the Pentagon’s budget, and they literally cannot tell you what they did with it.

What this means:

Expect higher taxes or bigger deficits. When government agencies can’t track spending, money disappears into black holes. Congress will either raise taxes to cover the gaps or borrow more money (which increases the national debt you’ll eventually pay for through inflation or higher interest rates).

Defense stocks might actually benefit. Weird but true. When the Pentagon can’t track assets, they often just buy new ones instead of finding the old ones. Companies like Lockheed Martin, Raytheon, and Northrop Grumman keep winning contracts regardless of Pentagon accounting problems. If you’re looking for recession-resistant investments, defense contractors have guaranteed government customers who literally don’t know what they already own.

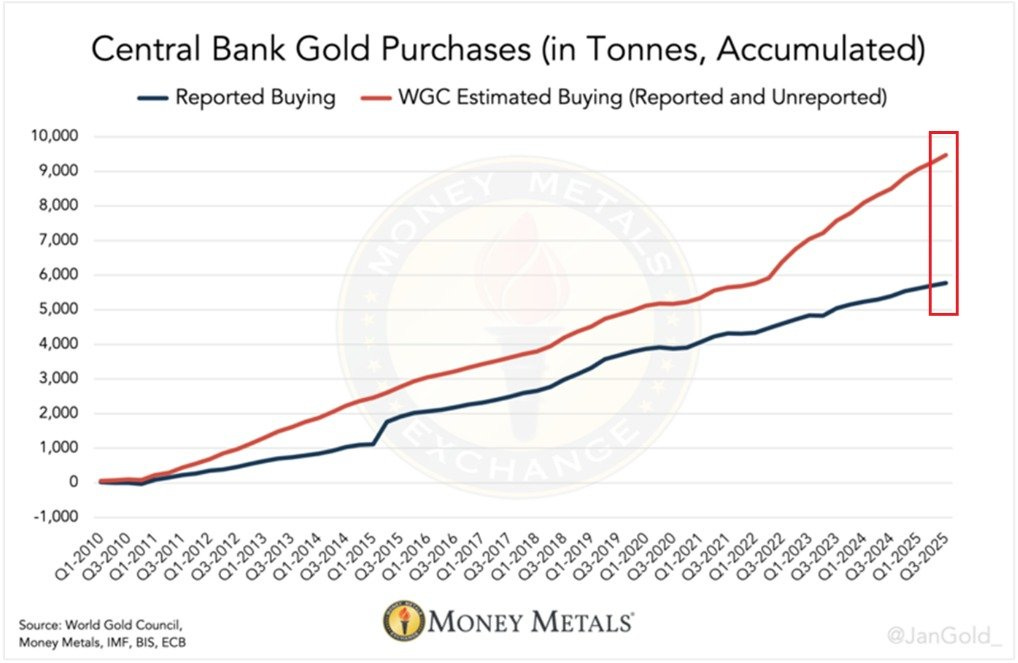

4️⃣ Gold and Silver Hit Record Highs

Gold prices surged to $4,400 for the first time in history, while silver jumped above $67 per ounce, marking a 133% gain this year. Copper also reached multi-month highs driven by demand from China's EV sector and U.S. AI investment, while platinum soared above $2,000 for the first time since 2008.

Long-term Significance:

When every metal rallies at once, it’s not a coincidence. It’s a message.

During my time at Goldman, I learned that precious metals don’t just track inflation. They track fear and currency confidence. When gold, silver, platinum, AND industrial metals like copper all surge together, investors are saying: “I don’t trust paper anymore.”

What’s driving this:

China’s buying gold aggressively for its central bank reserves, reducing dollar exposure. Supply disruptions in Chile and Peru are constraining copper production. Potential U.S. tariffs on refined metals are creating buying panic. AI data centers need massive amounts of copper for wiring and cooling systems.

Here’s what most people miss: Gold hitting new highs while stocks also hit new highs is unusual. Typically, people buy gold when stocks crash (flight to safety). Right now, both are rising. That means investors are hedging against something they can’t quite name yet (inflation, currency debasement, geopolitical chaos, or all three).

What to do:

Don’t chase the rally. Gold’s up huge, silver’s up huge. Buying at all-time highs is how amateurs lose money. Instead, think about precious metals as portfolio insurance, not a get-rich-quick trade.

The 5-15% rule: Keep 5-15% of your investable assets in precious metals as a hedge. You can buy physical gold/silver (coins or bars through dealers like APMEX or JM Bullion), or buy ETFs like GLD (gold) or SLV (silver) for easier trading.

Industrial metals offer a smarter play right now. Copper’s rising because AI needs it. Electric vehicles need it. The green energy transition needs it. Unlike gold (which just sits there looking pretty), copper has genuine supply-demand fundamentals. Look at copper mining companies like Freeport-McMoRan or Southern Copper. Riskier than gold, but tied to actual industrial growth.

The contrarian move: If metals keep rallying into early 2026, consider gradually taking profits. When taxi drivers and your cousin at Christmas start talking about gold investments, that’s usually the top. Charlie Munger used to say, “The big money is not in the buying and selling, but in the waiting.” Buy insurance when it’s cheap, sell it when everyone wants it.

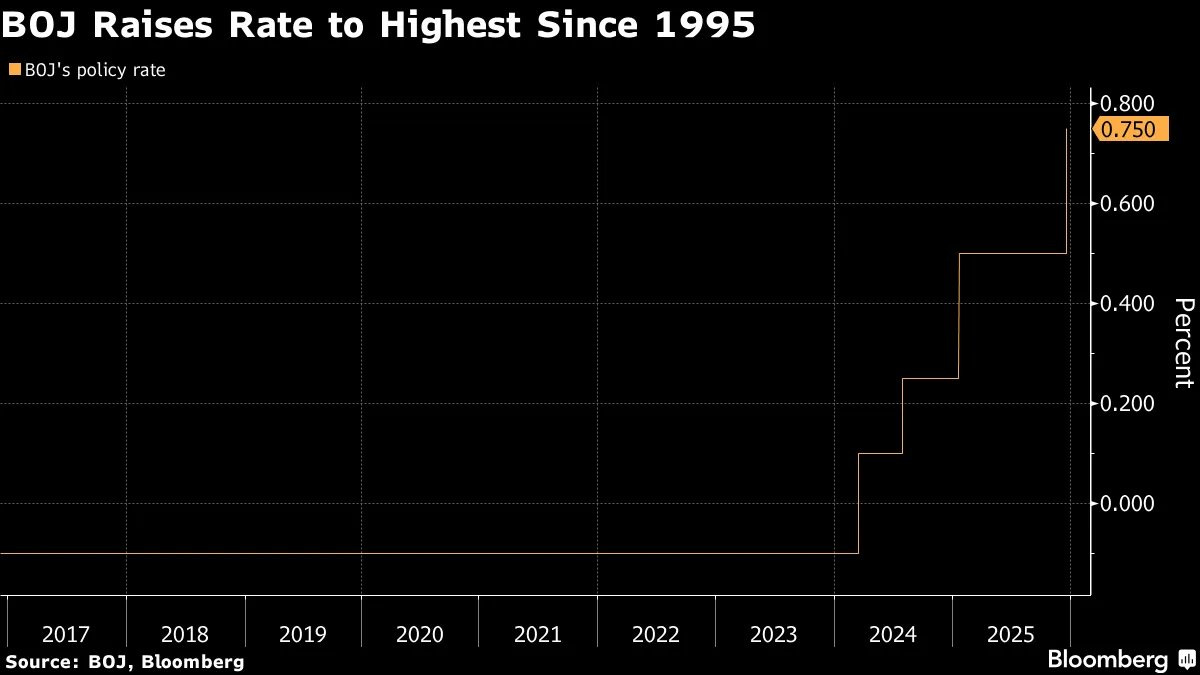

5️⃣ Bank of Japan Raises Rates to 30-Year High

The Bank of Japan raised its benchmark interest rate by 25 basis points to 0.75%, the highest level since 1995. The move drove Japanese government bond yields to multi-decade highs, with 10-year yields surpassing 2% for the first time since 1999. The yen weakened against the dollar following the announcement.

Long-term Significance:

Japan's shift away from ultra-loose monetary policy marks a significant change in global finance. With the world's third-largest economy tightening policy, we might see reduced liquidity in global markets and potential capital flows back to Japan as yields become more attractive. This could pressure global stock markets and strengthen the yen over time.

If you’re thinking “why should I care about Japan?” you’re missing the bigger picture.

Japan’s had near-zero interest rates for decades, making it the world’s cheapest place to borrow money. Hedge funds and institutional investors used what’s called the “carry trade,” borrowing yen at 0% and investing in higher-return assets like U.S. tech stocks.

Now that trade’s unwinding.

When Japan raises rates, borrowing yen gets more expensive. Investors who borrowed cheap yen to buy expensive Nvidia shares now face a choice: pay higher interest on their loans or sell their stocks to pay back the debt. Guess which one they’re choosing?

Why this matters:

Remember August 2024 when global stock markets crashed for a few days? That was partially triggered by Japanese rate hikes causing carry trade unwinding. It could happen again, but worse.

Tech stocks are most vulnerable. Companies like Nvidia, Tesla, and Meta have huge institutional ownership. If global funds need to liquidate positions to cover Japanese borrowing costs, they’ll sell their biggest, most liquid holdings first. That’s your Magnificent 7 stocks.

Japan’s also drowning in debt. Their debt-to-GDP ratio is 230%, the highest in the developed world. Raising interest rates makes that debt more expensive to service. It’s like Japan took out an adjustable-rate mortgage and the rate just adjusted up. Eventually, something breaks.

Advice:

Diversify away from pure tech exposure. If your portfolio is 70-90% Magnificent 7 stocks, you’re taking on Japanese monetary policy risk without realizing it. Add international diversification, value stocks, and fixed income.

Watch the yen. If the yen strengthens sharply against the dollar (moves from 155 to 140 or lower), that’s your warning signal. A strong yen means carry trades are unwinding fast. Check xe.com weekly to monitor the USD/JPY exchange rate.

Consider Japanese stocks. Contrarian idea: If you believe Japan’s economy strengthens as rates rise, Japanese stocks become more attractive. ETFs like EWJ (iShares MSCI Japan) give you broad exposure. When rates rise in a country, banking stocks usually benefit first (they make more money on loans).

Keep cash ready. If carry trade unwinding triggers a market selloff (like August 2024 but bigger), having 20-30% cash lets you buy quality stocks at discounts. This is why I keep telling you: cash isn’t trash when volatility’s high.

💡 Andrew’s Analysis:

Here’s what connects everything:

Every story this week points to the same conclusion: The era of free money is over, and nobody knows what comes next.

Inflation’s supposedly falling (but maybe not). Jobs are disappearing (but stocks don’t care). The Pentagon can’t account for trillions (but keeps spending). Precious metals are screaming warnings (but equities keep climbing). Japan’s ending three decades of cheap money (but markets haven’t priced it in).

This is what financial instability looks like before it becomes obvious.

When I worked in finance during the 2008 crisis, the warning signs were everywhere for months before the crash. Not a single massive red flag, but dozens of small contradictions that didn’t make sense. Housing prices falling while mortgage bonds stayed expensive. Banks reporting record profits while hedge funds quietly imploded. Everyone knew something was off, but nobody wanted to be first to admit it.

We’re in a similar moment now. Not necessarily heading for a crash, but definitely in transition. The old playbook (buy tech, ignore everything else) worked for 15 years. That playbook’s getting rewritten in real time.

My advice:

Diversify like your portfolio depends on it (because it does). Own some tech, some value, some international, some bonds, some precious metals, and some cash. When you don’t know which asset will win, own a little of everything.

Build systems, not predictions. Stop trying to guess where the market goes next. Instead, set rules: “I’ll buy when the S&P falls 10%,” or “I’ll take profits when any stock doubles,” or “I’ll rebalance every quarter regardless of headlines.” Systems survive chaos. Predictions don’t.

Focus on what you control. You can’t control inflation data, Fed decisions, or Japanese interest rates. You can control your savings rate, your debt levels, your career skills, and your emergency fund. In uncertain times, double down on what you can actually influence.

The best investors don’t predict the future. They prepare for multiple futures. Start preparing.

👉 For daily insights, follow me on X/ Twitter, Instagram Threads, or BlueSky, and turn on notifications!

(3) Chart of the Day

The "Circular Money" Trap:

💡 Andrew’s Analysis:

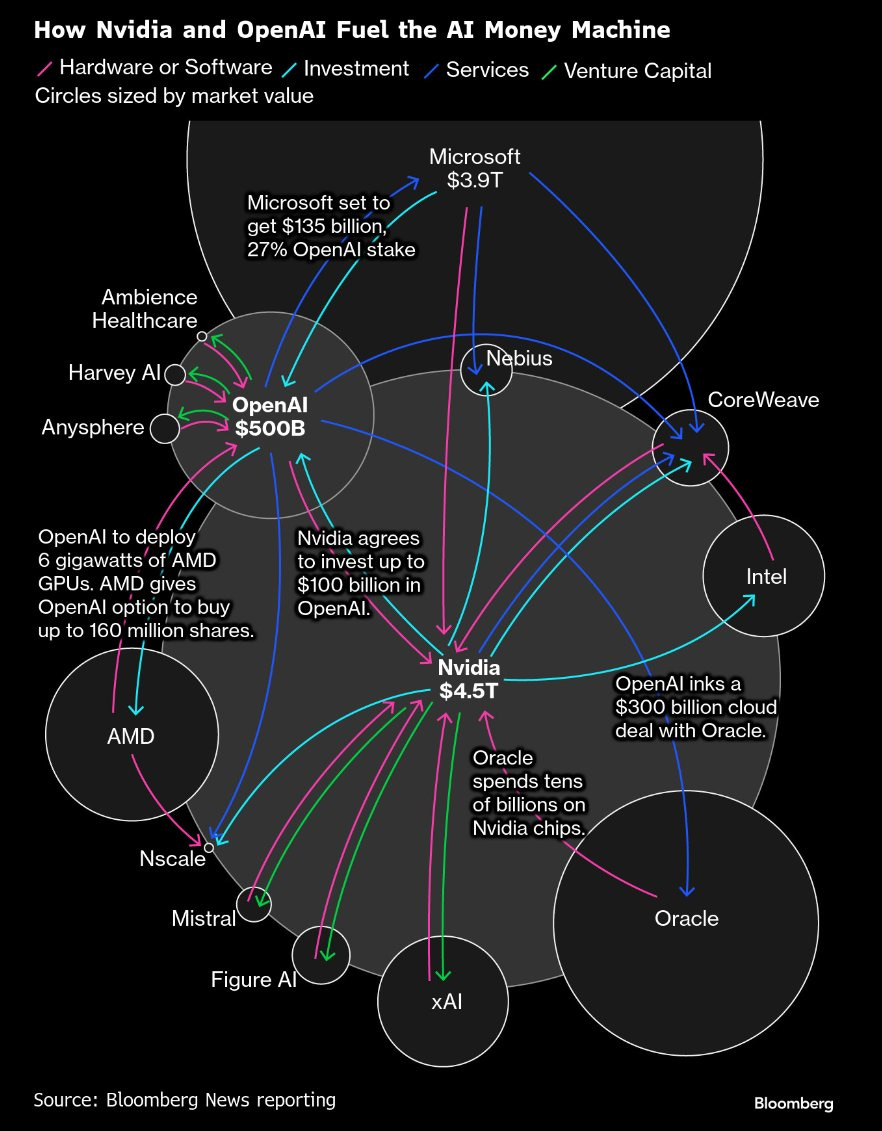

What you are looking at: This network graph shows the flow of money between the biggest players in AI: Nvidia, OpenAI, Microsoft, and Oracle. It reveals a fascinating (and slightly scary) loop:

Microsoft invests billions in OpenAI -> OpenAI uses that money to buy chips from Nvidia -> Nvidia invests in other AI startups -> Those startups buy more chips from Nvidia.

Why this is dangerous: This looks eerily similar to the Dotcom Bubble. In 2000, internet companies bought ads on each other's websites to pump up revenue numbers. When the investment capital dried up, the revenue vanished overnight because there were no real customers outside the circle.

Why this matters:

Concentration risk is massive. Notice how everything flows through Nvidia, Microsoft, and OpenAI? If any one of these companies stumbles, the whole ecosystem shakes. This isn’t diversification, this is concentrated bets wrapped in complexity.

The winners are already decided (for now). Nvidia’s making money regardless of whether AI succeeds long-term because every company needs their chips today. Microsoft’s hedged beautifully by owning a huge stake in OpenAI while also selling cloud services to OpenAI’s competitors. Oracle’s positioned as critical infrastructure.

The losers? Anyone not in this circle. If you’re a tech company without AI partnerships, investor money’s not flowing your way. If you’re Intel trying to catch up on chip manufacturing, you’re already five years behind. This chart shows who has power in the AI economy, and it’s a very small club.

What this means for you:

Own the infrastructure, not the hype. Nvidia and Microsoft aren’t going away even if some AI startups fail. They’re selling the picks and shovels during a gold rush. During the 1849 Gold Rush, most miners went broke. You know who got rich? Levi Strauss selling jeans and the companies selling mining equipment.

Be wary of concentration. If your portfolio is heavy in Nasdaq 100 or S&P 500 index funds, you already own a ton of these interconnected companies. That’s not diversification across industries, that’s multiple bets on the same outcome. Consider balancing with international stocks, small caps, or sectors entirely outside AI.

Watch for the next layer. This chart shows first-generation AI infrastructure. The next wave will be companies building applications on top of this foundation. Healthcare AI, education AI, finance AI, manufacturing AI. Right now, these sectors are undervalued because all the money’s chasing infrastructure. That’s your future opportunity.

The regulatory risk nobody’s pricing in. When you have this much money flowing in circles between this few companies, governments start asking questions. Antitrust regulators are already investigating Microsoft’s OpenAI relationship. If regulators force divestitures or block mergers, this whole map gets redrawn. Keep 10-20% of your portfolio in assets that don’t care about AI regulation (utilities, consumer staples, commodities).

Here’s my contrarian take: This chart will look completely different in five years. Maybe OpenAI gets acquired. Maybe Nvidia’s dominance gets challenged by custom AI chips from Google, Amazon, or Apple. Maybe the whole AI boom turns out to be overhyped and money flows elsewhere.

The lesson from history: In 2000, everyone thought Cisco, Sun Microsystems, and Nortel Networks would dominate the internet forever. Those companies either disappeared or became irrelevant. The internet still won, but the winners changed. AI will probably follow the same pattern.

Advice: Own a piece of this ecosystem (through broad index funds or select tech stocks), but don’t bet your entire future on this map staying static. The companies in this circle are making huge bets on each other. You don’t have to match their conviction. You can be smart, diversified, and still profit from AI without putting all your chips (pun intended) on Nvidia.

Final thought: When I see charts like this showing circular money flows between the same players, I think of 2008’s mortgage-backed securities or the dot-com bubble. Not because AI will crash the same way, but because extreme interdependence creates systemic risk. If one domino falls, others follow.

Stay invested. Stay diversified. Stay skeptical.

👉 For daily insights, follow me on X/ Twitter, Instagram Threads, or BlueSky, and turn on notifications!

(4) Top Stocks

Everything you need to know about the top stocks this week:

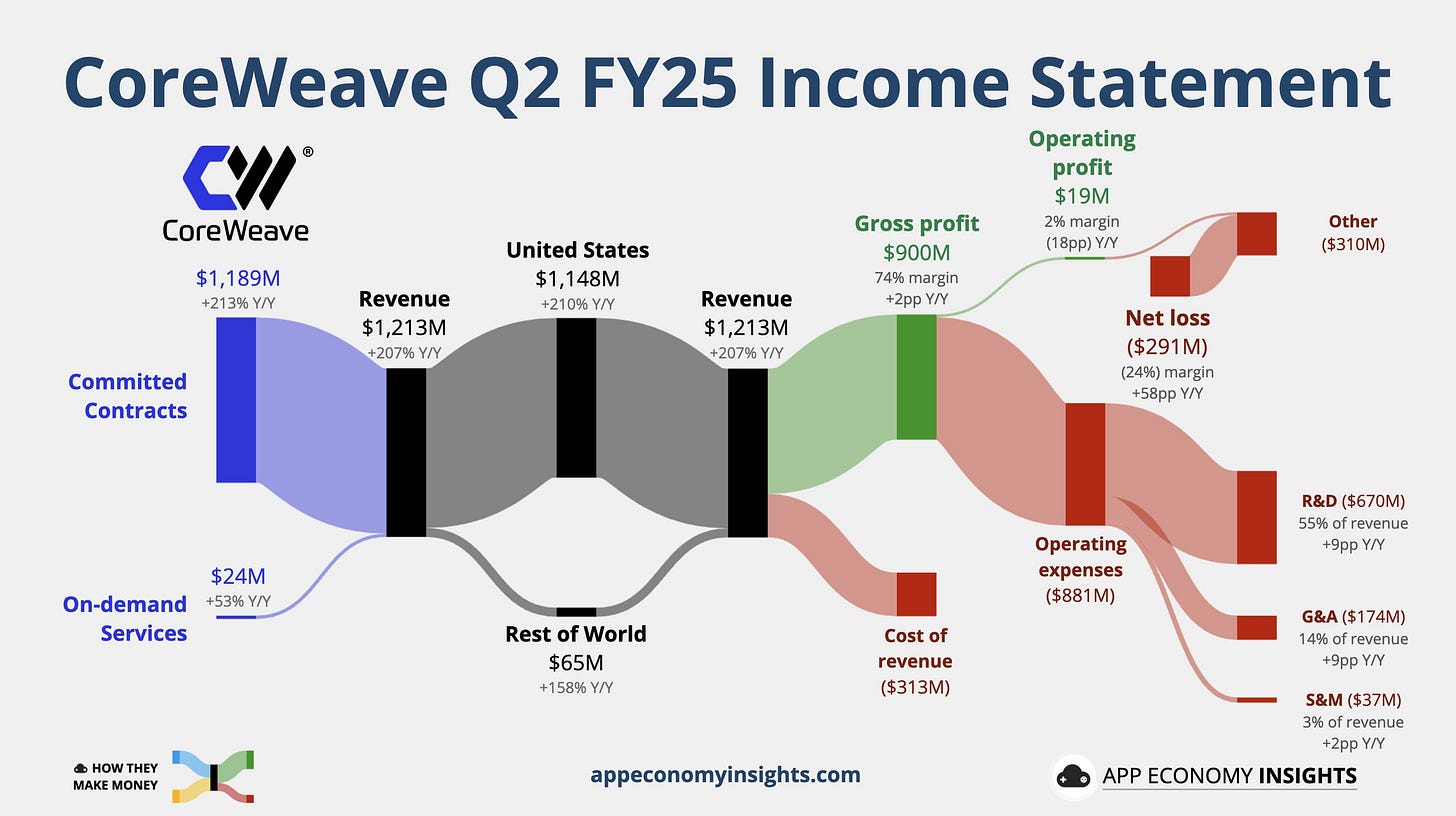

CoreWeave surged 22.64% after Citi’s Buy rating. This AI cloud provider meets explosive data center demand.

Hut 8 rose 8.98% on a $7B Louisiana data center lease. It shifts from crypto mining to AI hosting.

Texas Pacific Land gained 7.59% via a $50M AI data center partnership on its land.

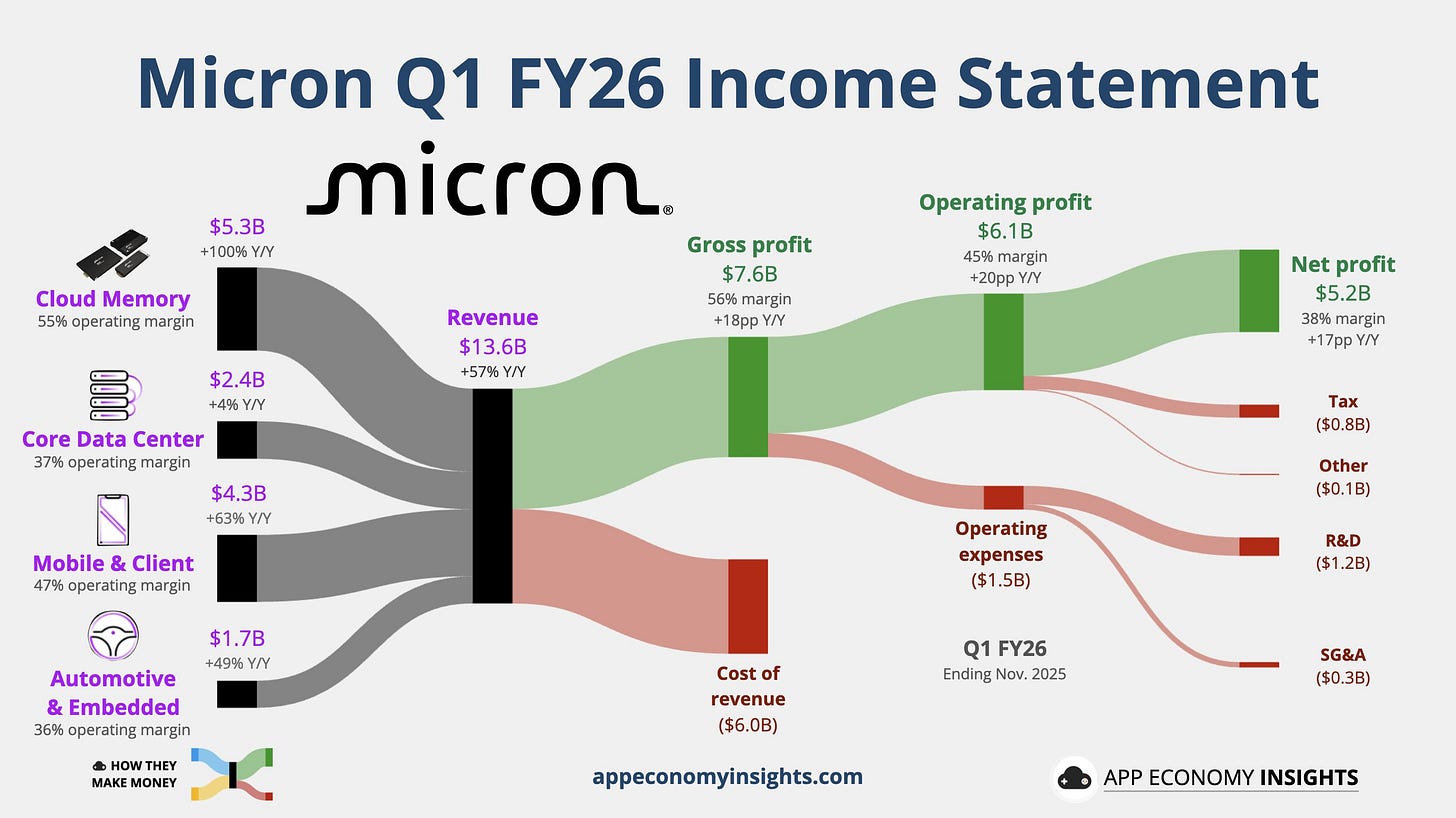

Micron Technology $MU added 6.99%. AI chip demand drove record results.

Rocket Lab climbed 11.05% post successful Space Force launch. Space tech supports AI satellites.

Rivian Automotive $RIVN jumped 15.03% on Baird upgrade. Its R2 platform ties to AI-driven EVs.

Udemy soared 12.66% on $2.5B Coursera merger. Online learning booms with AI skills needs.

DBV Technologies leaped 25.42% on strong peanut-allergy trial. Biotech advances fuel health AI.

Others: Carnival +9.81% (strong guidance), Winnebago +8.43% (revenue beat), Trump Media +8.28% (fusion energy merger), Lululemon +3.48% (activist stake), SoFi +4.04% (stablecoin launch).

Pharma giants like Gilead, Amgen, Bristol Myers rose 1-2% on tariff relief deals.

💡 Andrew’s Analysis:

Long-term, AI demands massive power and compute. This creates winners in energy (fusion, data centers), chips, space, EVs, education, and health. Think 1990s internet—early infrastructure plays exploded.

These stocks connect through AI’s hunger for power and tools. Energy/land deals feed data centers; chips and space enable them; education trains workers; health uses AI diagnostics.

Common Patterns/Themes:

Growth in AI and Tech: Companies like Micron, CoreWeave, and Hut 8 are seeing significant gains due to strong investor interest in AI-related technologies.

Healthcare Innovations: Pharma companies and biotech firms like Amicus Therapeutics and DBV Technologies are making strides in healthcare, showing the sector’s potential for growth.

Consumer Demand: Companies like Carnival, Winnebago, and Chipotle are benefiting from strong consumer demand and recovery in travel and leisure sectors.

👉 For daily insights, follow me on X /Twitter; Instagram Threads; Facebook; or BlueSky, and turn on notifications!

(5) Today’s Trade

PTC Inc. $PTC

PTC $PTC sells design and industrial software used in product design, digital twins, and factory planning.

What happened

Call volume jumped to about 4,046 contracts, about 1,000 times normal.

Traders focused on July 17, 2026 calls at 160 and 165 strikes.

They bought the 160/165 call spread for about 3.10 dollars.

There was zero open interest at those strikes before today.

A call spread means the buyer is bullish but controls risk: they buy a lower-strike call and sell a higher-strike call to cut the cost.

How to read it

This is clearly bullish options flow.

The trader is betting $PTC will be above 165 by July 2026, but not paying for unlimited upside.

The very wide markets show the options are illiquid, which means this is likely a patient, high-conviction bet, not a day trade.

PTC sits right in the “software that powers hardware” theme. As factories, cars, and devices become smarter, design and simulation tools matter more.

My take

This is a bullish signal from someone willing to risk capital on PTC's upside. The industrial software sector has been resilient as companies continue digitization efforts despite economic uncertainty. PTC's focus on augmented reality, IoT, and digital twins positions it well for the manufacturing renaissance.

I read this as a measured long-term bull view. If the stock drifts sideways or drops, the spread can lose value, but the risk per share is capped at the cost of the spread.

If you like $PTC:

The simple version is to own the stock and think in a 2-year window, since the trade’s timing stretches into 2026.

If you use options, study call spreads. They are a good way to express a view without risking your whole account on one idea.

Key lessons from today’s flow

Use this simple “3R Options Checklist” when you watch unusual activity:

Role: Is the flow new speculation, or a hedge on an existing position?

Risk: Is the trader buying options (limited risk, big reward) or selling options (limited reward, big risk)?

Range: What price range and time window are they targeting?

Most retail traders only see “calls up, so stock bullish.” The pros ask all three questions. You should too.

👉 For daily insights, follow me on X /Twitter; Instagram Threads; Facebook; or BlueSky, and turn on notifications!

(6) Fear & Greed Analysis

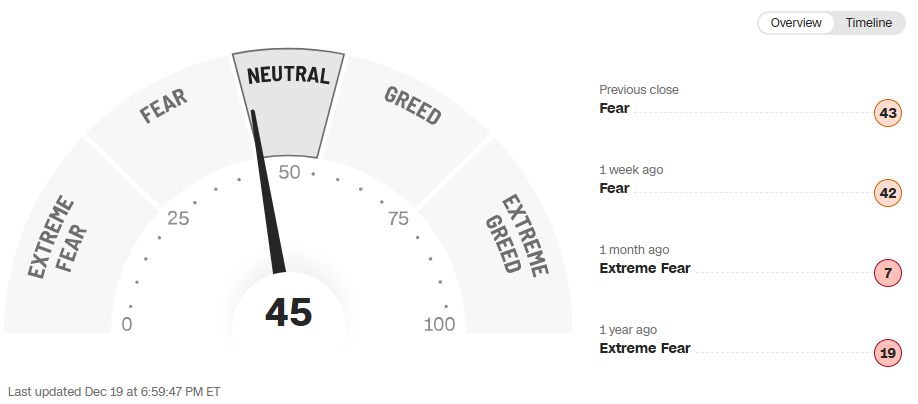

At 45 on the Fear & Greed Index, we’re neither scared nor greedy. That’s actually the most dangerous place to be. When everyone’s unsure, volatility spikes.

A month ago, we sat at 42. A week ago, 43. Today, 45. That’s basically sideways. Markets hate indecision. They want conviction (either bulls or bears in control). Right now, nobody’s winning.

Four indicators signal fear (momentum, breadth, puts, junk bonds). Two signal neutrality (price strength, volatility). One signals greed (safe haven demand).

My bet? We're in the late stages of a rally that's running on hope, not fundamentals. The smart money's hedging (puts), rotating (junk bonds), and waiting (momentum). The retail money's still buying stocks because "stocks only go up."

What this means: Don't make big bets either direction right now. The market's telling you it doesn't know what comes next. When the index sits between 40-60, expect choppy, range-bound trading. Save your ammunition for when it hits extremes (below 25 or above 75).

👉 For daily insights, follow me on X /Twitter; Instagram Threads; Facebook; or BlueSky, and turn on notifications!

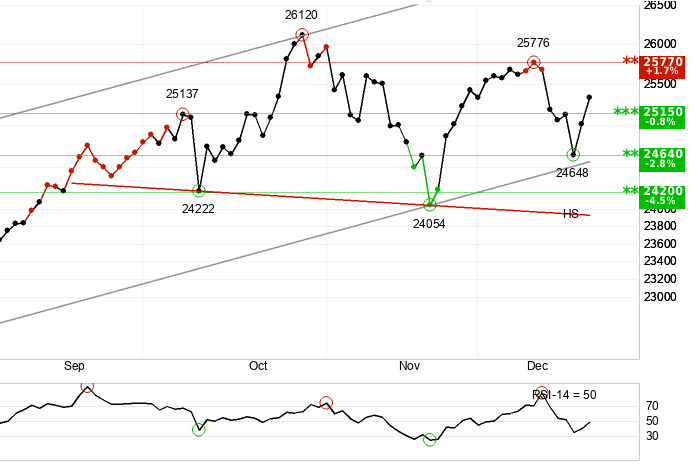

(7) Technical Analysis

1) S&P 500 SPY 0.00%↑

S&P 500 ($SPY) Trend: Weak Positive. The overall market is grinding higher in a rising channel.

The Setup: We are seeing a pattern of “higher highs and higher lows,” which is the definition of an uptrend. However, it is labeled “weak” because the momentum isn’t explosive.

The News: Inflation data was fuzzy, jobs data was weak, but AI stocks lifted the index. The lift is narrow.

The Key Levels: The floor (support) is at 6720. As long as we stay above that, the trend is safe. The ceiling (resistance) is 6900.

2) Tech Stocks QQQ 0.00%↑

Tech Stocks ($QQQ) Trend: Positive. Tech stocks are showing strong development and optimism.

The Setup: The Nasdaq broke through a resistance ceiling at 25,150. In technical analysis, “old ceilings become new floors.” So, 25,150 is now your safety net.

The Warning: There is a potential “Head and Shoulders” pattern forming. This is often a reversal signal. You need to watch the volume. If the price drops below 23,939 on high volume, the party is over.

The News: AI mania drives the move. Oracle, Nvidia, and Microsoft lead. The sector is priced for perfection. One earnings miss and the shoulders collapse.

3) Bitcoin $BTC

Bitcoin ($BTC) Trend: Weak Negative. Bitcoin is taking a breather and sliding downwards.

The Setup: BTC is stuck in a falling channel. Investors are losing a bit of interest in the short term.

The News : Regulatory pressure is rising. The SEC is sniffing around stablecoins. SoFi just launched SoFiUSD, which invites more scrutiny. Institutions are pausing crypto allocations until 2026.

The Key Levels: Support is at $84,000. Resistance is at $93,400.

The Analysis: The 66‑day momentum is down 21%. Weak negative means lower highs and lower lows. The most likely path is a test of $80,000. I’m bearish until $84,000 holds for two weeks straight.

👉 For daily insights, follow me on X /Twitter; Instagram Threads; Facebook; or BlueSky, and turn on notifications!

👋Final Thoughts:

🙌Thanks for reading and joining 108,000 members who trust our newsletter! If you enjoyed it please:

Hit the LIKE button ❤️ on this post to help us grow our audience on Substack 🙏

Help us by sharing it with friends or family to help us grow our audience, and become a paid subscriber to support our writing and research (learn about all of the benefits here):

Did you know your job can pay for this newsletter with its employee development budget? To make it easy, we’ve created this email template to send to your manager.

And please let us know what you think of today’s newsletter:

Missed an issue? Read past issues here at TheFinanceNewsletter.com

☺️ My goal is to help you become smarter with money — Join 3 million and follow me across social media for daily insights:

Instagram Threads: @Fluent.In.Finance

Twitter/ X: @FluentInFinance

Facebook Page: Facebook.com/FluentInFinance

Linkedin: Linkedin.com/in/Lokenauth

Youtube: Youtube.com/FluentInFinance

Instagram: @Fluent.In.Finance

TikTok: @FluentInFinance

Facebook Group: Facebook.com/Groups/FinanceTalk

Reddit Community: r/FluentInFinance

➕Please add this newsletter to your contacts to ensure that none of our emails ever go to spam!

This content is for educational purposes only. Such information should not be construed as legal, tax, investment, financial, or other advice. See for Disclaimer, Terms and Conditions.