💥Investing Insights & Market Analysis You Need to Know [July 9, 2025]

How Trump’s ‘Big Beautiful Bill’ will affect you, US dollar suffers worst start to year since 1973, Home Sellers now outnumber Buyers by almost 500,000 (the largest gap ever recorded), & More

👋 Good morning my friend, and welcome back to your favorite newsletter! I hope you’re having a great week!

Thanks for subscribing to our newsletter, dedicated to helping you become richer and smarter with money! Due to health issues, I took time off from writing our newsletter but I’m back!

We have so much important information to cover! In this issue we discuss:

1) Market Analysis

2) Important Financial Events

3) Important Charts & Numbers

🎯Premium Research & Analysis:

4) What I'm Investing in [Stock Picks & Analysis]

5) Insider Trades from Billionaires, Politicians and CEO's

6) Stocks to Watch (and Catalysts)

7) Real Estate & Housing Market Insights

8) Interest Rate Predictions (and Mortgage Rate Updates)

9) Short-term Technical Analysis [S&P 500, Tech Stocks, Bitcoin]

10) Market Sentiment & Economic Outlook

11) Trade of the Week [Options Trading]

12) Important Economic Events this Week

13) Important Earning Announcements (and stocks to watch)1. This Week’s Market Analysis:

Year-to-date, the S&P 500 is up 6.1%, the Nasdaq is up 5.8%, Gold is up 26.2%, and Bitcoin is up 17%. This week:

The S&P 500 and Nasdaq hit new all-time highs thanks to tech stocks

Extreme greed returns to the Stock Market for the first time this year. This is the highest reading since March 2024!

The Warren Buffett Indicator is going parabolic as it soars to 209%, the most expensive valuation in history.

Copper rose past $10,000 per ton, to its highest level since March.

Bitcoin volatility hit a two-year low.

💡Andrew’s Analysis:

The Fear & Greed Index is flashing “Extreme Greed”. This means investors are piling in, often without thinking about risk. When everyone’s greedy, prices can get stretched. History shows that after periods of extreme greed, markets often pull back or get choppy as reality sets in.

If you’re feeling FOMO, take a breath. Don’t let emotions drive your decisions. Remember, the best investors buy when others are fearful and trim positions when others are greedy.

The Buffett Indicator is at 209%—way above its long-term average. This tells us that US stocks are very expensive compared to the size of the economy. In the past, when this ratio got this high, future returns were often lower, and sometimes there were sharp corrections.

This doesn’t mean a crash is coming tomorrow. Markets can stay expensive for a while, especially when there’s excitement about new technology.

Copper breaking $10,000 a ton signals strong demand for industrial metals, often a sign the global economy is humming. It’s also a bet on the future—think electric cars, renewable energy, and infrastructure. If you want to play this trend, look at mining stocks or funds that track industrial metals.

Meanwhile, Bitcoin volatility is at a two-year low. This means crypto markets are calm, which can be good or bad. Calm markets can attract big investors who want less drama, but it can also mean a big move is coming. If you’re in crypto, don’t get lulled to sleep—volatility can return fast.

👉 For daily insights, follow me on Twitter/ X or Instagram Threads or BlueSky, and turn on notifications!

🤔How do you feel about the markets?

2. Most Important Financial Events this Week:

This week, we analyze:

1) Trump’s ‘Big Beautiful Bill’ has been signed into law. Here’s how Trump’s megabill will affect you.

2) US dollar suffers worst start to year since 1973. The US Dollar Index has dropped more than 10% in just 6 months.

3) Trump says he is about to raise tariffs as high as 70% on some countries.

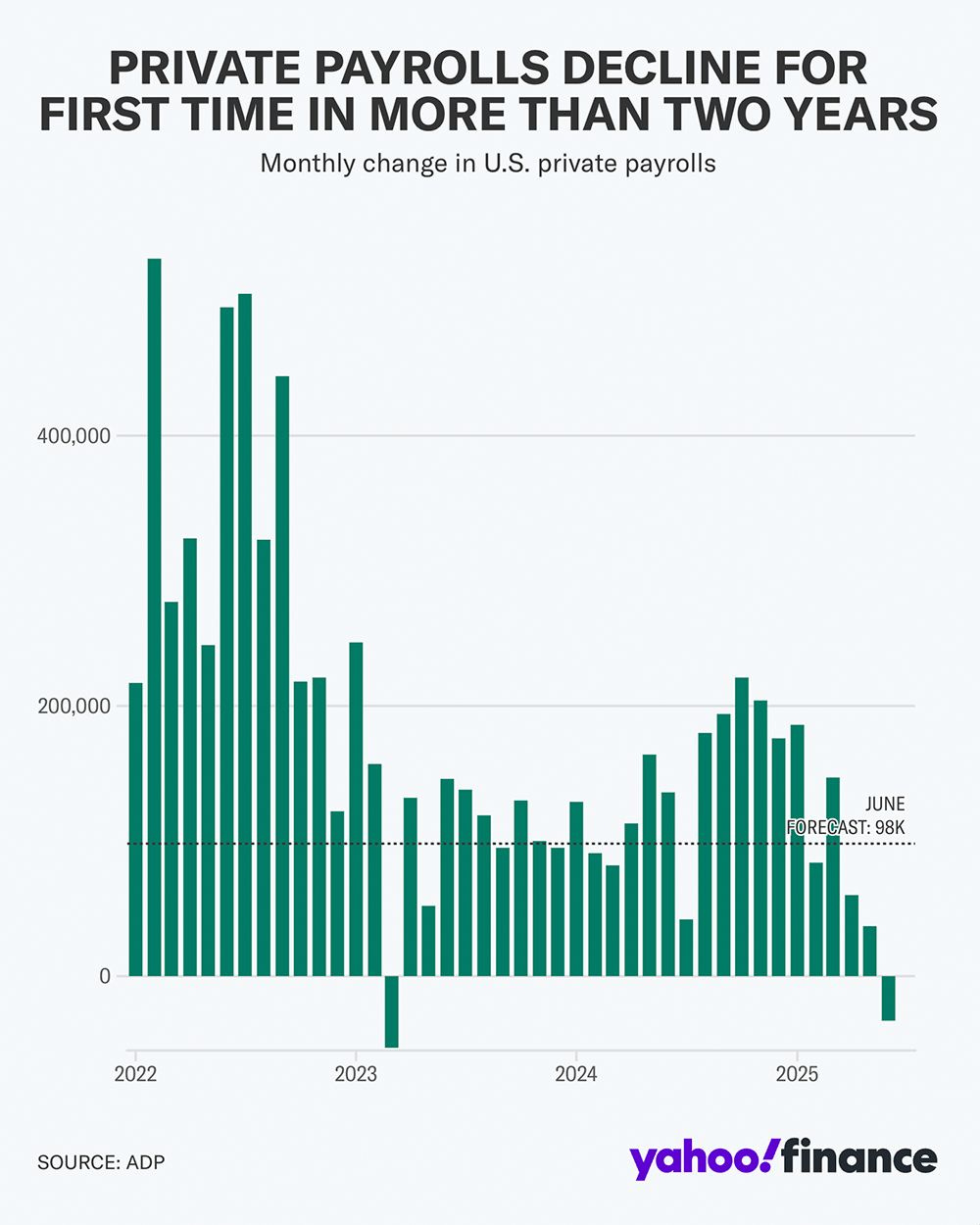

4) The private sector lost 33,000 jobs in June, badly missing expectations for a 100,000 increase.

5) Powell confirms that the Fed would have cut by now were it not for tariffs

6) Elon Musk has announced he is forming a new political party called the America Party.1️⃣ Trump’s ‘Big Beautiful Bill’ has been signed into law. Here’s how Trump’s megabill will affect you.

This week, President Trump signed his "Big Beautiful Bill" (or BBB) into law. It’s a huge, nearly 900-page document that changes a lot about taxes and government spending.

The main event is a $4.5 trillion tax cut. This makes the tax cuts from Trump's first term permanent. For businesses, this is great news. They can now write off 100% of their spending on new equipment and research right away. The idea is that this will get them to spend more money and help the economy grow.

For people, it's a mixed bag. The wealthiest families will get an average tax break of about $12,000. However, the poorest individuals will end up paying approximately $1,600 more per year. (The bill pays for the tax cuts by cutting spending on programs like Medicaid and food stamps (SNAP)).

There are some other changes, too. The child tax credit goes up a little, from $2,000 to $2,200. There's a new $6,000 tax deduction for older adults who make less than $75,000. And if you buy an American-made car, you can deduct up to $10,000 in interest payments. But the popular $7,500 tax credit for electric vehicles is gone as of September 30th. (A big blow to the EV industry).

The bill also puts a lot of money into border security, including funds for a border wall and hiring 10,000 more ICE agents.

💡Andrew’s Analysis:

For Investors: Companies that cater to wealthy consumers (think luxury brands, high-end travel) might do well. Also, look at defense contractors and private prison companies, which will get a boost from the increased security spending.

On the flip side, hospitals, especially in rural areas, could face serious financial trouble. Be cautious about investments in healthcare providers that rely heavily on Medicaid.

For Personal Finance: If you or your family rely on Medicaid or SNAP, you need to prepare for big changes. The new work requirements (80 hours a month) will be a hurdle for many. Start looking into your state's specific rules now.

For everyone else, review your budget. The changes to tax deductions might affect you. That new car loan deduction is nice, but don't buy a car just for a tax break. The end of the EV credit means if you were thinking of buying an electric car, you need to act fast.

2️⃣ US dollar suffers worst start to year since 1973. The US Dollar Index has dropped more than 10% in just 6 months.

The U.S. dollar has had its worst start to a year since 1973. It's down more than 10% in just six months. That's a huge drop for a major currency.

Why is this Happening?

Investors around the world are getting nervous about the U.S.

Trump's policies are a big reason. The constant threat of trade wars and tariffs makes the U.S. appear less stable as a place to invest.

The new "Big Beautiful Bill" is also a factor. It's expected to add over $3 trillion to the national debt. That's a lot of borrowing, and it makes the dollar look weaker.

Basically, big investors are starting to hedge their bets. They're moving some of their money out of the dollar and into other currencies, like the euro, or into assets like gold.

💡Andrew’s Analysis:

The dollar has been the world's most important currency for a long time. This means countries everywhere hold dollars and use them for trade. This gives the U.S. a lot of power. A falling dollar could, over many years, start to challenge that power. It makes imports more expensive for Americans (so that trip to Europe will cost you more) but makes U.S. exports cheaper for other countries.

This could be the beginning of a long-term trend where the world becomes less reliant on the dollar. It won't happen overnight, but it's a major shift to watch.

For Investors: A weak dollar is great news for U.S. companies that sell a lot of stuff overseas (think big tech or manufacturers). Their products become cheaper for foreign buyers. It's also a good time to think about investing in international stocks. Your U.S. dollars will buy you more shares in a German or Japanese company. Gold and other commodities often do well when the dollar is weak, so that's another area to consider.

For Personal Finance: If you're planning an international trip, your money won't go as far. Budget for that. At home, you might start to see prices for imported goods go up. This is a good time to focus on buying American-made products if you can.

3️⃣ Trump says he is about to raise tariffs as high as 70% on some countries.

Just when you thought the trade wars were calming down, Trump announced he's about to hit some countries with tariffs as high as 70%. He said his administration will start notifying countries of their new rates, which would kick in on August 1st.

This is part of Trump's "reciprocal" trade strategy. He wants other countries to lower their barriers to U.S. goods. If they don't play ball, he hits them with tariffs. This new round of tariffs could be much higher than what we've seen before.

💡Andrew’s Analysis:

Tariffs this high would be a massive shock to the global economy. They are basically a tax on imported goods. That tax gets paid by American companies, who then pass the cost on to you, the consumer. Everything from clothes to electronics could get a lot more expensive.

This creates huge uncertainty for businesses. They can't plan for the future if they don't know what their costs will be. This could cause them to stop hiring or even lay people off. It could easily tip the U.S. and global economies into a recession.

For Investors: High tariffs are bad for almost everyone. Companies that rely heavily on imports (like retailers) will get hurt badly. The entire stock market will likely fall if these tariffs go into effect. This is a good time to have some cash on the sidelines, ready to buy good companies at a discount if the market panics.

For Personal Finance: Brace for higher prices. If you've been planning a big purchase (like a new TV or appliance), it might be smart to buy it sooner rather than later. This is also another reminder to have a healthy emergency fund. If the economy takes a hit, you'll want that cushion.

4️⃣ The private sector lost 33,000 jobs in June, badly missing expectations for a 100,000 increase.

The latest jobs report was a big surprise, and not in a good way. The private sector lost 33,000 jobs in June. Everyone was expecting an increase of 100,000 jobs. That's a huge miss.

What Happened?

Companies seem to be getting nervous. They are hiring less and are not replacing workers who leave. The service industry, which has been the engine of job growth, lost a lot of jobs. This is a sign that the economy might be weaker than we thought.

💡Andrew’s Analysis:

One bad jobs report isn't a disaster. But it's a major warning sign. The job market is the backbone of the economy. When people are working, they have money to spend. When they're not, the whole system slows down. If this trend continues, a recession becomes much more likely.

For Investors: A weak job market is bad for stocks. It means less consumer spending and lower corporate profits. Be prepared for more market volatility.

For Personal Finance: This is a wake-up call. Make sure your finances are in order. Build up your emergency fund (aim for 3-6 months of living expenses). Pay down high-interest debt. If you're worried about your job, start updating your resume and networking now. Don't wait until you get a pink slip.

5️⃣ Powell confirms that the Fed would have cut rates by now were it not for tariffs

Federal Reserve Chair Jerome Powell confirmed what many suspected: the Fed would have already cut interest rates if it weren't for Trump's tariffs.

Why?

The Fed's job is to keep the economy stable. It cuts rates to boost a weak economy. The recent job numbers suggest the economy needs a boost. But tariffs push prices up (inflation). The Fed usually raises rates to fight inflation. So, the Fed is stuck. They can't cut rates to help the job market because they're worried about inflation from the tariffs.

💡Andrew’s Analysis:

For Investors: This means interest rates will likely stay higher for longer than they otherwise would have. That's generally not great for the stock market. It makes borrowing more expensive for companies and consumers.

For Personal Finance: If you have debt with a variable interest rate (like a credit card), try to pay it down as fast as you can. Those rates aren't likely to drop anytime soon.

6️⃣ Elon Musk has announced he is forming a new political party called the America Party.

Elon Musk announced he's forming a new political party called the "America Party." Musk, who was once a Trump ally, is furious about the "Big Beautiful Bill," calling it an "insane spending bill" that will bankrupt the country.

💡Andrew’s Analysis:

Starting a new political party is tough. But Musk is the world's richest man. If he's willing to spend a lot of his own money, he could have a real impact, especially in the 2026 midterm elections.

This adds another layer of unpredictability to an already chaotic political scene. A feud between Trump and Musk could split the Republican vote. This could create more gridlock in Washington and make it even harder to solve the country's problems. For businesses, more political instability is never a good thing.

For Investors: Political uncertainty is something the market hates. This news could cause some short-term jitters. In the long run, pay attention to which candidates Musk supports. His influence could boost certain industries (or hurt others).

Other important headlines this week:

Half a dozen states are pushing to amend the US Constitution to term-limit members of Congress, per Bloomberg.

US unemployment rate falls to 4.1%, lower than expectations.

Top tier AI employees at $META will make a base salary of $100 million, with bonus up to $300 million a year, per WIRED

👉 For daily insights, follow me on Twitter/ X or Instagram Threads or BlueSky, and turn on notifications!

3. Important Charts & Numbers This Week:

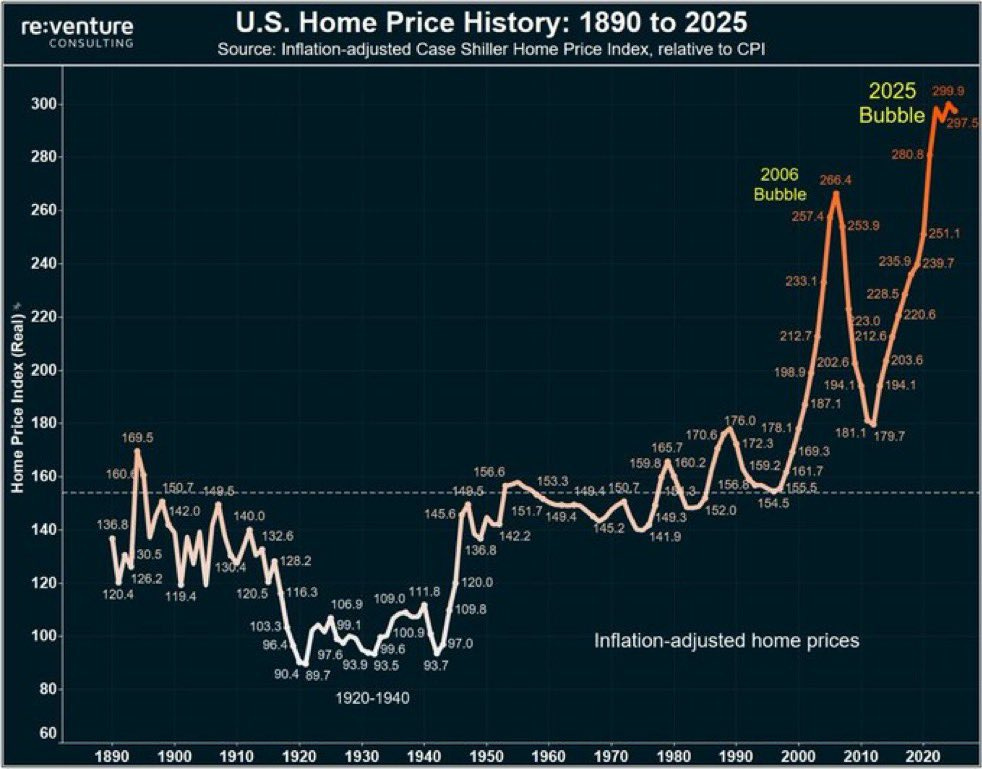

U.S. Housing Market has reached its most unaffordable level in history:

💡Andrew’s Analysis:

Why this matters:

Homes have never been this expensive relative to income and inflation. This isn’t normal growth. It’s a bubble. And bubbles pop.Long-term implication:

If wages don’t catch up—and fast—this market is unsustainable. Either prices drop sharply, or buyers stop buying altogether.Advice:

If you’re a buyer, consider waiting. Or look in mid-tier cities with stable prices and job growth.

Home Sellers now outnumber Buyers by almost 500,000, the largest gap ever recorded:

💡Andrew’s Analysis:

Why it matters:

This supply-demand imbalance points to a coming price correction. When sellers outnumber buyers, they’re forced to cut prices—or wait.Long-term implications:

Expect price declines in overvalued regions. But also expect fewer new homes built (since builders will pull back), which could worsen long-term affordability.Advice:

If you’re buying, negotiate hard—you’ve got the upper hand.

The "buy the dip" strategy has been remarkably effective this year:

💡Andrew’s Analysis:

Why it matters:

This kind of behavior often signals euphoria, not logic. Retail traders, algos, and even institutions are betting that dips will always bounce.But here's the risk:

When too many people pile in expecting quick gains, even small shocks (bad earnings, a rate hike, a regulation) can trigger panic.What to watch next:

Earnings reports: If AI companies miss, watch out.

Inflation reports: If inflation stays hot, rate cuts get delayed, and markets pull back.

Tips:

Don’t chase hype stocks. Focus on profitable tech names with real revenue.

Take profits on outsized positions—especially if you’ve doubled or tripled returns this year.

Use stop losses if trading high-volatility names.

U.S. National Debt projected to soar to $55 Trillion by 2034 now that the Big Beautiful Bill has passed:

💡Andrew’s Analysis:

Why this matters:

That’s not just a big number—it means higher interest rates, weaker credit ratings, and possibly currency devaluation down the line.Long-term risks:

Interest on the debt could crowd out other spending (like Social Security or infrastructure).

The U.S. may lose its “safe haven” status if investors lose faith in our ability to repay.

More debt means more inflation risk, especially if the Fed keeps rates low to manage costs.

Tips:

Hold some inflation-protected assets (like TIPS, gold, or real estate).

Don’t rely on Social Security alone—build your own retirement plan.

Consider diversifying globally to hedge against a weaker U.S. dollar.

Public companies are buying Bitcoin at a rapid pace:

💡Andrew’s Analysis:

Why this matters:

Institutional demand is no longer just a trend—it’s the new normal. As fiat weakens, and debt soars, Bitcoin’s role as “digital gold” grows.Long-term implications:

Bitcoin could become a core treasury asset for more companies.

Regulatory clarity may push more pensions and asset managers into crypto.

Price volatility could shrink as more Bitcoin gets locked up by long-term holders.

Tips:

Don’t ignore Bitcoin—it’s now institutional.

Consider dollar-cost averaging into Bitcoin ETFs or holding a small direct allocation.

Watch Bitcoin miners, wallets, and exchanges—they’re riding the same wave.

👉For more charts, follow me on Instagram or Facebook or LinkedIn, and turn on notifications!

🔒Premium Research

4. What I’m Investing in [Stock Picks & Analysis]:

1) MercadoLibre (MELI): The Amazon + PayPal of Latin America

The Big Idea: The Amazon and the PayPal for an entire continent that's just now coming online.

Why I Like It: MercadoLibre is the undisputed leader in e-commerce and digital payments in Latin America. The region has a population of over 650 million people. That's almost double the U.S. population. But their digital economy is years behind. This gives MELI a massive runway for growth. They are already dominant, and their market is still in its early days.

Why It's a Great Bet: This isn't just an e-commerce company. It's an infrastructure play. Their payment system, Mercado Pago, is their secret weapon. In a region where many people don't have bank accounts, Mercado Pago is becoming the go-to financial tool. It's their bank, their credit card, and their investment app all in one.

When you own the payment system, you own the customer. It creates a powerful loop. People shop on the marketplace, pay with Mercado Pago, and then use Pago for everything else. The company just applied for a banking license in Mexico. This is huge. It means they can move from simple payments to higher-margin services like loans and insurance. They are building the entire digital ecosystem for Latin America. Amazon can't just show up and compete with that.

The Numbers That Matter:

Revenue grew 37% year-over-year to $22.4 billion in the last twelve months

Revenue grew 64% last year. That's incredible for a company this size.

Earnings per share jumped 44% last quarter, beating expectations.

Fintech business is booming: 61 million monthly users, up 34% in a year, and a $6.6 billion credit portfolio.

Stock is up over 50% this year, crushing the S&P 500

It has perfect 99 ratings for both its overall performance (Composite Rating) and its earnings growth (EPS Rating). This is a stamp of A+ quality.

Big, smart money is buying. 55% of the stock is held by funds like Fidelity.

Moat:

127M users

Leading in Brazil, Mexico, Argentina

Fintech arm Mercado Pago has 40M users doing everything from bill pay to P2P to transit

Applied for bank charter in Mexico—could drive growth and lower funding costs

Big picture:

Latin America is under-digitized. MELI’s early lead and product ecosystem give it a wide moat. It’s Amazon in 2010, but for Latin America—plus a payments engine.

Own the leader in an under-penetrated, high-growth region. Expect continued compound growth and strong tailwinds from fintech expansion.

How I Play It: The story is fantastic, and the chart gives us a perfect entry point. The stock has pulled back to its 10-week moving average. This is a classic spot for strong stocks to bounce. I will buy more here. The stock is also building a new base with a buy point at 2,635.88. It's a quality company with a great story and a solid technical setup.

MercadoLibre revenues:

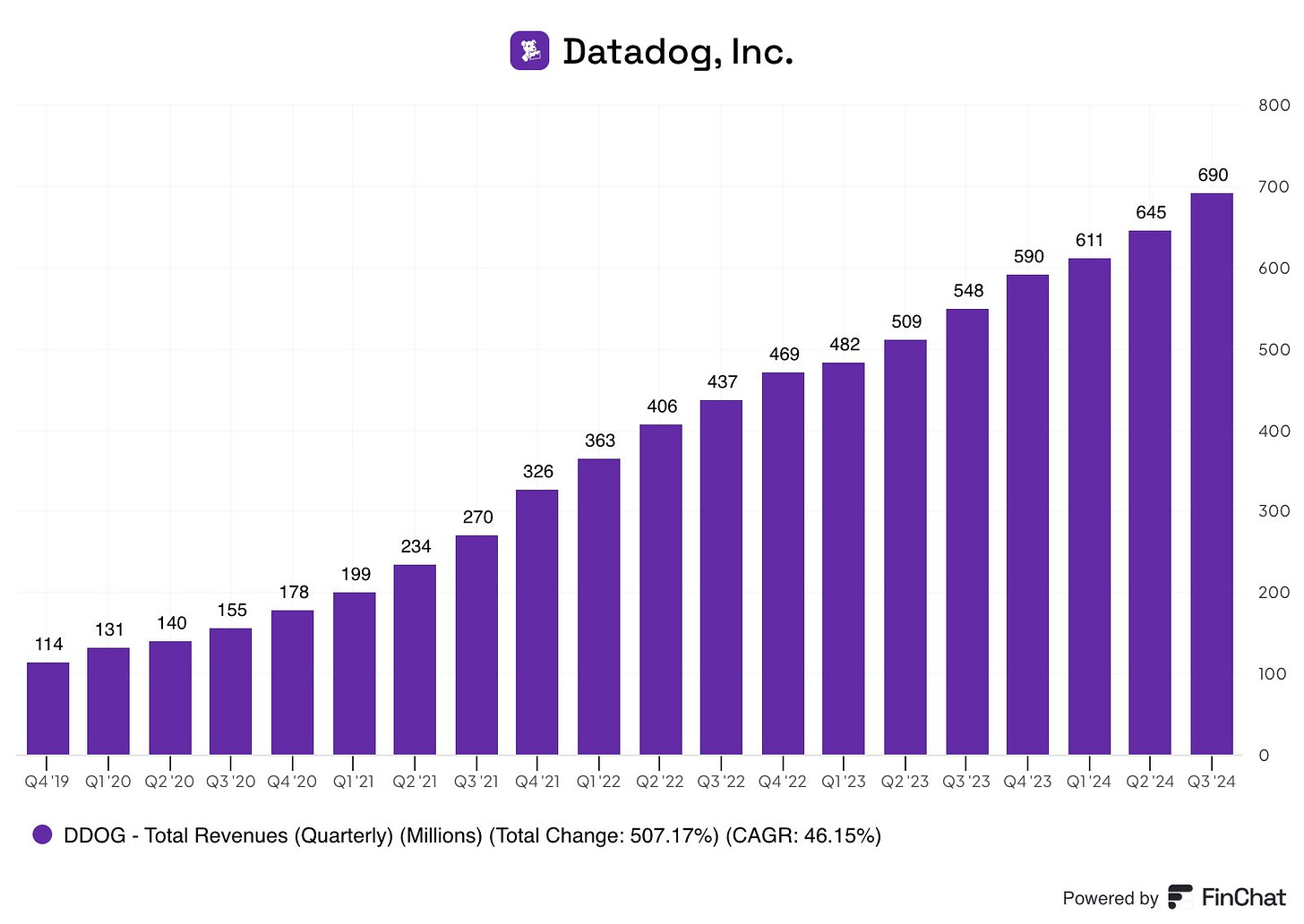

2) Datadog (DDOG): The Nerve Center of Cloud and AI

The Big Idea: The essential monitoring tools that every single AI company needs to function.

Why I Like It: Datadog provides the "eyes and ears" for software applications. In simple terms, it tells companies if their websites and apps are working correctly. With the explosion of artificial intelligence, this job has become much more important and much more difficult.

Why It's a Great Bet: This is a "picks and shovels" play on the AI gold rush. It doesn't matter which company builds the winning AI model. They all need to be monitored. When an AI application fails, it's not a simple fix. It's a complex black box. Datadog builds the tools to look inside that box and see what's wrong.

Companies are spending billions to build AI. They must spend a fraction of that to make sure it works. Datadog is a direct beneficiary of every dollar spent on AI development. The best part? 8.5% of its revenue already comes from new AI companies. This proves the thesis is already working. As the AI revolution continues, Datadog's role becomes more critical. It's a non-negotiable tool in the AI age.

Numbers to know:

Revenue hit $2.8 billion in the last year, up 26%.

AI is a big driver: AI-native companies already make up 8.5% of Datadog’s recurring revenue.

Strong cash flow: Operating cash flow margin is 33%, much higher than most companies.

Analysts expect 20%+ growth to continue, both in revenue and free cash flow.

Moat:

Deep integrations with major clouds (AWS, Azure, Google Cloud)

Sticky product, high switching costs

Critical infrastructure = must-have, not nice-to-have

Big picture:

As more companies build AI products, monitoring becomes more complex. Datadog becomes more essential. It’s a picks-and-shovels play on AI.

Buy the backbone, not just the buzz. Datadog gives you exposure to AI adoption without betting on any one model or startup.

How I Play It: This is a bet on the entire AI ecosystem—buying a high-growth (20%+) and high-margin (20%+) business that's a clear leader in its field. It's a simpler, and likely safer, way to profit from the AI boom than trying to pick the winning AI application.

Datadog revenues:

3) Seagate Technology (STX): The Backbone of AI Data Storage

The Big Idea: AI is built on huge amounts of data. Buy the company that builds the warehouses to store all that data.

Why I Like It: Seagate makes data storage products, mainly hard disk drives (HDDs). People think hard drives are old technology. But for data centers, they are still the cheapest and most efficient way to store massive amounts of information. The AI boom is creating an explosion of data that needs a home.

Why It's a Great Bet: Everyone is focused on the fancy chips that power AI (like Nvidia). They're missing the bigger, more boring picture. Those AI models and the data they train on are enormous. They have to be stored somewhere. That's where Seagate comes in.

This is a classic cyclical company. It goes through booms and busts. Right now, it's coming out of a bust with record-high profit margins. This is happening at the exact moment the AI demand wave is hitting. The company has a 40% market share. Its new HAMR technology will help it store even more data, keeping it ahead of the competition. AI has made this "boring" company exciting again.

The Numbers That Matter:

Revenue grew almost 43% in the first nine months of its fiscal year.

Earnings are expected to more than double.

Operating income up 4x

Seagate owns 40% of global storage market

Big picture:

AI isn’t just about chips—it’s also about where you keep all that data. Seagate is winning quietly as AI fuels massive storage demand.

This is a low-key AI infrastructure play. Cheap on earnings, high on upside. Expect margin expansion and continued growth.

How I Play It: The market still sees Seagate as an old-tech hardware company. I see it as a critical supplier for the AI revolution. We're getting in at the beginning of a powerful new upcycle driven by a demand shock from AI.

4) Sprott Gold Miners ETF (SGDM): Gold as a Safe Haven

The Big Idea: In a world of uncertainty and debt, gold wins. This ETF gives us a high-powered way to bet on gold.

Why I Like It: This ETF doesn't hold physical gold. It holds stocks of gold mining companies. This gives leverage.

Why It's a Great Bet: Here's how the leverage works. Let's say it costs a miner $1,500 to pull an ounce of gold from the ground. If gold sells for $2,000, they make $500. If the price of gold rises 25% to $2,500, their profit doubles to $1,000. A 25% jump in gold can lead to a 100% jump in profits. That's why the ETF (up 64%) has crushed the performance of physical gold (up 25%).

With soaring government debt, a shaky U.S. dollar, and trade wars, gold is the ultimate insurance policy. It's a real asset that holds its value when paper currencies don't. This ETF is a direct and powerful bet on that theme.

Numbers to know:

Assets: $412M

Up 64% YTD (gold itself up 25%)

Expense ratio: 0.5%

Big picture:

If rates drop or inflation flares up, gold usually shines. Add the political noise, and gold becomes a safety trade.

Use SGDM as a hedge against market shocks, currency devaluation, or geopolitical risk. And with gold near record highs, miners may still have more room to run.

How I Play It: This isn't a long-term growth investment. This is an insurance policy that pays you. Add this as a hedge against market chaos, inflation, and a falling dollar. It's a tactical position that will perform best when other assets are struggling.

5) YieldMax PLTR Option Income Strategy ETF (PLTY) – High Risk, High Yield

The Big Idea: Collect a huge cash "dividend" from the volatility of a hot AI stock.

Why I Like It: This ETF is a clever income play on Palantir (PLTR), a very popular but volatile AI stock.

Why It's a Great Bet: Here's how it works. The fund sells "covered call" options on its Palantir position. Because Palantir is so popular and its price swings so much, those options are very expensive. By selling them, the fund collects a ton of cash. It then pays that cash out to shareholders as a distribution.

This is a way to turn a stock's hype and volatility into a steady stream of income. The trade-off is that you give up some of the massive upside. If Palantir stock triples, this ETF won't. But you get paid a very high yield while you wait. It's for someone who likes the Palantir story but expects the stock price to be a rollercoaster.

Numbers to know:

Assets: $623M

Expense ratio: 1.44%

Tracks Palantir (PLTR) and sells options to return cash to holders

Risk:

This is not a passive ETF. If PLTR drops hard or trades flat, PLTY could get hit harder. But in a strong momentum environment, returns can be supercharged.

Big picture:

Investors want income from AI—not just growth. PLTY gives exposure to AI plus high yield, though with volatility risk.

Use as a trading tool, not a core position. Great for yield in a hot AI market, but keep tight risk controls.

How I Play It: This is a special tool for a specific job. It's a bullish income strategy. It's a way to stay in a great growth story while reducing some of the volatility and generating cash flow. We must be clear about the risk: if Palantir stock falls hard, this ETF will fall hard too. It is not a safe, low-risk income play. It's a tactical position for monetizing volatility.

👉For more insights, follow me on Twitter/ X or Instagram Threads, and turn on notifications.

5. Insider Trades from Billionaires, Politicians and CEO’s:

Taiwan Semiconductor TSM 0.00%↑

On June 24, Congressman Cleo Fields, a Democrat House Representative from Louisiana, bought $100,000 to $250,000 worth of Taiwan Semiconductor stock, disclosed July 2. TSM is the largest chip foundry in the world, supplying companies like Apple, Nvidia, and AMD. With the U.S. increasing pressure on domestic chip manufacturing, TSM is key to global chip supply.

A political buy here may hint at policy alignment or strategic partnerships between the U.S. and Taiwan—making this a good medium-term play on both semiconductors and geopolitics.

JPMorgan US Government Money Market Fund $OGVXX

On July 2, 2025, Congressman John Rose of Tennessee, a Republican, disclosed a large purchase into the JPMorgan US Government Money Market Fund worth between $1 million and $5 million. This fund is a low-risk, cash-equivalent product designed for capital preservation.

While this isn’t a stock pick, it’s telling. A move this large into a money market fund by a sitting politician suggests risk-off positioning—a possible signal that lawmakers are preparing for market volatility or political uncertainty.

PVH Corp PVH 0.00%↑

On June 30, 2025, PVH CEO Stefan Larsson bought 15,645 shares of his own company at $63.92, totaling just over $1 million. PVH owns brands like Tommy Hilfiger and Calvin Klein.

This insider buy boosts confidence as the company recovers from weak retail margins and pivots to direct-to-consumer sales and AI-driven inventory management. Larsson increasing his stake by 6% suggests internal optimism ahead of next quarter’s earnings. Insider buying by CEOs is one of the strongest bullish signals for value and turnaround investors.

Asana ASAN 0.00%↑

On June 27, CEO Dustin Moskovitz—also a Facebook co-founder—bought 87,755 shares of Asana at $12.97, worth about $1.14 million. Moskovitz already owns over 55 million shares. Asana offers cloud-based workflow tools and is expanding its AI project automation features.

The stock is down from past highs, but with this insider buy, there may be belief in a comeback story. Asana could be a speculative rebound play if adoption of AI task management grows.

Bit Digital BTBT 0.00%↑

On June 26, Bit Digital CEO Samir Tabar bought 750,000 shares at $2.00, totaling $1.5 million, boosting his stake by 55%. Bit Digital is a Bitcoin mining and infrastructure company, and this buy came as Bitcoin ETFs saw record inflows. It also comes amid growing speculation about Bitcoin’s next halving cycle and institutional demand.

When CEOs buy in bulk in crypto stocks, it often signals confidence ahead of macro crypto events. A bounce in Bitcoin could mean significant upside here.

Netlist $NLST

Also on June 26, Netlist CEO Chun Hong bought 4.29 million shares at $0.70, totaling $3 million, increasing his position by 67%. Netlist makes memory and storage solutions, and has been involved in legal battles over patent rights. The company just won a partial court ruling in a major case, which could lead to a financial settlement.

This large insider purchase shows the CEO believes the company is undervalued and nearing a major legal or licensing win. This could be a speculative high-reward bet.

Global Medical REIT GMRE 0.00%↑

On June 25, CEO Mark Decker Jr. bought 160,000 shares at $6.52, spending just over $1 million. This is a brand-new position. GMRE owns healthcare properties and offers high dividend yields. REITs have been under pressure due to high rates, but this insider buy shows confidence that healthcare real estate demand remains steady. Investors looking for income might see this as a bottoming opportunity in a beaten-down sector.

6. Stocks to Watch (and Catalysts):

Monday 7/7 - Phibro Animal Health PAHC 0.00%↑ up 8%.

The company makes animal health and nutrition products. The jump came after JPMorgan upgraded the stock to overweight, saying Phibro’s performance has been strong and customer demand is solid.

This upgrade is a positive catalyst and shows confidence in the company’s future. For investors, steady demand in the animal health sector can mean stable growth and less risk during market swings.

Monday 7/7 - Geo Group $GEO up 8% and CoreCivic $CXW up 5%.

Both companies run private prisons and detention centers. Their stocks jumped after President Trump signed a bill on July 4 that boosts funding for immigration detention. This new law is a big positive for both companies, as it could mean more government contracts and higher revenue.

For investors, policy changes like this can drive quick gains, but keep in mind these stocks can be sensitive to political shifts.

Thursday 7/3 - First Solar $FSLR up 8% and Enphase Energy $ENPH up 5%.

Both companies make solar energy products. Their stocks rose as President Trump’s spending bill moved closer to becoming law. The Senate dropped a tax on solar and wind projects, which is a big win for these companies. The Invesco Solar ETF $TAN is up 3% as well.

This news is a strong catalyst for solar stocks, showing that policy changes can boost clean energy growth. Investors should watch for more government support in this sector.

Thursday 7/3 - Datadog $DDOG up 12%.

Datadog provides cloud monitoring services. The stock surged after S&P Global said it will add Datadog to the S&P 500 index on July 9. This is a big deal because index funds will need to buy Datadog shares, which can push the price higher. Being in the S&P 500 also raises the company’s profile and attracts more investors.

Thursday 7/3 - Tripadvisor $TRIP up 16%.

Tripadvisor runs a travel review website. The stock soared after news broke that activist investor Starboard has taken a 9% stake. Activist investors often push for changes to boost shareholder value, which can be a strong catalyst for future gains.

Thursday 7/3 - Bit Digital $BTBT up 6%, SharpLink Gaming $SBET up 2%, and Bitmine Immersion Technologies $BMNR up 35%.

These are crypto-related stocks. They rallied as interest in Ethereum and stablecoins surged. Bitmine has jumped over 1,000% since announcing plans to hold Ethereum in its treasury. For investors, crypto stocks can move fast on news, but they are also risky and volatile.

Wednesday 7/2 - Robinhood $HOOD up 7%.

Robinhood is a trading platform for stocks and crypto. Traders are betting it could be added to the S&P 500 after Hewlett Packard Enterprise finished its acquisition of Juniper Networks, opening a spot in the index. Inclusion in the S&P 500 would force many funds to buy Robinhood shares, which is a positive catalyst.

Wednesday 7/2 - Rigetti Computing $RGTI up 7%.

Rigetti is a quantum computing company. The stock jumped after Cantor Fitzgerald started coverage with an overweight rating, saying quantum computing could have huge economic impact in the future. Early-stage tech stocks like Rigetti can be volatile, but they offer big upside if the technology succeeds.

Wednesday 7/2 - Verint Systems $VRNT up 12%.

Verint makes customer service software. The stock jumped after reports that buyout firm Thoma Bravo is in talks to acquire the company. Buyout news is usually a strong catalyst for a stock, as it often means a premium offer for shareholders.

Tuesday 7/1 - Kontoor Brands $KTB up 7%.

Kontoor owns brands like Wrangler. The stock rose after Goldman Sachs added it to its conviction list, noting that buying Helly Hansen should strengthen its portfolio. Smart acquisitions can drive long-term growth.

Tuesday 7/1 - Bloomin’ Brands $BLMN up 12%.

Bloomin’ owns Outback Steakhouse and Carrabba’s. The stock rebounded after a losing streak, showing that beaten-down stocks can bounce back quickly when sentiment shifts.

Tuesday 7/1 - Circle Internet Group $CRCL up 6%.

Circle issues stablecoins. The stock rose after the company applied for a bank charter, which would let it offer digital banking services. This is a big step for any crypto company and could open new revenue streams.

👉For more insights, follow me on Twitter/ X or Instagram Threads, and turn on notifications.

7. Real Estate & Housing Market Update:

The U.S. housing market in 2025 is at a turning point. For the first time in years, buyers are starting to gain some leverage, thanks to a mix of rising inventory, slower price growth, and a slight drop in mortgage rates. The market is shifting toward balance, but it’s not a boom or a bust. Price growth will likely stay modest—around 3 to 4% nationally—for the next year. Affordability will remain a challenge until mortgage rates drop more or incomes rise faster than home prices. The supply of homes is improving, but the U.S. still faces a housing shortage that could last for years, especially for affordable homes.

The number of homes for sale is rising. Active inventory is up 27% over last year and new listings are up nearly 4%. This is the highest inventory since before the pandemic, which gives buyers more choices and negotiating power. However, supply is still below historical norms, especially in the Midwest and Northeast, so the market hasn’t fully shifted to buyers yet. In the South and West, inventory gains are stronger, and buyers have more room to negotiate.

Existing-home sales are up as more homes hit the market, but new-home sales are slowing as builders face more competition from resales. Pending home sales—a sign of future activity—are rising, which could mean more sales in the coming months. However, overall demand is still weak, with sales down 6% from last year. Many buyers are sitting on the sidelines, waiting for better affordability or more economic certainty.

Mortgage rates have dipped for another week, now sitting around 6.8% for a 30-year fixed loan. While this is a small drop, it’s a welcome sign for buyers who’ve been squeezed by high borrowing costs. Rates are still much higher than the 3% rates seen a few years ago, and experts expect them to hover near 7% for the rest of the year. Still, affordability remains a huge challenge—most buyers can’t keep housing costs under 30% of their income, especially in expensive markets like Los Angeles and San Jose.

👉For more insights, follow me on Twitter/ X or Instagram Threads or BlueSky, and turn on notifications.

8. Interest Rate Predictions:

Interest rates are expected to decrease in the near term. Here’s why:

The 10-year Treasury yield is falling. It went from 4.60% in May to 4.24% now. Mortgage rates tend to follow this closely.

The spread between mortgage rates and Treasury yields is narrowing. That suggests lenders are more confident in the economy and willing to offer better terms.

Inflation is easing. It’s not back to normal yet, but it’s no longer rising fast. That takes pressure off the Fed.

Job growth is slowing. The labor market is cooling off, with recent data showing fewer new jobs than expected. That gives the Fed room to cut rates.

The Fed is signaling it may cut rates later this year. While it's waiting to see how inflation and tariffs play out, a July or fall rate cut is still on the table.

In short: the direction is down, but don’t expect a crash in rates. Think slow, steady, and modest.

The 30-year mortgage is now 6.79%, which is -0.18 lower than last month, and -0.24 lower than last year:

9. Short-Term Technical Analysis [S&P 500, Tech Stocks, Bitcoin]:

S&P 500 SPY 0.00%↑ (Short-term, 1-3 months): Positive

The S&P 500 is trending up. It's been climbing steadily, and that tells us investors are still buying into strength. The price is above its average level over time, which supports the idea that the market wants to keep rising. There’s no clear resistance ahead, meaning there's no technical ceiling stopping prices from going higher.

My Take:

The long-term picture still looks strong. Even if we see a short dip, the trend is clearly up. Stay invested, but be ready to buy the dip if the index pulls back to support.Tip:

If you're looking to invest, focus on strong companies within the S&P 500 that are leading the charge in AI, healthcare, or clean energy. Use ETFs if you want broader exposure.

Tech Stocks QQQ 0.00%↑ (Short-term, 1-3 months): Positive

The Nasdaq-100 is also on a roll. It broke through a key resistance level, which is a bullish signal. This means big tech stocks like Apple, Nvidia, Amazon, and Google are leading the market higher. Just like the S&P 500, there’s no resistance overhead. That opens the door for more gains.

If there’s a pullback, the support level is around 22,100.

My Take:

I’m bullish. The Nasdaq tends to run hard when momentum is strong, and there’s still fuel in the tank. But since tech can be volatile, don’t chase big moves blindly. Be patient and look for dips.Tip:

If you’re trading, watch for short-term pullbacks to support. If you’re investing long term, dollar-cost average into Nasdaq ETFs or quality tech stocks.

Bitcoin $BTC (Short-term, 1-3 months): Positive

Bitcoin is in a strong uptrend. It recently broke through a key resistance level at $107,710, which suggests more upside is likely. The next target is around $115,727 or higher. The RSI also shows growing strength, which supports the bullish move.

Bitcoin’s rally is tied to growing interest in crypto from Wall Street. Public companies like MicroStrategy and ETFs are buying and holding Bitcoin as a reserve. Plus, investors are hedging against inflation and U.S. debt concerns by parking money in crypto. There's also renewed demand around Ethereum and stablecoins, which helps boost confidence in the broader crypto space.My Take:

I’m bullish on Bitcoin. The trend is clear, and long-term investors are stepping in. But expect sharp swings—crypto is never calm. Short-term traders should look for pullbacks below $110,000 to add exposure.Tip:

Don’t overleverage. Stick to spot buying or use small position sizes if you're trading. For long-term investors, consider holding Bitcoin as part of a diversified portfolio, especially if you believe in crypto’s future as digital gold.

10. Market Sentiment & Economic Outlook:

Fear & Greed Index = Extreme Greed

Right now, the index stands at 75, which means greed is driving market behavior. A week ago, it was 78. A month ago, it was 65. A year ago, it was 49—close to neutral. This shows that investor confidence has been climbing steadily.

Markets move on emotion—not logic. When people are scared, they sell. When they’re greedy, they buy everything. Market sentiment often runs ahead of the fundamentals, which means this tool can act as a contrarian signal.

Extreme fear often means prices are low and it's a buying opportunity.

Extreme greed often means prices are stretched and a correction may be coming.

Build a watchlist of great stocks you want to own. If fear returns and prices drop, be ready to buy. Don’t chase the hype. Wait for dips to buy quality names.

AAII Sentiment Survey — 6-Month Outlook = Bullish

Retail investors are increasingly confident that stocks will continue to rise over the next six months.

Bullish sentiment is up to 45%, a strong jump of nearly 10 percentage points. This is the first time in six weeks that optimism has broken above the historical average of 37.5%.

This week’s bull-bear spread—the difference between bullish and bearish sentiment—rose sharply to +11.9%. That’s the first time in 22 weeks it's climbed above its historical average of 6.5%.

Economic Indicators & Market Signals = Neutral

Overall, the data is mixed but mostly stable.

Markets are calm (low VIX), rates are steady, and inflation is under control.

The job market is healthy, and home prices are rising at a manageable pace.

The main warning signs are a slightly negative GDP and low consumer confidence, which could slow growth if they get worse.

The yield spread is close to zero, so keep an eye on it for signs of recession risk.

Long-Term Significance:

Stable inflation and jobs support steady growth, which is good for long-term investing.

If GDP stays negative or consumer sentiment drops further, risk of recession rises.

A calm VIX and steady rates mean investors can plan without fear of sudden shocks.

11. Trade of the Week [Options Flow Activity]:

Bullish Activity on Pinterest Inc PINS 0.00%↑

Pinterest shows extremely bullish sentiment with a massive 16:1 ratio of call options to put options, primarily targeting July 11th $37.00 calls. Smart money bought 19,946 contracts at prices between $0.20-0.35 each, with minimal existing positions since open interest was only 530 contracts.

Pinterest operates a visual search and discovery platform where people find ideas for recipes, home inspiration, and shopping. The company just reported strong Q1 2025 results with $855 million revenue growing 16% year-over-year and record 570 million monthly active users, up 10%. Pinterest has its next earnings announcement scheduled for July 29, 2025, which means these July 11th calls expire well before earnings. This suggests traders expect a major catalyst or positive news flow within the next few days. The timing is particularly interesting because Pinterest shares rose 15% after their last earnings beat, and management provided better-than-expected guidance for Q2 with revenue projected at $960-980 million.

I'm bullish on this trade because the massive call buying volume at relatively cheap prices suggests institutional confidence in near-term upside, potentially driven by advertising revenue recovery or partnership announcements ahead of the summer shopping season.

Bullish Activity on Ingersoll Rand Inc IR 0.00%↑

Ingersoll Rand Inc IR 0.00%↑ experienced a surge in call option activity, with volume about 69 times the daily average. Most of the action was on the August 15th $90.00 call, with 1,501 contracts traded (far above the 33 open previously), bought for $2.25–$2.50 each. This shows traders expect the stock to rise above $90 by mid-August.

Ingersoll Rand provides industrial and medical technology solutions. The company just announced a $160 million acquisition of TMIC and Adicomp, which will boost its presence in the renewable natural gas market and strengthen its core business. This kind of growth and expansion is seen as a positive catalyst for the stock.

The strong call buying suggests bullish sentiment. Traders are betting on continued upside, likely driven by the positive news about the acquisition and the company’s strategy to expand into high-growth markets.

I’m bullish here. The new acquisition could drive earnings and revenue higher, and the heavy call buying shows traders agree. For investors, this is a stock to watch for continued growth, especially if management keeps executing on smart deals.

Bearish Activity on TPG Inc TPG 0.00%↑

TPG displays overwhelming bearish sentiment with a staggering 100:1 ratio of put options to call options, concentrated on November 21st $42.50 puts. Traders aggressively bought 1,378 put contracts at the ask price of $1.65 each, indicating urgent bearish positioning since they paid full asking price rather than negotiating.

TPG operates as a leading global alternative asset management firm specializing in private equity, impact investing, credit, real estate, and market solutions. Recent corporate activity includes raising $992 million through a follow-on equity offering and acquiring Peppertree Capital Management for up to $960 million. TPG reported Q1 2025 earnings with EPS of $0.48, missing analyst estimates of $0.52. The November expiration suggests traders expect sustained pressure on private equity valuations through the remainder of 2025. The company faces headwinds from economic uncertainty, inflation concerns, and market volatility that pose challenges to investment returns.

I'm bearish on this trade because the massive put buying at premium prices indicates institutional knowledge of potential portfolio devaluations, fundraising difficulties, or economic conditions that could severely impact private equity performance through late 2025.

12. Important Economic Events this Week:

US 10-Year Note Auction – Wednesday

The government sells 10-year bonds to raise money. If fewer investors buy, interest rates rise. If demand is strong, rates fall. This affects mortgage rates and borrowing costs.

Weak demand = rates up = avoid tech. Strong demand = rates down = bullish for growth stocks.

Fed Meeting Minutes – Wednesday

This shows what the Fed really thinks about inflation and rate cuts. It can shift the market if investors hear a change in tone.

If the Fed sounds ready to cut, stocks could rally. If they stay cautious, expect choppy trading.

Initial Jobless Claims – Thursday

This tracks how many people filed for unemployment. A big increase signals a weaker job market.

More jobless claims = rate cuts more likely = bullish for bonds and real estate. Fewer claims = inflation risk stays = bullish for banks and energy.

US 30-Year Bond Auction – Thursday

Long-term investors buy these bonds. If they want higher returns, it pushes long-term rates up, hurting borrowing.

Strong demand = good for real estate and stocks. Weak demand = stay cautious on high-growth sectors.

IEA Monthly Report – Friday

This global report looks at oil trends. If it shows strong demand, oil may rise. If demand is weak, it may signal a slowdown.

Energy bulls should watch this closely. A weak outlook could signal recession risk—protect gains and stay diversified.

13. Important Earnings Announcements this Week:

Here’s what you need to know for the most anticipated earnings releases this week:

Delta Air Lines ($DAL) - Delta is a major airline. The big question is whether strong summer travel demand can offset high fuel costs and a new 20% tariff on planes from its European supplier, Airbus. For their earnings, the bullish case is that people are still paying high prices to travel, boosting profits. The bearish case is that rising costs are eating into those profits.

My take is to listen for their forecast on future travel bookings, as this will tell us if the consumer is starting to get tired. A simple way to trade this is to watch how other airline stocks react; if Delta gives good news, the whole sector could fly higher.

Penguin Solutions ($PENG) - Penguin Solutions provides high-performance computing and AI infrastructure, a very hot area right now. The bullish case is that the AI boom is creating massive demand for their specialized computer systems and services. The bearish case is that they face huge competition from bigger players, and any sign of slowing sales could hit the stock hard.

What I'm watching is their sales growth and, more importantly, their future guidance. An actionable idea is to look at the results of bigger AI companies like NVIDIA; if the giants are still booming, smaller players like Penguin should have a strong tailwind.

Levi Strauss & Co. ($LEVI) - Levi's is the iconic blue jeans company. The bullish case is that their classic, durable brand can perform well even if consumers are spending less on trendy fashion. The bearish case is that clothing is one of the first things people cut back on in a tough economy, and that rising cotton prices are hurting their profits.

My analysis is that their inventory levels are key; if they have too much unsold product, it means they'll have to discount heavily, which hurts the brand. For an investor, watch for their comments on direct-to-consumer sales, as strong online sales show the brand is still connecting with younger shoppers.

Conagra Brands ($CAG) - Conagra owns famous food brands you see in the grocery store, like Slim Jim, Birds Eye, and Duncan Hines. The bull case is that people eat at home more to save money during uncertain times, which helps Conagra. The bear case is that shoppers are choosing cheaper store brands instead of Conagra's more expensive name brands.

My opinion is that the most important number is their "sales volume." We need to see if they are selling more items, not just charging higher prices. A smart move is to check if their profit margins are improving, which would show they have inflation under control.

Kura Sushi USA ($KRUS) - Kura Sushi is a fun, technology-focused sushi restaurant with a revolving conveyor belt. For Kura, the bullish thesis is that its unique dining experience attracts customers looking for affordable fun, even in a slow economy. The bearish thesis is that restaurant spending is highly sensitive, and any sign that customer traffic is slowing down would be a major red flag.

I believe the key metric to watch is same-store sales growth, which tells us if they are getting more business from their existing locations. An actionable idea is to look at their expansion plans; if they are confidently opening new restaurants, it's a great sign for future growth.

PriceSmart ($PSMT) - PriceSmart is like a Costco or Sam's Club, but it operates in Central America and the Caribbean. The bullish case is that its warehouse club model does very well when people are looking to save money by buying in bulk. The bearish case is that its customers in emerging markets can be very sensitive to economic slowdowns and currency fluctuations.

My take is to watch their membership renewal rates. High renewal rates show that customers are loyal and see value in the membership, which is the heart of their business model.

WD-40 ($WDFC) - WD-40 is a simple, iconic company that makes the famous multi-use spray. The bull case is that it's a product people always need in their homes and workshops, making it very resistant to recessions. The bear case is that as a global company, a strong U.S. dollar can hurt its profits from overseas sales.

My analysis is that this is a "boring is beautiful" stock. Look to see if they are maintaining their strong profit margins, which shows they can pass on any cost increases to customers without a problem.

Saratoga Investment ($SAR) - Saratoga is a business development company, or BDC. It lends money to and invests in medium-sized private companies. The bullish argument is that they can earn very high interest rates on their loans in the current environment. The bearish argument is that if the economy weakens, some of the companies they lent money to could go out of business, leading to losses.

The most important thing to watch for in their report is the health of their loan portfolio. Listen for any mention of "non-accruals," which are loans that have stopped paying.

Byrna Technologies ($BYRN) - Byrna makes non-lethal self-defense weapons, like a pistol that shoots pepper spray projectiles. The bullish case is that in uncertain times with rising concerns about crime, demand for personal safety products grows. The bearish case is that they operate in a niche market with a lot of regulatory risk.

My view is that you need to watch their sales growth very closely. Strong growth would prove their products are gaining mainstream acceptance. A smart move is to look at their marketing expenses; if they can grow sales without a massive increase in ad spending, it shows their brand has real pull.

AZZ ($AZZ) - AZZ provides essential services like metal coating and welding solutions to the energy and infrastructure industries. The bullish thesis is that government spending on infrastructure and the energy grid creates a huge and stable demand for their services. The bearish thesis is that they are tied to big industrial projects, which can be delayed or canceled if the economy goes into a deep recession.

My opinion is that their project backlog is the number to watch. A growing backlog means they have years of work already lined up, which makes their future earnings very predictable and safe.

🙌Thanks for reading our newsletter! If you enjoyed reading it, please support us by sharing it with friends or family, and becoming a paid subscriber:

Please let me know what you think of our newsletter:

See you again next week! (Missed an issue? You can read past issues here at TheFinanceNewsletter.com)

👉My goal is to help you become richer and smarter with your money — Join 3 million and follow me across social media for daily insights:

Instagram Threads: @Fluent.In.Finance

Twitter/ X: @FluentInFinance

Facebook Page: Facebook.com/FluentInFinance

Linkedin: Linkedin.com/in/Lokenauth

Youtube: Youtube.com/FluentInFinance

Instagram: @Fluent.In.Finance

TikTok: @FluentInFinance

Facebook Group: Facebook.com/Groups/FinanceTalk

Reddit Community: r/FluentInFinance

➕Please add this newsletter to your contacts to ensure that none of our emails ever go to spam!

This content is for educational purposes only. Such information should not be construed as legal, tax, investment, financial, or other advice. See for Disclaimer, Terms and Conditions.