💥Investing Insights & Market Analysis [August 10, 2025]

Social Security expected to run out of cash in 8 years, Home sellers outnumber buyers by 500,000, Palantir up 600%, S&P 490 has no earnings growth since 2022, My Stock Picks, Insider Trades, and More!

👋 Good evening my friend and welcome back to your favorite newsletter! I hope you had a great weekend! Thank you for joining 108,000+ readers and subscribing to our newsletter which is dedicated to helping you get richer and smarter with money!

If you enjoy reading our newsletter, please hit the ❤️LIKE button on this post so more people can discover it on Substack 🙏

📬In today’s issue, we discuss:

Part I — Financial Markets:

1) My Stock Market & Economic Analysis

2) Most Important Financial Events This Week (and my thoughts)

3) Most Important Charts & Numbers This Week (and why it matters)

🎯Premium Research & Analysis:

Part II — Stock Market:

4) What I'm Investing in (stock picks, research and analysis)

5) Insider Trades from Billionaires, Politicians and CEO's

6) Trade of the Week (options trading)

7) Best Performing Stocks This Week (and catalysts, earnings, news)

8) Important Earnings & Stocks to Watch

Part III — Real Estate:

9) Real Estate Analysis and Housing Market Trends

10) Interest Rate Predictions (and current rates)

Part IV — Economy & Macro:

11) Technical Analysis (S&P 500, Tech Stocks, Bitcoin)

12) Economic Outlook & Market Sentiment

13) Important Economic EventsBut before we get into it, three quick announcements! Please support us and:

Hit the ❤️LIKE button on this post so more people can discover it on Substack 🙏

Share this newsletter with your friends and family to help them get richer and smarter with money!

Become a paid subscriber to support us! (This newsletter takes hours of research and writing!)

1) My Stock Market & Economic Analysis:

This year, the S&P 500 is up 8.0%, the Nasdaq is up 10.2%, Gold is up 30.5%, and Bitcoin has gone up 25.8%. Here's everything important that happened this week:

This week ended strong. Big tech (the “Magnificent 7”) did really well, helping the Nasdaq reach a new record high.

Gold rallied again. It’s been up in five of the last six days. Traders think the Fed may cut rates soon because the economy looks weaker.

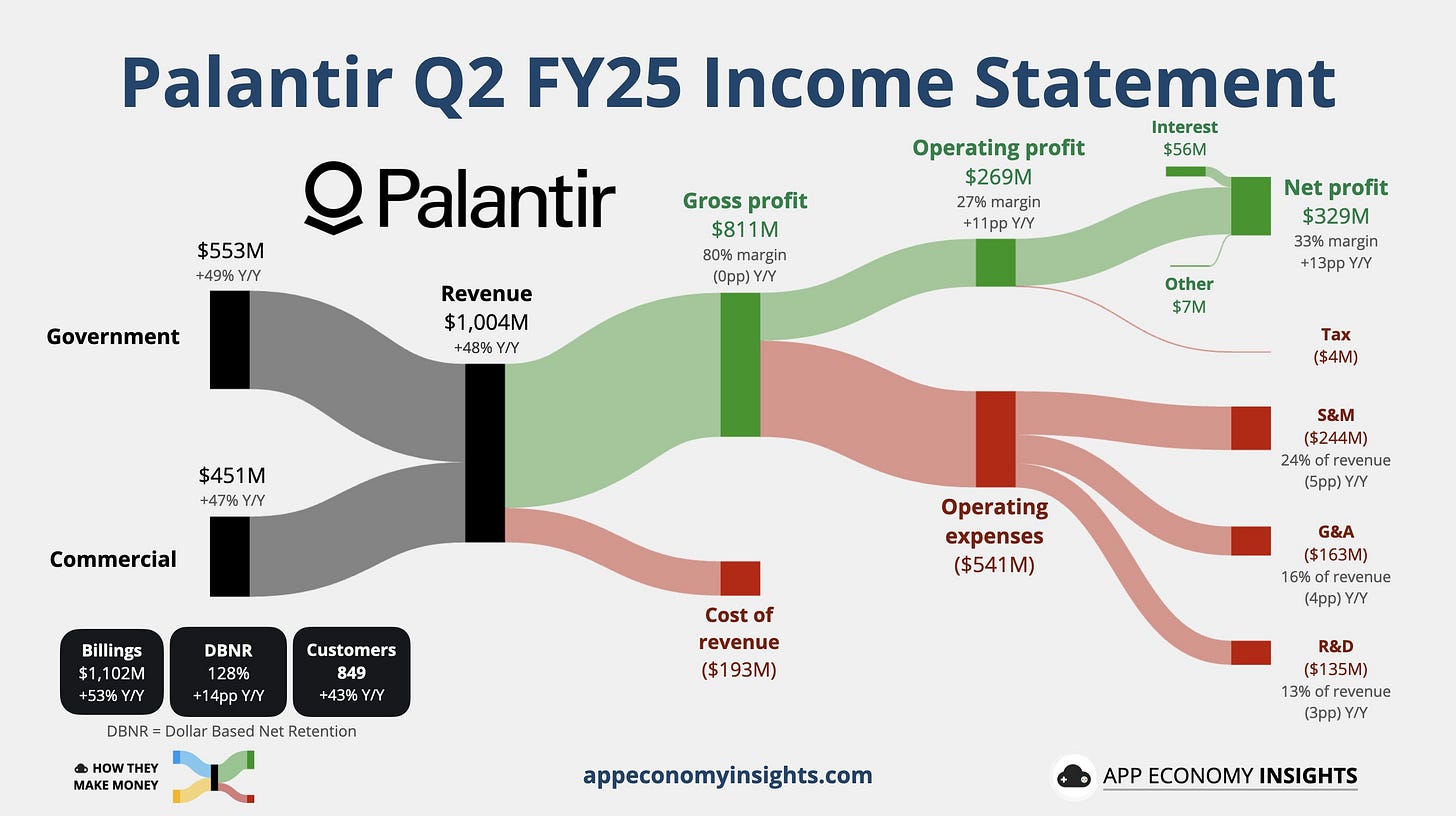

Palantir PLTR 0.00%↑ crushed it. It beat earnings and revenue. Sales jumped 48%. Commercial sales doubled. It passed $1B in quarterly revenue for the first time, raised its outlook, and closed 66 deals (total contract value up 140%). The company said AI is having an “astonishing” impact.

There’s now a record amount of money—$7.4 trillion—sitting in Money Market Funds, which is like a safe place for people and companies to keep cash. That’s more cash on the sidelines than ever before.

💡Andrew’s Analysis:

This week’s market action sends a powerful message about where the economy might be heading. The markets closed on a high note, fueled by strong earnings from the Magnificent 7 companies. When these big players show strength, the Nasdaq hits record levels, reminding us tech and innovation remain engines of growth.

Gold’s climb to a new all-time high is a big deal. For nearly a week, Gold has gained on hopes the Federal Reserve will cut interest rates soon. Why does this matter? Lower interest rates mean borrowing is cheaper, which helps boost the economy. But it also reduces the appeal of bonds and savings accounts, pushing investors towards gold as a safe store of value. If the Fed cuts rates, you could see more movement between stocks, bonds, and gold—so keep an eye on how investors shift their money.

Palantir’s earnings beat is a showstopper. Hitting over $1 billion in quarterly revenue for the first time, with sales growing 48%, is impressive. What’s even more exciting is their commercial revenue doubling and AI playing a huge role in growth. Palantir’s business is booming because AI is becoming essential in many industries. Their bold forecast upgrade and 66 new contracts worth 140% more in value tell us this isn’t a flash in the pan. This signals that companies that get AI right could be tomorrow’s market leaders.

Look at the $7.4 trillion piling up in Money Market Funds—an all-time high. This shows a lot of money is parked safely, waiting. It’s like everyone is holding their breath, maybe uncertain about where to invest next or waiting for the market to show clearer signs. This huge cash pile could be a springboard for future market moves once investors decide to deploy it.

My Advice:

If you’re worried about market ups and downs, remember Warren Buffett’s advice: be greedy when others are fearful, and fearful when others are greedy. This week’s facts show big business is growing, but many investors are cautious. Use that to your advantage—buy quality when prices dip and be prepared for both risk and reward.

Use the cash on the sidelines as a signal. That $7.4 trillion in Money Market Funds says there’s a lot of dry powder ready to flow back into markets. When that happens, prices could jump quickly. Be ready to act but don’t get caught up in the rush. Patience and planning win here.

Watch tech and AI stocks closely. Palantir’s results show how AI isn’t just hype—it’s a game changer. Investing in companies using AI is like getting in early on smartphones back in the 2000s. Think about Steve Jobs betting on innovation that reshaped industries. Look where AI is making the biggest impact for long-term profits.

Build a watchlist of AI leaders like Palantir and other tech innovators. Follow their earnings closely and be ready to add on dips.

Consider adding gold or gold-related assets if you want to balance risk. Gold often shines when uncertainty rises.

Watch Federal Reserve announcements carefully. When the Fed says it will cut rates, markets often jump. Have cash or buying power ready to deploy for quick opportunities.

Don’t forget your emergency fund. With so much money parked in safe funds, it’s a reminder to keep your own safety net solid so you can invest without stress.

Think long term: Markets rarely move in a straight line. Focus on businesses with strong growth and real products. Beware of chasing every headline (that’s a trap traders often fall into).

👉 For daily insights, follow me on Twitter/ X, Instagram Threads, or BlueSky, and turn on notifications!

2) Most Important Financial Events This Week (with my thoughts):

This week, we analyze:

1) President Trump says there will be a 100% tariff on all semiconductors entering the US, exempting companies that build in America.

2) President Trump officially signs executive order opening the $12.5 trillion 401(k) retirement market to crypto investments.

3) Home Sellers outnumber Buyers by more than 500,000, the largest gap ever recorded.

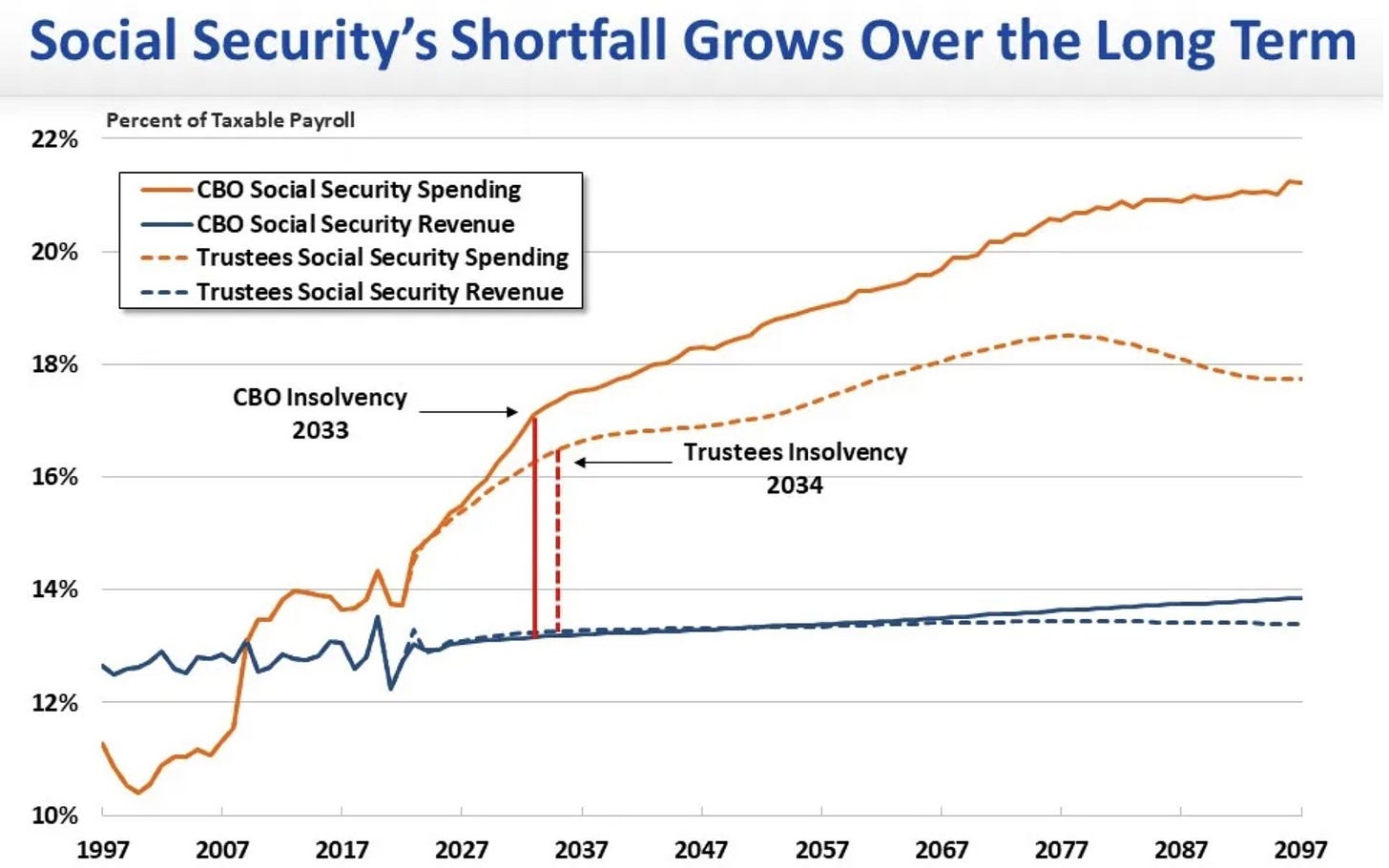

4) The Social Security trust fund is expected to run out of cash in eight years.

5) Palantir $PLTR is the S&P 500's best performing stock of 2024 and 2025, and just hit $400B market cap.1️⃣ President Trump says there will be a 100% tariff on all semiconductors entering the US, exempting companies that build in America.

The White House says it’ll slap a 100% tariff on semiconductors made overseas. No tariff if the company builds or commits to build in the U.S.

Apple also pledged $100B more for U.S. manufacturing, taking its total U.S. plan to $600B

💡Andrew’s Analysis:

Here's what this means in simple terms: Every computer chip, smartphone processor, and car computer that comes from overseas will cost twice as much. But if companies like Apple, Samsung, or TSMC build factories in America, they don't pay these crushing taxes.

Why it matters long term:

Chip supply moves home. More plants here. More jobs. Higher capex.

Prices can rise. Electronics, cars, appliances, cloud gear may cost more.

National security risk drops. Less supply shock risk (think COVID chip shortage).

Best-case vs. worst-case:

Best: U.S. companies can scale quickly. Costs fall over time. Inflation impact fades.

Worst: Tariffs stick, prices rise, profits get squeezed, growth slows (and consumers feel it).

Personal finance tip: Expect higher device prices. Your next iPhone, laptop, or car will cost more unless Apple and others build here fast. If you need new electronics, consider buying before these tariffs fully kick in.

My investment play: Buy companies that are already building in America or have announced US manufacturing plans. Think Intel, Micron Technology, and Applied Materials. Avoid companies heavily dependent on Chinese chip imports like many consumer electronics retailers. This isn't just about next quarter - this is about the next decade of American manufacturing.

2️⃣ President Trump officially signs executive order opening the $12.5 trillion 401(k) retirement market to crypto investments.

An executive order opens the $12.5T 401(k) market to alternatives like crypto, private equity, and real estate (subject to plan design and fiduciary rules).

💡Andrew’s Analysis:

Why it matters long term:

More choice. You can hold assets that used to be off-limits.

Product wave. Expect new target-date funds with small alternative options.

Best-case vs. worst-case:

Best: Small, smart allocations lift long-term returns and diversification.

Worst: High fees + volatility

How to invest it (now):

Default to core. Keep 70–90% in low-cost index / target-date.

Alt cap: Crypto ≤5–10%; total private markets ≤10–15% (max).

Focus on Bitcoin and Ethereum - they're the "blue chips" of crypto. Avoid the meme coins.

Set guardrails: Quarterly rebalance. If crypto rises >2-3x, trim back to target.

Use “if–then” rules: “If BTC drops -25% from a 90-day high, add +0.25% (max two adds).”

Proceed with caution and never bet your retirement on speculation.

3️⃣ Home Sellers outnumber Buyers by more than 500,000, the largest gap ever recorded.

For the first time ever recorded, the number of homes for sale now outnumbers the number of potential buyers by more than 500,000. We have a flood of supply, but buyers are on strike because prices and mortgage rates have made homes unaffordable.

💡Andrew’s Analysis:

What This Really Means: The power in the housing market has officially shifted. The days of bidding wars and sellers naming their price are over. We've hit an "affordability wall." People simply cannot afford the monthly payments on today's home prices at today's interest rates. It's a classic standoff: sellers are stuck with yesterday's high price expectations, and buyers are stuck with today's financial reality.

Best-case vs. worst-case:

Best: Modest rate cuts + more supply = soft landing in prices.

Worst: Rates stay high; sellers pull listings; volumes slump; prices drift.

Advice:

Where to look: Markets with job growth, new supply, and landlord-friendly rules.

Offer playbook: Come in below ask with fast close + inspection. Ask sellers for 2–3% rate buydowns or closing credits.

If buying a home, keep total housing ≤30% of take-home pay. Avoid adjustable-rate-mortgages.

If You're a Buyer:

What to do: This is your moment. Be patient and be aggressive.

How to do it: Don't be afraid to make offers that are significantly below the asking price. Sellers are getting nervous. Use your newfound leverage to demand inspections, repairs, and other concessions. The power is back in your hands for the first time in years.

If You're a Seller:

What to do: Get real about your price.

How to do it: You must price your home competitively from day one. Overpricing your home will just cause it to sit on the market. Be prepared to negotiate and offer incentives, like paying to buy down the buyer's mortgage rate. The market has changed, and your strategy needs to change with it.

4️⃣ The Social Security trust fund is expected to run out of cash in eight years.

The Social Security trust fund is now projected to run low on cash in just eight years, by 2033. When that happens, benefits will be automatically cut by about 23% unless Congress acts.

💡Andrew’s Analysis:

The psychological trap most people fall into is thinking "the government will fix this." But Congress has known about this problem for decades and keeps kicking the can down the road. It's like watching a train wreck in slow motion - you can see it coming, but most people hope someone else will stop it.

Your defense strategy: Don't count on Social Security for your full retirement. Treat it like a bonus, not your main plan. If you're under 50, assume you'll get 70% of currently promised benefits. If you're over 50, you'll probably get most of what's promised, but prepare for some cuts.

Best-case vs. worst-case:

Best: Congress acts soon; phase-in changes; smaller cuts.

Worst: No action; sudden across-the-board cuts hit in one year.

My advice: Maximize your 401(k) contributions - especially if your employer matches. Open a Roth IRA for tax-free growth. Consider working an extra 2-3 years beyond your planned retirement date. Each extra year you work adds significantly to your retirement security while delaying the need for Social Security.

5️⃣ Palantir $PLTR is the S&P 500's best performing stock of 2024 and 2025, and just hit $400B market cap.

Palantir just became a $400 billion company and the S&P 500's best performer for two years running. This is like watching a tech company grow from startup to Apple-sized in record time. The stock is up over 600% in the past year - that's Tesla-level growth in a much shorter timeframe.

💡Andrew’s Analysis:

What makes Palantir special? They're not just another AI company - they're the AI company that governments and Fortune 500 companies actually pay billions to use. Think of them as the Oracle of AI - they help organizations see patterns in massive amounts of data that humans could never spot.

When everyone loves a stock, that's when you need to be most careful. Palantir trades at 277 times forward earnings - that's more expensive than almost any major company in history. Even Tesla at its peak wasn't this pricey.

The smart money approach: Don't chase the stock after a 600% run. Instead, look for companies that will benefit from Palantir's success - data storage companies, cybersecurity firms, and cloud providers. When one company dominates AI, the entire ecosystem around it grows.

Why it matters long term:

AI spend is real. Customers are buying outcomes, not demos.

Backlog builds moats. Multi-year contracts lock in revenue and boost margins.

Valuation risk is high. Great business + great price ≠ great return if expectations outrun reality.

Best-case vs. worst-case:

Best: Growth stays 40%+, margins keep rising, new federal and commercial wins stack. $1T talk shows up.

Worst: Growth slows, pricing pressure hits, market re-rates the multiple.

How to invest it: Use a plan: Add on pullbacks to the 50-day/200-day moving average.

The bigger opportunity: Look for the "next Palantir" - smaller AI companies with real revenue and government contracts but much cheaper valuations. The AI revolution is just beginning, and there will be more winners than just one company.

*️⃣ Other important headlines this week:

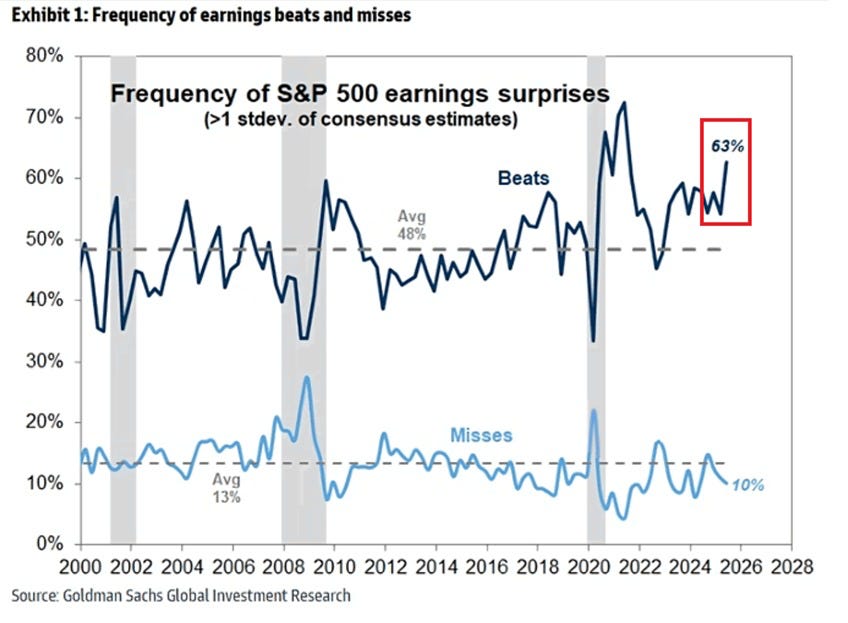

82% of S&P 500 companies beat quarterly earnings estimates, despite President Trump's tariffs

President Trump fires IRS Commissioner Billy Long

11% of all young people are considered NEET—meaning not in employment, education, or training.

Canada loses 40,800 jobs in July, largest monthly decline since the COVID pandemic

Bank of England cuts interest rates by 25bps to 4%

👉 For daily insights, follow me on Twitter/ X, Instagram Threads, or BlueSky, and turn on notifications!

3) Most Important Charts This Week (and why it matters):

This week, we analyze:

1) The S&P 490 has had no earnings growth since 2022.

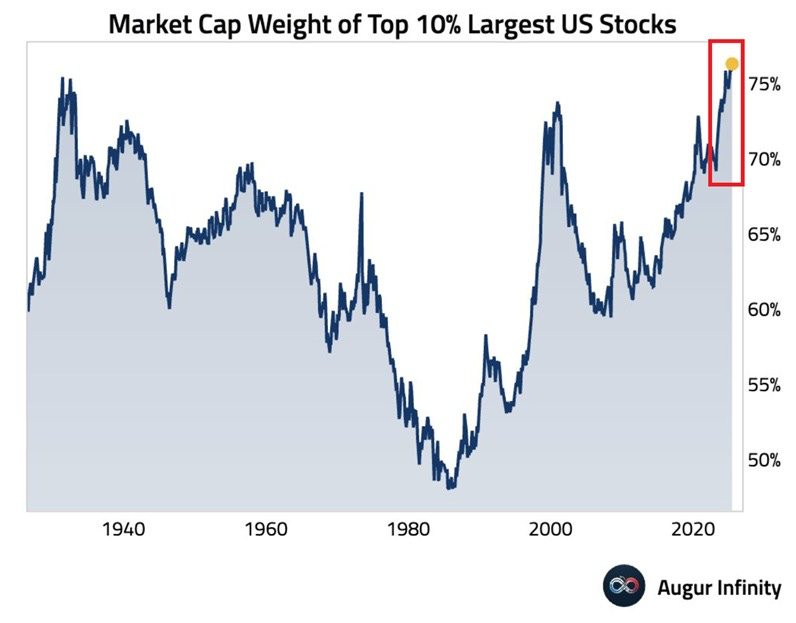

2) The top 10% largest US stocks now reflect a record 76% of the US equity market. This has officially surpassed the previous record set before the Great Depression in the 1930s.

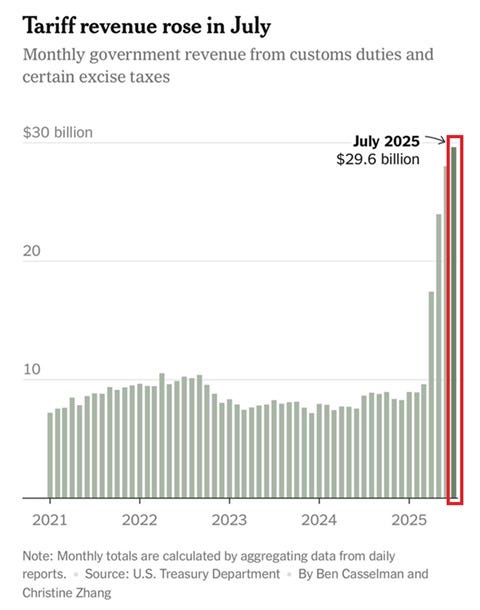

3) US tariff revenue surged to a record $29.6 billion in July. At this pace, annual tariff revenue could reach $308 billion, a $231 billion increase compared to 2024.

4) This has been one of the best earnings seasons in years. 1️⃣ The S&P 490 has had no earnings growth since 2022.

💡Andrew’s Analysis:

While everyone celebrates the S&P 500's record highs, here's the shocking truth: the bottom 490 companies haven't grown their earnings at all since 2022. Think of this like a basketball team where only the top player keep scoring while the rest of the team sits idle. The market is essentially a tale of two economies - the AI winners and everyone else.

This reminds me of the story Warren Buffett tells about his favorite holding period being "forever" - but that only works when you own the right companies. If you're invested in broad market index funds, you're essentially betting that 490 stagnant companies will somehow catch up to 10 superstars. That's like betting that typewriter companies would catch up to Apple in the 1980s.

Advice: Start focusing on the companies that are actually growing. Look for businesses with AI integration, platform advantages, or network effects. Think Microsoft, Apple, Nvidia - companies that get stronger as they get bigger, not weaker.

2️⃣ The top 10% largest US stocks now reflect a record 76% of the US equity market. This has officially surpassed the previous record set before the Great Depression in the 1930s.

💡Andrew’s Analysis:

Market concentration is now higher than at any point in modern history—even surpassing the late 1920s before the Great Depression. The top 10% of U.S. stocks now make up a record 76% of the entire stock market's value. History shows extreme concentration often leads to higher volatility when leaders stumble. In 2000, Microsoft and Cisco were “can’t-miss” stocks—both dropped over 50% when the dot-com bubble burst.

Advice: For long-term wealth builders, diversify into international equities, small caps, or hard assets to reduce single-point failure risk.

3️⃣ US tariff revenue surged to a record $29.6 billion in July. At this pace, annual tariff revenue could reach $308 billion, a $231 billion increase compared to 2024.

💡Andrew’s Analysis:

The tariff chart tells an incredible story: government revenue from tariffs surged to $29.6 billion in July alone. At this pace, annual tariff revenue could hit $308 billion - nearly matching the $366 billion collected from corporate income taxes.

A massive, hidden tax is being woven into the price of almost everything you buy that isn't made in America. While companies pay the tariff upfront, they almost always pass that cost on to you, the consumer. This is a fundamental reshaping of our economy, designed to make foreign goods more expensive and American-made goods more attractive.

4️⃣ This has been one of the best earnings seasons in years.

💡Andrew’s Analysis:

Despite all the economic uncertainty, this has been one of the best earnings seasons in decades, with a record number of companies beating profit expectations.

There's a psychological element at play here, too. Wall Street analysts likely became too pessimistic in their forecasts, setting a very low bar that companies could easily step over. This makes the "beats" look more impressive than they might actually be.

Advice: The most valuable information is not what a company did in the last 90 days, but what it plans to do in the next 90. For any company you own, listen to the CEO on the earnings call or read the transcript of their forward-looking guidance. Are they confident? Are they cautious? Are they investing for growth or cutting costs? That forward-looking commentary is the single most important indicator of where the stock is likely to go next.

Contrarian play: Don't get swept up in the earnings celebration. Look at actual revenue growth, not just earnings beats. Focus on companies that are growing their top line, not just managing their bottom line through cost cuts and share buybacks.

👉For more charts, follow me on Instagram, Facebook, LinkedIn, and turn on notifications!

🔒 Premium Research & Analysis 🔒

4) What I’m Investing in (stock picks, research and analysis):

Each week, I invest about $5,000 into long-term investments. Here’s where my money is going this week.

This week, we analyze:

1) Amazon $AMZN – The Everything Store Becomes the Everything Platform

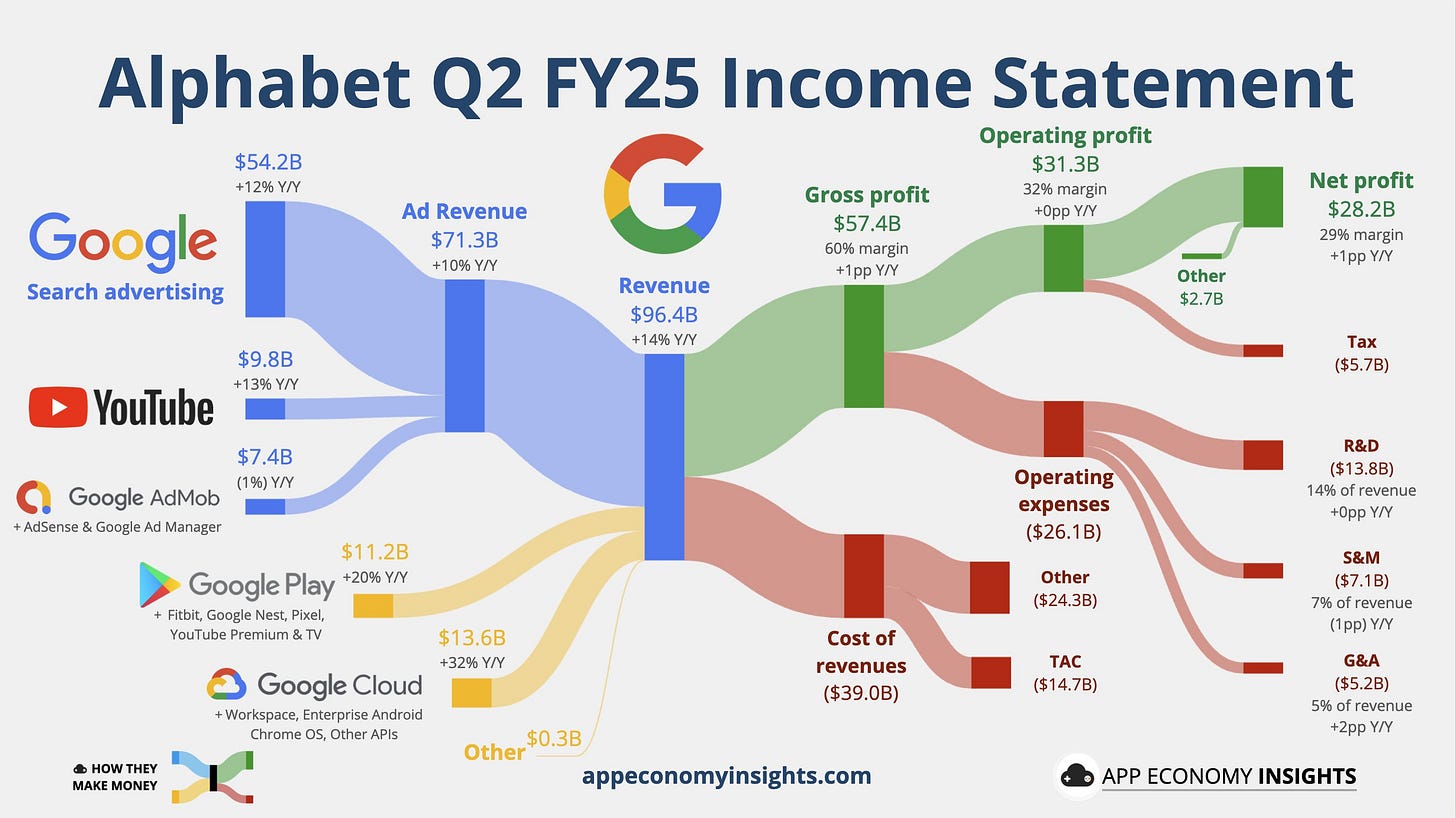

2) Alphabet $GOOGL – The Undervalued Cash Machine Trading Like a Value Stock

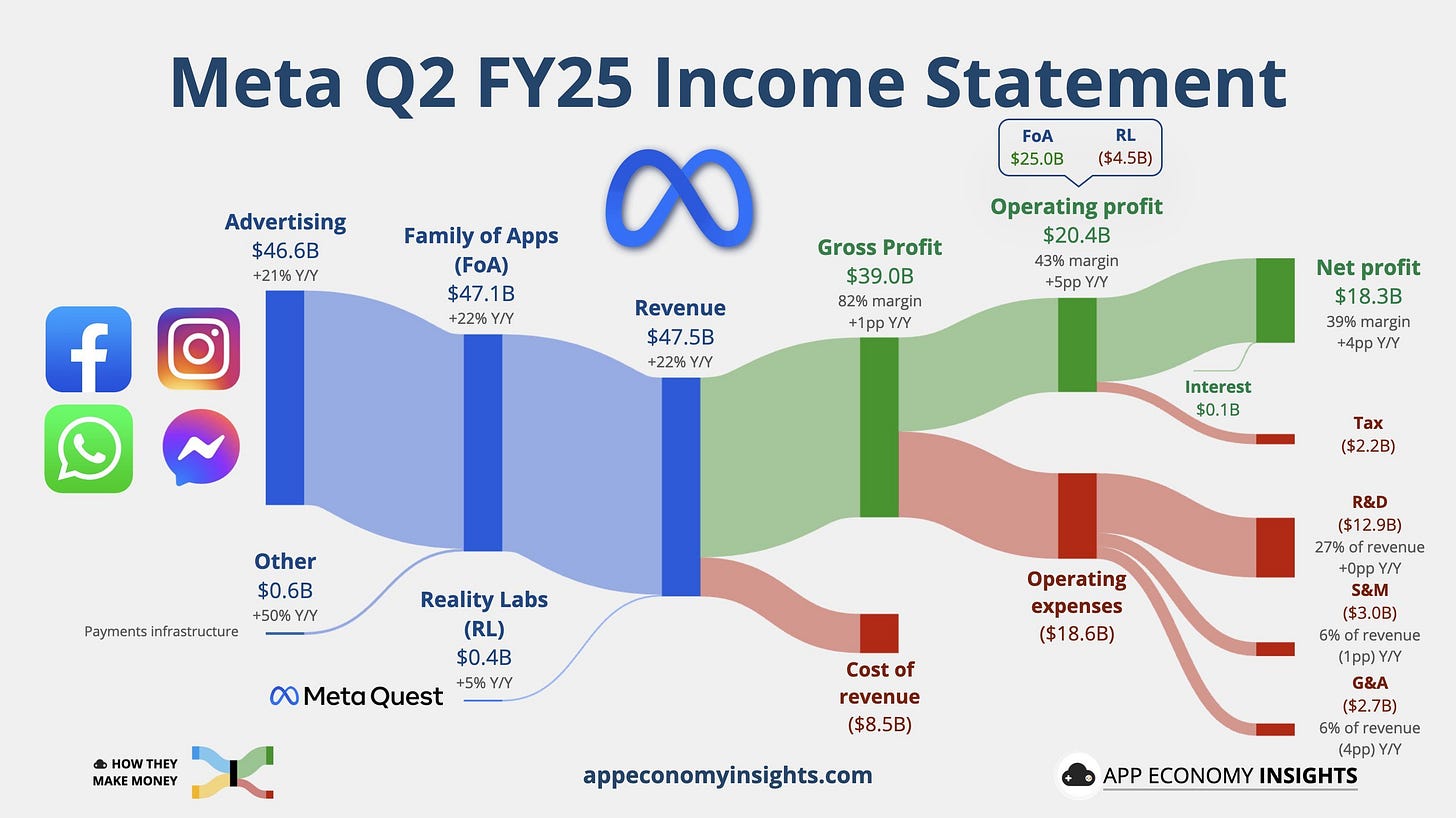

3) Meta Platforms $META - AI AdvertisingThe AI revolution is happening whether you participate or not. You can either own the companies building the future or watch from the sidelines as they create unprecedented wealth.

These three companies aren't just surviving the AI revolution - they're leading it. Amazon provides the infrastructure, Google organizes the information, and Meta connects the people. Own all three, and you own the foundation of the digital economy.

If you remember one lesson, it’s that the winners keep reinventing themselves and building deeper moats.

1️⃣ Amazon $AMZN – The Everything Store Becomes the Everything Platform

Think about McDonald's in the 1970s. Ray Kroc figured out that McDonald's wasn't really a burger company - it was a real estate company that happened to sell burgers. Amazon isn't really a retail company - it's an infrastructure company that happens to sell products.

Amazon is a giant in both online shopping and cloud computing. Right now, over 40% of every online shopping dollar in the U.S. goes through Amazon. As people get busier and want everything delivered fast, Amazon keeps making it easier to shop for daily needs — that means customers spend more and more each year on its platform.

But there’s more. Amazon’s cloud business, AWS, controls almost a third of the entire worldwide market and is bigger than any competitor. What makes AWS special now? Amazon’s betting over $100 billion on artificial intelligence, rolling out new tools and services to lock in current clients and lure new ones. That helps AWS stay ahead as more big companies use the cloud for AI.

Don’t forget Amazon is building a new advertising empire too — along with streaming. Both pack strong profits and help Amazon create steady, rising income.

The key right now: Amazon’s profits (not just its sales) are growing faster than ever. It’s winning because its cloud and advertising businesses bring in much higher margins than its retail segment. Even if the stock looks expensive at first glance, it’s actually a bargain if you focus on its future profit growth (— not just revenue numbers).

Long-term impact: Amazon’s grip on shopping and cloud isn’t going away. With every new move in AI, advertising, and tech, it’s building new walls against competitors. For investors, this is a chance to ride not just one, but several strong waves.

The numbers tell an incredible story:

AWS revenue: $116 billion annually (50% larger than Microsoft's Azure)

Advertising revenue growing 23% year-over-year

Operating income growing much faster than revenue - the classic sign of a maturing business model

As AWS and advertising grow faster than retail, Amazon's profit margins will explode. A 13% revenue increase can translate to 30%+ profit growth when your highest-margin divisions are growing fastest.

Advice:

Buy on dips, especially after the Q2 pullback.

Focus on the long-term profit engine from AWS and ads.

Watch ongoing AI momentum and global expansion.

Use valuation dips as entry points — don’t obsess over short-term stock moves.

2️⃣ Alphabet $GOOGL – The Undervalued Cash Machine Trading Like a Value Stock

Alphabet trades at just 19.7 times forward earnings while the S&P 500 trades at 23.8 times.

Why is Google so cheap? Fear. Investors worry that ChatGPT will kill Google Search the same way Google killed Yellow Pages. But here's what they're missing: Google processes 8.5 billion searches per day. Even if AI takes 20% of that traffic, Google still dominates the biggest advertising market in human history.

The opportunity: Google is using AI to make search better, not replace it. Their new AI-powered search results keep users on Google instead of losing them to ChatGPT.

Google Search: Still the world’s #1 gateway to information, generating over half of Alphabet’s revenue. Yes, AI tools like ChatGPT are nipping at the edges, but usage data still shows overwhelming dominance.

YouTube: The second-largest search engine in the world, growing ad revenue and now monetizing Shorts aggressively (TikTok-style).

Cloud + AI: Google Cloud finally turned profitable last year and is layering in AI APIs, Gemini, and enterprise solutions to boost margins.

Other Bets: Waymo (self-driving) could be the “sleeper hit” if autonomous adoption jumps in the late 2020s.

Alphabet has the rare mix of scale, profitability, and optionality. It’s essentially an AI tollbooth, charging rent whether you search, watch, build, or deploy AI.

Why Google Will Win the AI War

Google has three massive advantages:

Real-time data: Google knows what people are searching for right now

Integration: AI results appear in regular search, not a separate app

Revenue model: AI-enhanced search generates more ad clicks, not fewer

3️⃣ Meta Platforms $META - AI Advertising

Meta owns Facebook, Instagram, WhatsApp, and Threads — social platforms where billions of people spend time daily. Meta’s key story is its ad business is thriving, and its investment in AI is driving better ad performance and user engagement.

Meta has an advantage that no one else can replicate. It's a perfectly closed loop. They have nearly half the world's population using their apps (Facebook, Instagram, WhatsApp). They have the data on what those billions of users are interested in. And now, they have the world-class AI to connect advertisers with the perfect customer at the perfect time with terrifying efficiency. The AI makes the ads better, which keeps users more engaged, which generates more data, which makes the AI even smarter. It is a flywheel of profit that is just beginning to spin at full speed.

Here's what excites me most about Meta: they're just getting started with monetization. WhatsApp has 2 billion users but barely shows ads. Instagram Reels is growing like crazy. AI is making ad creation so easy that small businesses can now afford Meta advertising.

Think about it like this: Meta built the world's largest audience, and now AI is making it profitable to advertise to every single person in that audience, no matter how small your business.

👉For more insights, follow me on Twitter/ X, Instagram Threads, and turn on notifications.

5) Insider Trades from Billionaires, Politicians and CEO’s:

Follow the money!

This week, we analyze:

1) Warren Buffett & Sirus XM

2) Congressman Cleo Fields Goes All-In on AI

3) CEO of Vertex Pharmaceuticals1) Warren Buffett and Sirius XM Holdings SIRI 0.00%↑

Sirius XM Holdings $SIRI had a major vote of confidence filed on August 4th, as Warren Buffett's Berkshire Hathaway bought over $106 million worth of the stock over four days. Berkshire Hathaway, run by the legendary investor Warren Buffett, is famous for its simple, value-based investment philosophy: buy wonderful companies at a fair price. So, why are they buying a satellite radio company in the age of Spotify? The story here isn't about competing with streaming music; it's a bet on the "captive audience" of the 150 million-plus cars on the road in America with their radios installed. Sirius is a cash-flow machine with a remarkably loyal subscriber base and low costs. In Buffett's world, this is like owning a toll road—a boring, predictable business that just keeps generating cash. The long-term play is that while Wall Street is obsessed with the "new new thing," Buffett and his team are buying an undervalued asset that the market misunderstands.

When the world's greatest investor makes a $100+ million bet, you should pay attention.

2) Congressman Cleo Fields Goes All-In on AI

Trades filed on August 7th shows that Congressman Cleo Fields made a massive, multi-million dollar investment across the biggest names in technology and AI.

His investing spree included NVIDIA $NVDA with eight separate purchases totaling $1.4-1.9 million, plus significant positions in Alphabet $GOOGL, Amazon $AMZN, Apple $AAPL, Microsoft $MSFT, Palantir $PLTR, and Taiwan Semiconductor $TSM - all in the $100,000-$500,000 range per trade.

Politicians often have unique insights into regulatory trends and government spending priorities. When a sitting congressman loads up on AI stocks, he's essentially betting that government policy will favor these technologies. Remember, Congress controls AI regulation, defense spending, and technology initiatives.

3) CEO of Vertex Pharmaceuticals VRTX 0.00%↑

Vertex Pharmaceuticals $VRTX, a biotech giant and the leader in treating cystic fibrosis, had its CEO and President, Reshma Kewalramani, purchase almost $3.9 million worth of stock, according to an August 7th filing. This is a massive signal of her conviction in the company's future. For a company as large and successful as Vertex, a multi-million dollar buy from the CEO suggests she believes the market is underestimating the potential of their drug pipeline. She is sending a clear message that their next wave of drugs—perhaps in new areas like pain management or genetic diseases—could be even bigger than their current blockbusters.

6) Trade of the Week (options trading):

Each week, I swing trade around $1,000-$2,000 in stock options. Here’s where my money is going this week.

Bullish on FTAI Infrastructure Inc – FIP 0.00%↑

FTAI Infrastructure $FIP just witnessed some serious "smart money" action with an incredible 32-to-1 ratio of call options over puts - that's like seeing 32 people betting on a horse to win for every 1 person betting it will lose.

The action centered on January 16th $5.00 call options, with traders paying $1.10 per contract and creating massive volume of 2,699 contracts against just 667 in open interest. This means most of this activity represents brand new bullish positions, not people closing existing trades.

FTAI Infrastructure $FIP operates in the aviation and transportation infrastructure space, managing assets like aircraft engines, railcars, and other critical infrastructure components. Think of them as the company that owns the toll roads, airports, and railways that everyone else needs to use. The multiple large block purchases all hitting the ask price of $1.10 tells you something crucial - these weren't bargain hunters waiting for a good deal, these were urgent buyers willing to pay market price immediately.

Here's why this matters: When you see Warren Buffett-style "bet the farm" positioning like this, it usually means institutional traders know something the rest of us don't yet. The $5.00 strike price represents about a 10% move higher from current levels (assuming the stock is trading around $4.50 based on the range provided), which suggests these traders expect significant upward movement by January 16th. That's not a lottery ticket play - that's a calculated bet on a specific catalyst.

The infrastructure sector has been getting renewed attention thanks to government spending initiatives and the ongoing need to modernize America's aging infrastructure. Infrastructure companies like FIP often benefit from long-term contracts and steady cash flows, making them attractive during uncertain economic times. Think of infrastructure like the pipes in your house - you might not notice them until they break, but you definitely need them working.

My Advice: This options activity screams that something big is coming for FTAI Infrastructure. The smart money doesn't risk this kind of premium ($1.10 per contract) unless they have strong conviction. Consider following this smart money by buying the same January 16th $5.00 calls, but only risk what you can afford to lose. Alternatively, if options feel too risky, consider buying the actual stock - if these big traders are right, the stock should move higher, benefiting both options and stock holders.

The psychological insight here is crucial: Most retail investors make the mistake of trying to be too clever, looking for "cheaper" options or waiting for better prices. But when you see 32-to-1 bullish positioning with buyers hitting the ask aggressively, that's institutional urgency. It's like seeing fire trucks racing toward a building - you don't need to know what's burning to know something significant is happening.

Risk management is key: Set a stop-loss at 50% of your premium if you buy these options. If the trade doesn't work within the first few weeks, the time decay will start eating your profits. Also watch for any company announcements, earnings reports, or infrastructure spending news that could be the catalyst these smart money traders are anticipating.

7) Best Performing Stocks This Week (and catalysts, earnings, news):

Smart Money’s Biggest Bets

1) Grocery Outlet $GOGL up +38% on Wednesday 8/6

Grocery Outlet $GOGL absolutely exploded after crushing second-quarter earnings expectations, earning 23 cents per share versus the 17 cents analysts expected. This discount grocery chain is like the Costco of bargain hunting - they buy excess inventory from major brands and sell it at steep discounts to budget-conscious shoppers. The key insight here is that when economic uncertainty rises, consumers flock to value retailers. Think about how Dollar General thrived during the 2008 recession - Grocery Outlet is positioned perfectly for a similar trend.

Advice: This earnings beat signals that discount retail is hitting its stride. Consider adding other value retailers to your watchlist like Dollar Tree or Big Lots, as the "trade-down" consumer trend could be just beginning. Warren Buffett always says "be fearful when others are greedy," but right now, being greedy about value retailers might be the contrarian play that pays off.

2) LegalZoom $LZ up +34% on Friday 8/8

LegalZoom $LZ skyrocketed after Bank of America upgraded the legal solutions provider from "underperform" to "buy" and raised their price target suggesting another 43% upside potential. LegalZoom is essentially the "TurboTax for legal services" - they help small businesses and individuals handle legal paperwork without expensive lawyers. The AI revolution is actually helping LegalZoom, not hurting it - they're using artificial intelligence to streamline legal document preparation even further. This is a classic example of what Peter Lynch called a "ten-bagger" setup - a company that solves a real problem for millions of people.

Advice: When analysts flip from bearish to bullish this dramatically, it often signals a major business transformation. Look for more AI-enabled service companies that are automating expensive professional services. The legal industry is ripe for disruption, and LegalZoom is leading the charge.

3) Firefly Aerospace $FLY up +34% on Thursday 8/7

Firefly Aerospace $FLY launched its IPO debut with a bang, pricing at $45 per share above the expected range and closing at $60.35. This Texas-based rocket company is riding the "New Space" wave alongside SpaceX and Blue Origin, but focusing on smaller satellite launches. Think of Firefly as the "Uber for space launches" - they provide on-demand rocket services for companies that can't afford a full SpaceX mission. The space economy is projected to reach $1 trillion by 2040, and Firefly is positioning itself as the affordable alternative for smaller payloads.

Advice: IPO pops this big often signal strong institutional demand. Watch for any pullback to the $45-50 range as a potential entry point. The key catalyst to watch is their upcoming launch schedule - successful missions will drive the stock higher, while failures could create buying opportunities. Remember, investing in space companies is like betting on the internet in 1995 - high risk, but potentially life-changing returns.

4) Lemonade $LMND up +29% on Tuesday 8/5

Lemonade $LMND surged after dramatically raising full-year revenue guidance from $661-663 million to $710-715 million. Lemonade is revolutionizing insurance using AI and behavioral economics - they're like the Tesla of insurance, using technology to eliminate traditional inefficiencies. The company's AI can process claims in seconds instead of weeks, and their "Giveback" program donates leftover money to charities, creating customer loyalty traditional insurers can't match. This guidance raise suggests their AI-driven growth model is accelerating faster than expected.

Advice: Insurance is a massive, slow-moving industry ripe for disruption. Lemonade's success could signal the beginning of a broader transformation. Look for other insurtech companies like Root or Metromile that are applying similar AI-first approaches. Warren Buffett built his fortune on insurance float - Lemonade might be showing us what insurance 2.0 looks like.

5) Duolingo $DUOL up +28% on Thursday 8/7

Duolingo $DUOL soared after beating earnings expectations and guiding Q3 revenue to $257-261 million versus analyst expectations of $253 million. Duolingo has created something rare: a truly addictive educational product - their gamified language learning keeps users coming back daily. The company is benefiting from the "upskilling" trend as workers realize they need new skills to stay relevant in an AI-driven economy. Think of Duolingo as the "Netflix of education" - they've cracked the code on making learning entertaining and habit-forming. The long-term opportunity is massive as global language learning markets expand and AI makes personalized education more effective.

Advice: Education technology stocks often trade like growth stocks during uncertain times because people invest in skills when job security feels shaky. Consider other edtech plays like Coursera or Udemy that are riding similar trends. The key insight: Duolingo's sticky user base creates predictable revenue streams that investors love.

6) DigitalOcean $DOCN up +27% on Tuesday 8/5

DigitalOcean $DOCN rallied after beating Q2 expectations and raising full-year revenue and earnings guidance. DigitalOcean is like the "Southwest Airlines of cloud computing" - they focus on simplicity and affordability for small-to-medium businesses that can't afford Amazon Web Services' complexity. As AI democratizes software development, more developers need simple cloud infrastructure. The company is perfectly positioned for the "long tail" of cloud adoption - the millions of small businesses and indie developers who need cloud services but don't want enterprise complexity.

Advice: While everyone focuses on Amazon and Microsoft's cloud dominance, DigitalOcean is quietly capturing the underserved small business market. This guidance raise suggests their strategy is working. Look for other "David vs. Goliath" cloud plays that serve niche markets the big players ignore. Remember, Southwest Airlines succeeded by serving routes the major airlines didn't want - DigitalOcean is applying the same playbook to cloud computing.

7) Energizer $ENR up +24% on Monday 8/4

Energizer $ENR jumped after beating Q3 revenue expectations and raising full-year guidance from $3.30-3.50 EPS to $3.55-3.65 EPS. Energizer is the classic "boring business that prints money" - batteries are essential products that people need regardless of economic conditions. The shift to electric everything actually helps Energizer as more devices need batteries, and their Duracell competition creates a stable duopoly. This is what Warren Buffett calls a "wonderful business" - predictable demand, pricing power, and high barriers to entry.

Advice: Consumer staples like Energizer often outperform during uncertain times because they provide steady dividends and defensive characteristics. The guidance raise suggests stronger-than-expected demand, possibly from increased electronics usage and emergency preparedness trends. Consider other recession-resistant consumer staples that could benefit from similar dynamics. Sometimes the best investment strategy is buying the boring companies that keep working while exciting companies flame out.

👉For more insights, follow me on Twitter/ X or Instagram Threads, and turn on notifications.

8) Important Earnings & Stocks to Watch:

Here’s what you need to know for the most important earnings this week:

Applied Materials ($AMAT) - This is the ultimate "shovel seller" for the AI gold rush. Instead of making the chips themselves, AMAT builds the incredibly complex machines that chip companies like Nvidia, Intel, and TSMC need to build their factories.

What to Watch: The recent 100% tariff on foreign chips is a massive tailwind for AMAT. It forces companies to build factories in the U.S., and they need AMAT's equipment to do it. Listen for any comments on the strength of their order book from U.S.-based projects. A bullish signal would be a huge backlog of orders; a bearish signal would be any hint of a global slowdown that makes companies pause their factory-building plans.

Advice: For most people, this is a much safer way to invest in the AI boom than trying to pick the winning chip company. AMAT wins as long as the demand for more, and more powerful, chips continues. Think of it as a core tech holding that profits from the entire industry's growth.

CoreWeave ($CRWV) - Think of CoreWeave as the ultimate AI landlord. They buy up massive amounts of Nvidia's most powerful chips—the ones that are nearly impossible to get—and rent out access to them. They are providing the essential computing power that fuels the entire AI revolution.

What to Watch: Their key advantage is their special relationship with Nvidia. The bull case is that demand for AI training is so high that they can charge a premium for their services. The bear case is their massive spending on hardware and their reliance on a handful of large customers. Pay close attention to their profit margins—it will tell you if they have true pricing power or if they are just in a low-margin hardware rental business.

Advice: This is a pure-play bet on the demand for AI computing. You're not betting on an AI model; you're betting that everyone will need more power to build their own. Before you invest, ask yourself: do you believe the need for massive data centers will keep growing?

monday.com ($MNDY) - This company makes software that helps teams at work get organized. They are the digital version of a project manager's whiteboard, helping everyone from small startups to giant corporations track their work.

What to Watch: The big story for monday.com is their push from serving small businesses to landing huge corporate clients. This is critical because big companies pay more and are "stickier" (they are less likely to cancel their subscriptions). The bull case is they keep winning big accounts. The bear case is a slowing economy makes businesses cut their software budgets. Look for the growth rate of customers paying over $50,000 a year. That number tells you if their strategy is working.

Advice: MNDY's performance is a great barometer for the health of business spending. If they're doing well, it's a sign that companies are still investing in efficiency and growth.

Circle Internet ($CRCL) - Circle is the company behind USDC, one of the most trusted "stablecoins" in the world. They aim to provide a safe, stable, digital U.S. dollar that acts as the bedrock for the entire crypto ecosystem.

What to Watch: The recent executive order allowing crypto in 401(k) plans is a huge potential catalyst. More people entering the crypto world means more demand for a safe "home base" like USDC. The bull case is that they become the official digital dollar for the internet. The bear case is heavy-handed regulation or a loss of trust. Their earnings call is all about trust and transparency—listen for how they talk about the reserves that back their stablecoin.

Actionable Advice: Investing in Circle is like investing in the plumbing of the crypto world. You don't need to pick the winning cryptocurrency; you just need to believe that the overall system will grow and need a stable currency to function.

Oklo ($OKLO) - Backed by AI visionary Sam Altman, Oklo wants to build tiny, personal nuclear reactors. Their dream is to provide massive amounts of clean, reliable power for things like remote communities and, more importantly, the energy-hungry data centers that power AI.

What to Watch: This is a "moonshot" bet. The bull case is that AI's demand for electricity becomes so huge that the world has no choice but to adopt new nuclear technology like Oklo's. The bear case is the enormous regulatory hurdles and the fact that it could be a decade or more before they generate any meaningful revenue. The only catalyst that matters is any news related to regulatory approval or successful test projects.

Advice: Think of this as a venture capital investment. The risk of failure is very high, but the potential reward is enormous. This is a lottery ticket on the future of energy, not a core retirement holding.

Archer Aviation ($ACHR) - Archer is trying to build "flying taxis." They are a leader in the race to create electric vertical takeoff and landing (eVTOL) aircraft to ferry people over city traffic.

What to Watch: The company is pre-revenue, so their financials don't matter much. The entire story is about one thing: FAA certification. The bull case is they become one of the first companies to get full government approval to fly commercially. The bear case is they fail to meet the incredibly high safety and regulatory standards. Any update on their certification timeline is the only news to care about.

Advice: Like Oklo, this is a binary bet on a future technology. You are not buying a business; you are buying a dream. Wait for them to pass major FAA milestones before even considering an investment.

AST SpaceMobile ($ASTS) - This company wants to kill the cellular "dead zone." Their goal is to build a network of satellites that can beam a 5G signal directly to any standard, unmodified cell phone on the planet.

What to Watch: This is another company where the tech is everything. The financials are just a measure of how quickly they're burning cash to achieve their goal. The bull case is that their technology works, and they partner with every major telecom company in the world. The bear case is that the technology is too complex and fails to work at scale. Look for news of successful satellite deployments and tests with partners like AT&T.

Actionable Advice: This stock is a bet on a single technological breakthrough. Either it works and it's revolutionary, or it doesn't and the stock is worth zero. It's a high-risk, high-reward venture.

BigBear.ai ($BBAI) - BigBear provides AI and data analysis solutions, primarily for the U.S. government, defense, and intelligence communities. They are the less flashy, more serious cousin to the commercial AI companies.

What to Watch: The bull case is that government spending on AI for national security is a massive, long-term trend, and BigBear can carve out a profitable niche. The bear case is they get crushed by larger competitors like Palantir and that government contracts can be "lumpy" and unpredictable. Listen for commentary on the size of their contract pipeline and their ability to win new deals.

Advice: This is a small-cap way to play the government AI trend. It carries more risk than a giant like Palantir, but also potentially more upside if they execute well.

Rigetti Computing ($RGTI) - Rigetti is in the mind-bending field of quantum computing. They are trying to build computers that are exponentially more powerful than even the best supercomputers today, which could revolutionize everything from drug discovery to financial modeling.

What to Watch: This is the most speculative stock on the list. We are likely a decade or more away from a commercially viable quantum computer. The company is purely a research and development play. The only news that matters is a scientific breakthrough. Did they solve a problem that was previously unsolvable?

Actionable Advice: Owning this stock is like funding a university science experiment. Do not expect any returns for a very, very long time. This belongs in the tiny, "what if?" corner of a portfolio that can tolerate extreme risk.

👉For more insights, follow me on Twitter/ X or Instagram Threads or BlueSky, and turn on notifications.

9) Real Estate Analysis & Housing Market Trends:

This summer, the U.S. housing market is at an important crossroads. On one side, you have homebuyers who are exhausted by high prices and worried about the economy. On the other, you have home sellers who are still dreaming of the red-hot market of years past. The result is a standoff.

Homes are piling up on the market, not because we are building a ton of new houses, but because the existing ones are sitting unsold for longer. Inventory is at its highest level since 2019, and homes are taking a full week longer to sell than they did last year. That may not sound like much, but in real estate, it’s a lifetime. It’s a clear signal that the frantic, bid-over-asking-price days are firmly in the rearview mirror.

This market is also defined by what we call the "golden handcuffs." Millions of current homeowners are sitting on mortgages with unbelievably low 3% interest rates. They are reluctant to sell their homes because they know they’ll have to get a new mortgage at a rate above 6.5%. This keeps the best, most desirable homes off the market, leaving buyers with fewer great options to choose from.

Two Wildcards Are Changing the Game

The first wildcard is a bit of good news: mortgage rates just dipped to their lowest level since April. This provides a small dose of relief for buyers. A lower rate means a slightly lower monthly payment, which could bring some buyers back from the sidelines. However, let's be clear: a dip from 6.8% to 6.6% is like getting a 5% off coupon for a car you still can't really afford. It helps, but it doesn't solve the fundamental affordability crisis.

The second wildcard is much more ominous: the new tariffs, a hidden tax on the American Dream. Higher tariffs on imported goods create a ripple of fear through the economy. They make everything from appliances for your new kitchen to the building materials needed to construct a home more expensive. More importantly, they create uncertainty about jobs. Nothing kills housing demand faster than people worrying about their next paycheck. This fear is a powerful headwind that is canceling out much of the optimism from slightly lower mortgage rates.

The Power Is Shifting

The story these numbers tell is undeniable: the power in the housing market is shifting away from sellers and into the hands of buyers. More homes to choose from, more time to make a decision, and more sellers willing to cut their prices create a massive opportunity—if you know how to play the game. Here is your actionable playbook.

If You're a Homebuyer:

This is your moment. For the first time in years, you have leverage. Your mission is to be patient, be bold, and hunt for a deal.

What to do: Become a hunter of "stale" listings.

How to do it: Work with your agent to find homes that have been on the market for 30, 60, or even 90 days. Those sellers are motivated. They are tired of paying the mortgage on an empty house and are far more likely to negotiate.

What to do: Negotiate everything.

How to do it: Don't just make an offer below the asking price. Ask the seller to pay for your closing costs. Ask them to pay for a "rate buydown" that lowers your mortgage interest rate for the first two years. In this market, everything is on the table.

What to do: Look at new construction.

How to do it: The data shows that the price difference between a new home and an existing one is at a historic low. Homebuilders are publicly traded companies that need to make their quarterly numbers. They are offering massive incentives right now—from free upgrades to huge interest rate buydowns—to get houses sold before the end of the year. Go talk to them.

If You're a Home Seller:

Your strategy from two years ago is now obsolete. You must adapt to the new reality to succeed. Your mission is to win on price and presentation.

What to do: Price your home for today's market, not yesterday's.

How to do it: The single biggest mistake you can make right now is overpricing your home. Buyers are savvy and have more options. If your home is overpriced, they will simply ignore it. Get a realistic price from your agent and price it to sell from day one. A small price cut now is better than a huge price cut three months from now.

What to do: Make your house the best on the block.

How to do it: With more homes for sale, your property has to shine. Fresh paint, clean carpets, and great curb appeal are no longer optional; they are the bare minimum. Buyers want a move-in ready home, not a project.

YIf You're a Real Estate Investor:

This is not a market for quick flips. This is a market for playing the long game. The short-term is messy, but the fundamental shortage of housing in America is a powerful long-term trend.

What to do: Hunt for bargains where supply is highest.

How to do it: The data shows the biggest price drops are happening in Southern metros where inventory is high. This is where you should focus your search for deals.

What to do: Focus on cash flow, not appreciation.

How to do it: The goal in this market is to buy properties that will generate positive cash flow from rent from day one, even with today's higher interest rates. Run the numbers conservatively. If a property's rent covers the mortgage, taxes, insurance, and maintenance with some left over, it’s a solid investment that will pay you while you wait for the market to recover.

👉For more insights, follow me on Twitter/ X or Instagram Threads or BlueSky, and turn on notifications.

10) Interest Rate Predictions (short-term):

In the short term, interest rates are heading down.

Weak job numbers, softer inflation, and lower Treasury yields have all teamed up to push borrowing costs down.

The latest jobs report was a dud — initial numbers were revised down by hundreds of thousands over recent months, showing the job market isn’t as strong as it looked. Add in slowing inflation and investors expecting the Fed to cut rates — possibly as soon as the next meeting — and you have the recipe for mortgage rates drifting lower.

I see 30-year mortgage rates sliding toward the 6.4% range by year-end. We could even see two or even three Fed cuts before December. For now, the market itself is doing the work — Treasury yields have dropped sharply, and lenders are already adjusting rates down.

The Best-Case vs. Worst-Case

Best Case: Inflation cools, Fed cuts twice, rates drop to low-6s or even high-5s in 2026. Demand spikes, prices rise, and equity builds fast for early movers.

Worst Case: Inflation flares, Fed holds steady, rates stay in mid-6s — the buying window stays narrow but still better than 2023 highs.

Current Interest Rates:

The 30-year mortgage is now 6.57%, which is -0.06 lower than last week, -0.24 lower than last month, and -0.06 lower than last year:

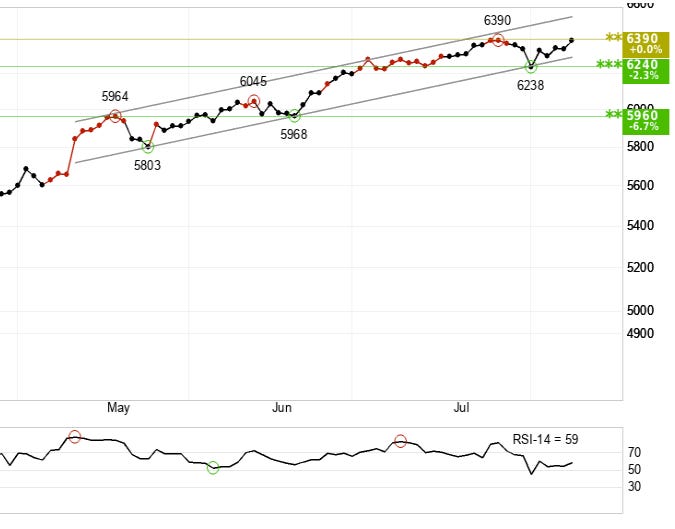

11) Technical Analysis (S&P 500, Tech Stocks, Bitcoin):

1) S&P 500 SPY 0.00%↑ (Short-term): Positive

The S&P 500 is climbing inside a rising channel, which means buyers keep stepping in at higher prices. Big picture, you’ve got a strong earnings season, hopes for a fall rate cut, and headline noise from tariffs.

2) Tech Stocks QQQ 0.00%↑ (Short-term): Positive

The Nasdaq-100 also rides a rising channel and just broke above 23,300. That points to more upside as AI and mega-cap earnings carry the tape. Recent news still favors tech: strong beats from big platforms, softer jobs data that pulled yields down, and talk of coming Fed cuts.

3) Bitcoin $BTC (Short-term): Positive

Bitcoin sits in a rising channel and just broke out above 118,077 from a rectangle base. Volume looks soft on the breakout, so expect tests and fake-outs. Macro helps the story: falling yields, talk of rate cuts, and policy moves that opened the door for retirement-account crypto have kept risk appetite alive.

12) Economic Outlook and Market Sentiment:

The institutions (smart money) are cautiously optimistic, retail investors (emotional money) are scared, and the economic fundamentals are solid. This is actually a pretty good setup for patient investors.

Remember Peter Lynch's advice: "The key to making money in stocks is not to get scared out of them." Right now, the data suggests that while individual investors are getting scared, the underlying conditions remain supportive for patient, long-term investors.

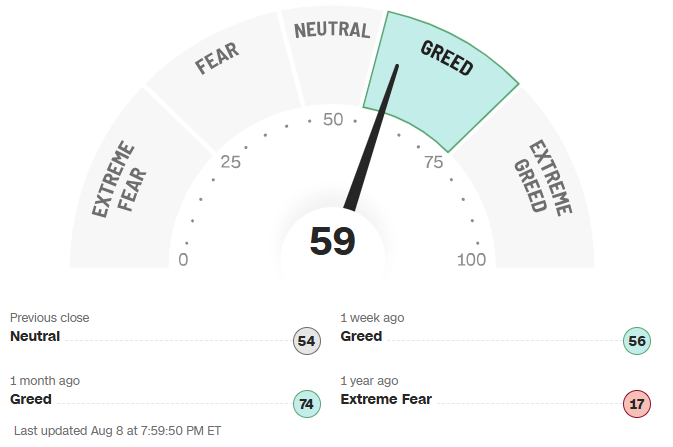

1) Fear & Greed Index = Positive

The Fear & Greed Index sits at 59, firmly in "greed" territory, which tells us investors are feeling optimistic but not recklessly so. Think of Warren Buffett's famous advice: "Be fearful when others are greedy, and greedy when others are fearful." Right now, we're in that sweet spot where people are confident but not euphoric. Greed pushes stocks higher in the short term, but also raises the risk of pullbacks

What's fascinating is the journey this index has taken. A year ago, it was at 17 - extreme fear territory. That was when smart contrarian investors were backing up the truck to buy stocks while everyone else was panicking. Now we've swung to cautious optimism, with junk bond demand showing "extreme greed," meaning investors are chasing riskier investments for higher returns.

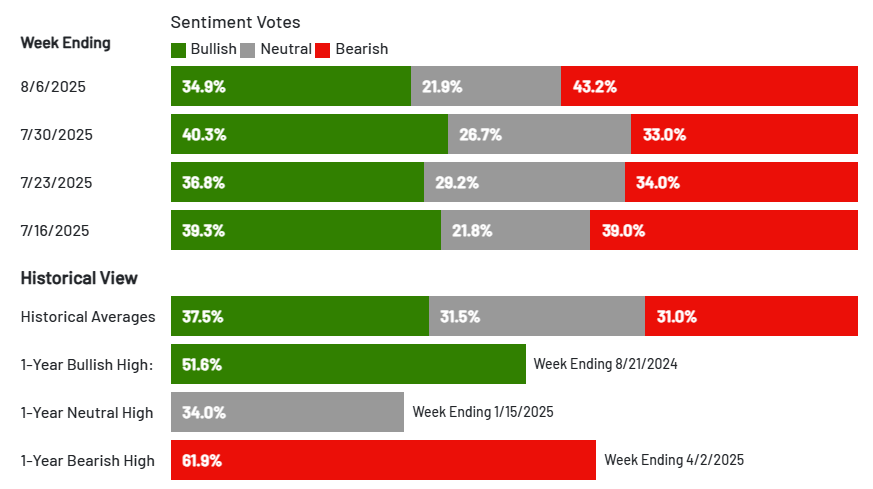

2) AAII Investor Index (6-Month Outlook) = Negative

While the Fear & Greed Index shows cautious optimism, individual investors are becoming significantly more bearish. The latest survey shows 43.2% bearish sentiment - well above the historical average of 31.0% - while only 34.9% are bullish.

This spike in bearishness is interesting because markets tend to climb when investors are overly pessimistic (contrarian signal).

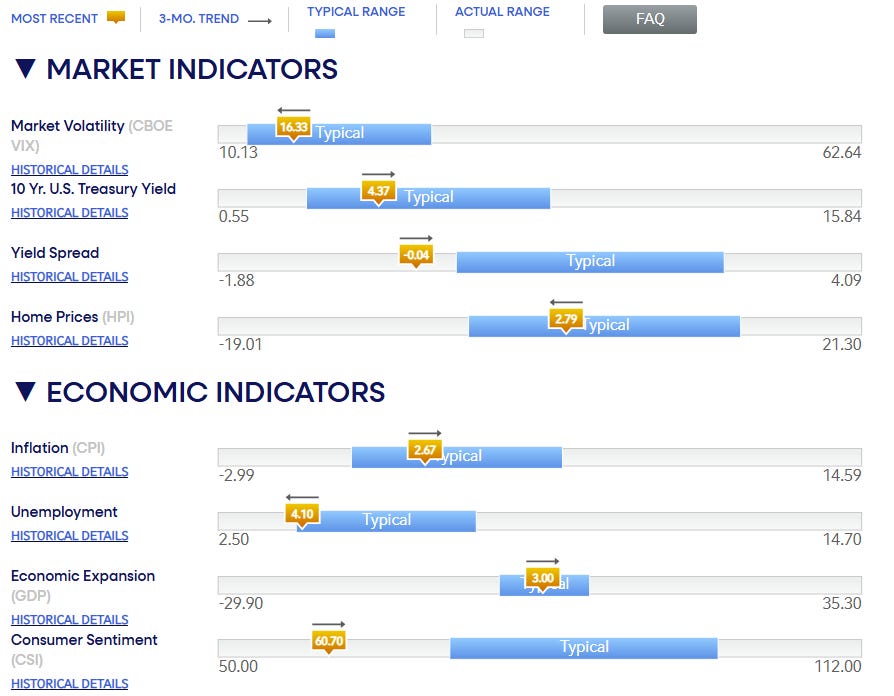

3) Economic Indicators = Neutral/Positive

Inflation, Unemployment, and Economic Expansion (GDP) are all sitting comfortably in their "Typical" range. The economy is not running too hot, which would force the Fed to raise interest rates, and it's not running too cold, which would signal a recession. It's in a "Goldilocks" state—just right. Market volatility is low, and home prices are stable.

13) Important Economic Events:

1) July CPI – August 12

The Consumer Price Index is the biggest market mover this week because it’s the main inflation gauge the Fed watches. If CPI stays hot, the Fed could keep interest rates high longer. If it cools more than expected, it could spark a broad market rally as traders price in earlier rate cuts.

Long-term, this tells you where inflation is trending and whether we’re closer to “normal” rates.

2) July Retail Sales – August 15

Retail sales show how healthy consumer spending is, which drives about 70% of the U.S. economy. Strong sales mean the economy’s holding up, but it can also mean inflation stays sticky if demand stays high. Weak sales suggest consumers are pulling back, which could slow growth.

3) July PPI – August 14

The Producer Price Index tracks wholesale inflation—the costs businesses face before prices hit consumers. A big move here often shows up in CPI later. Rising PPI can be a warning sign inflation might bounce back, while falling PPI could signal more relief ahead.

4) July Industrial Production – August 15

Industrial production measures factory and manufacturing output. It’s a real-time health check for the goods-producing side of the economy. Rising output shows economic momentum; falling output can hint at a slowdown.

5) Preliminary August University of Michigan Consumer Sentiment – August 15

This is a peek into the consumer’s mind—how confident people feel about their finances and the economy. High confidence usually means more spending ahead; low confidence can foreshadow slower growth. It also tracks inflation expectations, which the Fed watches closely.

If inflation expectations rise, gold and inflation-protected bonds (TIPS) could see demand.

👋Final Thoughts:

🙌Thank you for joining 108,000+ members and reading our newsletter! If you enjoyed reading it please:

Support us by sharing it with friends or family to help us grow, and become a paid subscriber to support our work (this newsletter takes hours to research and write!):

Hit the LIKE button ❤️ on this post so more people can discover it on Substack 🙏

And please let us know what you think of our newsletter:

See you again next week! (Missed an issue? Read past issues here at TheFinanceNewsletter.com)

☺️ My goal is to help you get richer and smarter with your money — Join 3 million and follow me across social media for daily insights:

Instagram Threads: @Fluent.In.Finance

Twitter/ X: @FluentInFinance

Facebook Page: Facebook.com/FluentInFinance

Linkedin: Linkedin.com/in/Lokenauth

Youtube: Youtube.com/FluentInFinance

Instagram: @Fluent.In.Finance

TikTok: @FluentInFinance

Facebook Group: Facebook.com/Groups/FinanceTalk

Reddit Community: r/FluentInFinance

➕Please add this newsletter to your contacts to ensure that none of our emails ever go to spam!

This content is for educational purposes only. Such information should not be construed as legal, tax, investment, financial, or other advice. See for Disclaimer, Terms and Conditions.

Hi Andrew, great issue as always! I’m curious — AI has been driving huge growth for some time now, but how do you personally decide when to stay invested in these AI leaders versus when it might be time to take profits or step back? What signs or signals do you watch for to balance riding the wave and managing risk?

I’d love to hear what others in the community think as well — how do you approach this balance in your own investing? Thanks!