💥My Investment Research and Market Analysis [August 18, 2025]

US hits highest layoffs since COVID, Nobody’s buying homes, US tariff revenue surged +300% in July — Plus My Stock Picks, Insider Trades, Interest Rate Predictions, Technical Analysis and Much More!

👋 Good morning my friend and welcome back to the #1 finance newsletter! I hope you had a great week! Thank you for joining 108,000+ readers and subscribing to our newsletter which is dedicated to helping you get richer and smarter with money!

If you enjoy reading our newsletter, please hit the ❤️LIKE button on this post so more people discover it on Substack 🙏

📬In today’s issue, we discuss:

Part I — Financial Markets:

1) My Stock Market & Economic Analysis

2) Most Important Financial Events This Week (with my thoughts)

3) Most Important Charts & Numbers This Week (and its importance)

🎯Premium Research & Analysis:

Part II — Stock Market:

4) What I'm Investing in (stock picks, research and analysis)

5) Insider Trades from Billionaires, Politicians and CEO's

6) Trade of the Week (options trading)

7) Best Performing Stocks This Week (catalysts, earnings, and news)

8) Important Earnings & Stocks to Watch

Part III — Real Estate:

9) Real Estate Analysis and Housing Market Trends

10) Interest Rate Predictions (and current rates)

Part IV — Economy & Macro:

11) Technical Analysis (S&P 500, Tech Stocks, Bitcoin)

12) Economic Outlook & Market Sentiment

13) Important Economic EventsBut before we get into it, please support us and:

Hit the ❤️LIKE button on this post so more people discover it on Substack 🙏

Share this newsletter with friends and family to help them get richer and smarter with money!

Become a paid subscriber and support us! (This newsletter takes many hours of research and writing!)

1. My Stock Market & Economic Analysis:

This year, the S&P 500 is up 10.2%, the Nasdaq is up 12.6%, Gold is up 26.7%, and Bitcoin has gone up 26.7%. Here's everything important you need to know (that happened this week):

The S&P 500 and Nasdaq hit new all-time highs as investors grew confident the Fed might cut interest rates in September.

Treasury Secretary Scott Bessent even suggested a half-point cut, while President Trump hinted at replacing Fed Chair Jerome Powell early.

Bitcoin hit a new all-time high above $124,000.

Major stock indexes across the globe rallied: Canada’s TSX, Japan’s Nikkei, and Australia’s ASX all reached new highs this year, while Europe’s FTSE 100 and Stoxx 600 are close.

CoreWeave, a fast-rising AI computing firm, crushed its earnings report with huge revenue growth, thanks to strong AI demand and a deal with OpenAI. But keep an eye on its lockup expiration this week—early investors may dump shares after a 272% climb from the IPO.

💡Andrew’s Analysis:

Right now, we're in what some people call an "everything rally." It feels like no matter where you look—US stocks, global stocks, Bitcoin, gold—prices are climbing. It’s rare to see such a global wave of record highs: the U.S., Canada, Australia, Japan, and soon Europe.

The main reason is simple: The market is betting on cheaper money.

Think of interest rates as the price of borrowing money. When rates are high, it's expensive for companies to take out loans to build new factories or hire people. It's also expensive for you to get a mortgage or a car loan. When the Federal Reserve (or "the Fed") cuts rates, it's like putting money on sale. Suddenly, it's cheaper for everyone to borrow and spend. That usually juices the economy and pushes stock prices up.

What you're seeing this week isn't a reaction to rate cuts that have already happened. It's the market predicting they will happen. Investing is always about the future. The crowd is placing a massive bet that the Fed will cut rates in September, and they're buying things up now to get ahead of the game.

Why it matters: More than just good news, it signals coordinated optimism about the future. Investors are betting on lower rates, strong corporate earnings, and AI-driven growth. When everyone’s hitting highs together, it’s usually tied to big themes: think of the early 2000s with the dot-com boom, or the 2010s with globalization and cheap money.

What This Means Long-Term: We’re standing at a crossroads. Markets hitting all-time highs can mean two things:

Best case: We're starting a new bull run. Rate cuts fuel growth. AI companies like CoreWeave lead a tech revolution. Your investments could double in 3-5 years.

Worst case: We're at the top. Remember 1999? Everyone thought tech stocks would go up forever. They didn't. (Spoiler: The Nasdaq crashed 78%.)

The truth? It's probably somewhere in the middle.

Remember this: The Crowd is Usually Wrong at Extremes. In 2007, everyone thought housing prices would never fall. In March 2020, everyone thought the world was ending. Both times, doing the opposite made people rich.

👉 For daily insights, follow me on Twitter/ X, Instagram Threads, or BlueSky, and turn on notifications!

2. The Most Important Financial Events This Week (with my thoughts):

This week, we analyze:

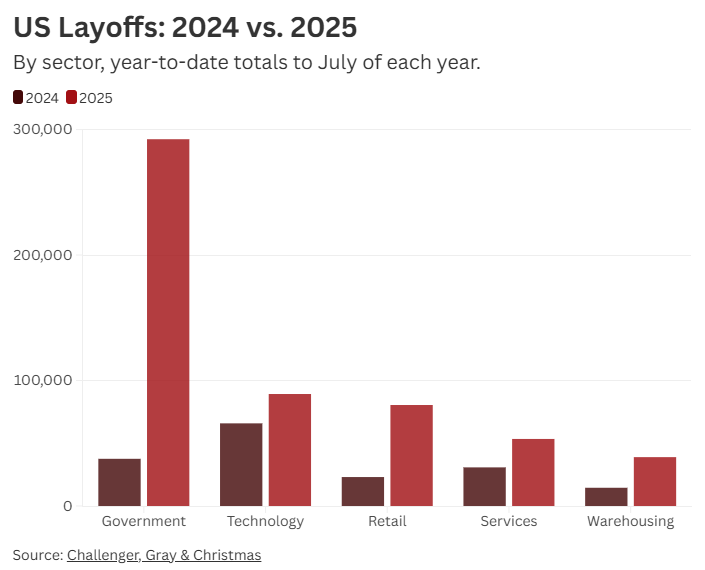

1) US hits highest layoffs since COVID.

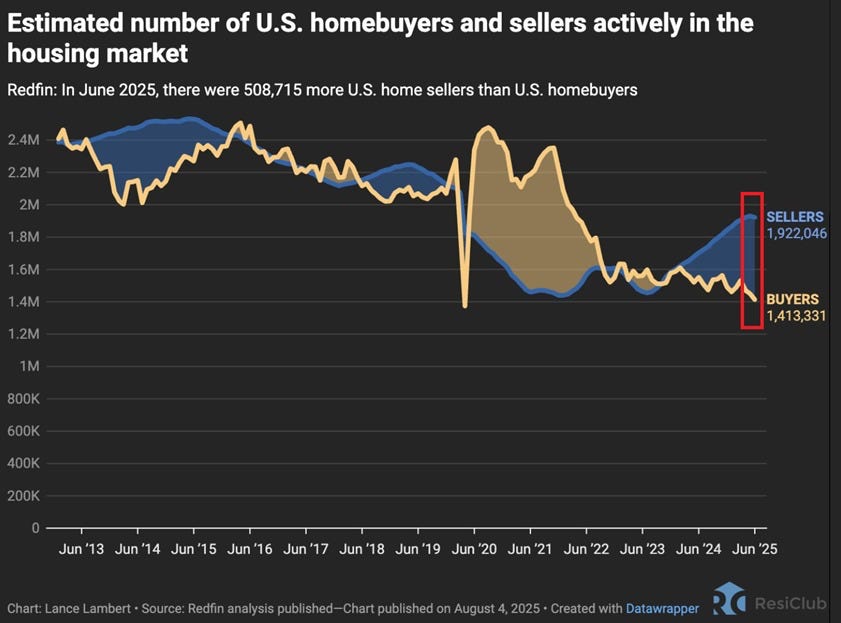

2) Nobody’s Buying Homes, Nobody’s Switching Jobs—and America’s Mobility Is Stalling.

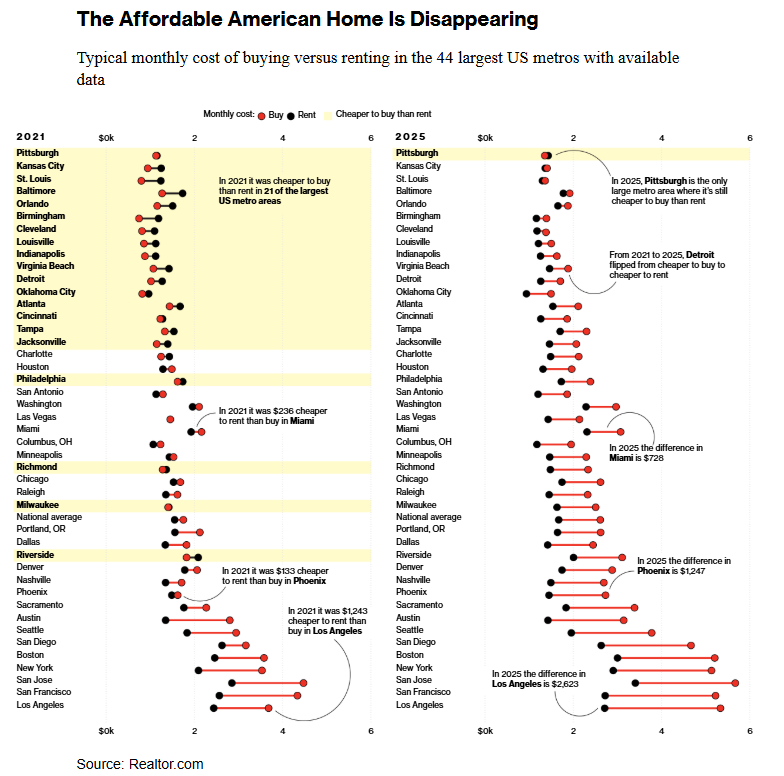

3) Americans Are Getting Priced Out of Homeownership at Record Rates.

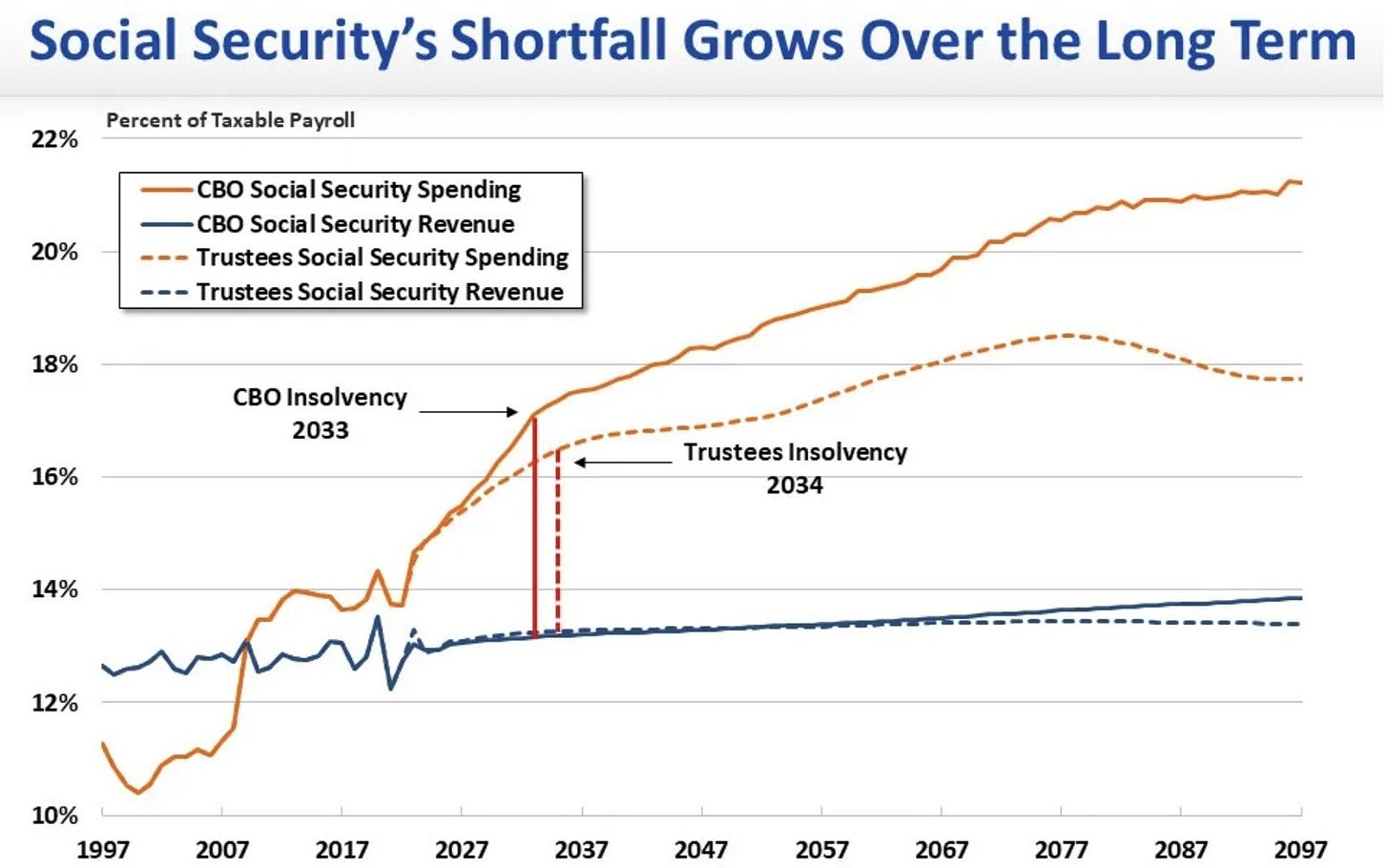

4) The Social Security tsunami: Payments could be cut by 23%, doubling the poverty rate for America's seniors.

5) E.J. Antoni, Trump's candidate to lead the Bureau of Labor Statistics, is now suggesting suspending the agency’s monthly jobs report.

6) US wholesale prices jump 3.3% as Trump tariffs hit economy.1️⃣ US hits highest layoffs since COVID.

July saw 62,075 job cuts – that's the highest since the pandemic started. We're up 140% from last year. The federal government's cutting 292,294 jobs this year alone (thanks to Trump's DOGE efficiency push). Tech companies are replacing workers with AI – over 10,000 jobs lost to robots last month. Tariffs killed another 6,000 jobs.

Here's the scary part: We've already hit 806,383 layoffs this year. That's 75% more than last year, and we're only in August.

💡Andrew’s Analysis:

Long-Term Impact:

When lots of people lose jobs and can’t get hired, shoppers spend less, businesses shrink, and the economy slows down. High layoffs can spook investors and make stock prices drop (think "domino effect"). If this keeps up, it can trigger a “vicious cycle”: more layoffs, less spending, slowing growth.Actionable Advice:

Don’t ignore risk. Keep some cash handy in case you lose your job or when investments drop.

Boost your skills, especially with tech and AI. Learning new things can save your career when layoffs hit.

Think like Warren Buffett: Buy strong companies when others are scared, but do it slowly—wait for prices to drop first (patience pays).

Diversify: Never put all your money in one stock or sector. Spread investments to protect yourself.

2️⃣ Nobody’s Buying Homes, Nobody’s Switching Jobs—and America’s Mobility Is Stalling.

Only 7.8% of Americans moved last year – the lowest since they started tracking in 1948. (In the 1960s, 20% of people moved yearly.) Job switching dropped from 2.8% monthly in the '90s to 2.3% now.

Why's everyone stuck? People with 3% mortgages won't sell. Companies aren't hiring entry-level workers. Dual-income families can't risk one person losing their job. The result: Growing families are trapped in tiny homes, empty-nesters won't downsize, and young people can't start their lives. This immobility is literally shrinking our economy.

💡Andrew’s Analysis:

Long-Term Impact:

Less moving means the economy grows slower—imagine a football team where nobody trades players or tries new positions. People earn less money, companies find it hard to hire good workers, and everyone feels stuck.Why it matters (long-term): Lower mobility = lower dynamism. Productivity, wage growth, and new business formation can slow. Companies hire more local; remote and stay-put upgrades (renovations, ADUs) matter more.

Advice: The "golden handcuffs" are a psychological trap. A low mortgage is great, but it can make you feel stuck in a job or city you've outgrown.

WHAT TO DO: Calculate your "Freedom Number." Figure out exactly how much a move for a better job or a better quality of life would cost you in higher housing payments.

HOW TO DO IT: Let's say a new mortgage would cost $1,500 more per month. Could a new job in a new city increase your income by more than that? Could it offer better long-term career growth? Sometimes, the most expensive thing you can do is stay in a situation with no growth. Run the numbers. Don't let fear make the decision for you.

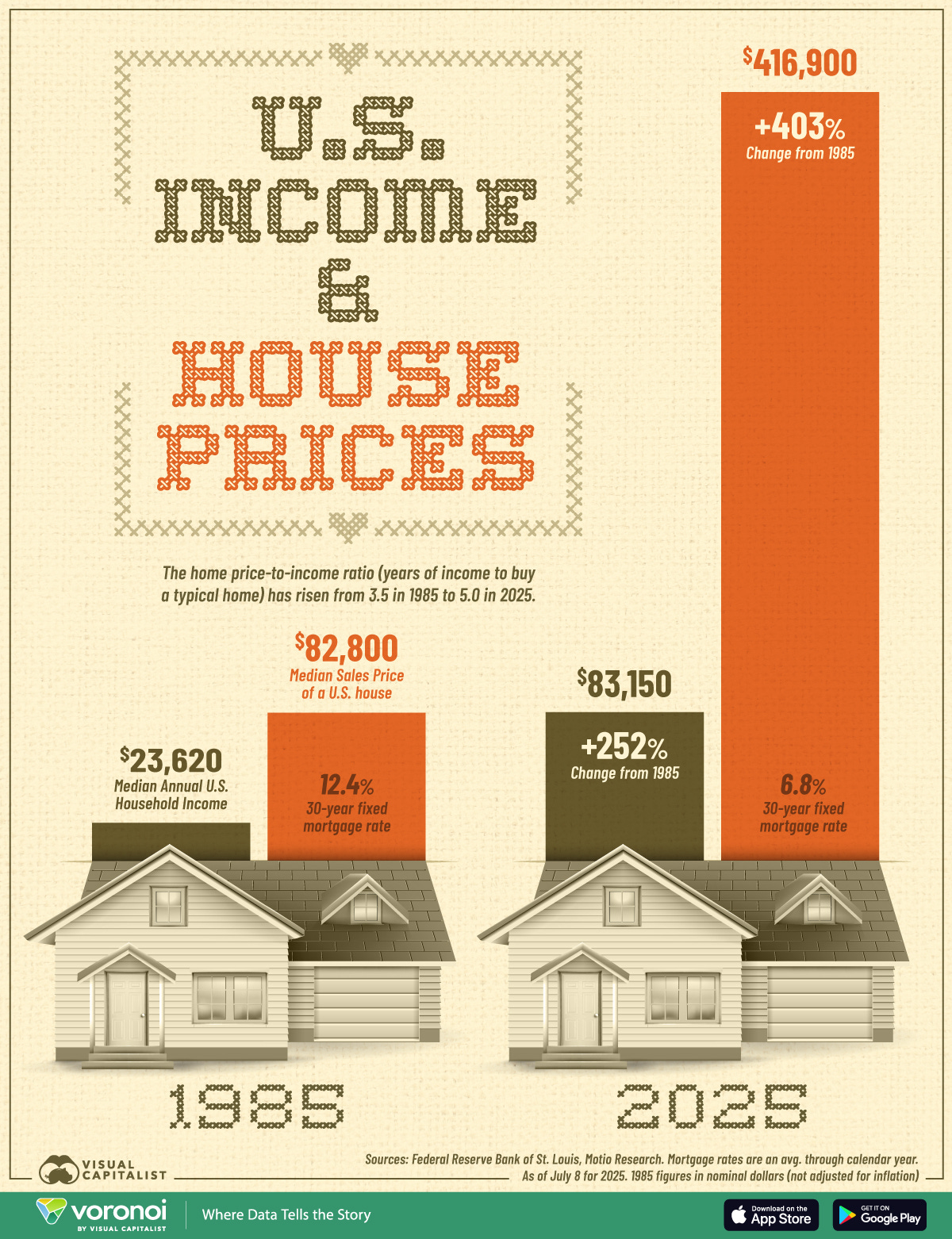

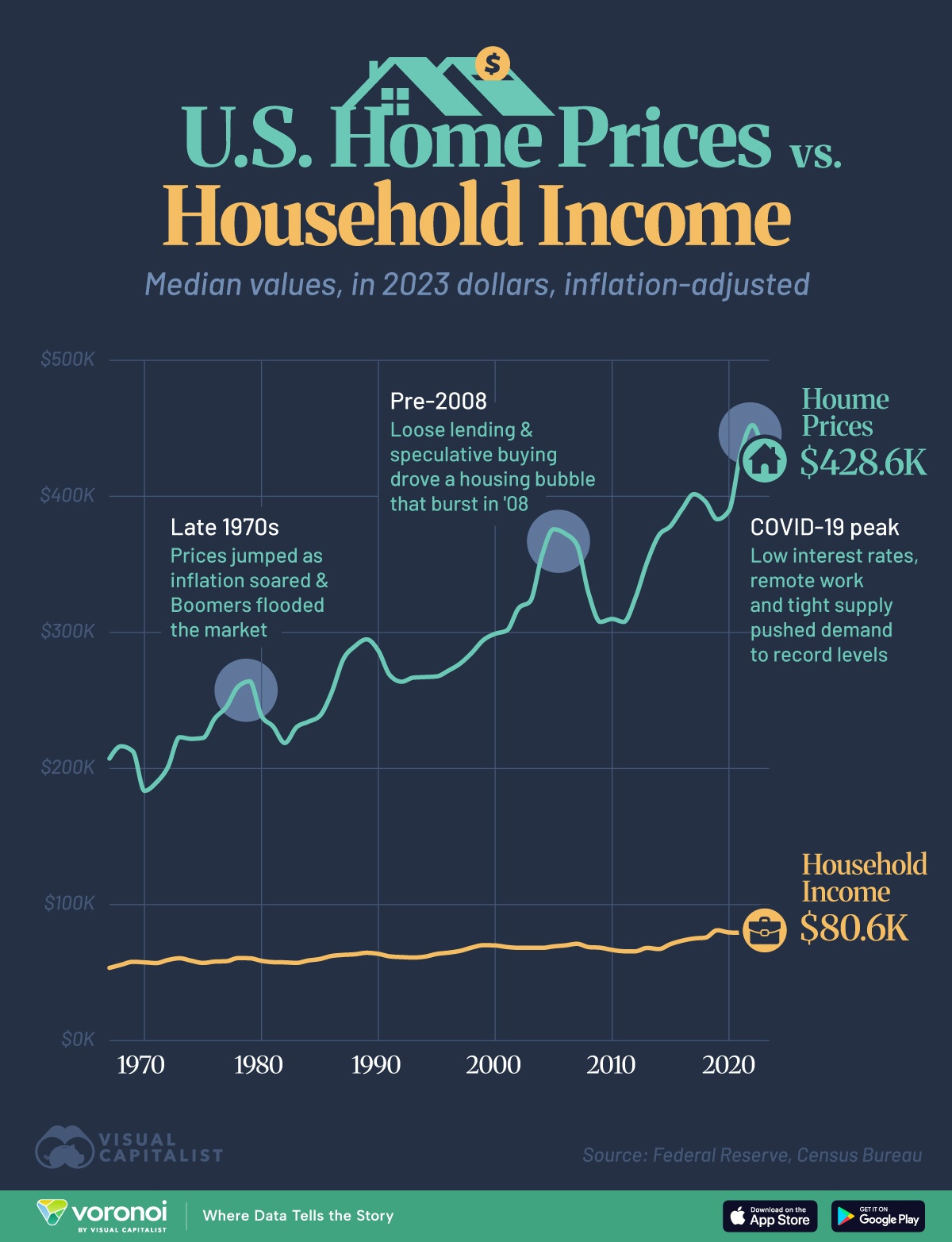

3️⃣ Americans Are Getting Priced Out of Homeownership at Record Rates.

It's now cheaper to rent than to buy a starter home in 49 of the 50 biggest US cities. The income needed to afford a typical home has jumped 60% since 2021, while wages have barely moved. Insurance, taxes, and maintenance costs are also exploding.

You need $126,670 annual income to afford a median home today. That's up 60% from 2021. The median household makes $80,610. See the problem? Renting is now $908 cheaper per month than buying. Pittsburgh's the only major city where buying still beats renting.

First-time buyers' average age jumped to 38 years old (was 28 in 1991). Their market share crashed to 24% – the lowest since 1981. The housing shortage hit 4.7 million units. Insurance costs jumped 74% since 2010. Property taxes in Florida rose 50% in five years. The median homeowner has 43 times more wealth than a renter. If you can't buy now, you're likely locked out forever.

💡Andrew’s Analysis:

Why It Really Matters: For generations, homeownership was the main way middle-class families built wealth in America. That engine is now stalling. This creates a massive long-term wealth gap. Existing homeowners are getting richer from their home equity, while renters are falling further behind, unable to save for a down payment because rents are so high. This reshapes society, making it harder for people to build a stable financial future.

Why it matters (long-term): We’re drifting toward a “renter nation.” Expect more build-to-rent, smaller homes, and policy fights over zoning, density, and fees. Equity gaps widen if younger buyers can’t get on the ladder.

Advice:

Don’t rush to buy just because "everyone says so." Wait for the right time, save as much down payment as possible.

Watch for cities where prices drop—opportunity shows up when others panic.

Consider house-hacking: Rent out rooms to help pay your mortgage.

Remember: renting gives you freedom. Use any extra money to invest (stocks, ETFs) and build wealth through other ways.

If rent < own by $900+/mo, rent on purpose and invest the spread (automate it). Re-check buy vs. rent each quarter.

Buy only when your budget works—not when you “feel pressured.”

4️⃣ The Social Security tsunami: Payments could be cut by 23%, doubling the poverty rate for America's seniors.

The government's own report says Social Security's main fund will run out of reserves by 2033. If Congress does nothing, all benefits will be automatically cut by 23%. A $2,000 check would become $1,540. A couple could lose $18,000 yearly.

💡Andrew’s Analysis:

Why It Really Matters: This is a slow-moving crisis that everyone sees coming. For decades, politicians have kicked the can down the road. But the math is unforgiving: more people are retiring, and fewer people are working to pay for them. Relying on the government for your retirement is becoming an increasingly risky bet. You must become your own safety net.

Investing Playbook: The solution to a smaller Social Security check is a bigger personal investment portfolio. The magic of compounding is your best friend.

WHAT TO DO: Automate your wealth building. The single most important thing you can do is increase the amount you save for retirement, starting today.

HOW TO DO IT: Log into your 401(k) or IRA account right now. Increase your contribution percentage by 1%. You likely won't even notice the difference in your paycheck. Do it again in six months. This tiny, painless action can add hundreds of thousands of dollars to your nest egg over time. It's the most powerful move you can make.

Personal Finance Plan: Think of Social Security as a potential bonus, not a reliable plan.

WHAT TO DO: Create your own "Personal Pension."

HOW TO DO IT: Focus on filling up your tax-advantaged retirement accounts first (401(k), Roth IRA). Once you max those out, open a regular brokerage account and continue investing in low-cost index funds. The goal is to build a portfolio so large that you won't even need Social Security to live comfortably.

5️⃣ E.J. Antoni, Trump's candidate to lead the Bureau of Labor Statistics, is now suggesting suspending the agency’s monthly jobs report.

E.J. Antoni (Trump's pick for Bureau of Labor Statistics) wants to suspend the monthly jobs report. He says the data's broken – response rates below 50%, constant downward revisions. Trump fired the previous commissioner after weak jobs numbers, calling them "rigged."

💡Andrew’s Analysis:

The only numbers that truly matter are yours. What is your savings rate? What is your net worth? Is your income going up? Are your debts going down? Track these numbers every month. The national jobs report is interesting, but your personal financial progress is what will actually change your life.

6️⃣ US wholesale prices jump 3.3% as Trump tariffs hit economy.

Wholesale prices (what businesses pay each other for goods) jumped 3.3% in July, much higher than expected. This is a sign that President Trump's tariffs are making raw materials and parts more expensive for American companies.

Tariffs are working through the system. Businesses are eating higher costs now, but they'll pass them to you soon.

💡Andrew’s Analysis:

Why It Really Matters: This is a classic "pipeline" problem. Higher costs for businesses eventually get passed on to you, the consumer. The inflation you see at the grocery store might have cooled off, but this report shows that price pressures are building back up behind the scenes. It puts the Federal Reserve in a tough spot: do they cut interest rates to help the weakening job market, or do they keep rates high to fight this new wave of inflation? This uncertainty is not good for the market.

Personal Finance Plan: The best way to beat inflation is to have your income grow faster than your expenses.

WHAT TO DO: Negotiate a raise or find a higher-paying job. This is the most direct way to increase your purchasing power.

HOW TO DO IT: Go into a salary negotiation armed with data. Research what your position pays on sites like Glassdoor. Make a list of your accomplishments and the value you've brought to the company. Practice your pitch. An extra 5% on your salary beats inflation and can be invested for your future. It's a win-win.

*️⃣ Other important news this week:

President Trump says interest rates should be at 1%.

President Trump says he is considering a major lawsuit against Fed Chair Jerome Powell.

U.S. spending on services — hotels, airfare, dining — has been down for three straight months, the first time since 2008, per Bank of America.

The founder of AriZona Iced Tea is considering increasing the price of the company's signature 99-cent beverages as a result of President Donald Trump's tariffs on aluminum imports, per Newsweek.

"There are now more homebuyers over age 70 than under 35," per FORTUNE.

Bitcoin surpasses Google to become the 5th largest asset in the world by market cap.

Ethereum $ETH flips MasterCard to become the world's 22nd largest asset by market cap.

👉 For daily insights, follow me on Twitter/ X, Instagram Threads, or BlueSky, and turn on notifications!

3. Most Important Charts This Week (and its importance):

This week, we analyze:

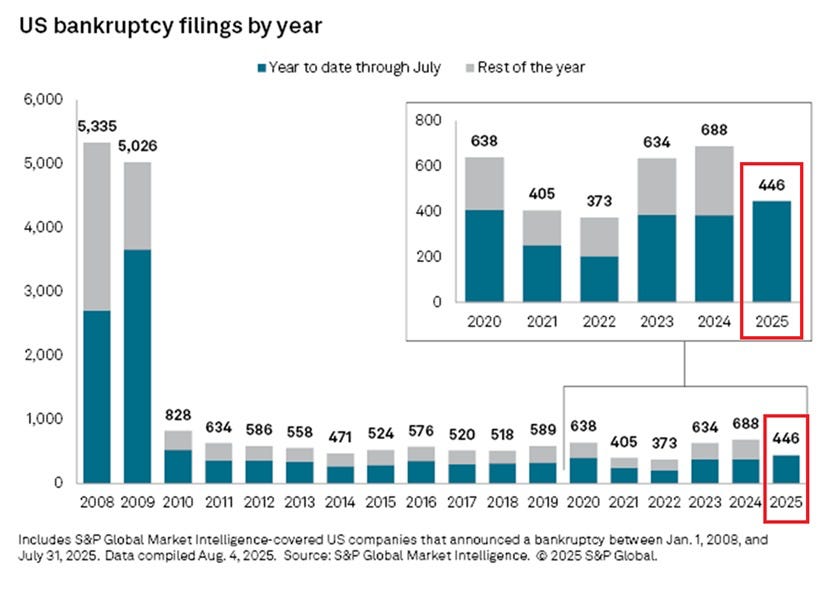

1) 71 large US companies went bankrupt in July, the highest monthly total since the 2020 pandemic.

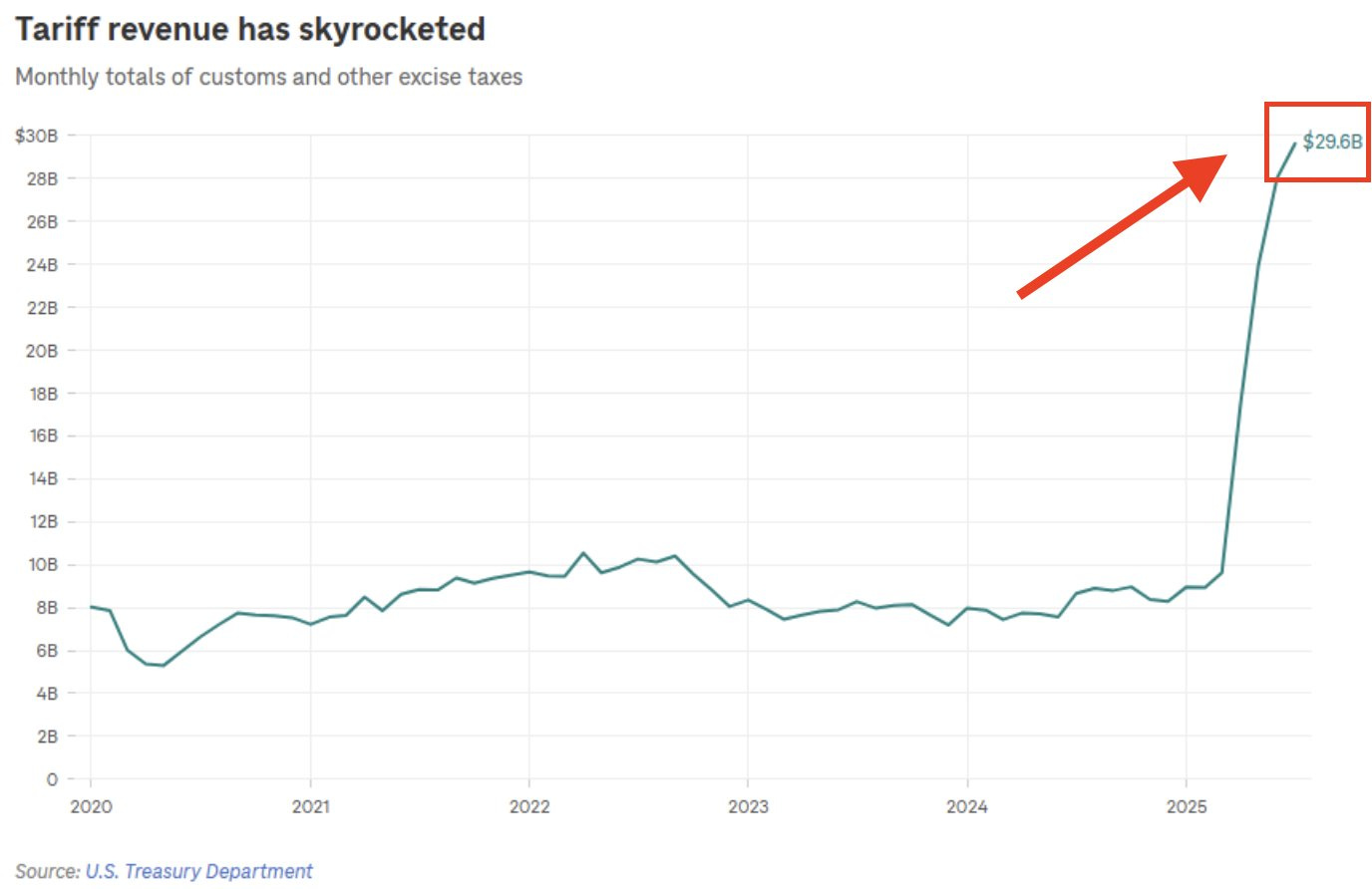

2) US tariff revenue surged +300% in July 2025, bringing in a record $29.6 billion in ONE month. At this pace, tariff revenue could exceed $350 billion PER YEAR through President Trump's term.

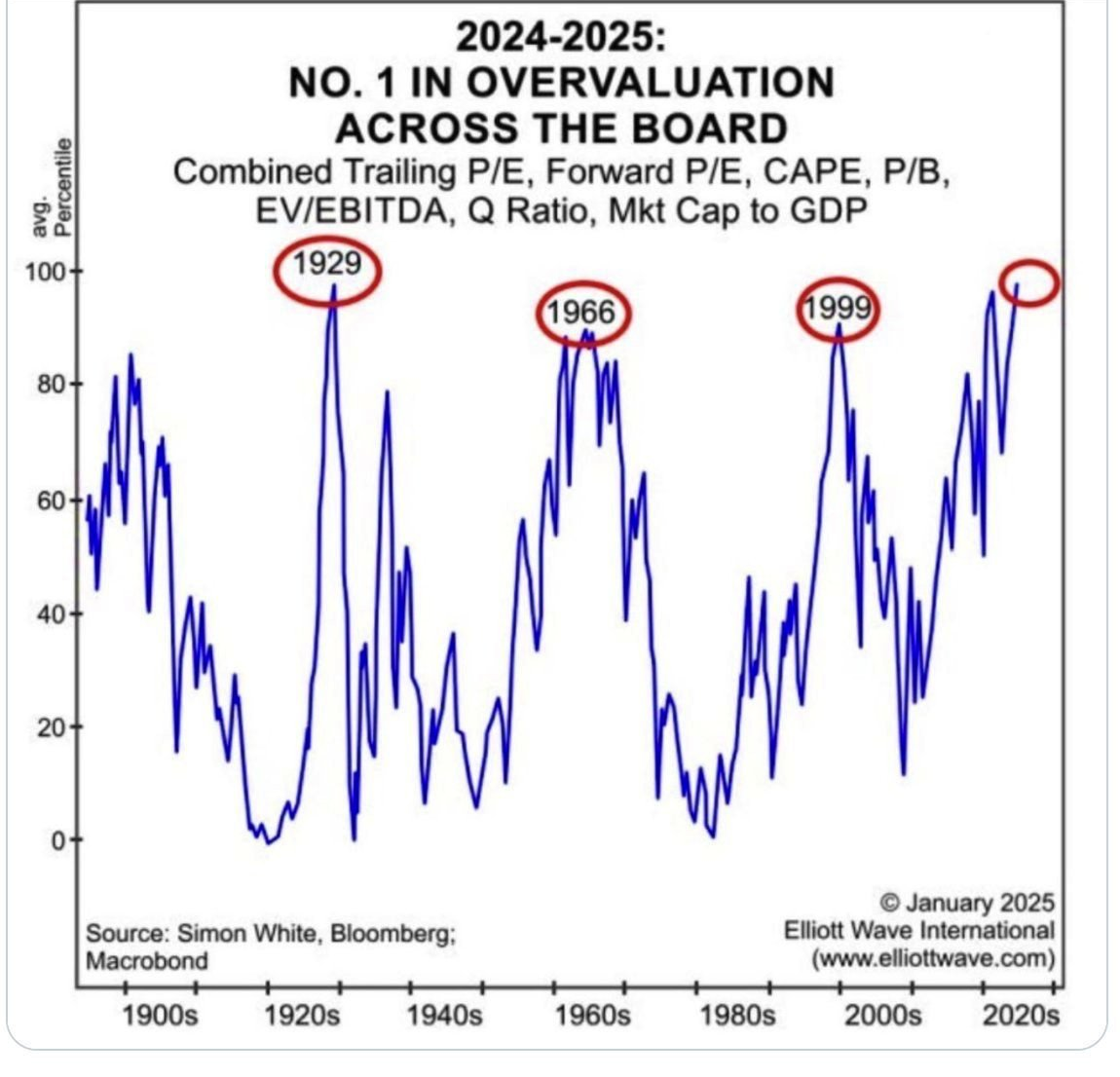

3) U.S. Stock Market at its most expensive valuation since the Great Depression.

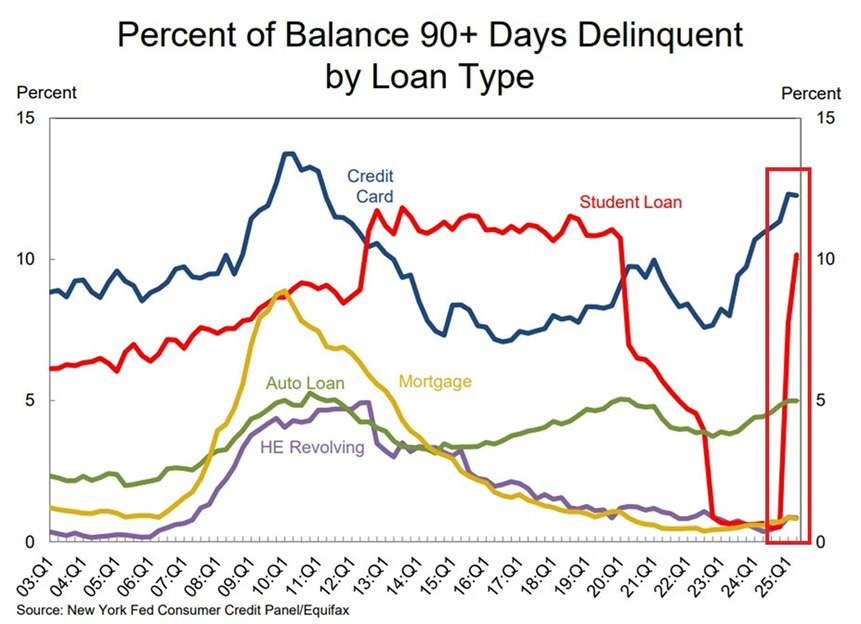

4) US serious delinquencies are skyrocketing. US consumers are falling behind on debt payments at rates rarely seen before.

5) M2 Money Supply jumps to a new all-time high of $22 Trillion.

6) The S&P 500 is now trading at 3.15x sales, its highest valuation in history.1️⃣ 71 large US companies went bankrupt in July, the highest monthly total since the 2020 pandemic.

💡Andrew’s Analysis:

More large US companies are going bankrupt than at any point in the last 15 years (if you ignore the initial COVID shock). This isn't a slowdown; it's a trend that's getting worse.

This is the clearest sign that the real economy is in trouble. While the stock market might be hitting new highs, Main Street is hurting. High interest rates act like a vice, squeezing companies that borrowed too much money. These bankruptcies are the canaries in the coal mine, signaling that the foundation of the economy is weaker than stock prices suggest. This is the first major crack.

Investing Playbook: When the tide goes out, you see who's been swimming naked. Many companies are loaded with debt. You want to own the ones with financial fortresses.

WHAT TO DO: Focus on companies with "fortress balance sheets." This means businesses with very little debt and lots of cash. They can survive a downturn and even buy up their weaker rivals for cheap.

HOW TO DO IT: Before buying a stock, look up its "debt-to-equity ratio." A low number is good. An easier way is to buy a "Quality Factor" ETF. These funds automatically screen for financially healthy companies, doing the homework for you.

2️⃣ US tariff revenue surged +300% in July 2025, bringing in a record $29.6 billion in ONE month. At this pace, tariff revenue could exceed $350 billion PER YEAR through President Trump's term.

💡Andrew’s Analysis:

The U.S. government is collecting record-breaking amounts of money from tariffs (taxes on imported goods). We're talking about a haul that could be bigger than all corporate income taxes combined.

Why It Really Matters: A tariff is a cost. A company in the U.S. pays that cost to import something, and then it passes that cost on to you by raising prices. This is a massive, hidden driver of inflation. It makes almost everything you buy more expensive. The government says this money will lower the deficit, but the data shows government spending is still out of control. This combination—a spending problem plus a new inflation engine—is a powerful argument for owning assets that protect you from a devalued dollar.

3️⃣ U.S. Stock Market at its most expensive valuation since the Great Depression.

💡Andrew’s Analysis:

Looking at a whole basket of valuation metrics, the stock market is now more expensive than it was before the crash of 1929, the dot-com bubble of 1999, and every other major peak. At the same time, the Price-to-Sales ratio for the S&P 500 is at its highest point in history.

Why It Really Matters: This is the definition of walking on a tightrope with no safety net. When stock prices are this high, it means investors expect everything to go perfectly. But as we see from the bankruptcy and debt charts, things are far from perfect. This creates a massive disconnect between market hype and economic reality.

4️⃣ US serious delinquencies are skyrocketing. US consumers are falling behind on debt payments at rates rarely seen before.

💡Andrew’s Analysis:

Americans are falling behind on their bills at an alarming rate. The percentage of credit card, auto loan, and student loan debt that is seriously late is spiking to levels not seen since the 2008 financial crisis.

Why It Really Matters: Consumer spending is the engine of the U.S. economy, making up about 70% of it. When people can't pay their bills, they slam the brakes on spending. This is a huge red flag. It shows that people have been using debt to maintain their lifestyle, and now the bill is coming due. This is the "Main Street" reality that the stock market is ignoring.

5️⃣ M2 Money Supply jumps to a new all-time high of $22 Trillion.

💡Andrew’s Analysis:

The M2 Money Supply—a broad measure of all the cash, checking, and savings deposits in the U.S.—has hit a new all-time high of $22 trillion.

Why It Really Matters: This chart is the key to understanding the great disconnect. Why are stock prices so high when the economy is so shaky? Because the system is flooded with money. All this cash has to go somewhere, and it has been pouring into assets, pushing up the price of stocks, crypto, and real estate. The stock market isn't necessarily strong; it's just afloat on an ocean of money. Over the long term, creating this much money devalues every single dollar in your pocket.

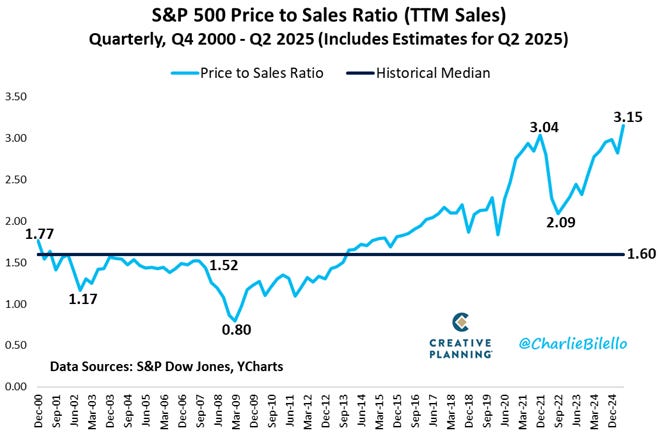

6️⃣ The S&P 500 is now trading at 3.15x sales, its highest valuation in history.

💡Andrew’s Analysis:

The S&P 500 trades ~3.1–3.3x sales, an all-time high (about 2x its long-run median).

Why It Really Matters: Sales are harder to “massage” than earnings. A stretched P/S means the market is pricing perfection—especially in mega-caps. When growth slows, P/S tends to mean-revert fast.

At 3.15 times sales, stocks are priced for perfection. But perfection never lasts.

👉For more charts, follow me on Instagram, Facebook, LinkedIn, and turn on notifications!

🔒 Premium Research & Analysis 🔒

4. What I’m Investing in (stock picks, research and analysis):

Each week, I invest around $5,000 into my long-term investments. Here’s where my money is going this week.

This week, we analyze:

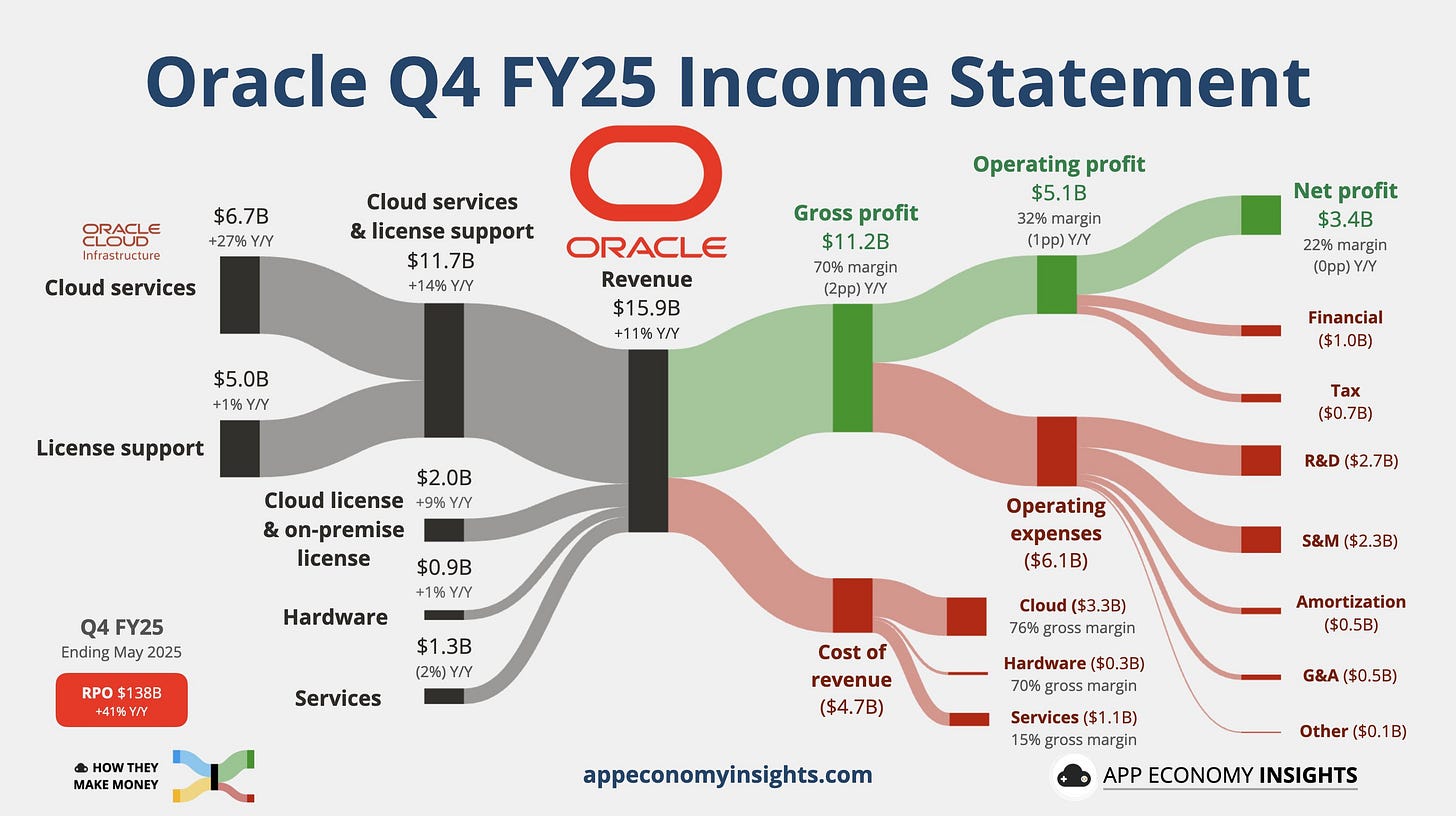

1) Oracle (ORCL): The Database King

2) Microsoft (MSFT): The Backbone of the Future

3) Nvidia (NVDA): The Engine of Artificial IntelligenceDuring the California Gold Rush in the 1840s, thousands of people rushed west to find gold. Most of them came back with nothing. The people who made the most consistent, surefire fortunes weren't the miners. It was the people who sold the miners their tools: the picks, the shovels, and the land. One of the first millionaires of the Gold Rush was a man named Sam Brannan, who sold shovels.

Today, we're in the middle of a new gold rush: the Artificial Intelligence revolution.

Everyone is rushing to build the next great AI application. But trying to pick the one winning AI app is like trying to find that one lucky gold nugget. It's a risky bet.

A smarter way to invest is to own the companies selling the "picks and shovels" for this new era. We're talking about the foundational infrastructure—the digital tools, land, and machinery—that every single company needs to compete in the age of AI.

Warren Buffett bought shares of Coke in 1988—not because he loved soda, but because he saw the brand everywhere, knew people wouldn’t stop drinking it, and believed in simple math: more sales meant more profits. If you invest in Microsoft, Oracle, or Nvidia, you’re betting on the same idea—these brands run the software, infrastructure, and chips that the world needs, every single day.

In 1999, Jeff Bezos told his investors that Amazon would lose money for years while building something nobody understood – cloud computing. People laughed. Today, AWS makes $100 billion a year. The same thing's happening right now with AI, and these three companies own the whole game.

Remember when Steve Jobs unveiled the iPhone in 2007? Nokia's CEO literally laughed. "They don't even know how to make phones!" he said. Seven years later, Nokia was dead.

We're at that exact moment with AI. Most investors think it's hype. They're looking at today's valuations like Nokia looked at Apple. They're about to get steamrolled.

Here's what's really happening: Every company on Earth needs three things to survive the AI revolution:

Chips to process AI (Nvidia owns this)

Cloud infrastructure to run AI (Microsoft dominates this)

Databases to organize AI data (Oracle controls this)

1️⃣ Oracle (ORCL): The Database King

In 2000, Larry Ellison (Oracle's founder) was asked about the internet boom. He said, "It doesn't matter how fancy your website is if your database sucks." Everyone laughed. Oracle stock went up 500% over the next decade while dot-coms died.

He's saying the same thing about AI now.

Oracle just announced something insane: Their cloud infrastructure will grow 70% next year. Not 7%. Seventy. For context, most mature tech companies are happy with 10% growth.

How? They're doing something brilliant. Instead of competing with Amazon and Microsoft, they're partnering with them. Oracle's databases now run inside AWS, Azure, and Google Cloud. It's like Coca-Cola putting vending machines inside Pepsi's headquarters.

Here's Oracle's secret weapon: Autonomous databases. These databases manage themselves using AI. No human needed. They fix problems before they happen, optimize themselves, and never go down.

Autonomous database revenue is growing 47% year-over-year. Why? Because hiring database administrators costs $150,000 per year. Oracle's autonomous database costs $50,000 and works 24/7 without coffee breaks.

Every company switching saves $100,000 per database per year. There are millions of databases. Do the math. This is a trillion-dollar opportunity hiding in plain sight.

Oracle just partnered with OpenAI on the "Stargate Project" – building $100 billion worth of AI infrastructure. Oracle gets to be the database backbone for ChatGPT and every AI model OpenAI builds.

Think about this: Every time someone asks ChatGPT a question, it queries a database. Billions of queries daily. Oracle gets paid for every single one. It's like owning a toll booth on the AI highway.

Catalysts (next 12–24 months):

Capex → revenue conversion as new Oracle Cloud Infrastructure (OCI) regions go live.

More mega-tenants (AI labs, model hosts, healthcare, financials) leasing bulk capacity.

Cross-selling Oracle apps + database atop OCI.

How to play it (What I’m doing): Add on dips tied to “tariff/scarcity/capex” headlines—the demand is there, and capacity becomes revenue with a lag.

2️⃣ Microsoft (MSFT): The Backbone of the Future

While everyone's obsessing over ChatGPT and flashy AI demos, Microsoft's doing something brilliant. They're embedding AI into boring stuff that every business already uses. Excel, Word, Teams – all getting AI superpowers. It's like putting a Ferrari engine in a Honda Civic that everyone already owns.

Azure's growing 39% year-over-year. That's not normal growth – that's explosion growth. But here's what nobody's talking about: Microsoft has $368 billion in contracted cloud revenue that hasn't even hit their books yet. That's more than their entire annual revenue today.

Think about that. They've already sold the next year and a half of growth. The money's guaranteed. It's just waiting to flow in.

Warren Buffett calls this a "toll bridge" business. Once you're on Azure, you can't leave. Your entire company runs on it. Microsoft can raise prices 5% a year forever, and you'll pay it because switching would cost millions and take years.

Here's Microsoft's genius move: They're not asking companies to buy new AI products. They're adding AI to products companies already pay for. Copilot for Microsoft 365 costs $30 per user per month. Sounds small, right?

Microsoft has 400 million Office users. If just 25% upgrade, that's $36 billion in pure profit annually. And once employees start using AI to write emails and make presentations, they can't go back. It's like giving someone a calculator then asking them to do math by hand again.

Remember when IBM dominated computers? They got lazy. They thought hardware was everything. Microsoft ate them by focusing on software.

Now everyone thinks AI chips are everything. Microsoft's doing it again – they're making the software layer that controls all the chips. In 10 years, it won't matter whose chips you use. You'll still need Microsoft's software to run them.

Catalysts (next 12–24 months):

Rising Copilot attach rates in M365 and GitHub.

Azure share creep vs. AWS as AI-heavy workloads pick Azure for tight app integration.

New AI data tools (Fabric, etc.) pulling more analytics spend into the house.

How to play it (What I’m doing):

Core long position. Add on broad market pullbacks or when Azure growth headlines wobble.

Income overlay: sell covered calls a bit OTM on part of the position to harvest premium while you hold the core.

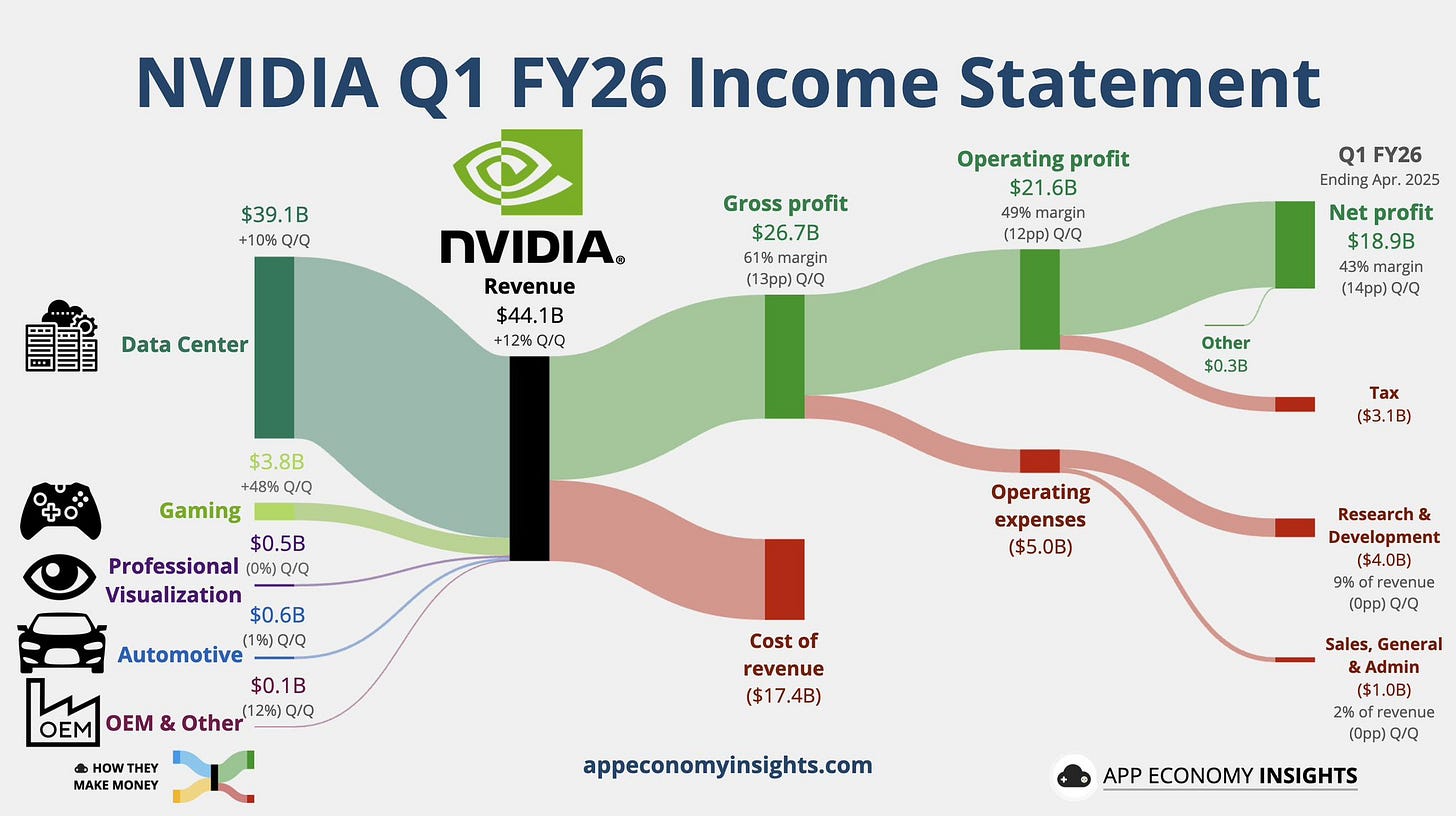

3️⃣ Nvidia (NVDA): The Engine of Artificial Intelligence

Nvidia isn't a chip company. It's a monopoly disguised as a chip company.

Peter Thiel says the best businesses are monopolies that don't look like monopolies. Nvidia owns 92% of AI chip markets. That's not market share – that's market domination.

Here's what many don't understand: Nvidia's real product isn't chips. It's CUDA – their software platform. Every AI developer learned on CUDA. Every AI model is optimized for CUDA.

Switching from Nvidia to another chip is like asking everyone in America to suddenly start driving on the left side of the road. Technically possible. Practically impossible.

Jensen Huang (Nvidia's CEO) saw this coming in 2013. He spent 10 years and billions of dollars building CUDA before AI was cool. Now competitors need 10 years to catch up, but AI is moving so fast that by then, Nvidia will be 10 years further ahead.

Nvidia's revenue went from $27 billion to $130 billion in two years. That's not growth. That's teleportation. No company in history has added $100 billion in revenue that fast.

But here's the crazy part: They're just getting started. AI spending is expected to hit $15.7 trillion by 2030. Nvidia currently makes $130 billion. They could 10x from here and still only have a small piece of the pie.

Everyone says Nvidia's expensive at 30 times earnings. They're doing kindergarten math.

Here's the math:

Intel trades at 25 times earnings and is shrinking

Nvidia trades at 30 times earnings and growing 50% annually

In 3 years, Nvidia will trade at 10 times earnings if the stock doesn't move

Charlie Munger said, "A great business at a fair price is superior to a fair business at a great price." Nvidia's a great business at a great price pretending to be expensive.

Catalysts (next 12–24 months):

New GPU generations and GB200 deployments at hyperscalers.

Inference at scale (not just training) widens the buyer base to every enterprise app.

Vertical systems (medical imaging, industrial vision, robotics) opening fresh TAM.

How to play it (What I’m doing):

Keep a core long. Trim only tactically into blow-off spikes; rebuy on 15–25% air-pockets when supply headlines or “competition” noise hits.

For income, sell cash-secured puts 10–15% OTM to enter on weakness.

👉For more insights, follow me on Twitter/ X, Instagram Threads, and turn on notifications.

5. Insider Trades from Billionaires, Politicians and CEO’s:

They're not gambling – they know something.

Legendary investor Peter Lynch famously said, "Insiders might sell their stock for any number of reasons, but they buy them for only one: they think the price is going up."

This week, we analyze:

1) A Texas Congressman's $3 Million Bet

2) Eli Lilly $LLY CEO David Ricks

3) Amrize Ltd $AMRZ CEO Jan Philipp Jenisch bought $28.5 million1) A Texas Congressman's $3 Million Bet

Rep. Michael McCaul just dropped over $3 million across six strategic positions, and his timing is fascinating. McCaul's not just any politician – he's one of the wealthiest members of Congress and sits on the House Foreign Affairs Committee.

Artisan High Income Fund $ARTFX caught McCaul's attention with a $500K to $1M purchase filed on August 14, 2025, for trades made July 6. This high-yield bond fund is yielding around 8% annually – double what Treasury bonds pay. With the Fed likely cutting rates soon, high-yield bonds typically explode higher. McCaul's basically betting that income-hungry investors will pile into these funds when traditional bonds yield peanuts.

Danaher Corporation $DHR received another $500K to $1M investment from McCaul on July 28 at $206.85 per share. Danaher's the company nobody talks about but everybody needs – they make the equipment that produces vaccines, develops new drugs, and purifies water. With bird flu concerns rising and biotech booming, Danaher's like buying a toll booth on the road to medical breakthroughs. They recently spun off their environmental business to focus purely on life sciences, and McCaul's betting this focused approach will pay off massively.

Microsoft $MSFT got a $100K to $250K allocation from McCaul on July 10 at $503.32. Here's what's interesting – McCaul sits on committees that see classified cyber threats. Microsoft's federal cloud business is exploding as government agencies migrate to secure cloud infrastructure. When a Foreign Affairs Committee member buys Microsoft, he might know something about upcoming government contracts we don't.

Vanguard Tax-Exempt Bond ETF $VTEB received McCaul's largest single investment – $500K to $1M on July 6 at $49 per share. This isn't sexy, but it's brilliant. Tax-exempt bonds become gold when tax rates rise. With Trump's new tax proposals potentially increasing rates on high earners, tax-free income suddenly becomes incredibly valuable. Warren Buffett once said, "It's not what you make, it's what you keep" – McCaul's keeping everything from these bonds.

Stanley Black & Decker $SWK caught $100K to $250K from McCaul on July 23 at $72.69. The toolmaker's been beaten down 40% from its highs, but here's the catch – America's about to rebuild its infrastructure, and somebody needs to supply the tools. With manufacturing returning to America and construction booming, buying SWK at these prices is like buying Home Depot in 2009.

Global Payments $GPN got hit twice by McCaul – $100K to $250K on July 2 at $81.85, then another $100K to $250K on July 23 at $83.05. He's dollar-cost averaging into a payment processor that handles transactions for small businesses worldwide. With cash disappearing and digital payments exploding in developing countries, GPN is positioned to tax every transaction in the new economy.

2) Eli Lilly $LLY CEO David Ricks

Eli Lilly $LLY CEO David Ricks just spent $1.05 million on August 12, grabbing 1,632 shares at $644.77. Lilly's weight-loss drugs are literally printing money faster than the Fed (lol). Their Mounjaro and Zepbound drugs have waiting lists months long. When a pharma CEO buys at all-time highs, he's seeing data we won't see for months. Ricks probably knows their next drug trial results, and his million-dollar bet suggests they're spectacular.

Eli Lilly & Co $LLY is the pharmaceutical giant at the center of the weight-loss drug phenomenon with its blockbuster treatments Mounjaro and Zepbound. For a CEO to buy more stock when it is already trading at all-time highs sends an incredibly bold message: he believes the multi-trillion dollar market for weight-loss drugs is just getting started.

What I’m doing: buy dips tied to supply headlines and ladder calls over the next two earnings cycles as capacity ramps.

3) Amrize Ltd $AMRZ CEO Jan Philipp Jenisch bought $28.5 million

Amrize Ltd $AMRZ witnessed the trade of the year – CEO Jan Philipp Jenisch bought $28.5 million worth on August 11, purchasing 595,000 shares at $47.92. This increased his stake by 46%. Nobody drops $28 million unless they're absolutely certain. Amrize makes sustainable building materials, and with Trump's infrastructure plans requiring American-made materials, Jenisch is positioning for a potential 10x return. This isn't an investment – it's a hostile takeover of his own company's float.

Amrize Ltd $AMRZ is a global leader in building materials like cement and concrete, the foundational ingredients for construction. A buy of this magnitude, which increased the CEO's ownership by a stunning 46%, is the strongest signal you can get. It's a massive bet that global spending on infrastructure, onshoring, and construction is set for a major boom.

6. Trade of the Week (options trading):

Each week, I swing trade around $1,000-$2,000 in stock options. I use AI to monitor options flow activity. Here’s where my money is going this week.

Bullish on Confluent Inc CFLT 0.00%↑

Confluent Inc. $CFLT just witnessed one of the most aggressive bullish bets I've seen all year. Someone dropped $207,120 on a single options trade, betting the stock will rocket past $22 by November 21st. Right now, the stock sits at $17.66. That means they need a 25% surge in just three months. But here's what makes this fascinating – the call-to-put ratio is an astronomical 19:1. For every one person betting against Confluent, nineteen are betting it's about to explode higher.

A single trader bought 1,420 call option contracts at $1.46 each, giving them the right to buy 142,000 shares at $22. The total volume hit 20,235 contracts versus only 212 in open interest – that means this is completely fresh money flooding in, not old positions being closed. When you see a ratio this lopsided, it's like watching everyone at a poker table suddenly push all their chips toward one player. They know something.

Confluent $CFLT is the company that makes data flow between applications in real-time – think of them as the plumbing system for the modern internet. When you order an Uber and see the car moving on your screen, that's real-time data streaming. When Netflix recommends your next binge-watch based on what you just finished, that's Confluent's technology working behind the scenes. They're the invisible force that makes 70% of Fortune 500 companies' data move instantly. With AI applications needing massive real-time data feeds, Confluent is basically selling shovels in the AI gold rush.

Here's what makes this trade suspicious in the best way possible. The November 21st expiration date isn't random – it's exactly two weeks after Confluent's Q3 earnings on November 7th. Someone's betting huge that earnings will blow expectations out of the water. The last time we saw similar unusual options activity was with Palantir before they announced their AI platform revenue doubled. That stock jumped 30% in a week.

Remember when Carl Icahn bought millions in Netflix options right before they announced their password-sharing crackdown results? The options were priced at $2, and they expired worth $47. This Confluent trade has that same smell – someone knows something we don't. The company recently launched their AI Assistant and Freight Clusters technology, making data streaming 90% cheaper. When companies can suddenly afford technology that was previously too expensive, adoption explodes. It's like when cloud storage went from $1 per gigabyte to 1 cent – suddenly everyone started using it.

The timing is perfect for Confluent. Walmart just announced they're using Confluent for real-time inventory management. Target and Home Depot are rumored to be next. When retail giants adopt your technology, it's like getting the Good Housekeeping seal of approval – everyone else follows. The company's also partnering with every major cloud provider – Amazon, Microsoft, Google. That's like Coca-Cola getting exclusive vending rights in every stadium simultaneously.

What I’m doing: I won’t copy the November calls – they're already expensive from all the buying. Instead, I’m buying the December 20th $20 calls. These give you an extra month of time and a lower strike price.

7. Best Performing Stocks This Week (catalysts, earnings, and news):

Smart Money’s Biggest Bets. Here are the stocks making millionaires:

1) Miami International Holdings $MIAX up +43% on Thursday 8/14

Miami International Holdings just pulled off one of the year's most explosive IPO debuts, up 43% on its first trading day at the NYSE. The company priced at $23 and shot past $31. MIAX operates electronic options exchanges – think of them as the digital casinos where Wall Street places its billion-dollar bets. With options trading volume hitting record highs as retail traders chase quick gains, MIAX is essentially taxing every trade. Remember when the NYSE itself went public in 2006? Early investors made 300% within two years.

My thoughts: IPO pops often fade within weeks as insiders dump shares. Wait for MIAX to pull back to $26-27. The options trading boom isn't ending – it's just beginning as Gen Z discovers derivatives.

2) Paramount Skydance $PARA up +31% on Wednesday 8/13

Paramount Skydance shocked everyone with a 31% moonshot, marking its best trading day ever. The mystery surge likely stems from whispers about the Skydance merger finally closing after months of drama. This is the company behind Top Gun, Mission Impossible, and SpongeBob – content that prints money across theaters, streaming, and merchandising. Warren Buffett once said, "Be greedy when others are fearful" – and everyone's been fearful about traditional media.

My thoughts: Paramount owns content libraries worth tens of billions that Netflix would kill for. When the merger details emerge, this stock could jump.

3) Mercury Systems $MRCY up +24% on Tuesday 8/12

Mercury Systems exploded 24% higher after crushing earnings expectations with 47 cents per share versus the expected 22 cents. This defense contractor builds the electronic warfare systems that protect fighter jets and naval vessels. With global tensions rising and defense budgets ballooning, Mercury's basically selling bulletproof vests to an army heading to war. They reported $273 million in revenue, smashing estimates by $29 million.

My thoughts: Defense stocks are recession-proof gold mines. When the economy tanks, governments still buy missiles. Build a position and hold for the next conflict cycle. History shows defense contractors triple during wartime.

4) DLocal $DLO up +23% on Thursday 8/14

DLocal surged 23% after beating earnings and getting an HSBC upgrade to buy. This fintech powerhouse processes payments in emerging markets where Visa and Mastercard fear to tread – think Brazil, Nigeria, Egypt. They're the bridge between global companies and 2 billion unbanked consumers. HSBC noticed their improved cost controls and new products driving revenue acceleration.

My thoughts: This is PayPal for the developing world. As these economies digitize, DLocal could 10x. The next billion internet users won't have credit cards – they'll have DLocal.

5) Sinclair $SBGI up +18% on Tuesday 8/12

Sinclair Broadcasting jumped 18% after announcing a strategic review that could spin off their Ventures business. They own more TV stations than anyone except Nexstar, reaching 40% of American households. While everyone thinks local TV is dying, Sinclair's secretly building a sports betting and streaming empire. They own the Tennis Channel and stadium naming rights across the country.

My thoughts: Everyone hates traditional media, making it dirt cheap. The parts are worth more than the whole – classic sum-of-the-parts arbitrage.

6) Evolv Technologies $EVLV up +16% on Friday 8/15

Evolv rocketed 16% after the Justice Department dropped its investigation and the company's losses narrowed. They make AI-powered weapons detection systems that work like metal detectors on steroids – scanning 4,000 people per hour without lines. With mass shootings tragically common, every venue needs their technology. TD Cowen and Lake Street both upgraded to buy.

My thoughts: This is the "picks and shovels" approach to the security crisis. Schools, stadiums, and offices all need upgraded security. Buy and hold for the government contracts coming in 2026.

7) Hillenbrand $HI up +15% on Tuesday 8/12

Hillenbrand surged 15% after beating earnings and raising guidance. This industrial conglomerate makes everything from cremation equipment to industrial processing machinery. Morbid but true: death is recession-proof, and their cremation business generates steady cash while their industrial arm benefits from reshoring manufacturing.

My thoughts: Buy boring, profitable companies everyone ignores. They've paid dividends for 50+ years and won't stop now.

8) UnitedHealth $UNH up +14% on Friday 8/15

UnitedHealth exploded 14% for its best day since 2008 after Buffett revealed a $1.6 billion stake. When the Oracle of Omaha buys, you follow. Michael Burry of "Big Short" fame and billionaire David Tepper also disclosed massive positions. UNH is America's largest health insurer, covering 50 million people and generating $370 billion annually.

My thoughts: When three legendary investors buy the same stock, don't overthink it. Buy UNH on any dip below $550. Healthcare spending only goes up, and UNH gets a cut of every dollar.

9) Bullish $BTCPW up +14% on Thursday 8/14

Bullish soared 14% in extended trading after already exploding 83% on its Wednesday debut. This crypto exchange is backed by billionaire Peter Thiel and operates like Coinbase for institutional investors. They're building the infrastructure for when BlackRock and JPMorgan go all-in on crypto.

My thoughts: Own the exchange where everyone trades it. BTCPW under $10 could be this cycle's Coinbase, which went from $50 to $400 in the last crypto boom.

👉For more insights, follow me on Twitter/ X or Instagram Threads, and turn on notifications.

8. Important Earnings & Stocks to Watch:

Here’s what you need to know for the most important earnings this week:

Walmart $WMT - The big question for Walmart, the world's largest retailer, is simple: is the American consumer finally starting to break? The bullish case is that in a tough economy, everyone flocks to Walmart for their low-priced groceries, which should keep sales strong. The bearish story to watch for is weakness in general merchandise—things like electronics and clothing—which is where people cut back first. Listen for one thing on their conference call: management's comments on future consumer spending. Their guidance will tell you more about the health of the U.S. economy than a hundred government reports.

Home Depot $HD - For the king of home improvement, the entire story boils down to the housing market. Are people still spending money on their homes, or has the market ground to a halt? The bullish argument is that since high mortgage rates have trapped people in their current homes, they'll spend on renovations instead of moving. The bear case is that those same high rates have crushed demand from professional contractors who rely on new construction and home sales. The number to watch for is "big-ticket transactions." If people are still buying new kitchens and expensive appliances, it's a sign of confidence.

TJX Companies $TJX - This is the parent company of T.J. Maxx and Marshalls, the masters of off-price retail. Their earnings will answer the question: is the "treasure hunt" for bargains more popular than ever? The bull thesis is obvious: when people feel squeezed, they hunt for deals, and TJX is the prime beneficiary. The bear case is that rising costs could be squeezing their profit margins, even if sales are strong. Focus on their inventory levels and profit margins. If they are getting great deals from suppliers and turning that inventory into profitable sales, the stock is likely a winner.

Palo Alto Networks $PANW - This cybersecurity giant's report will tell us if companies are still spending big to protect themselves from digital threats. The bull story is that cybersecurity is no longer optional; it's a fundamental cost of doing business, like paying the electricity bill. The bear case revolves around "spending fatigue," where clients might be pushing back against high prices. The company recently changed its sales strategy, causing a temporary slowdown that spooked investors. Therefore, the only thing that matters in this report is their forecast for "future billings growth." This number is the best indicator of their future sales pipeline and will determine whether the stock soars or sink.

Target $TGT - Target's earnings will give us a clear picture of the middle-class American shopper. The story to watch is the battle between their low-priced essentials and their higher-margin discretionary goods. The bull case is that their grocery and essentials business remains strong. The bear case, and the company's recent struggle, is that shoppers are walking right past the clothing and home goods aisles, which is where Target makes its real money. Think of it as a tug-of-war. Your "what to do" is to focus on their profit margin guidance. This will tell you if they believe they can get customers buying their more profitable items again.

Toll Brothers $TOL - As a builder of luxury homes, Toll Brothers gives us a unique window into the mindset of the wealthy homebuyer. The big question is whether high-end consumers are immune to the high interest rates that have frozen the rest of the housing market. The bull case is that their wealthy clients often pay with cash and are less sensitive to mortgage rates. The bear case is that even the rich will pause on a multi-million dollar purchase when there is economic uncertainty. Instead of looking at the number of homes sold, your actionable insight is to focus on their "new order growth" and "cancellation rate." This will give you the most current read on the health of the luxury housing market.

👉For more insights, follow me on Twitter/ X or Instagram Threads or BlueSky, and turn on notifications.

9. Real Estate Analysis and Housing Market Trends:

On one side, you have homebuyers, pulling for lower prices and mortgage rates. On the other, you have home sellers, anchored in place by the amazing low-rate mortgages they secured years ago. For the past year, neither side has been willing to budge, creating a frozen and frustrating market. But now, we're starting to see the rope slowly, almost imperceptibly, begin to move.

The big story is that the deep freeze in the housing market is beginning to thaw. Mortgage rates have fallen for four straight weeks, dipping to their lowest level since last October. At the same time, more homes are coming up for sale, and they are sitting on the market longer. This is a subtle but incredibly important shift. The intense, everything-sells-in-a-weekend pressure is fading. Power is slowly shifting away from sellers and back toward buyers.

This is happening against a backdrop of mixed signals for the economy. Inflation is cooling, but new tariffs could push prices back up. This uncertainty is keeping the market from taking off, but it's also creating a unique window of opportunity for those who are prepared. This isn't a crash, and it isn't a boom. It is a rebalancing.

Plan for Homebuyers:

For the past two years, you've been told you have no power. That's changing. With more homes for sale and less competition, your moment is coming, but only if you prepare for it now.

Get Your Finances Ready. This is non-negotiable. Get fully pre-approved for a mortgage, not just pre-qualified. This shows sellers you are a serious, credible buyer and gives you an edge in negotiations.

Become a Neighborhood Expert. With homes sitting on the market for longer, you have time to do real research. Track the sale prices of homes in your target area. Know what a good deal looks like. When a home has been listed for 45 or 60 days, you'll know exactly what a fair but aggressive offer looks like.Make a "Non-Emotional" Offer. The days of waiving all contingencies are over. You can now make a strong offer that still protects you. Include an inspection contingency. If a home has been on the market for a while, don't be afraid to make an offer below the asking price. The worst they can say is no, but in this market, they are more likely to negotiate.

Plan for Home Sellers:

You're likely sitting on a mortgage with a rate of 4% or less, which feels like a pair of "golden handcuffs." Selling and buying a new home at a 6.5% rate is a tough pill to swallow. But a house is more than just a mortgage rate; it's your home.

Reframe the decision. Instead of thinking about losing a low rate, think about the opportunity cost of staying in a home that no longer fits your life. Is it too small for your growing family? Too far from a new job? The cost of staying put might be higher than the cost of a new mortgage.

Price It Right From Day One. This is the number one rule in a rebalancing market. If you price your home based on what your neighbor got a year ago, it will sit unsold. Work with your agent to price your home based on today's reality. An aggressive, fair price will create a buzz and attract the most serious buyers.

Be the Best-Looking House on the Block. When buyers have more choices, they become pickier. The homes that are clean, decluttered, and move-in ready are the ones that sell. A fresh coat of paint and good curb appeal are the highest-return investments you can make before listing.

Be Ready to Negotiate. The winning strategy today is flexibility. Be prepared for buyers to ask for things like help with closing costs or a home warranty. A little give-and-take can be the difference between a successful sale and your home lingering on the market for months.

Plan for Real Estate Investors:

For investors, this market is about strategic, patient hunting for motivated sellers and unique opportunities.

Hunt for "Stale" Listings. Your primary target should be properties that have been on the market for over 60 days. These sellers are often becoming more "motivated" or desperate. This is where you can find the best below-market deals from individuals who need to sell now.

Look at New Construction. Home builders are facing the same high-rate environment you are, and they need to move inventory. Many builders are offering significant incentives, like buying down your mortgage rate to 5% or even lower, or including free upgrades. In some cases, the deals from builders can be better than what you can find in the existing home market.

Important Charts:

American Income vs. Home Prices (1985–2025):

The Decline of U.S. Housing Affordability:

👉For more insights, follow me on Twitter/ X or Instagram Threads or BlueSky, and turn on notifications.

10. Interest Rate Predictions:

Interest rates are heading down.

Three critical forces are pushing rates down:

Force #1: Inflation is cooling. The July data shows inflation holding steady, not accelerating. Translation: The Fed's biggest fear (runaway inflation) is becoming their biggest opportunity to cut.

Force #2: Economic data is weakening. The jobs report came in much weaker than expected. When the economy slows, rates follow.

Force #3: Bond markets are celebrating. Treasury yields are falling, demand for mortgage-backed securities is rising. The money is already moving—rates are just catching up.

Rates are at their best position since October 2024. I’m expecting rates to fall into the 6.4% range by year-end.

Right now, most are making the same mistake people made in 2008—they're waiting for certainty. They want rates to drop first. But here's the brutal truth: By the time certainty arrives, opportunity is gone.

The cognitive bias at work here is called "anchoring." People are anchored to the idea that current rates are "high" compared to the 3% rates of 2020-2021. But smart investors understand: Those rates were the anomaly, not today's rates.

Advice:

Get pre-approved today at current rates

Lock in rates on properties you're serious about

Plan to refinance when rates hit 6.4% (likely by December)

Focus on cash flow properties that work at today's rates—they'll be gold mines at lower rates

Build your cash reserves now—rate drops bring competition

Create your target property list—know exactly what you want before bidding wars start

Establish lender relationships—when rates drop, loan officers get swamped

Buy distressed properties with cash, improve them, then refinance at lower rates later

The Long-Term Picture:

Here's what most people don't understand: Rate cycles create generational wealth opportunities. The investors who positioned themselves in early 2010s (after rates peaked) built massive portfolios. The same pattern is happening now.

Best-case scenario: Rates drop to 6.4% by year-end, then continue to 5.5-6% in 2026. Your properties bought today become cash cows, and you refinance into permanent low-payment situations.

Worst-case scenario: Rates stay flat around 6.5%. You still bought quality properties at good prices with manageable payments. You didn't miss anything.

Most likely scenario: Gradual rate decline gives you multiple opportunities to improve your position through refinancing.

Rate drops don't just lower your borrowing costs—they increase property values. When rates fall from 6.6% to 6.4%, buyer purchasing power increases significantly. That means your properties become worth more while your costs go down.

It's like buying stock right before a dividend increase and a stock split.

Current Interest Rates:

11. Technical Analysis (S&P 500, Tech Stocks, Bitcoin):

1) S&P 500 SPY 0.00%↑ (Short-term): Positive

The S&P 500 is currently on an upward path, with investors showing strong interest and pushing prices higher. The index recently broke past a key resistance level around 6,380, hinting that it could climb further. However, a warning sign appears in the form of the RSI—a measure that tracks momentum—which is showing a downward trend. This suggests that the rally might be losing strength soon, potentially leading to a short-term pullback.

2) Tech Stocks QQQ 0.00%↑ (Short-term): Positive

The Nasdaq-100 follows a similar story. It’s riding a rising trend and recently pushed above resistance at 23,400, encouraging bulls to believe in more gains ahead. The volume supports this move, indicating strong buying interest. Still, the RSI is also heading lower, warning that the rally may be stretched. This pattern often signals the market is ready for a breather before deciding its next move. The overall technical setup remains positive over the short and longer terms.

3) Bitcoin $BTC (Short-term): Positive

Bitcoin $BTC is showing solid strength in its short-term uptrend. It recently hit resistance near 122,400 and pulled back slightly, but the price stays above strong support levels around 113,500. The RSI confirms a positive momentum, which suggests buyers still control the market. Bitcoin is in a healthy rally phase but has key levels to break to confirm the next leg higher.

12. Economic Outlook and Market Sentiment:

Wall Street traders are chasing short-term momentum. Main Street investors are feeling a deep-seated anxiety about the future. And the economic data suggests that anxiety is worth paying attention to. That setup favors buying dips in leaders and letting winners run.

Warren Buffett says the market is a device for transferring money from the impatient to the patient. Use sentiment to stay patient when others panic and to stay disciplined when others get greedy.

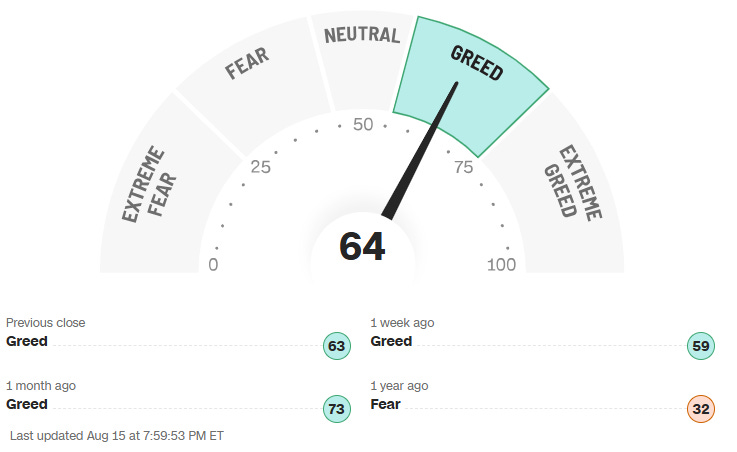

1) Fear & Greed Index = Greed

The market’s mood sits in Greed, not euphoria. Investors are leaning risk-on. Momentum is strong. Many stocks are making new highs. Options flow shows lots of call buying. Junk bond spreads are tight. VIX is calm. In short, the crowd feels confident. Greed readings tell you the up-trend has support.

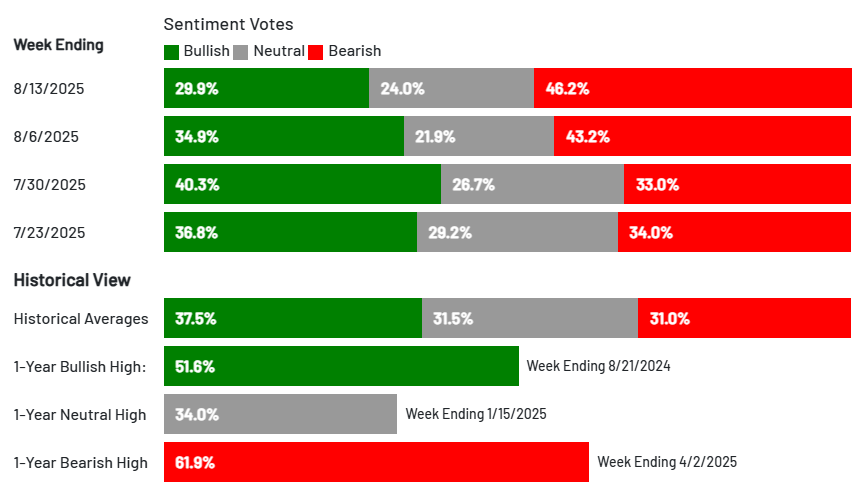

2) AAII Investor Index (6-Month Outlook) = Negative

Main Street feels cautious. Bulls near 30 percent and bears near mid-40s show individual investors are worried. That gap is wide. Historically, heavy pessimism while prices trend up has been a contrarian tailwind because there’s cash on the sidelines that can chase strength later.

3) Economic Indicators = Mixed/Positive

Growth looks okay, inflation progress is bumpy, and risk gauges are calm. The yield curve is still inverted, which keeps recession chatter alive, but credit markets are steady and volatility is low. The VIX tends to stay low in bull markets and spike in stress. Right now it’s closer to calm.

13. Important Economic Events This Week:

1) Fed Chair Powell Speaks — Friday, August 22

What Powell says about inflation, growth, and the path of rate cuts can swing stocks, bonds, and the dollar in minutes. His views affect everything from mortgage rates to corporate profits.

2) July Fed Meeting Minutes — Wednesday, August 20

The minutes show what most Fed voters were thinking at the last meeting. The Fed’s meeting minutes reveal what the Federal Reserve discussed about the economy and future rate plans. This is huge because it shows how ready the Fed is to cut or raise interest rates.

3) August S&P Composite PMI — Thursday, August 21

This is an early read on the whole economy in August. A strong composite PMI usually leads to stock gains and job growth, while falling numbers could hint at recession risks. A weak headline with rising prices is stagflation risk.

4) July Existing Home Sales — Thursday, August 21

This data tells you how many homes sold last month in the U.S. When home sales rise, it means people feel confident, and mortgage rates or prices might be attractive. If sales fall, it could mean higher rates or prices are scaring buyers away.

For the economy, housing is a major driver of jobs, spending, and wealth.

👋Final Thoughts:

🙌Thank you for joining 108,000+ members and reading our newsletter! If you enjoyed reading it please:

Support us by sharing it with friends or family to help us grow, and become a paid subscriber to support our work (this newsletter takes many hours to research and write!):

Hit the LIKE button ❤️ on this post so more people can discover it on Substack 🙏

And please let us know what you think of our newsletter:

See you again next week! (Missed an issue? Read past issues here at TheFinanceNewsletter.com)

☺️ My goal is to help you get richer and smarter with money — Join 3 million and follow me across social media for daily insights:

Instagram Threads: @Fluent.In.Finance

Twitter/ X: @FluentInFinance

Facebook Page: Facebook.com/FluentInFinance

Linkedin: Linkedin.com/in/Lokenauth

Youtube: Youtube.com/FluentInFinance

Instagram: @Fluent.In.Finance

TikTok: @FluentInFinance

Facebook Group: Facebook.com/Groups/FinanceTalk

Reddit Community: r/FluentInFinance

➕Please add this newsletter to your contacts to ensure that none of our emails ever go to spam!

This content is for educational purposes only. Such information should not be construed as legal, tax, investment, financial, or other advice. See for Disclaimer, Terms and Conditions.

![May be an image of text that says 'EARNINGS WHISPERS Monday Before Open After Close PAMN FREIGHTOS Tuesday Before Opeл After Close Most Anticipated Earnings Releases August 2025 paloalto [TOy] BITDEER Wednesday Before Open After Close TIGT Toll Brothers blik riskified OTARGET AMER Thursday Before Open After FEAR BBVA ИЙT fabrinet Friday Before Open Walmart> 中比新作理 LAUDER AMERICA AIRPORTS zoom CanadianSolar CARLYLE COTY workday Nyxoah) WALD] ก Medtronic UITA waldencast Nordson ANALOG 28 Opera InTuii ROST ROSS DRESS BDU agora DS1SYSTEWS.INC PREMIER Liscentage 国 Telix Baid百度 KEYSIGHT BP FLXS) 世纪互联 VNET ODYCOM SOM UNIFI AEGON |YMM auno LOWE'S FUTU) GFUTU http:/feps.shycal 日.区1山1 MAOIAIMI YATSEN scansource Earnings Whispers' May be an image of text that says 'EARNINGS WHISPERS Monday Before Open After Close PAMN FREIGHTOS Tuesday Before Opeл After Close Most Anticipated Earnings Releases August 2025 paloalto [TOy] BITDEER Wednesday Before Open After Close TIGT Toll Brothers blik riskified OTARGET AMER Thursday Before Open After FEAR BBVA ИЙT fabrinet Friday Before Open Walmart> 中比新作理 LAUDER AMERICA AIRPORTS zoom CanadianSolar CARLYLE COTY workday Nyxoah) WALD] ก Medtronic UITA waldencast Nordson ANALOG 28 Opera InTuii ROST ROSS DRESS BDU agora DS1SYSTEWS.INC PREMIER Liscentage 国 Telix Baid百度 KEYSIGHT BP FLXS) 世纪互联 VNET ODYCOM SOM UNIFI AEGON |YMM auno LOWE'S FUTU) GFUTU http:/feps.shycal 日.区1山1 MAOIAIMI YATSEN scansource Earnings Whispers'](https://substackcdn.com/image/fetch/$s_!SXG1!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fb751535e-c62c-498f-95a1-5d9e9317552a_1920x1080.jpeg)

Renting is cheaper than buying. So sad 😩

This is Gold!