💥 America's $64 Trillion Time Bomb (And How To Profit)

Are You Ready for What's Coming? (The Truth About the Economy)

There’s a well-known idea in psychology called “normalcy bias” It’s the tendency to assume things will keep going the way they’ve always gone, right up until the moment they don’t.

In 2007, housing prices had gone up for so long that most people genuinely couldn’t imagine them falling. In 2000, internet stocks had climbed for so long that most people couldn’t imagine a crash. And in 2024, AI stocks had surged so long that most investors couldn’t imagine a world where the AI trade becomes a liability.

This month, the market started to imagine it.

The S&P 500 flipped negative for the year. The Nasdaq has bled for four straight weeks. A single startup’s press release wiped billions off wealth management stocks. The government admitted 2 million jobs never really existed. And the US national debt is on a path to hit $64 trillion within a decade.

This isn’t a correction. This is a reset. The rules of the last two years are changing. And the investors who recognize that early will be the ones building wealth while everyone else is watching their portfolios bleed.

This week, I'm going to show you what's really happening in the economy, why it matters, and exactly what to do with your money right now.

📬 Here’s what’s in today’s newsletter:

Part I - Markets:

1. Market Update & Analysis

2. Most Important Finance News Right Now

3. Chart of the Day

Part II - Investing:

4. Insider Trading

5. Top Stocks Right Now

6. Today's Trade

7. Fear & Greed Analysis

8. Technical Analysis

Part III - Actionable Advice to Build Wealth:

9. Important Points & Lessons to Remember

10. Final Thoughts, Advice, and Reccomendations

11. Questions from SubscribersThis newsletter takes a few hours to research & write so please help us and:

Hit the LIKE button❤️ on this post & please share this newsletter with a friend or family🙏

Become a paid subscriber to support our writing & research! (Get a free 30-day trial with this link) (learn about the benefits here):

(fyi, your job can pay for this newsletter with its employee development budget. We’ve created this email template to send to your manager)

(1) Market Update & Analysis

📈 Everything Important You Need to Know (in 60 seconds):

The S&P 500 fell, turning negative for the year. The Nasdaq has been red for four straight weeks.

AI disruption fears spread from software into wealth management, trucking, real estate, and freight logistics.

Charles Schwab dropped 7%, Raymond James fell 9%, and LPL Financial fell 9% after AI fintech startup Altruist launched a tool that automates custom tax strategies.

Japan’s Nikkei hit record highs Monday after PM Sanae Takaichi won a landslide election. The Nikkei is up 49% over the past 12 months vs. the S&P 500’s 15%.

China instructed banks to reduce US Treasury holdings, pushing yields higher and weakening the dollar.

The January jobs report showed 130,000 jobs added, but past job figures were revised DOWN by over 1 million — the largest negative revision in 20+ years.

US home sales fell 8.4% in January, the biggest monthly drop since February 2022.

💡 Andrew’s Analysis (how this impacts YOU):

The AI that was supposed to make everyone rich is now scaring the market to death. But here’s what nobody’s telling you.

For two years, investors poured money into AI stocks like it was a gold rush. Every Big Tech earnings call was a love letter to the future. Every GPU announcement sent stocks higher. The narrative was simple: AI means profits, and profits mean higher prices.

That story is cracking.

The S&P 500 fell for three straight days and flipped negative for the year. The Nasdaq, packed with the very companies supposed to lead the AI revolution, has been in the red for four straight weeks. And the reason isn’t bad earnings or a looming recession. It’s fear.

The market is asking a question it ignored for two years. What if AI disrupts the companies we own, not just the ones we compete against?

It started with software a few weeks ago. Anthropic released AI tools that handle tasks software firms like Snowflake, Salesforce, and ServiceNow charge thousands per month for. The S&P software sector index dropped roughly 17% in a month. During my time at Goldman and JPMorgan, I’ve watched sectors get repriced fast. This speed was different.

Then the fear spread. This week, a fintech startup called Altruist announced an AI tool that builds custom tax strategies for clients, no human advisor needed. Charles Schwab dropped 7%. Raymond James and LPL Financial each fell about 9%. In a single session, wealth management lost billions in market cap because of one press release.

The pattern is clear: any industry that touches human knowledge work is now vulnerable to an AI-driven selloff.

Real estate stocks dropped on fears that AI-powered companies won’t need office space. Insurance stocks fell after news of the first AI-powered insurance app built on ChatGPT.

But here’s the thing. Most of these drops aren’t justified by actual lost revenue yet. Wedbush analyst Dan Ives called it “a doomsday scenario” baked into prices that is “extremely overblown.” Many of the stocks that sold off Thursday ended Friday in the green.

So what’s really going on?

Think about the dot-com era. In the late 1990s, the internet was going to change everything too. At first, it drove prices up as excitement built. Then uncertainty set in. Nobody knew which companies would survive. Stocks swung wildly on rumors, press releases, and pure fear. Sound familiar?

We’re in that uncertainty window right now.

The investors who won during the internet era weren’t the ones who panicked in 1999. They were the ones who identified the toll collectors, the companies providing infrastructure, and held on. Today’s toll collectors are names like Corning, which signed a $6 billion fiber-optic deal with Meta. Memory chipmakers like SK Hynix and Micron. Data center power providers like Vertiv. These companies get paid whether AI creates jobs or destroys them.

Now zoom out further.

Last week, Alphabet raised $20 billion in bonds, including a 100-year tranche, to fund $185 billion in AI spending for 2026. The tech giants are borrowing money they may not pay back for a century to fund technology nobody fully understands yet. In the last three months of 2025, the hyperscalers issued about $60 billion in bonds. Analysts expect as much as $500 billion more this year.

Meanwhile, Japan’s market is at record highs. Foreign stocks are up about 9% year-to-date while the S&P is up just 1.4%. China is telling banks to cut US Treasury exposure. The dollar is weakening. And over 2 million jobs were quietly erased from official US payroll data over the past three years through downward revisions.

What does all of this connect to?

There’s a quiet but building “Sell America” trade running beneath the surface. It’s not a panic. It’s a slow, deliberate reallocation. Foreign investors are looking at a US market that’s richly valued, a weakening dollar, a debt burden growing toward $64 trillion, and AI disruption eating through sector after sector. They’re choosing to diversify.

This doesn’t mean sell everything. The S&P is still near all-time highs. Earnings have been strong, with 76% of S&P 500 companies beating estimates this season at a 13% blended growth rate. The long-term setup for AI infrastructure remains intact.

But the easy money phase of this AI trade is over. The winners from here will be the people who understand which companies benefit from AI spending, not which companies get disrupted by it. Think infrastructure over software. Think toll collectors over toll payers.

I’ve been pointing to this shift for months. If you’ve been watching where the smart money flows (fiber optics, memory chips, power equipment, nuclear), this week’s market action should feel like confirmation, not shock.

My advice: Review your portfolio. Ask yourself how many of your holdings fall in the “AI toll collector” bucket vs. the “AI disruption target” bucket. Your answer will tell you exactly how much risk you’re sitting on right now.

👉 For daily insights, follow me on X /Twitter; Instagram Threads; Facebook; or BlueSky, and turn on notifications!

(2) Most Important Finance News Right Now

📬 In today’s issue we analyze:

1) America's $64 Trillion Time Bomb

2) AI's Real Winner Isn't Nvidia—It's Glass

3) The People Building AI Are Now Warning Us About It

4) America's Housing Crisis Is Getting Worse. Here's the Math.

5) 2 Million Jobs Were Quietly Erased

6) Foreign Stocks Crush US Markets

🤔 But first, how do you feel about the economy?

1️⃣ America’s $64 Trillion Time Bomb

The Congressional Budget Office released its annual fiscal outlook this week, and the numbers aren’t good. The US national debt, already above $38 trillion, is now projected to hit $64 trillion within a decade. Debt as a share of the economy is on track to reach 120% of GDP by 2036, blowing past the previous record of 106% set right after World War II.

Here’s what makes this different from past debt debates. After WWII, the debt shrank because the economy grew fast. That’s not happening this time. Annual interest payments alone are set to more than double, from $1 trillion now to $2.1 trillion by 2036. That’s more than the entire US defense budget. Per person, that’s roughly $40,500 in net interest costs alone.

The CBO said Trump’s One Big Beautiful Bill will widen the deficit by $4.7 trillion over the next decade. Tariff revenue offsets about $3 trillion of that, but the net result is still deeply in the red. And if courts strike down the tariffs, debt could reach 131% of GDP.

The “debt spiral” risk is the part to watch. When the interest rate the government pays on its debt exceeds the rate of economic growth, debt becomes self-reinforcing. The CBO’s projections show this tipping point arriving later this decade.

During my years in finance, I’ve watched countries hit this kind of inflection point. The warning signs don’t all arrive at once. They build slowly, then suddenly.

What this means for you: Higher government borrowing pushes interest rates up over time, which keeps mortgage rates elevated, borrowing expensive, and growth subdued. The best hedge against this long-term trend is owning assets that hold value when currencies weaken. Real assets, dividend-paying companies with pricing power, and international diversification all become more valuable in this environment.

2️⃣ AI’s Real Winner Isn’t Nvidia—It’s Glass

While software stocks got crushed on AI disruption fears, Corning $GLW has been quietly becoming one of the biggest winners of the AI era. Corning’s stock hit an all-time high, up more than 130% over the past year, because AI data centers run on fiber-optic cable, and Corning makes the best in the world.

Late last month, Corning signed a $6 billion fiber-optic cable contract with Meta $META. The company expects other AI hyperscalers to follow. Corning also locked in a $2.5 billion deal with Apple $AAPL last year to supply all cover glass for iPhones and Apple Watches.

CEO Wendell Weeks made a point worth remembering: moving data with photons is three times as efficient as electrons over short distances, and roughly 20 times more efficient over long hauls. As AI demands more data movement, Corning’s technology grows more valuable, not less.

This is the toll-collector thesis in action. Memory chipmakers are seeing the same dynamic. Contract prices for DRAM and NAND flash memory have surged roughly seven times over the past year as AI data centers absorb supply. SK Hynix is up over 150%. Sandisk $SNDK is up over 400%. The companies selling picks and shovels to the AI gold rush are winning big.

One warning worth noting: Corning followed a similar upward trajectory from 1997 to 2000, then lost over 90% of its value when the dot-com bubble popped. The company says it’s more diversified today, and that’s true. But history rhymes. Monitor position sizing.

What this means for you: Look for the picks and shovels. Every gold rush, the people selling equipment made more reliable money than the prospectors. AI is no different. Companies enabling the buildout — chipmakers, fiber providers, power infrastructure — collect checks regardless of which AI apps win.

3️⃣ The People Building AI Are Now Warning Us About It

Multiple insiders at the biggest AI labs went public with concerns about where their own technology is headed.

At Anthropic, the head of Safeguards Research resigned, writing in his exit letter about a world “in peril” and noting that the company repeatedly struggled to “let our values govern our actions” under competitive pressure.

At OpenAI, three employees went public within days of each other. A researcher quit over concerns about ChatGPT’s ad strategy and what she called “a potential for manipulating users.” A top safety executive was fired after opposing the planned release of AI erotica. An engineer posted publicly saying he “finally feels the existential threat that AI is posing.”

When the people building a technology start warning the public from the inside, that’s a signal worth taking seriously.

Anthropic also announced a $20 million commitment to a political group backing AI safety-focused congressional candidates. OpenAI is funding the opposing side, a pro-AI super PAC that backs against those same candidates. The two biggest AI labs are now funding opposing political movements about regulating the industry they created.

This doesn’t mean sell all tech. But it does mean the regulatory and ethical landscape around AI is getting messier and less predictable. Companies building on top of AI infrastructure, rather than the models themselves, may carry less of this uncertainty.

What this means for you:

Job disruption isn’t coming — it’s here. White-collar work (software, finance, law, media) is in the crosshairs. The companies cutting headcount today are just early adopters.

But don’t panic. The internet disrupted newspapers and travel agents, then created Google and Amazon. New jobs emerge. Old ones evolve. The key is adapting.

Your career insurance: Develop skills AI can’t easily replicate — complex problem-solving, emotional intelligence, creative thinking, building relationships. Be the person who works with AI, not the one replaced by it.

4️⃣ America’s Housing Crisis Is Getting Worse. Here’s the Math.

The National Association of Realtors reported that sales of existing US homes fell 8.4% in January from December, the biggest monthly decline since February 2022. Sales were also down 4.4% from a year ago. Homes sat on the market for a median of 46 days last month, up from 41 days a year prior.

The NAR partially blamed arctic weather, but areas that weren’t impacted by cold also declined. The real culprits are economic uncertainty, high prices, and mortgage rates stuck above 6%.

The core problem is a market frozen by “golden handcuffs.” US homeowners held their properties for an average of 8.6 years in Q4 2025, the longest tenure on record since data began in 2000. People who locked in 3% mortgages aren’t selling because trading up means trading into a 7% rate.

Below the surface, the picture is K-shaped. Mortgage delinquencies remain low overall, but they’ve tripled among borrowers in the lowest-income ZIP codes since 2021, rising to 3% from 0.5%. Wealthier homeowners are fine. Lower-income homeowners are falling behind fast.

The geographic split is striking. Homes in Austin, TX sit on the market for 106 days before going under contract. Miami clocks in at 92 days. San Jose takes just 25 days, driven by the Bay Area’s AI employment boom. The housing market isn’t one story. It’s dozens of local stories shaped by job markets and local economics.

What this means for you:

Housing isn’t a one-size-fits-all market. Where you buy matters enormously. Sun Belt boomtowns that overbuilt (Austin, Miami, parts of Florida) now see homes sitting for 90+ days. Bay Area homes sell in 25 days thanks to AI.

If you’re buying: You have more negotiating power than you think. Redfin found 62% of buyers last year paid below asking price — highest since 2019. Don’t be afraid to negotiate.

If you’re selling: Price realistically. The days of bidding wars and waived inspections are over in most markets. The exception? Affordable Midwest markets (Kansas City, Milwaukee, St. Louis) where homes still move fast.

5️⃣ 2 Million Jobs Were Quietly Erased

The jobs report showed 130,000 jobs added in January and wage growth of 3.7% year over year. On the surface, that looks solid enough to keep the Federal Reserve from cutting rates at its March meeting. President Trump has pushed hard for rate cuts, but this report makes that outcome very unlikely.

But look under the hood. US job numbers were revised DOWN by over 1 million for 2025, the largest annual revision in at least 20 years. This follows a downward revision of 818,000 in 2024 and 306,000 in 2023. In total, more than 2 million jobs have been quietly erased from official data over the past three years.

The job numbers the market was reacting to for years were wrong. The economy was weaker than reported.

There’s also an AI signal buried in the January data. Financial activities and information sectors lost about 34,000 jobs combined. Goldman Sachs noted that tech-related information employment hit its lowest level since May 2022. This is consistent with companies using AI automation to trim white-collar headcount.

The Fed’s next meeting is March 17-18. With wages elevated and inflation above 2%, a rate cut looks off the table. Cleveland Fed President Beth Hammack said rates could stay on hold “for quite some time.” If you’re waiting for lower mortgage rates to make a housing move, patience will be required.

What this means for you:

Mortgage rates stuck around 6-7% for now. Don’t wait for 4% mortgages to return. If you find a house you love at a price you can afford, buy it. Time in the market beats timing the market.

Borrowing costs stay elevated. Credit card debt, car loans, business financing — all remain expensive. Pay down high-interest debt aggressively.

The “higher for longer” narrative is back. Markets that rallied on rate-cut hopes (tech stocks, crypto, speculative plays) could face headwinds.

6️⃣ Foreign Stocks Crush US Markets

While US investors dealt with AI disruption fears, foreign markets moved sharply higher. Japan’s Nikkei 225 hit record highs after Prime Minister Sanae Takaichi won a landslide election with a two-thirds supermajority. The Nikkei is up 49% over the past 12 months. South Korea’s KOSPI is up 110% over the same period, fueled by memory chip giants Samsung and SK Hynix.

The broader MSCI ex-US index is up nearly 9% this year while the S&P is up just 1.4%.

Warren Buffett has been ahead of this trend. His bet on Japanese trading companies through Berkshire Hathaway is looking like a late-career masterstroke. I highlighted international diversification as an opportunity a few months back. If you acted on that, you’re seeing it play out in real time.

The weaker dollar is a key driver. When foreign investors hold US assets and the dollar weakens, their returns shrink when converted back to their home currency. That makes US assets less attractive at the margins and pushes capital toward international markets.

The “Sell America” trade isn’t a panic. It’s a slow, rational reallocation. The US remains the world’s dominant financial market. But the valuation gap between US and international equities has narrowed, and the fundamental case for international exposure is stronger today than it’s been in years.

What this means for you:

Consider international ETFs. Funds tracking foreign indexes give you exposure without picking individual stocks. MSCI EAFE, emerging market funds, or country-specific ETFs (like EWJ for Japan, EWY for South Korea).

Don’t abandon the US entirely. Some American stocks got unfairly punished by AI fears. Insurance stocks tanked 12% on news of an AI insurance app — for a sector built on complex commercial policies that AI can’t easily replace. Look for bargains.

Hedge against dollar weakness. If the Trump administration talks down the dollar (which they’ve signaled), foreign holdings act as a natural hedge.

💡 Andrew’s Analysis (what this all means for YOU):

Look at these stories together, and a theme emerges: We’re in a period of massive structural shifts, and the old rules don’t apply the same way.

Debt dynamics are changing. The US can’t keep borrowing forever without consequences. Interest payments crowd out everything else.

AI is reshaping industries in real time. Some businesses die; new ones emerge. The winners? Infrastructure providers and adaptable workers.

Global power is shifting. China diversifies away from Treasuries. Japan and Korea surge. The dollar’s dominance isn’t guaranteed.

The Fed stays independent. No matter who’s in the White House, inflation fighting trumps rate-cut politics.

Housing reflects deeper inequality. The K-shaped recovery touches everything — who can buy homes, who falls behind, who benefits.

Every story points to a world where US financial dominance faces more pressure than it has in a generation. Mounting debt, job market distortions, housing strain, AI disruption, dollar weakness, and foreign market outperformance are all symptoms of the same underlying shift.

My advice: Diversify across asset classes, geographies, and income streams. Don’t bet everything on US stocks, don’t assume the government will save you, and don’t ignore tectonic shifts happening beneath the surface. The next decade will look different than the last. Position yourself accordingly.

👉 For daily insights, follow me on X/ Twitter, Instagram Threads, or BlueSky, and turn on notifications!

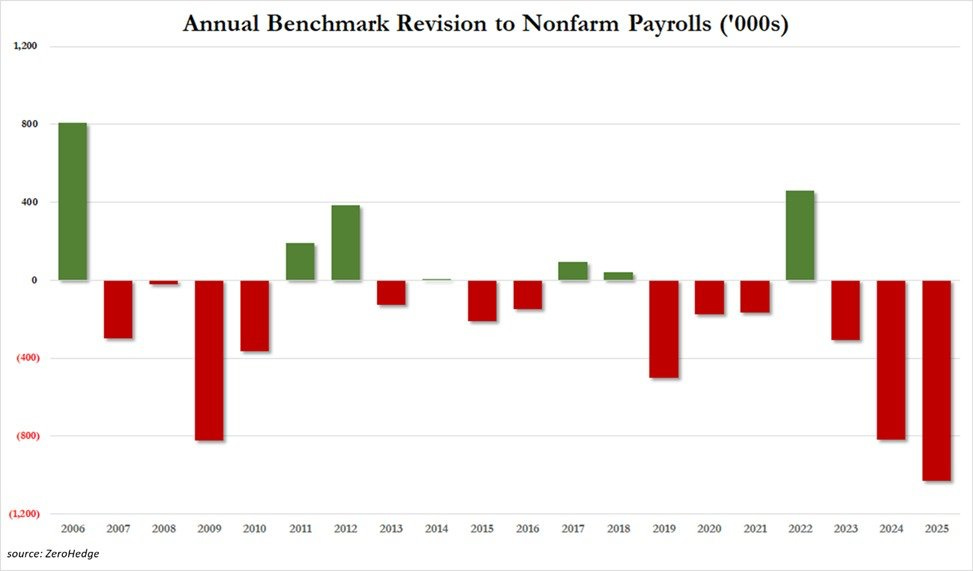

(3) Chart of the Day

2 Million Jobs Just Vanished

💡 Andrew’s Analysis (why this is important):

This week’s chart shows the Annual Benchmark Revision to Nonfarm Payrolls going back to 2006. What you’re looking at is the gap between the job numbers the government originally reported and what they were later corrected to be. Green bars mean revisions were positive (more jobs than first reported). Red bars mean revisions were negative (fewer jobs than reported).

The 2025 bar is the worst in the chart’s entire history, and it’s not close. Over 1 million jobs were erased from 2025 data alone. Combined with 818,000 removed from 2024 and 306,000 from 2023, more than 2 million jobs have been quietly deleted from the official record over three years. For perspective, the combined downward revisions during 2009 and 2010, right after the financial crisis, were only about 1.2 million.

Let that sink in. We just lived through three consecutive years of job revisions worse than the period following the worst financial crash since the Great Depression.

During my decade on Wall Street, I watched traders and policymakers move the world based on monthly jobs numbers. Turns out those numbers were off by millions.

Why this changes how you should think about everything.

The Federal Reserve uses jobs data to set interest rates. Congress uses it to evaluate fiscal policy. Businesses use it to plan hiring. If the underlying data was wrong, then every decision made on that data was built on a shaky foundation. The Fed may have held rates higher for longer than necessary. The White House may have misread the economy’s true condition.

For investors, three implications stand out.

First, the economy may be structurally weaker than headlines suggested, and the labor market more fragile than anyone realized.

Second, the AI disruption narrative hitting stocks right now may be more justified than the “overblown” camp believes. If white-collar job losses are already showing up in government revisions, automation may be further along than we thought.

Third, the Fed’s “data-dependent” approach is only as good as the data. With this level of revision error, investors should have less confidence in the Fed’s ability to make well-timed policy moves.

My advice: Don’t assume the economy is as strong as the monthly headlines suggested for the past three years. Companies with pricing power, recurring revenue, and fortress balance sheets hold up better when economic reality turns out softer than expected. Right now, that combination is worth paying a premium for.

👉 For daily insights, follow me on X/ Twitter, Instagram Threads, or BlueSky, and turn on notifications!

(4) Insider Trading from Billionaires, Politicians, and CEOs:

When people with deep knowledge, such as politicians who set policy, executives who run the company, or legendary investors, put their own money on the line, pay attention.

1. FTI Consulting ($FCN)

Rep. Michael McCaul (R-TX) filed a trade on February 12 showing his spouse bought between $100,000 and $250,000 of FTI Consulting stock on January 20. The trade was filed 21 days after the transaction date.

FTI Consulting is a global business advisory firm that helps companies manage change, litigation, investigations, and financial restructuring. With corporate distress rising and regulatory scrutiny increasing across industries, demand for these services typically grows.

McCaul sits on the House Foreign Affairs Committee, giving him insight into international business conditions and regulatory trends. His spouse’s purchase suggests confidence in the advisory space despite economic uncertainty.

2. International Flavors & Fragrances ($IFF)

Rep. Michael McCaul (R-TX) filed two separate trades on February 12:

On January 14, his spouse bought between $50,000 and $100,000

On January 12, his spouse bought between $100,000 and $250,000

IFF is a global leader in food, beverage, and consumer product ingredients. Think flavors for snacks, fragrances for perfumes, and ingredients for health products. The company has been restructuring to improve margins and focus on higher-growth categories.

Two purchases in three days signals strong conviction. McCaul’s committee work gives him visibility into trade policy and international supply chains — both critical for IFF’s global business.

3. Baxter International ($BAX)

Rep. Michael McCaul (R-TX) filed a trade on February 12 showing his spouse bought between $50,000 and $100,000 of Baxter stock on January 12.

Baxter develops medical products for hospitals and clinics — IV solutions, dialysis equipment, surgical tools. It’s a healthcare staple. The stock trades at about $19.65, near multi-year lows after spinning off its kidney care unit.

Healthcare spending isn’t optional. As the population ages, demand for hospital supplies grows. Baxter’s spinoff simplified the business, potentially unlocking value.

4. Transdigm Group ($TDG)

CEO Michael Lisman bought +950 shares on February 6 for $1,284.26 each — total value $1.22 million. Filed February 9. This increased his holdings by 22%.

Transdigm makes aircraft components — essentially, it owns a bunch of niche aerospace parts companies and dominates those markets. Airlines can’t operate without these parts. It’s a near-monopoly business with pricing power.

Why this matters: Aerospace took a hit during COVID but recovered strongly. Travel demand remains high (see Royal Caribbean and Marriott gains below). When a CEO puts $1.2 million of his own money into the stock, he’s betting the recovery continues.

Recent news: Commercial air travel remains strong. Defense spending holds steady. Transdigm’s model of acquiring and optimizing niche suppliers continues working.

5. Alexandria Real Estate Equities ($ARE)

Exec COB Joel Marcus bought +25,000 shares on February 12 for $53.92 each — total value $1.35 million. Filed February 13. This increased his holdings by 5%.

Alexandria owns lab space for life science and tech companies — think biotech research facilities, not office towers. It’s a specialized REIT with properties in innovation clusters (San Diego, San Francisco, Boston, NYC).

Why this matters: Commercial real estate is a disaster zone right now. Office vacancies are at record highs. But Alexandria isn’t offices. It’s mission-critical infrastructure for drug discovery and tech R&D. Different ballgame.

Recent news: Biotech funding bounced back. AI-driven drug discovery companies need lab space. Large tech firms expanding into health need facilities.

6. Hennessy Capital Investment Corp. VIII ($HCIC)

President Thomas Hennessy and COB/CEO Daniel Hennessy each bought +671,000 shares on February 6 for $10.00 each — total value $13.42 million combined. Filed February 9. This represents new positions.

HCIC is a SPAC (special purpose acquisition company) — essentially a blank-check company looking to merge with a private business and take it public. The Hennessy brothers have done this before successfully.

Why now? SPACs fell out of favor after the 2020-2021 boom. Many trade below their $10 IPO price. Hennessy is buying at $10, essentially saying “we’ll find a deal that makes this worth more.”

Recent news: No merger announced yet. The Hennessy team has experience in industrial and transportation sectors.

👉 For daily insights, follow me on X /Twitter; Instagram Threads; Facebook; or BlueSky, and turn on notifications!

(5) Top Stocks Right Now

1. Fastly $FSLY up +72% on 2/12

2. Cognex $CGNX up +36% on 2/11

3. Ichor Holdings $ICHR up +33% on 2/10

4. Rivian $RIVN up +27% on 2/14

5. Vertiv $VRT up +24% on 2/11

6. BorgWarner $BWA up +23% on 2/11

7. Novocure $NVCR up +19% on 2/121) Fastly $FSLY up +72% on 2/12

Fastly $FSLY was up +72% on Wednesday. The cloud networking and content delivery company beat both revenue and earnings expectations in its fourth quarter, with analysts upgrading the stock on signs that its pivot toward AI-powered edge infrastructure is gaining traction. Fastly had been a beaten-down turnaround story for years. A move this large on earnings signals that market expectations were set extremely low and that the underlying business is recovering faster than anyone anticipated. AI’s demand for real-time data delivery at the edge is a legitimate and growing long-term catalyst for Fastly’s business model.

2) Cognex $CGNX up +36% on 2/11

Cognex $CGNX was up +36% after delivering a standout quarterly report that added to growing evidence of a US manufacturing recovery. Cognex makes machine vision systems, the cameras and software that automated factories use to inspect products and guide robots on assembly lines. It’s a direct play on the automation of physical manufacturing. The strong results come as AI accelerates demand for factory automation, with companies racing to reduce labor costs and improve quality control. If US manufacturing activity continues to recover and AI-powered robotics drive a new wave of factory upgrades, Cognex sits at the intersection of both structural trends.

3) Ichor Holdings $ICHR up +33% on 2/10

Ichor Holdings $ICHR was up +33% after a robust fourth quarter powered by surging demand for etch and deposition services, two critical processes in semiconductor chip manufacturing. Ichor makes the precision fluid delivery systems that semiconductor equipment makers rely on. With AI data centers requiring enormous quantities of cutting-edge chips, demand for the equipment used to build those chips is at record levels. Ichor is the kind of company most people have never heard of that sits right at the heart of the global semiconductor supply chain.

4) Rivian $RIVN up +27% on 2/14

Rivian $RIVN was up +27% on Friday after beating both earnings and revenue estimates, even as vehicle deliveries slipped to 9,745 units amid a 36% drop in broader US EV sales. What drove investors was the improvement in gross margins and evidence that Rivian’s cost discipline is working. The company’s Amazon delivery van business provides a steady commercial demand floor regardless of consumer EV sentiment. In a sector where most names have been punished heavily, Rivian’s ability to beat on a disappointing delivery number suggests the worst is already priced in.

5) Vertiv $VRT up +24% on 2/11

Vertiv $VRT was up +24% after 2026 guidance topped analyst expectations by a wide margin and fourth-quarter orders surged sharply. Vertiv makes the power and cooling infrastructure inside data centers, a business growing at an extraordinary pace as AI applications require far more energy than traditional servers. This is the toll-collector thesis at its clearest: Vertiv doesn’t care which AI model wins the market. It sells the equipment every data center needs to function. Strong guidance here signals that hyperscaler spending plans remain fully intact despite the AI disruption fears hitting software stocks.

6) BorgWarner $BWA up +23% on 2/11

BorgWarner $BWA was up +23% on Tuesday after the auto parts maker announced new deals entering the AI data center power market. This is a notable pivot for a company best known for automotive drivetrain components. BorgWarner’s thermal management and power electronics expertise translates well to the extreme cooling and power demands of AI data centers. The market rewarded the announcement, and it serves as a reminder that AI infrastructure opportunities are showing up in the most unexpected sectors. Expect more “surprise” AI beneficiaries to emerge from traditional industrial businesses over the next 12 months.

7) Novocure $NVCR up +19% on 2/12

Novocure $NVCR was up +19% on Wednesday after the FDA approved its tumor treating fields device for certain pancreatic cancers, one of the deadliest and hardest-to-treat cancers with limited existing options. Novocure’s technology uses targeted electrical fields to disrupt cancer cell division without the toxicity of traditional chemotherapy. FDA approvals for new cancer indications are the primary catalysts that drive this stock. This approval opens a significant new market and validates Novocure’s broader technology platform. Healthcare names like Novocure are also benefiting from the powerful aging demographic tailwind driving healthcare demand across the US economy.

💡 Andrew’s Analysis:

Most of the biggest winners are tied to one idea. AI is forcing the world to rebuild infrastructure. Power, cooling, chips, fiber, and automation show up again and again. If you want “AI exposure” with less story risk, start with the companies that sell the physical picks and shovels.

👉 For daily insights, follow me on X /Twitter; Instagram Threads; Facebook; or BlueSky, and turn on notifications!

(6) Today’s Trade

The options market is where the smartest traders place their biggest bets. I monitor options flow activity daily.

1. Dauch Corp $DCH — Contrarian Bet on a Beaten-Down Name

Dauch Corp $DCH is a specialty auto parts manufacturer currently trading around $6.96, down over 17% today after reporting fourth-quarter net sales that came in roughly in line with analyst estimates but failed to excite investors.

Despite the sharp selloff, call options activity is extraordinary.

Call volume stands at 80,684 contracts, 100x the average daily volume and 20x the put volume. That’s a call-to-put ratio of roughly 20-to-1, one of the more aggressive bullish signals you can see in options markets on any given day.

The bulk of this activity traces back to a single large block trade: a buyer paid $0.39 per contract for 18,500 of the July 17, 2026, 8.00/10.00 call vertical spreads. This means they’re betting shares will climb from roughly $7 today to above $8 by July, with maximum profit if shares hit $10. More than 28,000 of these call verticals were purchased in morning trading. With total open interest at only about 19,900 contracts before today, this represents almost entirely new positioning from large players who believe today’s drop is an overreaction.

Outlook: Bullish. The options positioning signals that sophisticated traders see today’s 17% sell-off as overdone and are betting on a meaningful recovery by mid-summer. The July expiration gives the position room to breathe through at least one more earnings cycle.

2. SK Telecom $SKM — Momentum Bet on the Global AI Trade

SK Telecom $SKM is South Korea’s largest telecom company, trading around $32.17 and up over 60% from its 52-week low of $19.66 just six weeks ago. The stock hit a fresh 52-week high of $33.45.

Call volume has risen to 10,819 contracts, 19x the average daily volume and 30x the put volume. That’s a call-to-put ratio of 30-to-1, and it’s concentrated at the March 20, 2026, $40 strike call, where over 5,670 contracts traded through multiple block trades at prices ranging from $0.60 to $1.20. With only 328 contracts of open interest before today, this is entirely new money.

Buyers of the $40 strike calls are making an aggressive bet: they expect SKM to climb from roughly $32 today to above $40 by March 20, a roughly 25% move in five weeks. Why would anyone make that trade? South Korea’s KOSPI is one of the best-performing global indices this year, up 26%. The country is a major AI beneficiary through Samsung and SK Hynix. And SKM’s parent company structure ties it directly to SK Hynix, one of the biggest memory chip winners in the AI infrastructure buildout.

Outlook: Bullish, but aggressive. The setup implies strong conviction that Korean equity momentum continues. The tight five-week timeline makes this a higher-risk speculative position, but the unusual volume and block trade structure suggest a trader with significant conviction and resources behind the bet.

3. The connection between these two trades

DCH is a contrarian recovery play on a beaten-down domestic name. SKM is a momentum play on international AI infrastructure. Together they reflect the broader market split right now: some traders are buying the US dip while others are chasing the global AI trade. Both theses can play out simultaneously, and both are worth watching.

👉 For daily insights, follow me on X /Twitter; Instagram Threads; Facebook; or BlueSky, and turn on notifications!

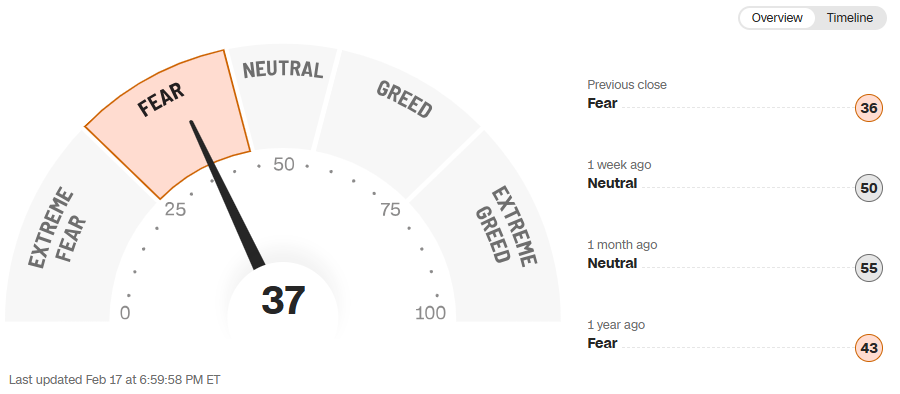

(7) Fear & Greed Analysis

How do you cut through the noise and understand what’s really happening? The secret is to look at the feelings people, the actions of investors, and the facts about the economy.

The Fear & Greed Index at 37, is firmly in Fear territory. A month ago it sat at 59 (Greed territory). One week ago it was at 43. A year ago it stood at 46. In less than four weeks, the market’s emotional state moved from Greed to Fear. That’s a fast and meaningful shift.

Fear readings like this one tend to mark turning points, but they can persist longer than most investors expect. History shows that sustained Fear readings often reflect genuine fundamental shifts, not just temporary nerves. With AI disruption spreading across sectors, jobs data being revised downward, and international markets outperforming the US, the underlying reasons for fear aren’t disappearing overnight.

The one-year comparison tells a story on its own. The market has moved from a neutral emotional baseline to Fear over 12 months, even as prices remained near all-time highs for much of that period. That gap between price and sentiment is worth paying attention to.

What to do with this information: Warren Buffett’s most repeated insight is to be fearful when others are greedy, and greedy when others are fearful. A reading of 36 is entering the historical range where patient, long-term investors have found above-average entry points. But “greedy when others are fearful” doesn’t mean buying everything blindly. It means identifying high-quality names that have been caught in fear-driven selloffs without real fundamental damage, and building positions over time.

The Fear & Greed Index doesn’t tell you when the bottom arrives. It tells you what emotional environment you’re operating in. Right now, that environment is one where panic-driven selling is creating opportunities for disciplined, patient buyers.

👉 For daily insights, follow me on X /Twitter; Instagram Threads; Facebook; or BlueSky, and turn on notifications!

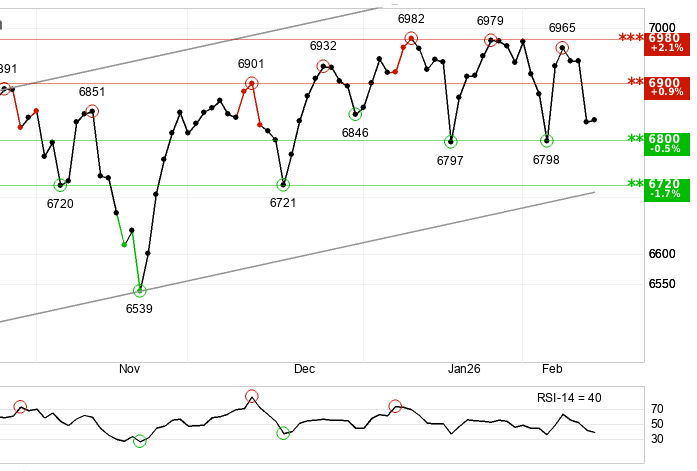

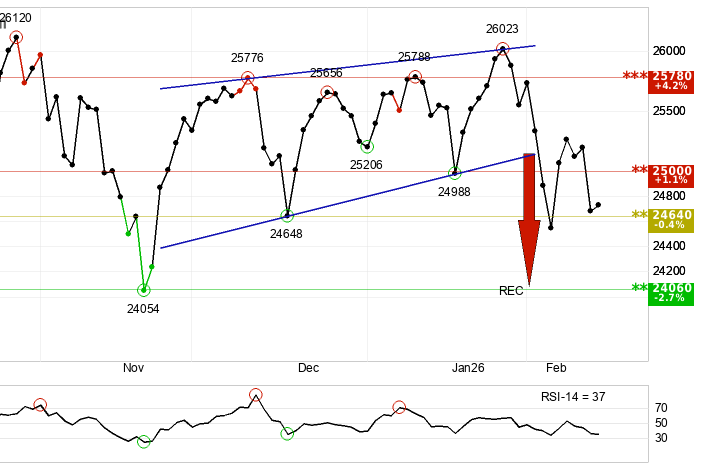

(8) Technical Analysis

Technical levels matter because they’re where millions of traders have programmed their buy and sell orders. When key levels break, algorithms kick in and magnify moves.

1) S&P 500 SPY 0.00%↑

The trend is Positive.

The index continues to trade within a rising trend channel in the short term, which remains technically constructive. Support sits at 6,800 and resistance at 6,900. As long as the index holds above 6,800, the short-term uptrend remains intact. A break below 6,800 would be the first meaningful warning signal for short-term traders.

The medium and long-term pictures both remain positive. This suggests the current weakness is a correction within a broader uptrend rather than a trend reversal. The short-term pressure reflects AI disruption fears and sector rotation playing out in real time, not a structural breakdown.

2) Tech Stocks QQQ 0.00%↑

The trend is Negative.

This is the most concerning chart in the newsletter this week. The index broke below a key support level at 25,149, generating a technical sell signal. The next support level sits at 24,640. A break below that would signal further downside toward 24,081.

This chart reflects exactly what’s playing out fundamentally: AI-heavy tech stocks face more pressure than the broader market. A 22-day decline of roughly 4% is meaningful. When the market’s leading growth index underperforms the broader benchmark by this margin, it often signals a leadership rotation already underway.

Medium and long-term technicals remain weakly positive and positive respectively, providing some longer-term cushion. But for active traders and investors with heavy tech exposure, the short-term setup warrants caution. Tightening stop-loss levels on tech-heavy positions is worth considering.

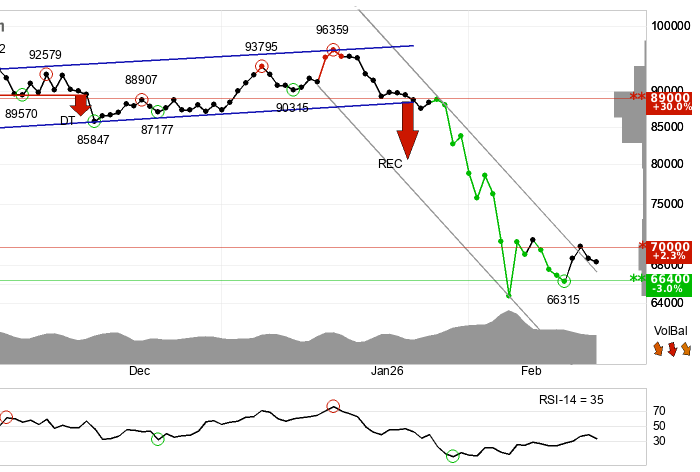

3) Bitcoin $BTC

The trend is Negative.

This is the most bearish chart in the newsletter this week, with negative signals across the short, medium, and long-term time frames. Volume balance is negative, meaning selling pressure continues to outpace buying. RSI shows a slight positive divergence against price, hinting at a possible short-term bounce, but the overall setup remains bearish.

Resistance sits at $71,000. A break above that level would be a positive signal. A failure to break through $71,000 would confirm continued weakness.

Bitcoin tends to amplify whatever risk sentiment is running in the broader market. With the Fear & Greed Index at 36 and the Nasdaq under pressure, the macro backdrop for crypto isn’t favorable right now. Short-term traders may want to reduce exposure near resistance. Long-term holders who’ve lived through Bitcoin’s historic volatility can sit through this kind of correction, as they have before.

4) What This All Means

The three charts tell a unified macro story this week.

The S&P is wobbling but holding. The Nasdaq is breaking down in the short term, reflecting the AI disruption rotation out of growth names. Bitcoin is in a multi-timeframe downtrend, amplifying broader risk-off sentiment.

This pattern is consistent with what happens during sector rotation events. The broad market holds reasonably well while growth and speculative assets absorb disproportionate selling. Combined with a Fear & Greed reading of 36, mounting US debt costs, a weakening dollar, and AI uncertainty spreading across industries, the technical signals confirm what the fundamentals are saying.

Caution is warranted in the short term. But long-term equity trends remain positive, and patient buyers who do their homework during fear-driven markets have historically come out ahead.

The one number to watch closely: S&P 500 support at 6,800. That’s the line between “healthy correction” and “something larger starting.” Keep it on your radar this week.

👉 For daily insights, follow me on X /Twitter; Instagram Threads; Facebook; or BlueSky, and turn on notifications!

(9) Important Points & Lessons to Remember:

Protect your buying power against inflation

The US debt is projected to hit $64 trillion in a decade. Interest payments alone will exceed the defense budget. This usually leads to currency debasement. Own real assets like gold, commodities, and real estate. These hold value when paper money loses strength. Do not keep all your wealth in cash or bonds.Invest in AI infrastructure not just software

Software stocks are falling on fear of disruption. But data centers need power cooling and chips regardless of who wins. Companies like Vertiv and Corning are the toll collectors. They get paid whether AI creates jobs or destroys them. Focus on the physical layer of the technology boom.Diversify outside the US dollar

Foreign markets are outperforming US stocks significantly. Japan and South Korea are leading the way. A weaker dollar hurts US returns for global investors. Holding international ETFs hedges this risk. Warren Buffett is betting big on Japanese trading companies. You should consider following that lead.Be cautious with housing in overbuilt markets

Home sales fell 8.4 percent in January. Some cities like Austin and Miami see homes sitting for over 90 days. Avoid markets that boomed too fast. Look instead at affordable Midwest markets where homes still sell quickly. Do not assume prices will go up everywhere.Prepare for higher interest rates for longer

The jobs report was stronger than expected despite revisions. This means the Federal Reserve may not cut rates soon. Mortgage rates could stay around 6 to 7 percent. Do not wait for 4 percent mortgages to return. If you find a deal you can afford buy it now.Watch for white collar job disruption

Over 2 million jobs were erased from data revisions. Financial and tech sectors are already seeing cuts. AI automation is hitting knowledge work first. Protect your career by learning skills AI cannot replicate. Focus on complex problem solving and human relationships.Follow the insider money flows

Politicians and CEOs are buying specific sectors quietly. Look at where insiders put their own cash. They are buying healthcare aerospace and consulting. They know where the government spending is going. Follow their filings to find hidden opportunities.

👉 For daily insights, follow me on X /Twitter; Instagram Threads; Facebook; or BlueSky, and turn on notifications!

(10) Final Thoughts, Advice, and Lessons:

Here’s the truth about moments like this.

They feel scary while they’re happening. They feel obvious in hindsight. And for investors who stay disciplined, they feel like opportunity.

The AI disruption story isn’t over. It’s just entering a new phase. The infrastructure providers—chipmakers, fiber companies, power equipment manufacturers—are collecting tolls regardless of which AI apps win. The companies that might get disrupted are facing real questions about their business models.

The jobs story matters. Two million jobs erased from official data means the economy was weaker than we thought. Be careful with economically sensitive names.

And the international story is real. Japan and Korea are crushing it. Foreign diversification isn’t just smart—it’s paying off right now.

So what do you do?

You don’t panic. You don’t go to cash. You look at your watchlist, you identify the names that got caught in fear-driven selling without real damage, and you build positions slowly.

Fear creates bargains. Greed creates bubbles. We’re closer to the first than the second.

Stay smart. Stay patient.

👉 For daily insights, follow me on X /Twitter; Instagram Threads; Facebook; or BlueSky, and turn on notifications!

(11) Questions from Subscribers

Welcome to our Q&A, where I answer the questions you send me!

Q: How worried should I be about the national debt?

You should take it seriously, but not panic. The US has carried high debt before. The question isn’t whether the debt is large — it is — but whether the market is losing confidence in the government’s ability to manage it. Right now, Treasury yields are elevated but not spiking. Foreign demand at auctions remains strong. The crisis isn’t here yet.

But the trend is unsustainable. Interest payments doubling to $2.1 trillion by 2036 crowd out every other government priority. The practical impact on your life is: higher borrowing costs for longer, likely more inflation over time, and slower economic growth. The hedge is owning assets that appreciate in inflationary environments: real estate (in the right markets), commodities, international stocks, and dividend-growing companies.

Q: How should I position my portfolio during this AI disruption?

Focus on AI infrastructure over AI software. Companies that sell picks and shovels—chip makers, fiber providers, power infrastructure, data center cooling—collect revenue regardless of which AI application wins. Avoid software companies that face direct disruption risk until the dust settles.

Diversify internationally. Foreign markets are outperforming, and the dollar is weakening. A 10-20% allocation to international ETFs provides natural diversification.

Hold quality. Companies with strong balance sheets, recurring revenue, and pricing power hold up better when economic reality proves softer than expected.

👋My Final Words:

🙌Thank you for reading and joining 108,000 members who trust our newsletter to get smarter and richer! My goal is simple: Make it easy for you to connect the dots on the economy, markets, and investing.

Each newsletter takes a few hours to research & write so please help us and:

Hit the LIKE button❤️ on this post & please share it with a friend or family🙏

Become a paid subscriber and support our writing & research (get a free 30-day trial with this link) (and learn about the benefits here):

(fyi, your job can pay for this newsletter with its employee development budget. To make it easy, we’ve created this email template to send to your manager.)

And please let us know what you think of this newsletter:

Missed an issue? Read past issues here at TheFinanceNewsletter.com

☺️ My goal is to help you become richer and smarter with money — Join 3 million and follow me across social media for daily insights:

Instagram Threads: @Fluent.In.Finance

Twitter/ X: @FluentInFinance

Facebook Page: Facebook.com/FluentInFinance

Linkedin: Linkedin.com/in/Lokenauth

Youtube: Youtube.com/FluentInFinance

Instagram: @Fluent.In.Finance

TikTok: @FluentInFinance

Facebook Group: Facebook.com/Groups/FinanceTalk

Reddit Community: r/FluentInFinance

➕Please add this newsletter to your contacts to ensure that none of our emails ever go to spam!

This content is for educational purposes only. Such information should not be construed as legal, tax, investment, financial, or other advice. See for Disclaimer, Terms and Conditions.